Digital banking leader for 25 years

After 25 years of digital innovation Bankinter has become the most profitable Spanish bank in 2015. Embedded in a competitive financial industry which is consolidating, how will Bankinter innovate to maintain the lead in digital banking?

Digital initiatives in Bankinter

Bankinter was founded in 1965 as an industrial bank and went public in 1972, evolving into a retail and commercial bank. Bankinter focused during its first 2 decades on gaining market share among affluent clients. From 1987 Bankinter starts taking key decisions that will enable it to become the leading digital bank in Spain12.

- In 1987 Bankinter develops a software that permits remote communications between companies and the bank. This software was installed individually in every business and was a proven success3.

- In 1992 Bankinter launches phone banking. Phone banking may not seem a leapfrogging digital endeavor but it enabled all clients to conveniently perform almost all operations (from ordering transactions to buying funds and shares) through their personal advisors without leaving the comfort of their homes2.

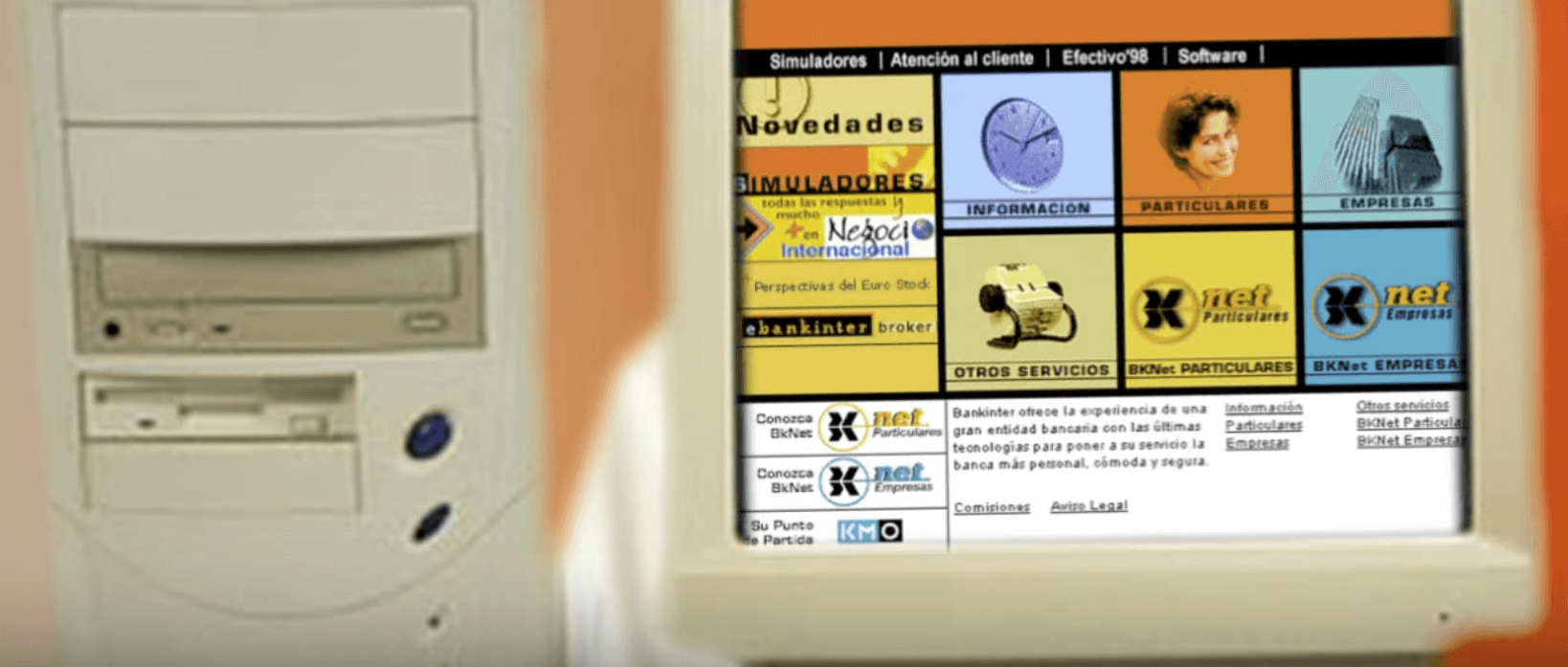

- In 1996 Bankinter launches the first banking website to enable all clients (both companies and retail) to access their data online and perform basic operations. This innovative solution was best-in-class worldwide, what attracted various international banks and non-financial companies to visit Bankinter and learn from their success3.

- In 1999 Bankinter upgrades its website capabilities, enabling customers to contract mortgages, funds and deposits online. It also enabled non-clients to complete the onboarding process without having to visit any branch3.

- In 1999 Bankinter launches a 100% online broker. This platform was the only one to offer this service in Spain, what helped Bankinter to obtain 25% market share in the Spanish retail banking environment3.

- In 2003 Bankinter is the first bank to offer financial services in mobile phones through SMS communication3.

- In 2004 Bankinter creates the ‘Innovation Foundation’, one of the biggest technology-related think tanks in the world2.

- In 2009 Bankinter launches Coinc, a platform that fosters a saving attitude among clients by leveraging behavioral economic theories5.

- In 2014 Bankinter becomes the first Spanish bank to offer contactless mobile payment in a software based app without any physical device (e.g. chip, plastic card)67.

- In 2016 Bankinter launches the first banking service through Twitter. It enables fast and efficient communication between clients and the bank, offering the possibility to check positions, receive alerts on chosen topics, give real time feedback etc8.

- In 2016 Bankinter also launches Bizum, an application similar to Venmo that enables real time payments between private individuals, bank accounts and businesses using the mobile phone number as identifier9.

Impact of the digital initiatives

All these efforts to enhance Bankinter’s digital operations have had a real impact in its business model. Bankinter differenciates with other banks because it offers the lowest fraud level in the Spanish banking landscape (it was the first one to obtain the ISO 27001 certification on IT security). Bankinter also claims to offer a highly functional website with low response times. Bankinter also tailors products to match the needs of outstanding clients (e.g. businesses, private banking). Last but not least, Bankinter offers its clients the possibility to complete almost their operations remotely (either through the internet or phone banking) so that they do not feel obliged to physically attend a branch if they do not want to3.

In the last 25 years, a consistently good implementation of this value proposition has enabled Bankinter to capture and retain a high percentage of affluent clients who value convenience, time and service quality above other features such as price or mean distance to the closest branch. Indeed, Bankinter has obtained the highest ROE in the Spanish banking industry. Its ROE of 10,7% is considerably higher than the average (5,95%) of is peer listed banks. The digital oriented strategy has enabled Bankinter to attract the most profitable clients in the industry10.

Taking digital to the next level

However, Bankinter still has many endeavors to fulfil to remain competitive in the near future. To begin with, Bankinter should upgrade its website to align it with contemporary trends. Despite showing high levels of functionality, Bankinter’s website still has room for improvement when compared to competitors in key aspects such as client onboarding, visual design, adaptive structure and digital marketing11.

Bankinter will only continue to lead profitability in the competitive and consolidating financial industry if it continues to excel in creating digitally advanced solutions that appeal to the most demanding clients and eases their bank-client relationship. This industry will continue to undergo major changes in the following decades and adaptability will be a key factor to guarantee success in the long term. Will this small yet very profitable bank be able to still lead the digital challenge 10 years from now?

744 words

References

- Bankinter – Wikipedia, la enciclopedia libre. 2016. Bankinter – Wikipedia, la enciclopedia libre. [ONLINE] Available at: https://es.wikipedia.org/wiki/Bankinter. [Accessed 15 November 2016]

- Bankinter>Sobre Bankinter>50 aniversario de Bankinter. 2016. Bankinter>Sobre Bankinter>50 aniversario de Bankinter. [ONLINE] Available at: https://webcorporativa.bankinter.com/www2/corporativa/es/sobre_bankinter/50_aniversario_bankinter. [Accessed 16 November 2016].

- 2016. Bankinter 1996: Primer banco en internet – YouTube. [ONLINE] Available at: https://www.youtube.com/watch?v=iIUtt_o_IEM. [Accessed 16 November 2016].

- Redes sociales. 2016. ¿Qué es Bizum? La nueva forma de pagar con el móvil en España. [ONLINE] Available at: https://blog.bankinter.com/economia/-/noticia/2016/10/3/bizum-bankinter. [Accessed 15 November 2016]

- Cuenta remunerada la mejor cuenta de ahorro.. 2016. Cuenta remunerada la mejor cuenta de ahorro.. [ONLINE] Available at: https://www.coinc.es/coinc/. [Accessed 17 November 2016].

- Blog Bankinter. 2016. Pagos con el móvil: TVM Bankinter. [ONLINE] Available at: https://blog.bankinter.com/economia/-/noticia/2014/12/11/pagar-m-243-vil-tvm-bankinter.aspx. [Accessed 16 November 2016].

- 2016. Bankinter 2003: Pioneros en utilizar el banco en el móvil- YouTube. [ONLINE] Available at: https://www.youtube.com/watch?v=WOEaX1m5yUc. [Accessed 16 November 2016].

- Comunicación. 2016. Bankinter lanza el primer servicio de banca por Twitter en España. [ONLINE] Available at: https://blog.bankinter.com/economia/-/noticia/2016/5/12/bankinter-lanza-primer-servicio-banca-twitter-espana. [Accessed 16 November 2016].

- Redes sociales. 2016. ¿Qué es Bizum? La nueva forma de pagar con el móvil en España. [ONLINE] Available at: https://blog.bankinter.com/economia/-/noticia/2016/10/3/bizum-bankinter. [Accessed 16 November 2016].

- El Confidencial. 2016. Ibex 35: Bankinter y Bankia son los únicos bancos que sacan una ganancia de verdad a su capital. Noticias de Empresas. [ONLINE] Available at: http://www.elconfidencial.com/empresas/2015-11-04/bankinter-y-bankia-son-los-unicos-bancos-que-sacan-una-ganancia-de-verdad-a-su-capital_1082862/. [Accessed 16 November 2016].

- Bankinter Particulares | Banca online y servicios financieros. 2016. Bankinter Particulares | Banca online y servicios financieros. [ONLINE] Available at: https://www.bankinter.com/www2/particulares/es/inicio/bienvenida. [Accessed 16 November 2016].

Great post! I’ll be curious to hear your views on market size – did the rapid adoption of technology lead to a positive perception and a wider customer base? Or did it just help ensure that they captured the more affluent segment of the population? If the latter, do you have any concerns with growth as the affluent segment is likely to be limited? On a separate point, Bankinter seems to be moving into the mobile money platform (similar to venmo). Do you think there are opportunities for growth in that segment or have the US apps already cornered the market?

Very interesting – thanks a lot for this. It sounds like Bankinter have really excelled. I fear now however that with digital banking becoming a ‘mainstream’ rather than niche customer proposition that they will not be able to capitalise on their first mover advantage and will instead merely educate larger banks who are able to create digital offerings which can compete directly. Do you think that they will be able to hang onto their market share as other banks catch up? Cheers!

Looking at the timeline in which Bankinter made so many of its digital developments, it is fascinating how ahead of the curve they were for their time. Looking towards the future though, I wonder if they will continue to stay relevant as other banks in Spain and Europe look to grow in their online presence.

This year, Bankinter launched the first banking service through Twitter. It enables fast and efficient communication between clients and the bank, offering the possibility to check positions, receive alerts on chosen topics, give real time feedback. Do you think this is really a value adding feature? Why specifically Twitter – It worries me that Twitter recently cut 9% of its workforces and revenue growth is growing – is this really the right time and the right investment of capital and effort for Interbank?

In 2016 Bankinter also launched Bizum, enabling real time payments between private individuals, bank accounts and businesses using the mobile phone number as identifier. I know that it has been difficult to launch venmo-like applications internationally because banking regulations are stricter or more varied than in the US. Can peer-to-peer payment services be grown in the same way? I worry that Venmo can grow internationally which would limit the growth of Bizum, which presumably only allows you to send payment to someone who is also an account holder within the bank. What if I am at Interbank and I want to send payment to a friend at a different bank?

Very interesting article – it seems from this article that Bankinter has been a leader in the digital banking for Spanish banks. I’ve read a lot about how BBVA has been focused on digitalization since 2006 (https://www.bcgperspectives.com/content/articles/financial-institutions-people-organization-power-people-digital-banking-transformation/?chapter=7). What in your view has made Bankinter more or less successful than BBVA?