David vs. ‘prescient’ Goliath: Can Lazada compete with Amazon’s “anticipatory shipping”?

Lazada used to be the “Amazon of Southeast Asia”, but as of summer 2017, has to compete directly with Amazon as they enter the Southeast Asian market. Can Lazada embrace digitalization to compete with Amazon’s “anticipatory shipping” model and two-hour Prime Now delivery service?

Lazada, also known as the “Amazon of Southeast Asia”1, is the region’s largest e-commerce operator, and was founded in Singapore in 2011 by Rocket Internet. Currently, it is owned by Alibaba, Temasek, and a small group of insiders2. Over the past couple of years, Lazada beat out domestic competitors3 such as Tokopedia, Elevenia, and Bukalapak, with their easy “cash-on-delivery”4 model, extensive delivery partnerships5, and seamless mobile commerce interface.

Exhibit 13: Lazada is the top e-commerce operator in its largest market, Indonesia

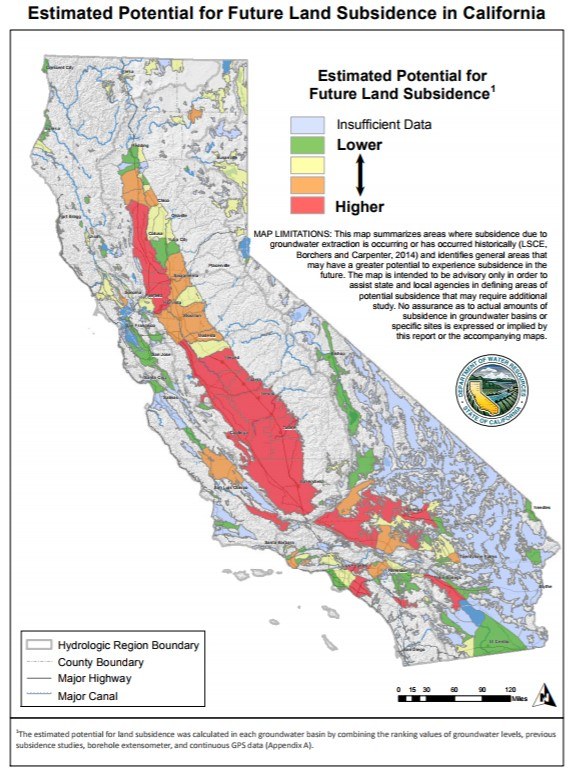

Although Lazada has had relative success in Southeast Asia thus far, it is still unprofitable, and now must face the ultimate competitive threat: Amazon. Amazon plans to break into Southeast Asia starting with Singapore this year6, where it is launching its most aggressive service, Prime Now two-hour delivery. For the first time ever, Lazada has to face the megatrend of digitalization against Amazon, the perennial supply-chain leader7 that has successfully utilized advanced data analytics to improve inventory management and delivery processes. To prevent loss of market share to Amazon in Singapore and other Southeast Asian regions, Lazada will need to embrace digitalization and build a more advanced logistics system to offer customers quicker and cheaper delivery options. In addition, as management aims to reduce delivery costs to drive Lazada towards profitability, a digitalized supply chain will also help to reduce costly usage of their delivery partners.

Exhibit 28: Amazon enters Singapore in July 2017, launching 2-hour Prime Now delivery service

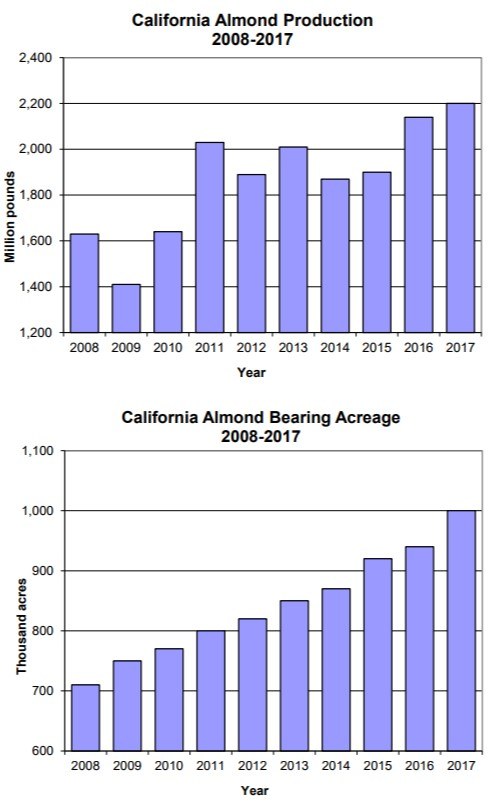

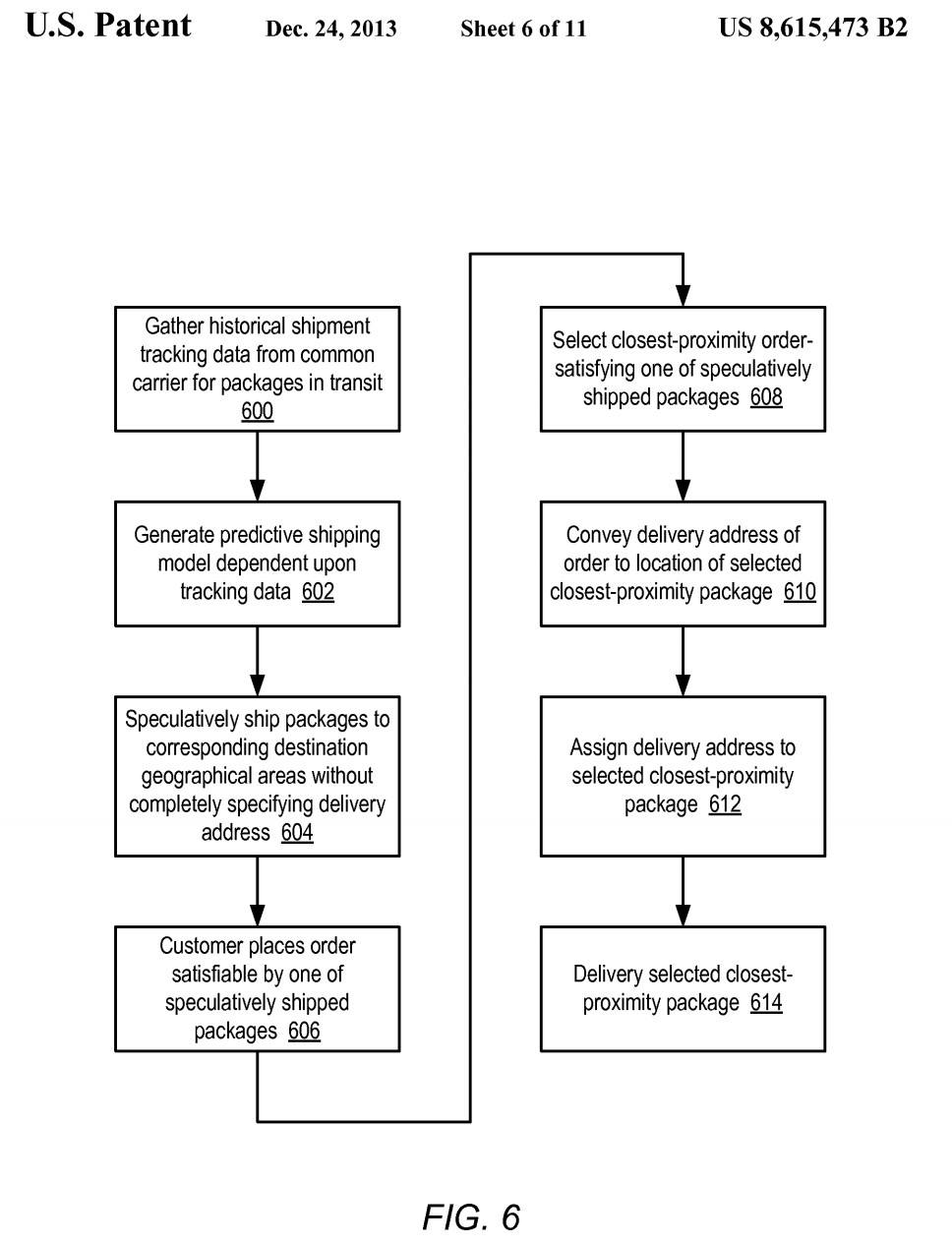

First of all, how does Amazon achieve two-hour delivery? To understand Amazon’s powerful digitalized supply chain, we need to go back to their 2013 patent for “anticipatory package shipping”9. By analyzing customers’ browsing, buying and replenishing behavior, Amazon is able to estimate the probability that a customer will buy a certain product within a specific period. By collating these predictions by location, Amazon is able to ship products early from its fulfilment center to a shipping hub, in anticipation of eventual purchases10. This anticipatory shipping not only adds value to the customer experience by allowing two-hour deliveries, but also allows Amazon to transport more items per shipment to the shipping hubs and hence save on shipping frequency and costs.

Exhibit 39: Amazon’s 2013 U.S. patent filing illustrates how anticipatory shipping works

Historically, Lazada has offered free delivery11 in certain cities like Metro Manila in the Philippines, but typically charges a fee for non-urban locations, or for orders below a certain basket size. In the recent past, it is evident that Lazada’s management is taking Amazon’s competition seriously. Last year, Lazada rolled out “Express Delivery”12, with the option for same-day or one-day delivery in selected cities such as Metro Manila and Laguna in the Philippines. However, it is not clear that the faster delivery option is a result of “anticipatory shipping”, since the delivery fees are noticeably higher than the free-shipping options, and most locations with shipping hubs still do not have “Express Delivery”. One can imagine that this move is management’s short-term reflexive response to the Amazon Prime Now threat. It is not clear if management has a medium-term plan in place to match Amazon’s efficient inventory management and delivery system.

Exhibit 412: Lazada offers same-day shipping in select (populous) areas

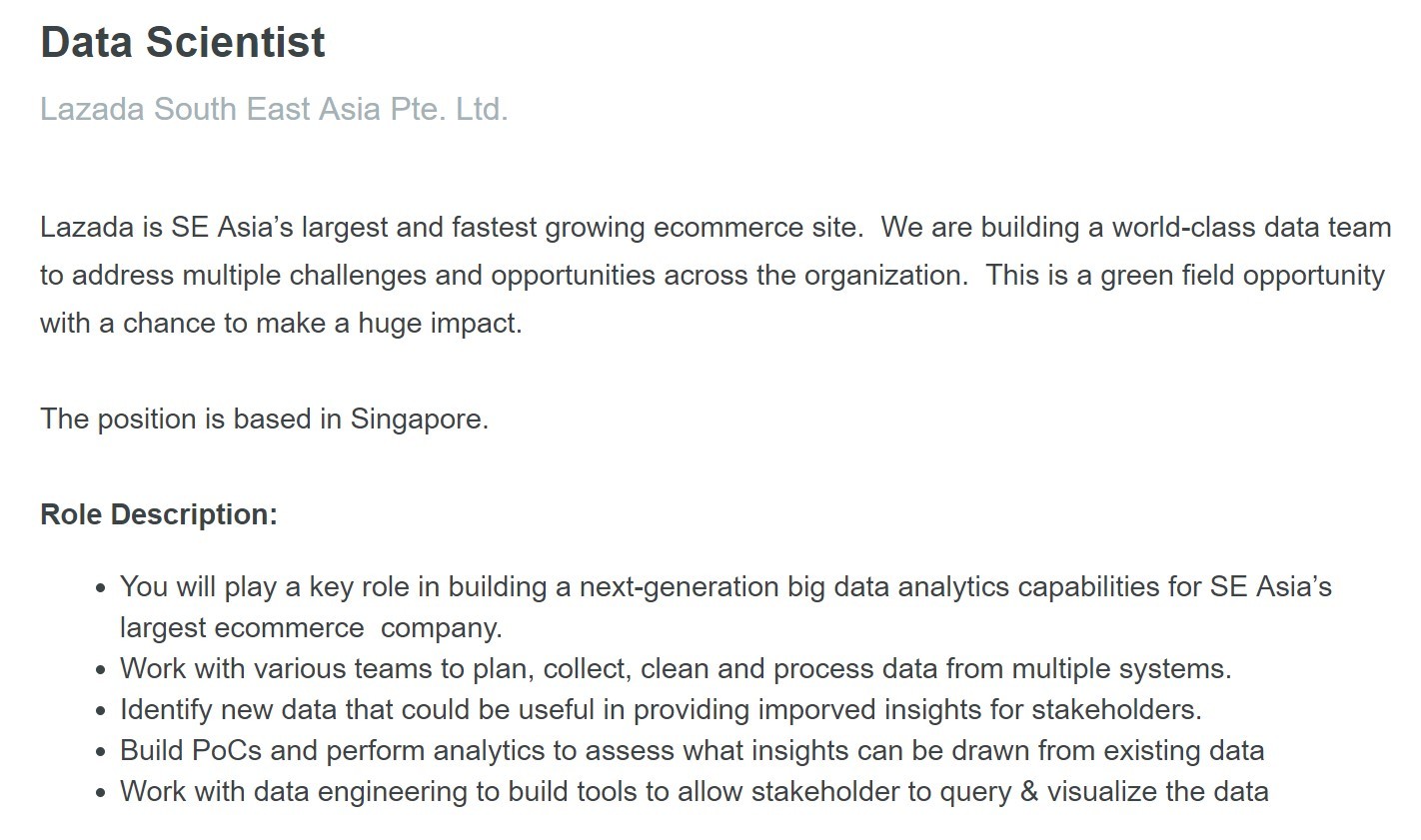

Looking ahead, there are a few things that Lazada’s management team should be working on in anticipation of more widespread competition from Amazon in Southeast Asia. First of all, given that Amazon only filed the “anticipatory shipping” patent in the U.S.9, Lazada can technically hire ex-Amazon engineers to help recreate a similar system to be used in Southeast Asia – this should be their medium-term solution to match Amazon’s same-day deliveries in a cost-efficient way. In the long-term, management should aim to hire top machine learning talent that will improve the accuracy of their anticipatory algorithms to be superior to Amazon’s own system.

Exhibit 513: Lazada recently opened up job searches for data scientists in Singapore

In the meantime, Lazada should focus on gathering data. They should be optimizing their mobile and online sites to gather data on customer searches, buying and replenishing frequency, and so on. Since Lazada will be coming from behind, the realistic expectation is that their algorithms will not be 100% accurate in the early days. Lazada will need to formalize contingency plans for when anticipatory shipments don’t end up getting purchased. For instance, will it be more cost-efficient to ship product back to their fulfillment centers, or offer region-specific discounts to offload the inventory? Finally, Lazada should be constantly looking for more areas to add value with digitalization. For example, using the Internet of Things (IoT) for maintenance-predicting sensors14 inside machines and electronics, which can allow for just-in-time replacement-parts delivery.

As a final point, it is not easy to compete with an organization with as much resources and brand equity as Amazon. One important question is how Lazada is going to attract top data scientist and machine learning engineers, especially since they are based in Singapore15, and not Silicon Valley. The other question that requires more thought is whether an anticipatory shipping system would even work in some sparsely-populated areas across Indonesia, Vietnam, and other parts of Southeast Asia.

Can Lazada triumph in this ‘David versus prescient Goliath’ story? Only time will tell.

Word count (excluding exhibits): 799 words

___________________________________________________________________________________________________

Endnotes

1Ansuya Harjani, “Meet the man behind the ‘Amazon of Southeast Asia’”, CNBC, April 11, 2014, https://www.cnbc.com/2014/04/11/meet-the-man-behind-the-amazon-of-southeast-asia.html, accessed November 2017

2 Lulu Yilu Chen, “Alibaba to Invest $1 Billion in Lazada to Speed Asian Drive”, Bloomberg News, June 28, 2017, https://www.bloomberg.com/news/articles/2017-06-28/alibaba-to-invest-1-billion-more-in-lazada-to-speed-asian-drive, accessed November 2017

3 Source: Map of e-Commerce in Indonesia, iPrice Insights, https://iprice.co.id/insights/mapofecommerce/en/, accessed November 2017

4 Lazada Group, “Payment Methods”, https://www.lazada.com.ph/payment-methods/#cod, accessed November 2017

5 Corporate News, “Lazada to seek delivery partnerships as demand grows”, The Star Online, September 30, 2017, https://www.thestar.com.my/business/business-news/2017/09/30/lazada-to-seek-delivery-partnerships-as-demand-grows/, accessed November 2017

6 Yoolim Lee, “Amazon Enters Singapore With Most Aggressive Service Yet”, Bloomberg News, July 26, 2017, https://www.bloomberg.com/news/articles/2017-07-27/amazon-enters-singapore-with-two-hour-prime-now-delivery-service, accessed November 2017

7 Source: Gartner Announces Rankings of the 2017 Supply Chain Top 25, Gartner Inc., https://www.gartner.com/newsroom/id/3728919, accessed November 2017

8 Sherisse Pham, “Amazon enters Southeast Asia, launching Prime Now service in Singapore”, CNN News, July 26, 2017, http://money.cnn.com/2017/07/26/technology/business/amazon-singapore-launch/index.html, accessed November 2017

9 Spiegel et al., “Method and System for Anticipatory Package Shipping”, Patent No. US 8,615,473 B2, December 24, 2013, https://tinyurl.com/yb4m9odk, accessed November 2017

10 “Amazon files patent for “anticipatory” shipping”, CBS News, January 20, 2014, https://www.cbsnews.com/news/amazon-files-patent-for-anticipatory-shipping/, accessed November 2017

11 Lazada Group, “Shipping”, http://www.lazada.com.ph/shipping/, accessed November 2017

12 Lazada Group, “Express Delivery”, http://www.lazada.com.ph/express-delivery/, accessed November 2017

13 Lazada Group, “Careers”, https://www.lazada.com/career-description?id=36026, accessed November 2017

14 Bernard Marr, “Internet of Things And Predictive Maintenance Transform The Service Industry”, Forbes, May 5, 2017, https://www.forbes.com/sites/bernardmarr/2017/05/05/internet-of-things-and-predictive-maintenance-transform-the-service-industry/, accessed November 2017

15 Sachin Chitturu et al., “What Southeast Asia needs to become a major player in artificial intelligence”, McKinsey Global Institute, September, 2017, https://www.mckinsey.com/global-themes/artificial-intelligence/what-southeast-asia-needs-to-become-a-major-player-in-artificial-intelligence, accessed November 2017

Really interesting post, Dennis! I think it gave a fantastic insight into Amazon’s anticipatory shipping (breaking down a really complex system into easy-to-understand steps), and was very clear in the implications it would have on Lazada. I particularly liked your view of Lazada’s competitive response (i.e., offering express but not anticipatory shipping in the short-term) and what it should do in the longer term (hiring data scientists to replicate Amazon’s model).

To answer your question about whether Lazada can triumph – I think that there are multiple types of retailer, across both online and offline. I think your post presupposes that Lazada should copy Amazon/ be the Amazon of Southeast Asia. While Amazon is fantastic in Europe/ USA/ a few other countries at offering a wide range of products at great prices quickly delivered to your door, not every retailer has to be exactly like Amazon to do really well (i.e., there will be more than one online retailer in any market). For instance, Jet.com offers lower prices on selected items/ lower cost shipping; Warby Parker offers brand/ innovative trialling/ returns policy. Both are doing fantastically. There is also a lot about the local market context that may make anticipatory shipping or even US-style ecommerce very challenging; while Singapore is well-adapted to Amazon, Indonesia or the Philippines have much less developed infrastructure to support 2-hour shipping across large parts of the country. Alibaba is a case in point of how Amazon is not destined to takeover all markets, and the fact that Alibaba has invested so heavily in Lazada I believe points to its long-term likelihood of success vs. Amazon.

Hi Dennis,

Thanks for your post about Lazada, one of the most interesting businesses in South-east Asia. I worked there over the last year and was involved in the strategic preparation for Amazon’s arrival. I believe this is a battle Lazada will win (and at worst, Alibaba – now 2 billion deep into Lazada and running out of parts of the world in which to reach its next billion customers – will not allow Lazada to lose).

The article is perfectly correct in it’s argumentation but wrong in the framing of its implications as it overstates the strategic importance of Amazon’s technology advantage in areas like anticipatory shipping as determinative in the outcome of the fight between the two companies. The article is premised on an example from Singapore having Prime Now while in reality Singapore is unique in South-East Asia; a tiny, well-developed city-state and the only part of the region with a sophisticated logistics infrastructure make it possible to launch Prime Now there. For the rest of the key countries in the region (Indonesia, Malaysia, Philippines, Thailand and Vietnam, where 90%+ of GMV typically comes from), the challenges of building a logistics business are many years behind a state where anticipatory shipping would shift the needle on results – especially in a low-cost labour environment. Lazada often had to develop logistics networks entirely from scratch as most parts of the region were so underserved. Developing warehouses and an entirely fresh logistics capability (including in two nations that are almost entirely islands) will require years of investment and hard work on the part of Amazon – while Lazada is using those years to increase its technological capability or leverage Alibaba’s.

In those first years the real challenges will come down to Amazon’s ability to match the existing network effect that Lazada has (in terms of having the largest variety and best prices for consumers), developing basic logistics infrastructure to cover the region and essentially a spending contest in commerical and marketing to win a dedicated customer base. Amazon is a Goliath of an organisation but is starting significantly behind a strongly-backed David.

Mr.Chua,

Loved reading this post about Lazada and the potential threats that it faced from the current behemoth of our world – Amazon. I have two comments to make about the points that you bring up, and I can use my experiences from my limited time in Asia for some additional insight.

You correctly argue that Amazon has these incredible prediction capabilities (which I knew nothing about until reading your article!) and that having the patent that was filed in the US given them a strong competitive advantage in the US Market. I only wonder whether Lazada needs to be threatened by this in the Asian markets, particularly in some of the relatively undeveloped countries which it serves and whether this poses a real threat to Lazada’s business model. From what I saw in Asia, there are very different logistical structures and systems that push product around from online shopping. Although Amazon has certainly mastered the developed US market, I am not sure what their patent and predictive technology would even do in the scattered delivery system in Asia. If the countries where Lazada primarily operated in had developed logistical system with the same tech as the US, I would be more concerned than I currently am. Although as Asia continues to get wealthier and pour more and more money into its expansion, the logistical systems of delivery will undoubtedbly also rise, and that is when Lazada should really be threatened by Amazon.

Secondly, I wouldn’t rule out Jack Ma and his boys. As we saw in class, Alibaba has a way of ruling the world of the East in ways that the West has not yet figured out, and I would argue might not do so for quite some time. I remember from the Alibaba case in class, when e-bay came into China for the first time, and Alibaba forced them to move out in a matter of two years. From this article you can see that have thought about trying to compete with Lazada, but have had to withdraw on more than one occasion. With an internet economy that is predicted to grow to over $200 Billion by 2025, I don’t see Alibaba giving that up, and with their knowledge of the local markets and logistical system, I think Amazon is years behind them for now.

Apologies, the article did not hyperlink!

Here it is: https://www.cnbc.com/2017/07/12/alibaba-backed-lazada-says-its-confident-it-can-withstand-competition-in-southeast-asia.html