Dark Skies Ahead for US Solar Panel Installation Industry?

Tariff proposal on President Trump’s desk puts future of US solar panel industry in jeopardy

What is a solar panel installation company to do when government regulation significantly increases the cost of the very panels it has made a business out of installing? That question is currently troubling Sunrun and other United States-based installation companies. Following a petition and comment process through the United States International Trade Commission (USITC), President Donald Trump must now decide whether to impose tariffs or other restrictions on imported crystalline silicon photovoltaic (CSPV) cells, a key component of solar panels. This decision may have far reaching implications on Sunrun and the broader solar power industry.

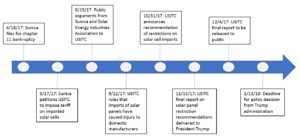

How did we get here? In May 2017, Suniva, a CSPV cell manufacturer with US operations, filed a petition to the USITC to impose tariffs on imported cells. The company argued that such cells, which are cheaper than domestically produced cells, are harming the company and rendering it uncompetitive in the US market[i]. Suniva filed for Chapter 11 bankruptcy in April[ii]. Outside of Suniva and SolarWorld (another installation company), the solar industry has generally criticized the potential tariff and has lobbied the USITC and other government bodies to that effect[iii]. After months of deliberation and incorporating input from interested parties, the USITC announced its recommendation to impose tariffs on October 31[iv] and delivered its final report to President Trump on November 13[v]. He has 60 days to consider the recommendation and determine the final course of action. See Exhibit 1 for a detailed timeline.

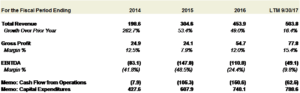

For Sunrun and other domestic solar panel installation companies, a tariff would be problematic. As foreign cell manufacturers will likely increase prices to compensate for the tariff, Sunrun is left with the options of maintaining current pricing (and losing margin – see Exhibit 2 for company financials) or passing the cost on to its customers (and potentially losing sales as a result). If Sunrun chooses the latter, the company will see its competitive position erode relative to other forms of electricity and solar panels. In recent years, Sunrun has been able to compete and win business on price, as solar costs have declined while residential utility rates on coal- and gas-powered electricity have increased[vi],[vii]. Even commercial utilities in certain cases have switched to solar panel fields, as costs can be comparable to plants powered by fossil fuels[viii]. Additionally, other types of solar panels, such as thin film cadmium-telluride models produced by Arizona-based solar panel maker First Solar, would become less expensive relative to CSPV panels, as the USITC petition is limited in scope to CSPV panels and derivatives[ix],[x]. While the specific financial impact of a tariff on Sunrun is difficult to quantify, Guggenheim research estimates that a tariff of the magnitude requested by Suniva would shrink the economically viable US residential rooftop solar panel market by 58-69%[xi]. President’s Trumps ultimate decision could have massive implications on Sunrun’s ability to compete and survive.

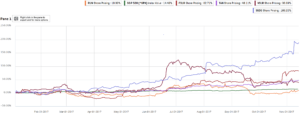

The politics surrounding President Trump’s decision have created uncertainty around Sunrun’s future, and its stock priced has lagged peers as a result (Exhibit 3). The decision forces the president to weigh two core components of his economic agenda, job creation and tariffs against Chinese imports. While the US solar panel installation industry supports far more jobs than the manufacturing industry[xii], President Trump’s unpredictable nature and focus on tariffs[xiii] make this a highly uncertain situation. Other than stockpiling solar panels at current market prices and supporting the industry lobbying force opposing the tariff, there is little Sunrun can do in the immediate near term to offset this risk.

In the intermediate and long terms, there are several steps Sunrun could explore to make the company a more competitive player in the industry. If Sunrun can still viably operate under a tariff (albeit less profitably), the company could use the dislocation caused by the tariff as an opportunity to consolidate the installation industry by taking share from or acquiring smaller, regional competitors that are unable to weather the impact of the tariff. The residential installation market is fragmented, with the top three players accounting for 30-40% of market share[xiv]. In the longer term, Sunrun should consider diversifying its product offerings to include thin film solar panels in addition to crystalline silicon. Trade disputes such as the one initiated by Suniva are unpredictable and unlikely to cease in the solar industry, with its high growth, volatility, and exposure to government regulation. A broader mix of products would help the company weather any future storms.

Key outstanding questions related to this ongoing dispute:

- Is it in the US’s long-term interest to have a competitive solar panel manufacturing industry, or should the US be comfortable ceding nearly all market share to China and specializing in installations?

- What are the best mechanisms at a government’s disposal to encourage investment in renewable energy?

(Word Count: 800)

Exhibit 1 Timeline of developments with the United States International Trade Commission

Exhibit 2 Sunrun Summary Income Statement and Select Cash Flow Metrics

Exhibit 3 Sunrun, Sunrun Peer, and Select Index Percent Change YTD 11/14/17

Note: RUN: Sunrun, FSLR: First Solar, TAN: Guggenheim Solar ETF, VSLR: Vivint Solar, SEDG: SolarEdge Technologies

[i] United States, International Trade Commission, Washington, DC, and Mary Messer. “Crystalline Silicon Photovoltaic Cells (Whether or Not Partially or Fully Assembled into Other Products).” 17 May 2017. www.usitc.gov/secretary/fed_reg_notices/safeguard_201_204_421/201_3218_notice_05232017sgl_1.pdf.

[ii] Roselund, Christian. “Suniva Files for Chapter 11 Bankruptcy.” Pv Magazine International, 18 Apr. 2017, www.pv-magazine.com/2017/04/18/suniva-files-for-bankruptcy/.

[iii] “U.S. Trade Support for Foreign Companies Hurts More Americans Than It Helps.” Solar Energy Industries Association, 8 Nov. 2017, www.seia.org/blog/us-trade-support-foreign-companies-hurts-more-americans-it-helps.

[iv] “USITC Announces Remedy Recommendations in Its Global Safeguard Investigation Involving Imports of Crystalline Silicon Photovoltaic Cells (Whether or Not Partially or Fully Assembled into Other Products.” USITC, 31 Oct. 2017, www.usitc.gov/press_room/news_release/2017/er1031ll857.htm.

[v] Walton, Robert. “60-Day Clock Starts for Trump to Decide on Solar Panel Tariffs.” Utility Dive, 14 Nov. 2017, www.utilitydive.com/news/60-day-clock-starts-for-trump-to-decide-on-solar-panel-tariffs/510851/.

[vi] “Sunrun Inc Form 10Q.” Securities and Exchange Commission, 8 Nov. 2017, www.sec.gov/Archives/edgar/data/1469367/000146936717000022/sunrun10q2017q3.htm.

[vii] “Sunrun Investor Overview Presentation – September 2017.” http://investors.sunrun.com/static-files/4b4ca882-be69-4ecf-97ae-c1e064f296ab

[viii] Salzman, Avi, and Bill Alpert. “There Goes The Sun.” Barron’s, 2 Oct. 2017.

[ix] Salzman, Avi, and Bill Alpert. “There Goes The Sun.” Barron’s, 2 Oct. 2017.

[x] United States, International Trade Commission, Washington, DC, and Mary Messer. “Crystalline Silicon Photovoltaic Cells (Whether or Not Partially or Fully Assembled into Other Products).” 17 May 2017. www.usitc.gov/secretary/fed_reg_notices/safeguard_201_204_421/201_3218_notice_05232017sgl_1.pdf.

[xi] Karp, Sophie. “RUN, Sunrun, Run. Maintaining a Buy, $11 PT, Despite N-T Suniva Headwinds.” 25 July 2017. Guggenheim Securities, LLC Equity Research.

[xii] Salzman, Avi, and Bill Alpert. “There Goes The Sun.” Barron’s, 2 Oct. 2017.

[xiii] Swan, Jonathan. “Exclusive: Trump Vents in Oval Office, ‘I Want Tariffs. Bring Me Some Tariffs!”.” Axios, 27 Aug. 2017, www.axios.com/exclusive-trump-vents-in-oval-office-i-want-tariffs-bring-me-some-tariffs-2478121273.html.

[xiv] Karp, Sophie. “RUN, Sunrun, Run. Maintaining a Buy, $11 PT, Despite N-T Suniva Headwinds.” 25 July 2017. Guggenheim Securities, LLC Equity Research.

It is amazing to see how regulation can have such a large influence in an industry. I believe that there is more than just Suniva’s interest here to file the petition. Making solar energy more expensive aligns with the coal and oil industry’s interests (both heavy supporters of the current administration). Moreover, Suniva would not benefit of being able to return to a market that could potentially shrink 69%. I guess we will have to wait another month too see how this story plays out.

As you point out, the impact of this trade barrier if imposed will definitely favor suppliers with more domestically oriented supply chains such as First Solar. However, I wonder if the specific form of the trade remedy also has an impact on what Sunrun’s strategy ought to be.

As the final detailed report to President Trump has not yet been made public, the question is still open as to which kind of measure the administration will ultimately impose. Might Sunrun’s response vary based on the type of barrier? While prices will rise under virtually any scenario, a potential quota in addition to tariff furthermore restricts the supply of modules beyond just pricing out certain panels. For example, two of the four commissioners on the USITC favor a 1GW tariff-free quota, with 30% tariff applied to any additional import. [1] The effect might exacerbate the decline in installation growth that we would expect from purely a price increase due to tariffs. If a quota goes through, Sunrun might consider striking concessions or longer-term contracts with its existing suppliers, so that it can capture a larger share of imports (if the tariff design permits). On the project development side, it could also prioritize its most profitable geographies to preserve margins, stunting the growth in less regulatory-friendly or lower solar-potential states.

Given the declining attractiveness of distributed and residential solar in many markets (e.g., diminishing net metering regimes), it would interesting to see whether the share of total PV in the US re-balances more into utility-scale installations such as the ones that First Solar specializes in.

[1] Sunrun Inc, SEC Filing, Form 10-Q, http://investors.sunrun.com/node/8096/html, accessed December 1

Really enjoyed reading this article.

As Victor mentioned, it’s amazing to see how much regulation can impact this rapidly growing industry. I found it interesting that the stock price of Sunrun is doing so much worse than its peers. Is it more heavily dependent upon solar panel imports than other installation firms? Or is it more exposed to the regulatory risk in a different way? I also wonder if Sunrun is able to exert any lobbying influence upon the government. Even if they cannot convince the Trump administration to resist the import tariff, they could potentially lobby state governments for higher subsidies to make up for the higher import costs. Especially in states like California, where tens of thousands of jobs are at stake, there might be greater incentives at a state level.

As you mentioned, this could create some intriguing opportunities for First Solar, which may become the most cost effective producer of solar panels available to American installers. I could also see this hurting First Solar, however. Asia-based manufacturers may switch their focus to thin-film panels since they are not subject to the same import restrictions, flooding the market and applying price pressure on First Solar. Perhaps there will be another tariff a few years down the line!

Parallel’s can be drawn between Sunrun’s situation and the manufacturing industry within Japan: for years, the strength of the Yen resulted in an ever increasing price tag on all Japanese manufactured goods. However, Japanese manufacturers responded by reducing costs through continuous operational improvements and innovation.[1] Looking at Exhibit 2, it appears that Sunrun’s gross profit margin has been steady/improving while EBITDA margin has been decreasing. This implies that the company’s overhead costs are the driver of the eroding EBITDA margins. If that is the case, the company should consider investing in its operations to reduce costs and remain competitive in the face of increasing material costs.

[1] “Japanese companies improve profit margins despite strong yen,” Nikkei Asia, November 2016, https://asia.nikkei.com/Markets/Tokyo-Market/Japanese-companies-improve-profit-margins-despite-strong-yen, accessed December 2017

Trade restrictions on the solar industry’s supply chain raise some very interesting questions, given the the geopolitical implications. It is in the U.S. government’s interest for the country to be as close to energy-independent as possible; however, given the Trump administration’s close ties to the Oil & Gas industry, it is unlikely that trade policy and other commercial regulation in the near-term will favor the solar industry. Recently the solar industry has experienced a “circle of death” – global overcapacity has driven down prices, which in turn has incentivized firms to pursue scale economies, further driving down prices. [1] These low prices have enabled the solar industry to compete on a price basis with natural gas. Therefore, the Trump administration would potentially welcome the higher prices that are sure to follow protectionist trade measures. In light of this, Sunrun should engage in active conversations with Congress, both regarding trade policy as well as environmental regulation, in an attempt to stall or block the proposed tariff. Furthermore, Sunrun should proactively pursue M&A, rather than waiting until the passage of the tariff. Strategic M&A targets would be firms with domestic supply chains as well as firms with complementary technologies / IP that would allow Sunrun to diversify its product portfolio.

[1] “A Trade Dispute Threatens America’s Booming Solar Industry.” The Economist. 17 Aug 2017. https://www.economist.com/news/business/21726733-civil-war-breaks-out-between-two-troubled-firms-and-many-their-solar-peers-trade-dispute

Interesting read. I would opt for ceding the manufacturing industry in favor of installations. Per SEIA (Solar Energy Industry Association), over 88,000 American solar jobs are at stake due to Suniva’s trade case and given the current administration’s stance on job creation, I cannot imagine that will sit well, despite the Chinese import element. [1] That being said, I am cognizant of the fact that there are industries where it makes sense to retain at least some domestic element for national security reasons (e.g., food production, telecomm, etc.); however, I do not think that applies in this case.

Guggenheim’s research regarding the decrease in the addressable residential solar market (58-69%) due to the tariff requested by Suniva was startling. I think that highlights just how price sensitive the residential market has become and with diminishing net metering regimes, as FRenergy alluded to, it is easy to see how tariffs could potentially price out the entire residential market.

[1] Stephen Lacey, “88,000 American Solar Jobs Are Under Threat From Suniva’s Trade Case, Says SEIA,” https://www.greentechmedia.com/articles/read/88000-solar-jobs-are-under-threat-from-sunivas-trade-case-says-sei, accessed December 2017.