Danone Russia: 5 years to collect Digitalization fruits

France-based Danone owns 57,5% of Danone Russia which have only 5 years in very competitive market to prove their potential and convince global company to buy out the remaining stake. Is Digitalization the right tool to efficiently support this transformation?

Danone and Danone Russia

Danone is a global Consumer Packaged Goods (CPG) company with HQ at Paris. Founded in 1899 it has ~100’000 employees, ~$24B sales, $42B Market capitalization. Operating in 4 divisions (Fresh Dairy Products, Waters, Early life Nutrition, Medical Nutrition) last time Danone was in the Forbes “The Most Innovative Companies” list at 2014 (#86) worsening 2013 result (#29) [1], [2]. Danone Russia (DR) is a subsidiary of Danone (57,5%) and Unimilk (42,5%) with ~10’000 employees, ~$700M sales, 17 factories [3].

Industry context and the role of Digitalization for Danone Russia

Competitive CPG industry is low marginal and pressure on profitability is increasing annually – CPG is the first step of supply chain and should share margins with Wholesalers, DCs, Retailers. At this crisis period costs continue to rise, while reduced purchasing power limits prices.

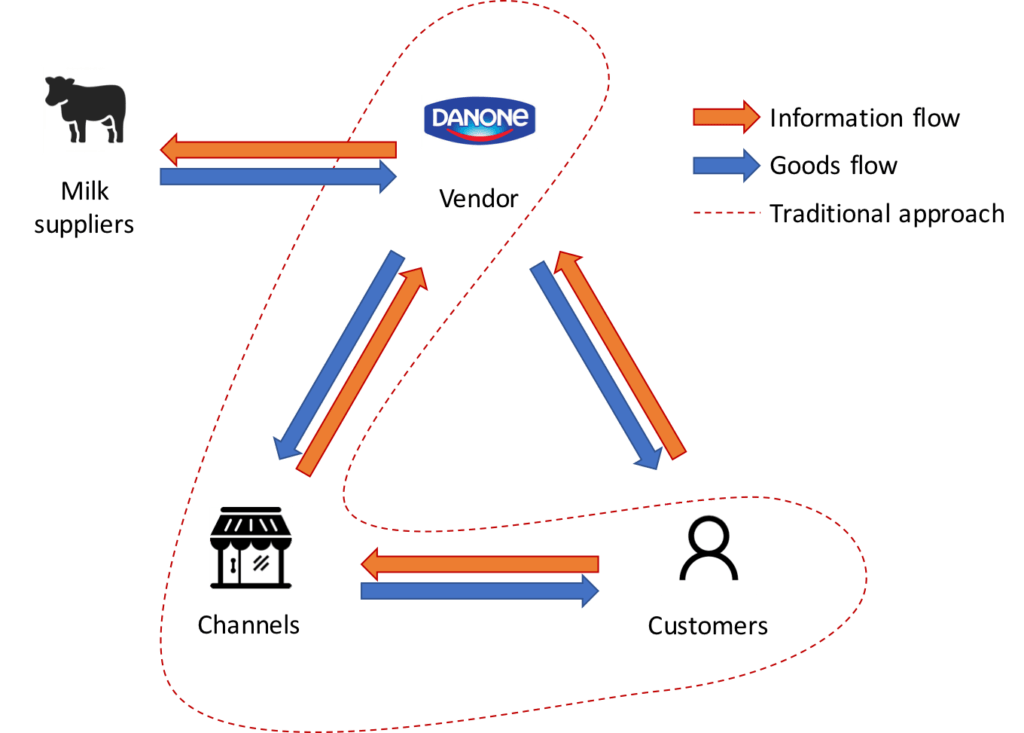

Digitalization opens DR an opportunity to be more profitable using three levers which support traditional “offline” approach and develop direct “Vendor<->Customer” connection.

WEB 2.0: “Know your customer”

Rationale: WEB 2.0 is important for demand (e.g. analyze cohorts’ behavior to balance assortment) and supply (e.g. use right channels in right geographies) both for short-term reactions and long-term planning. Report-based analyzes and personalized customer motivation are key for loyalty.

DR status: Current marketing strategy allocates up to 90% of budget to TV. Digital department has no formal KPIs and is mostly responsible for social media which are comparable underdeveloped both in original content and number of followers (Facebook, 1662 followers [4]; Instagram 48 followers [5]). There is also no keyword-based advertising and no potential customers’ digital activities analytics. [6]

Possible next steps: Offline promo-codes with online promo-site (PepsiCo model) will help DR to collect customer data. Further promotions (keywords, display advertising, social media), precise marketing and direct contact with low response time will engage customers in feedback loop what increases loyalty, helps DG to promote their products and to improve assortment (“mums” is one of these categories which is active in internet but ignored by DR). [7]

Improve production efficiency with digital technologies

Rationale: Digitalization is crucial for effective forecasting and process management/control what reduce inventory turnover, increases utilization and provides flexibility in unexpected situations.

DR status: DR is strongly depended on outdated Unimilk factories [8]. Current 5 years $700M program is mostly focused on achieving Danone’s quality standards rather than on supply chain effectiveness. High seasonality and weak forecasting makes DR to purchase from short list of milk suppliers at higher prices. New high-tech factories’ robotics technologies and sterile atmosphere lead to necessity of producing big batches with one month upfront planning. Thus, for some products, inventory turnover reaches 6 months.

Possible next steps: IT-transformation of supply-chain will support “just in time” process. Further automation of warehouses, predictive shipping, smart contracts and transparent for all participants web-connected supply chain tools (e.g. online biding for milk suppliers) are examples of quickly implemented best practices solutions applicable to DR.

Digital sales channels without middle men

Rationale: Direct sales channel will provide benefits for goods flow (potentially higher margin – no sharing with middle men and optimal design for established internal processes) and information flows (support for WEB 2.0 tools). “New service” advertising is more attractive and sticky than “new product”. Subscription model provides additional boost to loyalty.

DR status: Denis Makhanko (HBS MBA 2009) has launched DR internal online startup Milkdirect in May 2017 outside of Marketing department [9]. Milkdirect sells 3 product lines directly to customers [10]. Project is a response to previously discontinued e-channels trade marketing and no usage of existing customer database. Currently key target is to increase average check and decrease operations costs to make Milkdirect profitable without changes in prices. [11]

Possible next steps: Increasing the number of Danone’s brands jointly with cooperation with other non-competitive CPG companies will support higher average basket and attract broader audience what consequently will increase density of deliveries and decrease their cost. Volume will also support more efficient supply chain and decrease necessity to write off goods from too large batches. Additional revenue stream with low acquisition extra-cost will be introduction of subscription model (e.g. new for Russia fresh milk delivery each 2 days) or dash buttons.

Danone Russia 2022

Political crisis and increasing competition (Campina sales director has explicitly highlighted that his key goal is to surpass DR sales [12]) are important challenge as DR performance will influence on Danone’s decision whether to buy or not to buy Unimilk’s share at 2022 [13] what is vital opportunity for further sustainable growth using Danone’s global scale and experience.

Which of Possible next steps should DR implement and how to prioritize them in limited budget? Are 5 years enough to make Milkdirect notable and profitable channel? What will be the competitors’ response as many of them are considered by Forbes as ready for Digital “war”?

Word count: 799

Sources:

[1] Forbes, Danone profile, www.forbes.com/companies/danone/

[2] Forbes, The World’s Most Innovative Companies 2017, www.forbes.com/innovative-companies/

[3] Official Danone Russia site, www.danone.ru

[4] Official Danone Russia Facebook page, www.facebook.com/www.danone.ru/

[5] Official Danone Russia Instagram page, www.instagram.com/danone_russia/

[6] Test has been conducted for top-10 keywords at www.google.ru and www.yandex.ru

[7] eConsultancy, “Danone: Why social media should drive digital transformation”, www.econsultancy.com/blog/68380-danone-why-social-media-should-drive-digital-transformation/

[8] RBC, “Danone to close two of its plants in Russia”, http://www.rbc.ru/business/26/12/2015/567dabfd9a7947bfa700b6a6

[9] Kommersant, “Milk poured into the Internet”, https://www.kommersant.ru/doc/3455472

[10] Official site of Milkdirect project, www.milkdirect.ru

[11] Interview with head of Milkdirect Denis Makhanko (by Ted Lisitsyn, Nov 2017)

[12] Interview with Campina Sales Department (by Ted Lisitsyn, Oct 2017)

[13] Finmarket, “Danone and Unimilk will “merge” in milk”, www.finmarket.ru/main/article/1530497

I find Danone Russia an interesting case study (… sorry everyone, couldn’t resist) in examining when a company should use digitization, or another complex process change, in their supply chain. In more developed markets and with larger companies, it can be easy to see how digitization can help virtually any entity in some way or another. But how should we think about less developed companies where there may be other low hanging fruit that’s easier to execute on?

My initial thought is that even in those less-developed cases (which seem to be aligned with Danone Russia), we should not ignore digitization initiatives in the name of pursuing other opportunities given the wide benefits that digitization can create. With that said, if the company is actually going to pursue digital initiatives, I feel that they should do so with gusto vs. in the halfhearted way that Danone Russia seems to be doing (e.g., having a dedicated social media initiative that has only resulted in 1662 followers on Facebook and 48 on Instagram implies it was not being taken particularly seriously by the company).

Danone Russia has an opportunity to use digital initiatives to massively improve not only the efficiency of its supply chain, but to also dramatically improve its ability to forecast demand (which currently seems to be a material struggle). If they can do this effectively (and assuming at least a bit of luck in terms of changes to the current geopolitical situation), I believe they have the opportunity to create a self sustaining enterprise that can create value for the company.

Thanks for sharing this interesting case! I share your concerns on meeting “5 year” targets with digitization, but believe that Danone Russia should explore on taking pricing to improve margins or selling more leveraging its strong presence, rather than investing in digitization. Reason is that digitization will lead significant upfront investment (cost & resources) and would also depend on the state of digitization of other stakeholders (suppliers, customers etc). My concern is that if Danone Russia don’t see gains materializing within 5 years, they may resort to cutting corners in quality of product which will make the situation even worse (https://www.ft.com/content/e1c99df2-78a1-11e4-b518-00144feabdc0).

Other than timeline concern, I agree with 2 out of 3 possible next steps. Regarding the marketing spend, I think Danone Russia should stick to TV advertising as this is the product for masses and internet penetration in Russia is ~50%. Effectiveness can be measured with help of market research companies (such as Nielson) through consumer surveys in terms of brand awareness, equity etc. Also, as read in Marketing cases, its bit difficult to calculate returns even on digital marketing.