Danko Arlington: The Future of Additive Manufacturing in the Aerospace Casting Industry

3D printing to disrupt the aerospace casting supply chain

Additive manufacturing technology is both a competitive advantage and threat for casting houses, such as Danko Arlington, a rising Aerospace foundry in Baltimore. My three years of experience rolling out additive manufacturing within a large, highly-diversified, tier 1, Aerospace supplier have demonstrated to me that foundries, equipped with the technology, can meet a customer’s development schedule and budget demands unparalleled by any alternative approaches. But as the technology becomes more mainstream, it will erode the major negotiation lever for casting houses: high switching costs. Consequently, Danko Arlington and other casting houses will need to extend capability to new additive manufacturing work streams and create new barriers of entry to resist supplier consolidation and margin erosion.

Historically casting product development cycles included hand crafted wooded patterns, prototype pouring, quality inspection, and pattern refinement. It was a delicate back and forth refinement between the shop floor and the back room, pattern artisans to get the product right. The process took anywhere between 25-50 weeks and occupied a large portion of the development schedule. In addition, it also consumed a healthy portion of the capital budget, running anywhere from $100K to $500K.

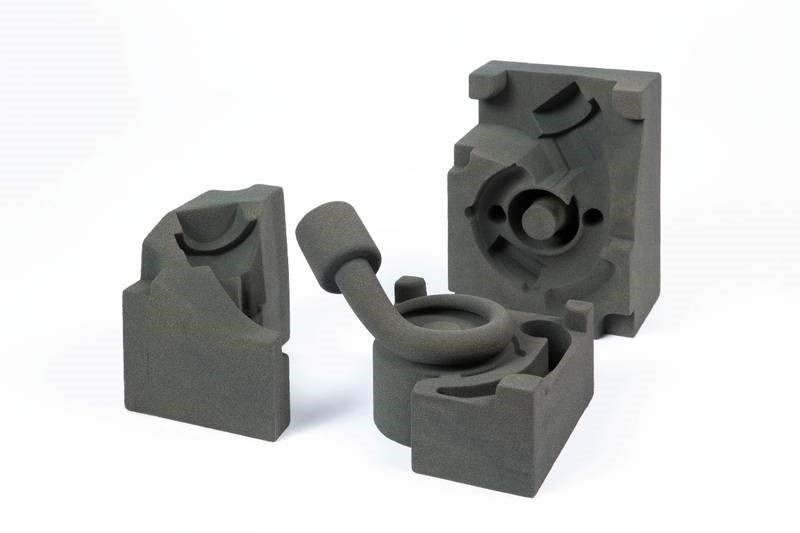

Danko Arlington, recognizing these pain points for its customers, invested in in-house, additive manufacturing capabilities in 2010. This investment included the purchase of two Stratasys 900MC, fused deposition modeling printers to produce plastic patterns. The printers eliminated the need to manually alter tooling and sped up the iteration process. It also reduced the cost to produce the first prototype tooling; although, the impact was not as dramatic, given the rise of machined sand, foam, and soft tooling. In addition to the plastic printers, Danko Arlington announced on January 2nd, 2018 that it will purchase a Voxeljet 3D sand printer, renovate 5000 square feet, and dedicate an additive manufacturing center in the spring. These moves bolster Danko Arlington’s competitive advantage by increasing the complexity of its rapid prototyping capabilities over the industry’s alternative.[1]

Unfortunately, over time, as other foundries also adopt the technology, it will become more of cost to play rather than a competitive differentiator. In fact, as wide-spread adoption ensues, tier 1 and tier 2 aerospace suppliers may begin to hold more negotiation leverage over foundries. For example, in today’s landscape, the negotiation power has been largely wielded by casting foundries. The capital and schedule investments create high switching costs. This is exacerbated by the Federal Aviation Administration (FAA) Airworthiness Standards which require that parts be tested prior to sale for commercial platforms.[2]

Ernest & Young published in its 2017 report, Top 10 Risks in Aerospace and Defense, that disruptions from single source supplied programs pose an enormous risk in terms of production and cost overruns. Sadly, there are few options for looking at alternative suppliers without incurring significant switching costs.[3] It would not come as a surprise if additive manufacturing decreases those significant switching costs across the industry, resulting in Danko Arlington’s customers qualifying parts off 3D printed sand rather than off hard tooling.

Today, a part’s qualification is tied closely to the tool used to produce the test specimens demonstrating airworthiness to the FAA. The cost of tooling capital pushes many commodity managers to risk a single source supplier. However, this anxiety may come to an end in the future as commodity managers treat tooling as a digital file for 3D printed sand. The cost of running two suppliers through qualification becomes digestible and dual sourcing becomes more of a reality. As Ernest & Young pointed out in their 2018 report, Supply Chain Management in Aerospace and Defense, “dual or multiple sourcing increases price competition by increasing the number of suppliers.” [5] Danko Arlington’s customers may leverage moving volume to their competitors in pricing discussions.

To address this issue, Danko Arlington should consider “would expanding into metal additive manufacturing and internally developing material allowances help preserve the product development funnel and maintain their negotiation position long term?” FAA requirements necessitate that material and design values be substantiated on a statistical basis.[6] Should customers qualify metal additive manufacturing parts off their systems and data, it would recreate high switching costs in the form of expensive statistical test plans.

The short term seems secure for Danko Arlington. Arguably, these developments and shifts are unlikely to occur rapidly; however, they should be cognizant of the potential change in tide and thereby invest today for a future tomorrow.

(736)

[1] “Danko Arlington Invests in 3-D Sand Printing.” America Makes, National Center for Defense Manufacturing and Machining, 17 Jan. 2018, www.americamakes.us/danko-arlington-3d-sandprinting/.

[2] Airworthiness Standards, Federal Aviation Administration, 9 Nov. 2018. https://www.gpo.gov/fdsys/granule/CFR-2002-title14-vol1/CFR-2002-title14-vol1-sec25-603

[3] Top 10 Risks in Aerospace and Defense. Ernst & Young Global Limited, 2017, Top 10 Risks in Aerospace and Defense, www.ey.com/Publication/vwLUAssets/ey-top-10-risks-in-aerospace-and-defense/$File/ey-top-10-risks-in-a&d.pdf.

[4] Voxeljet AG: What foundries have to know about 3D-Printing. (2015, November 22). Retrieved November 12, 2018, from https://www.foundry-planet.com/equipment/detail-view/voxeljet-ag-what-foundries-have-to-know-about-3d-printing/?cHash=51a1e57d7bbe191b539cc14f1150f7fc

[5] Supply Chain Management in Aerospace and Defense. Ernst & Young Global Limited, 2018, Supply Chain Management in Aerospace and Defense, www.ey.com/Publication/vwLUAssets/ey-ad-edge-supply-chain-management-in-aerospace-and-defense/$File/ey-ad-edge-supply-chain-management-in-aerospace-and-defense.pdf.

[6] Airworthiness Standards, Federal Aviation Adminitstration, 9 Nov. 2018. https://www.gpo.gov/fdsys/granule/CFR-2002-title14-vol1/CFR-2002-title14-vol1-sec25-603

Sean, I think you are spot on in highlighting the high costs of qualifying parts through the FAA. Because Danko Arlington is a first mover in the additive space within aerospace castings, I think it could capture a large piece of the market especially as it offers faster innovation at a lower start up cost. The challenge for Danko Arlington will be to drive down the cost curve so its per piece cost begins to get closer to traditional castings. This will strengthen their sales pitch to customers and allow them to entrench themselves in the market due to the high switch costs you mentioned.

Thanks Sean, it is interesting to consider how additive manufacturing can be a differentiator for Danko Arlington in the short term, but ultimately weaken their competitive positioning in the long term. I agree with your suggestion that Danko Arlington could attempt to maintain customer loyalty in the long term by developing expertise and capabilities in additive manufacturing above and beyond what its competitors can offer to customers or what customers could develop on their own. And if this expertise that will be necessary in the future, it seems like being an early mover would make a lot of sense. In retail, as we have seen a shift from brick and mortar to e-commerce, the companies that stuck to the traditional ways of doing things were left behind. If a substantial part of the industry will be moving to additive manufacturing over the next 20 years, Danko Arlington may want to ask themselves how a pure-play additive manufacturing business would structure its costs and processes, and begin making adjustments today to be ready to compete.

Very interesting insight into the casting and manufacturing process in aviation, before I read this I was flying blind. You make a very interesting point at the end regarding the potential of switching to metal additive manufacturing, which could recreate the high switching costs. Given the company’s already large investments, how will they balance the needs of today with the capex required to fund some of these (presumably) expensive manufacturing capabilities, and what is preventing larger airline manufacturers from bringing this kind of technology in house?

Great read, Sean! I have always thought of this industry as so intensely risk-averse that I think of them as *very* late adopters. I didn’t realize how much the landscape has already embraced additive manufacturing! I’m curious reading this…what do the key competences look like for an aerospace casting house of the future? Comparing that to where Danko is now (and with consideration of their competitive landscape), what gaps do they need to proactively fill? On another note, will this this trend toward additive manufacturing in aerospace casting show up in any visible/tangible ways to average consumers?