CVS Health: Can It Disrupt the Health Care Sector and Beat Amazon?

CVS Health has transformed itself into the largest health care conglomerate in the United States. Do its size and supply chain integration drive further competitive advantage, or leave it open to disruption?

The business model of CVS Health, the largest healthcare conglomerate in the United States, is under attack amid increasing calls for transparency and additional competition within the health care sector.

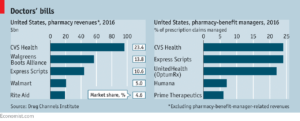

Source: The Economist [a]

Across the health care sector, health care costs and insurance premium increases have perennially outstripped economic growth, including an expected increase in 2018 of 6.5%.[1] Many employers, governments, and insurers have used pharmacy benefit managers (PBMs), which “organize the sale and reimbursement of prescription drugs between producers, pharmacists, and private and public health plans,” to hold down costs. [2] The largest PBM in the United States, CVS Health, had combined 2016 revenues of over $177B after massive investments over the preceding ten years in the vertical integration of its supply distribution chain. Indeed, the CVS Health CEO, Larry Merlo, believes that CVS’ key competitive advantage has been “our ability, largely through technology, to integrate pharmacy care from the payor to the provider to the patient” across benefit managers, 1,100 walk-in health care clinics, and 9,700 retail pharmacies.[3] Recently, however, PBMs have come under increasing fire for a lack of transparency in pricing and order accuracy.[4] Analysts argue that greater pricing transparency within the supply chain will cause PBMs (and CVS) to “lose market power and profits,” but could ultimately benefit consumers by removing “rent-seeking middlemen” and offering better choice at lower prices.[5] Additionally, Amazon has gained regulatory approval this year to become a wholesale pharmacy distributor in at least 12 states, further compounding the pressure on CVS to maximize the efficiency of its supply chain.[6]

As it seeks to address these challenges, CVS Health is rolling out same day delivery of prescription drugs in selected major markets and next day delivery across the entire United States within the next year.[7] The company has also reportedly made a $66B offer this month for the fifth-largest American insurance company, Aetna, as a further effort to more tightly integrate its supply chain for delivery of healthcare to consumers at the largest scale ever tried.[8] Additionally, CVS has announced a partnership with its biggest rival across retail pharmacies, Walgreens Boots Alliance, to align with additional independent pharmacies to serve as a 30,000 store retail pharmacy network. With this combination of improved “last mile” delivery efficiency, tighter supply chain integration, and significantly increased points of sale, CVS is clearly attempting to maintain its historic advantage over industry competitors and potentially forestall new entrants (i.e. Amazon) to the market. Over the medium term, these current initiatives are supplemented by a five year plan to optimize delivery platforms, rationalize the retail store footprint, and gain efficiencies in shared services functions while ultimately saving approximately $3B.[9] Simultaneously, CVS is expanding services into higher margin specialty prescriptions (the drug industry’s fastest growing segment).

In addition to these steps, CVS should maximize its ability to fully integrate health care systems through comparison of digitized medical files, pharmacy records, and patient outcomes. If the merger with Aetna is approved, the unique positioning of CVS Health as manufacturer/distributor (of medication), care provider (through walk-in Minute Clinics), and payer could revolutionize the ability to deliver better care at lower cost across the industry. This will require further refinements to their current capability to process digitized records and gather, analyze, and interpret outcome data. Properly executed, this analysis could help CVS develop new health care operating and business models by improving the efficacy and productivity of processes and treatment protocols.[10] CVS should also increase transparency in its PBM pricing model by publishing cost data to directly address concerns that it is profiting from consumer and health care payer ignorance.

Is CVS effectively positioned to address Amazon’s potential entry into the health care market? Will CVS Health’s attempt at tighter vertical integration and control of the distributor/provider/payer mechanisms for health care delivery improve quality of care and cost for the consumer?

(Total: 782 words)

[a] “The Right Dose?” November 10,2017, The Economist, https://www.economist.com/news/business/21730906-vertical-integration-could-put-brake-americas-unsustainably-soaring-health-care-costs, accessed November 2017

[1] Medical Cost Trends: Behind the Numbers – 2018, by the Health Research Institute (PwC), https://www.pwc.com/us/en/health-industries/health-research-institute/behind-the-numbers/reports/hri-behind-the-numbers-2018.pdf, accessed November 2017.

[2] Ralf Boscheck, ‘Pharmacy Benefit Managers: Fixing Healthcare Market Failures or Straining Regulatory Logics!?’ (2017) 40 World Competition, Issue 3, pp. 459–469

[3] CVS Health, “2016 Annual Report,” http://investors.cvshealth.com/~/media/Files/C/CVS-IR-v3/reports/annual-report-2016.pdf, accessed November 2017

[4] Thomas A Hemphill, “The “Troubles” With Pharmacy Benefit Managers,” Regulation, Spring 2017, Vol 40 Issue 1, pp14-17.

[5] “The Right Dose?” November 10,2017, The Economist, https://www.economist.com/news/business/21730906-vertical-integration-could-put-brake-americas-unsustainably-soaring-health-care-costs, accessed November 2017

[6] “Amazon Gains Wholesale Pharmacy Licenses in Multiple States,” October 27, 2017, St Louis Post-Dispatch, http://www.stltoday.com/business/local/amazon-gains-wholesale-pharmacy-licenses-in-multiple-states/article_4e77a39f-e644-5c22-b5e6-e613a9ed2512.html, accessed November 2017

[7] “CVS Is Rolling Out Free Same Day Delivery,” November 6, 2017, Fortune, http://fortune.com/2017/11/06/cvs-free-same-day-prescription-delivery/, accessed November 2017

[8] The Economist, op. cit.

[9] CVS Health 2016 Annual Report, op. cit.

[10] Nikhil Sahni, Robert Huckman, Anuraag Chigurupati, and David Cutler, “The IT Transformation Health Care Needs,” Harvard Business Review, Vol. 95, No. 6 (November-December 2017), p. 130-131

Very interesting, Kevin! I actually think that CVS Health is in a very favorable position compared to Amazon. Most notably, the physical presence of stores and clinics remains critical for healthcare delivery, so CVS’s retail presence and convenience for many consumers gives it a significant advantage over Amazon. We can only hope that Amazon’s expected entrance into this market continues to nudge companies to raise the standard for customer service and transparency in this industry, which as you note is sorely needed.

It will be fascinating to see what happens with the proposed Aetna merger. I agree that there is certainly potential for efficiencies and benefits for patients with a vertically integrated system. But because prescription drugs represent only about 10% of healthcare costs, I wonder how much value can really be derived from this type of vertical integration. Putting a significant dent in healthcare costs will require preventing chronic disease and improving care for patients with multiple chronic diseases, as this represents the bulk of healthcare spending [1]. I don’t believe that CVS has a competitive advantage in achieving this, as Minute Clinics are currently designed to primarily address one-off, low acuity problems rather than preventative primary care. I therefore tend to be more optimistic about vertical integration between payers and providers (though admittedly, these arrangements have produced mixed results to date). So if it is serious about vertical integration, CVS Health should consider opening full-service primary care clinics and more directly address the management of patient care. This move would make it an even more formidable player in the healthcare ecosystem.

[1] https://www.rand.org/blog/rand-review/2017/07/chronic-conditions-in-america-price-and-prevalence.html

Thanks for an interesting read. To answer your first question, I believe that CVS Health is well positioned against Amazon – CVS’s integration throughout the value chain (via its PBM and pending merger with Aetna) is a major competitive advantage that is difficult to replicate. CVS has already leveraged its PBM to drive traffic into its pharmacies. For example, In March 2017, CVS announced that its pharmacies would offer discounts on Novolin insulin through its PBM. [1] The potential savings of up to $100 for a 10ml vial have no doubt driven traffic to its pharmacies (and also benefited front-of-store sales).

If the Aetna merger is approved, CVS could take a similar approach to drive volume at its retail locations. For instance, they could offer Aetna members preferential rates to fill their prescriptions through CVS retail stores or its mail-order pharmacy. As Leigh points out in an earlier comment, it will be interesting to see whether these new Aetna programs will lead to an influx of new members. As you point out, CVS is also innovating on last-mile delivery to compete with Amazon’s convenience factor. Ultimately, if CVS can achieve a comparable level of convenience, its vertical integration will be a core barrier to entry – this integration will allow CVS to drive demand in a way that Amazon cannot.

1. CVS Health. “CVS Health Launches Reduced Rx Savings Program to Give Patients Access to More Affordable Medications,” https://cvshealth.com/newsroom/press-releases/cvs-health-launches-reduced-rx-savings-program-give-patients-access-more, accessed November 2017

**E-nonymous, not Kevin – got my articles mixed up and won’t let me edit!

Great article! Having worked in the payor-provider space, a merger between CVS and Aetna makes me wonder about the ripple effect not only to patients, but to providers and to other payors. It would seem with CVS being such a major PBM, they’d be in a position to give Aetna (and therefore themselves) preferred or exclusive access to prescription drugs, and to disadvantageously price toward other insurers. If price savings were passed down to customers/patients, would there be a massive influx of customers for Aetna coverage, and an exodus from other payors? Would this then cause hospitals and other providers to cut Aetna a better deal for in-network access to serve their patient pool? While I have some concerns around the potential anti-trust implications of the Aetna-CVS deal, I am especially convinced that this is one arena in which Amazon is starting off way behind the incumbent heavyweight player.

Thanks for commenting, Leigh.

Interesting questions that you posed, with a couple of thoughts as answers:

-Could there be an exodus from other payors to Aetna? Yes, I think this would have to be a key component of CVS’ strategy for them to attempt such a massive acquisition that is outside of an area where they currently have a core competency. To some degree, health insurance has been commoditized. In that scenario, a vertically integrated health care provider that can drive cost efficiency and thereby offer cheaper insurance could have a huge advantage over the competition.

-Would this cause hospitals and other providers to cut Aetna a better deal? Again, potentially yes. Other integrated health care systems like Kaiser Permanente and the Mayo Clinic have already executed an end-to-end customer health care experience, albeit on a vastly smaller scale. They report lower costs and better patient outcomes. If this can be done at a large scale (and CVS is the largest health care company in the US), that could have massive ripple effects across the entire health care sector.

*Update: I accidentally posted my comment as a reply to another comment. Reposting here as a new thread.

Thanks for an interesting read. To answer your first question, I believe that CVS Health is well positioned against Amazon – CVS’s integration throughout the value chain (via its PBM and pending merger with Aetna) is a major competitive advantage that is difficult to replicate. CVS has already leveraged its PBM to drive traffic into its pharmacies. For example, In March 2017, CVS announced that its pharmacies would offer discounts on Novolin insulin through its PBM. [1] The potential savings of up to $100 for a 10ml vial have no doubt driven traffic to its pharmacies (and also benefited front-of-store sales).

If the Aetna merger is approved, CVS could take a similar approach to drive volume at its retail locations. For instance, they could offer Aetna members preferential rates to fill their prescriptions through CVS retail stores or its mail-order pharmacy. As Leigh points out in an earlier comment, it will be interesting to see whether these new Aetna programs will lead to an influx of new members. As you point out, CVS is also innovating on last-mile delivery to compete with Amazon’s convenience factor. Ultimately, if CVS can achieve a comparable level of convenience, its vertical integration will be a core barrier to entry – this integration will allow CVS to drive demand in a way that Amazon cannot.

1. CVS Health. “CVS Health Launches Reduced Rx Savings Program to Give Patients Access to More Affordable Medications,” https://cvshealth.com/newsroom/press-releases/cvs-health-launches-reduced-rx-savings-program-give-patients-access-more, accessed November 2017

Anonymous,

Bonus points for the double post!

The Reduced Rx program is an effective manufacturers’ incentive program to encourage people to use specific brands of medication not covered by insurance. For CVS, these revenues are additive to those generated through PBM programs, and increase their share of the prescription drug filling market. Great point that the increased foot traffic to the pharmacies (at the back of the store) could also drive more front store sales.

CVS Caremark (the PBM within CVS Health) is already the PBM for Aetna, so customers with health insurance through Aetna can generally fill prescriptions through CVS retail pharmacies more cheaply than elsewhere. I think the potential value to a merger would be to increase customer loyalty within the CVS ecosystem, and to drive efficiencies once you can have an end-to-end health care relationship with a customer. can fill most of their medications throughgenerally receive best prices for filling medications through CVS retail pharmacies. which is why this merger could make capitalize on existing relationships.

Thanks for your comment!

Very insightful read, and I was surprised to learn about the size of CVS Health. I thought Leigh had an interesting comment about anti-trust issues, and I wonder if this could create any delays in approval of the CVS Health-AETNA merger, creating a window of larger opportunity for Amazon to swoop in. I was not surprised to hear that Amazon recently gained regulatory approval to be a wholesale prescription drug distributor in parts of the US, and this concerns me. Because Amazon has the existing infrastructure to quickly penetrate the market of prescription drug delivery without any major capital investments, CVS is smart to gear up with defensive measures to address this challenge and competitor through venture for same day delivery of prescriptions. Another challenge that CVS will have to endure is the high cost and the time it may take to bring the service up to speed, and it’s now entering the delivery part of the supply chain.

Thanks for the comment, Michelle. I didn’t realize the relative size of CVS within the healthcare space until I researched this article – they are the largest player in the US market. Given the overall size of the combined company, I think you’re right to be concerned about potential anti-trust concerns. I think those may be mitigated somewhat by the fact that Aetna only holds about 5-6% of the health insurance market, and CVS only has ~25% market share in the retail pharmacy and PBM spaces. I also share your concerns about CVS’ ability to effectively implement last mile delivery. They have run pilot programs within the last several years that had less than stellar reviews at the pharmacy level, but have chosen to proceed with nationwide rollout anyways. I guess we’ll know by the end of 2018 how effective they have been. Thanks again!