Coffee industry in danger of extinction

How climate change has been affecting and may soon cause the extinction of the coffee industry

The coffee production has been severely affected by recent climate changes, such as rising temperatures and long droughts punctuated by intense rainfall. The rising temperature directly impacts the production available area, as coffee beans are heat sensitive, and long droughts/intense rainfalls are responsible for lower crop yields. Because of these effects, the coffee industry is under high risk: analysts expect coffee prices to increase, flavour and aroma to change, and coffee could be extinct by 2080[i]. Additionally, millions of people could lose their jobs in the industry.

Brazil has been the highest global producer of coffee beans for over 150 years, responsible for 2.8 millions of tonnes of beans in 2015, roughly one third of world´s production. Other important producers are Colombia and Vietnam[ii]. Any relevant change in climate in these countries immediately impact prices worldwide, and the bad news is that all of them have been having warmer and drier weather recently, predicting substantial losses of coffee production by 2050[iii].

Here we´ll analyze how the industry is being affected, the threats and opportunities, and some of the best initiatives to address these issues based on a few analyses from Coffee Holding Co. (NASDAQ: JVA), a wholesale coffee roaster and dealer from the United States.

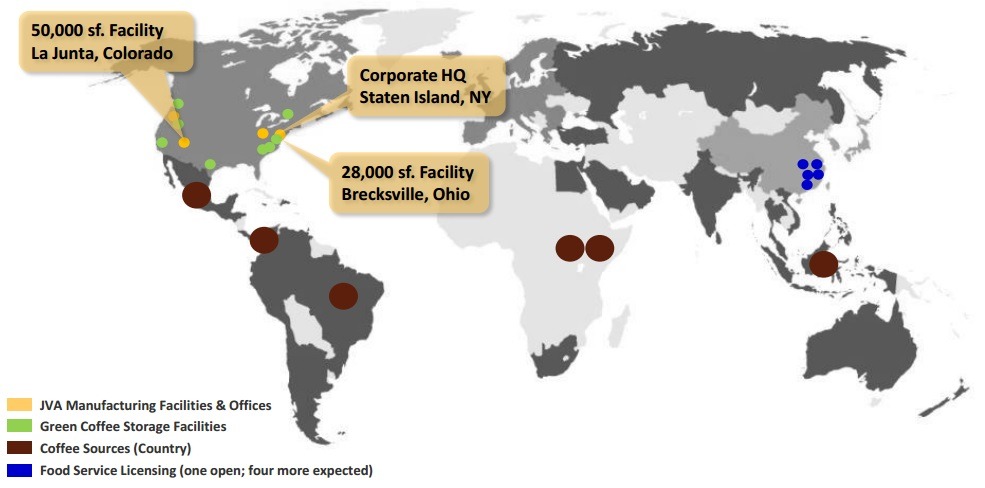

JVA has three fronts of business: wholesale green coffee (it sells unroasted green coffee beans to roasters and operators), private label (it roasts, blends and packages coffee for 30 private labels), and branded coffee (it has 5 proprietary brands and 2 exclusive agreements). The company sources its coffee from different countries, such as Brazil, Colombia and Mexico[iv].

Coffee prices from 1970´s to 2000´s were between $50 and $200/LB, however, recently prices have been facing more volatility. It changed from $225/LB in 2012 to $100/LB in 2014 and has now again been increasing, being sold at $164/LB in November/2016[v]. Some of the reasons that explain the recent increase in price include droughts in Brazil (2014 and 2016) and warmer temperature in Colombia (2016), driving yield levels in both countries down.

According to Climate Institute, we can expect several climate changes in the following years, which will directly impact their suppliers´ production cost. The question here is how companies will address this issue and fill the gap between growing demand and potentially limited supply.

Arabica cost is expected to significantly increase in the next years

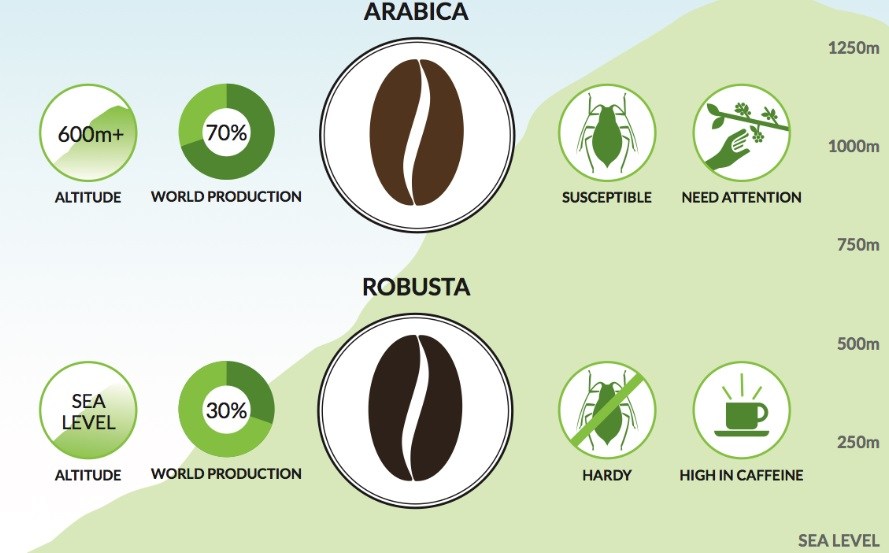

There are over 100 coffee species, however the two main ones are Arabica and Robusta. Arabica beans are naturally mild and aromatic. Robusta is easier produce on the farm, has a higher yield and is less sensitive to heat and pests. As Arabica is more heat-sensitive, slight rises in temperature affect yield – as temperature tends to increase in the following years, supply tends to be lower, increasing coffee prices.[vi]

So far, changes in price have been passed to clients, as we can see through JVA´s 2011-2015 Income Statement. Regardless the commodity price, there wasn´t a significant change in the company´s gross margin, keeping 4%-7% levels in these years, except by 2014, where commodity prices were unexpectedly low[vii].

The question is how much more consumers will absorb higher prices. Coffee is still a luxury product and is very unlikely to keep the same demand if prices skyrocket.

JVA is addressing this issue trying to both diversify their coffee supply and hedge the effects of future changing price. Based on their 2015 Annual Report: “We purchase coffee from a number of countries and are able to freely substitute one country’s coffee for another in our products”. “We also use hedging and short-term trading of coffee futures and options contracts, and intend to continue to use these practices”. These are indeed efficient initiatives in short-term, however, temperature rising will soon impact all regions, leaving the company with no option but to change its strategy.[viii].

Recommendations:

1) Increase private label and branded coffee production of Robusta

Although its flavour and aroma are not as rich as Arabica´s, there is still a huge market to grow in this front. Production is not expected to be that much affected, and countries such as Vietnam are more and more investing in its coffee production, which makes prices to be less affected in the future.

2) Partner with entities that are investing in genetically-modified Arabica

Genetic transformation has a huge potential in improving its resistance to heat. There are several projects being tested, such as a breeding program with the highly genetically-variable Nicaraguan coffee[ix]. Partnering with these entities will allow JVA to stay on top of industry improvements, make strategic decisions fast, and potentially benefit from production scarcity.

Obviously, these recommendations need to be further analyzed and optimized, but the fact is that climate changes are here and are already impacting the coffee business. Changing is no longer a matter of “if”, it´s a matter of “when” and “how”.

Word count (without citations): 799

[ii] http://www.worldatlas.com/articles/top-coffee-producing-countries.html

[iii] http://www.coffeeholding.com/

[v] http://www.tradingeconomics.com/commodity/coffee

[vi] https://www.theroasterie.com/blog/whats-the-difference-between-robusta-and-arabica-coffee/

[vii] http://irdirect.net/jva/corporate_overview

[ix] https://www.ncbi.nlm.nih.gov/pmc/articles/PMC3373144/

Interesting article – thank you! While I agree with both of your recommendations, I particularly agree that partnering with entities investing in genetically-modified Arabica may help mitigate against the weather-induced effects of climate change in the long run. An excellent example of this is the R&D work that Starbucks has been doing in Costa Rica. In 2013, Starbucks purchased a Costa Rican coffee farm and turned it into a laboratory for testing innovative coffee-growing practices and developing disease-resistant coffee beans capable of thriving in warmer temperatures [1]. Nonetheless, both Starbucks and other key players have more work to do in this space as current examples of disease-resistant coffee beans are slower-growing and lower-yielding than usual beans.

References:

[1] http://www.bloomberg.com/news/articles/2014-02-13/to-stop-the-coffee-apocalypse-starbucks-buys-a-farm

The impact of climate change on agriculture is an interesting discussion because of how inter-related agriculture and climate change are. Agriculture corresponds to a quarter of total greenhouse gas emissions [1] and conversion of non-agricultural land (e.g. forests) into agricultural land leads to surface warning [2]. The blog summarizes very well how the coffee industry is being negatively affected by climate change but it would be interesting to look at how the coffee industry itself is contributing to climate change. So in addition to the steps that you have recommended, maybe the coffee industry needs to look inwards for a more long-term and sustainable solution to global warming.

[1] https://www.ipcc.ch/pdf/assessment-report/ar4/wg3/ar4-wg3-chapter8.pdf

[2] http://www.treehugger.com/green-food/6-ways-agriculture-impacts-global-warming.html

This article really sounds the alarm for the future of coffee. I wrote my post on cocoa beans, which unlike the coffee bean, is not sensitive to temperature, only humidity. I would imagine that each degree of temperature increase would affect coffee beans many folds more that it would cocoa.

In your analysis, what I found most interesting (and maybe even controversial) was the assumption that coffee is a luxury good and therefore customers are unlikely to maintain the same demand if prices increase. While I agree that there are artisanal coffees that are very expensive and that customers will abandon right away if prices are too high, regular plain coffee is really a product for the masses and is a necessity. Furthermore, given how addicted to caffeine the world is (the American Psychiatric Association added caffeine addiction and withdrawal to its new diagnostic manual in 2013) [1], I would argue that the demand for coffee is quite inelastic and mirrors that of tobacco. As such, I think that price should not be a concern for JVA as it will be able to pass most, if not all, of the rising costs in its supply chain to the customers even as prices skyrocket.

That said, I do agree with your recommendations to find ways to increase coffee yield and production. Ultimately, JVA needs to maintain price AND volume to grow its top line. What I think would be interesting to see are some of the sustainability initiatives that JVA has taken to reduce its own carbon footprint. Given that it sources coffee beans from three different continents and processes them in a fourth, the CO2 emissions that result from this distribution network would likely be significant. Comparing and contrasting those initiatives with your recommendations could provide a good illustration of the trade-offs that JVA will need to evaluate for its future strategy.

[1] https://www.ncbi.nlm.nih.gov/pmc/articles/PMC3777290/

Thank for this well-documented article!

I agree that some coffees are clearly in the luxury category and reach very high prices. But I think the consumers of these types of coffees are less sensitive to price increase. What would really frightened me if I was JVA would on the contrary be the large market of daily basic coffee consumers, who would probably be much more sensitive to price variability.

Also, I’m not convinced that genetically modified coffee is the best way to go. While long-term effects of GMOs are still not fully undestood, there are probably other solutions to explore, like taking sustainability initiatives, or reducing costs other than raw coffee (for example through supply chain optimization, overhead costs reduction, packaging simplification…)