Climate Change Delivers New Opportunities for Maersk Line

New shipping routes open as Arctic ice caps recede due to climate change.

Climate Change Delivers New Opportunities for Maersk Line

Maersk Line and the Suez Canal Route

With over 610 container vessels globally, Maersk Line accounts for 15% of total maritime freight traffic and is the largest container shipping company in the worlda. Among the Copenhagen-based company’s most important routes is the Europe-to-Asia sea lane transiting through the Suez Canal Route (SCR)a [Exhibit 1]. At around 17,500 transiting vessels and 822mm1 tons of cargo shipped in 2015c, the Suez Canal accounts for 15% of global maritime tradeb and is the main nautical artery connecting Europe to Asia.

The SCR is a critical part of Maersk Line’s business given strong import-export activity between Europe and Asia. Asia is the largest destination for European exports – in 2015, Asia purchased 35% of EU goods traded outside of the EU d. Likewise, Europe is the largest non-Asian export destination for Chinese, Indian, and Japanese goods. In 2015, the EU purchased 12.4%, 11.2%, and 11.4% of 2015 exports from China, India, and Japan respectivelye.

Exhibit 1: Maersk’s 2015 Shipping Routes

The Earth’s Receding Frost Line

Climate change is twice as destructive in the Arctic as it is elsewhere on earth. From 1951 to 2012, temperatures in Greenland rose by 1.5°C compared to a 0.7°C average global rise during the same periodf. The effects on the Arctic Ocean have been particularly stark. In 2012, minimum summer sea ice levels decreased to 3.4m km2, a 60% drop relative to the 1960s. Some researchers predict ice-free summers in the Arctic Ocean starting in 2026b. Where sea ice isn’t disappearing, it is becoming thinner, unlocking new Arctic sea lanes and extending shipping seasons for existing onesg.

A Cool Opportunity

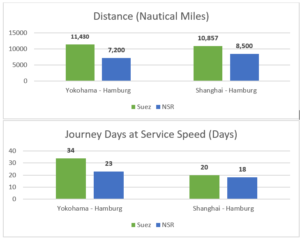

In response to thawing sea lines and improving navigation conditions, arctic cargo activity has grown dramatically as shipping companies seek shorter routes. Of particular interest is the Northern Sea Route (NSR) which provides an increasingly attractive shortcut linking Europe to Asia [Exhibit 2]. Maritime shipping through the NSR has risen from 110m tons of cargo and four vessels in 2010 to 1.4mm tons of cargo and 71 vessels by 2013h. These numbers are still insignificant relative to the Suez Canal, but they are expected to increase moving forwardg.

Exhibit 2: Northern Sea and Suez Canal Route

How will Maersk Line benefit? New shipping routes along the Arctic Ocean present an interesting long-term opportunity for the company: to reach Asia through the NSR rather than the SCR. Taking the Yokohama – Hamburg route as a yardstick, the NSR cuts distance traveled from Europe to Asia by 37% and time traveled by 32%i relative to the SCR [Exhibit 3]. The shorter distance traveled translates into significant cost savings in fuel (in the order of 35 to 45%)i. The lower travel time decreases salary costs per trip and increases overall fleet capacity as individual vessel cycle time2 decreases.

Exhibit 3: Comparative Analysis of Distance and Travel Time – Suez (SCR) and NSR

Breaking the Ice

When the time comes to capitalize on this opportunity, Maersk will need to invest in ice-water navigation and advanced planning and communications technologies.

For starters, Maersk will need to supplement its fleet with specialized vessels capable of navigating the Arctic’s icy waters. These vessels will be equipped with reinforced hulls designed to withstand collisions with ice, as well as specialized steering and propulsion systemsb. In addition, Maersk will need to invest in icebreakers, special-purpose ancillary ships developed to clear cargo ships’ paths of iceb.

Ice sheet placement, extent, thickness, and consistency vary wildly throughout the NSR and at different points during the yearb. Establishing a commercially viable shipping line in the NSR will require careful surveying of weather conditions and ice formations as well as diligent planning.

Moreover, given the route’s proximity to the north pole and the limited satellite coverage in the Arctic Ocean, Maersk will need to invest in specialized communications and navigation equipmentb.

Navigating the Path Ahead

Maersk Line must time its entry into the NSR carefully – early enough to be a first mover, but not before NSR ice levels become manageable for full-size cargo ships.

Though Maersk’s CEO has been giving Arctic shipping routes the cold shoulder, dismissing them as long-term opportunitiesj, the company should keep close tabs on thinning Arctic ice sheets and be prepared to enter the market when the time is right.

The shipping industry operates on razor-thin margins (Maersk Line reported 2015 net income margins of ~5%k) and limited differentiation. The NSR is an opportunity to provide customers with faster shipping at lower prices, as such, first movers will be handsomely rewarded with market share gains in the short-run.

The path ahead is risky given the required capital investments and the logistical complexity inherent in navigating unfamiliar waters with commercial cargo vessels. But with its low-leverage balance sheet (14% 2015 Debt-to-Assets ratiok) and its USD 5 Bn war chest3, k, Maersk is currently well positioned to sail ahead.

Maersk should consider entry into the NSR a strategic priority and pursue it aggressively. The company would be ill-advised to let this titanic opportunity cool off.

(780 words)

Notes:

1 mm = millions

2 Cycle time is defined as the time it takes a vessel to complete a given one-way trip (in this context an Asia – Europe, or Europe – Asia trip)

3 Cash + Liquid Securities

Sources:

a Maersk Group Annual Magazine, 2015, “Taking the Lead in a World of Change”, p.26, http://www.maersk.com/~/media/year-in-review/2015/annual-magazine-pj/landing-page/101831_uk_indhold_220x275_spread_final.pdf

b Raza, 2013, “A Comparative Study of the Northern Sea Rout (NSR) in Commercial and Environmental Perspective with focus on LNG Shipping”, https://brage.bibsys.no/xmlui//bitstream/handle/11250/192946/Raza_Z_2013_Masteroppgave.pdf

c Suez Canal Traffic Statistics, “Brief Yearly Statistics”, web, (data extracted on November 3rd 2016), https://www.suezcanal.gov.eg/TRstatHistory.aspx?reportId=4

d World Trade Organization, 2015, “WTO International Trade Statistics 2015”, p.50

e World Trade Organization Website and Database, web, (data extracted on November 3rd 2016) www.wto.org/statistics

f The Economist Online, June 16th 2012, “The Melting North”, web, http://www.economist.com/node/21556798

gFlake 2013, “Navigating an Ice-Free Arctic Russia’s Policy on the Northern Sea Route in an Era of Climate Change”, Taylor & Francis (June 27th 2013), p. 44 – 52

h Northern Sea Route Information Office, web, (data extracted on November 3rd 2016), http://www.arctic-lio.com/nsr_transits

iWergeland 2010, web, Arctic Shipping Routes – Cost Comparisons with Suez, CHNL http://www.arctis-search.com/Arctic+Shipping+Routes+-+Cost+Comparisons+with+Suez

jFinancial Times, October 16th 2013 , “Arctic shipping routes still a long-term proposition, says Maersk”, web, https://www.ft.com/content/f44bd53a-2e74-11e3-be22-00144feab7de

kMaersk, 2015, “Annual Report 2015”, web,

Very interesting perspective and suggestions! The NSR is certainly a possibility to be tapped in the future. The question, as you mentioned, really remains of when is the right time. In my belief, I think it is still too early to radically pursue this opportunity. The shipping industry, as you mentioned, is facing rough waters, as Hanjin, one of the world’s biggest carriers, has filed for bankruptcy earlier this year. Acknowledging an opportunity cost, Maersk should probably focus on consolidating its traditional container routes, acquiring cash-constrained competitors in the following years. In addition, environmental projections have been all over the chart in the past 10 years, especially regarding rising sea levels and Arctic sea ice declines. In my opinion, Maersk, would be better off waiting for more reliable data on the NSR to come out, focusing instead on other recently expanded routes, such as the Panama Canal.

This seems like a creative way to ride the rising tides of climate change and find ways to make existing practices more efficient. As Ricardo said, however, it seems like there are several risks associated with moving too early. My big concern here is around ships that end up stranded or trapped if weather conditions turn south quickly – ice sheets and bergs pose huge potential problems for a large fleet navigating north. Are there strategies Maersk could employ to avoid or manage these issues? I’m not sure about ice breaking technology, but developing predictive temperature models seems extremely important if you want the company to pursue this strategy. Hopefully you’d be able to get things pretty close before launching the fleet into potentially treacherous arctic waters.

I love how this post took a counter approach unlike most of your classmates, showing how global warming can be useful for certain industries and companies such as Maersk. I think that the opportunity here is excellent, and I like that you dutifully mentioned the possible issues with this strategy such as needing specialized hulls and icebreaker ships, as well as the heightened risks with ice navigation. I also liked how you really looked at the financials of the company in order to see why the time is nearly right for this opportunity.

My only question is why they need to be a first mover in this space at all, and could they simply be a high quality 2nd mover, similar in some ways to Apple. Instead of being the first to invest in the area, look at how others are succeeding or failing to ship in the icy waters, and then use the extensive war chest to create a strategy that would be able to ship in this route better than anyone else. It might be wise for them to stay out of this sector until then. After all, do you even remember MP3 players before the Ipod?

JM,

Great post (great minds think alike).

I particularly like how you emphasized that Maersk must manage risk going forward. This is an opportunity that has tremendous potential, but there is a long list of things that make this situation particularly complex: the uncertain seasonality of when routes are open, inability to effectively track 100% of ice movement along the NSR, and the current dearth of adequate emergency response (and icebreakers) throughout the Arctic.

Another challenge (that is impossible to fully address in 800 words) is the complex political situation in the Arctic. The number of competing claims to shipping lanes in the Arctic indicate that this is a situation that will not be fully resolved for many years. It will be interesting to observe how this plays out in the coming decades.