CircleUp: Riding The Wave of Machine Learning Into Your Pantry

CircleUp is ambitiously bringing a machine learning platform to life to enable the company to be more intelligent about sourcing, evaluating, and investing in CPG startups.

CircleUp

CircleUp, a San Francisco based company, is looking to bring machine learning to your pantry. Funded by the likes of Clayton Christensen, Google Ventures, and Union Square Ventures and touted by media outlets as one of “America’s Most Promising Companies” and a “CNBC Disruptor 50”, CircleUp is riding the megatrend of machine learning [1]. The company is both a platform for capital (venture capital and debt financing) and an aggregator of data in the consumer packaged goods (CPG) industry. In 2017, CircleUp launched its proprietary machine learning (ML) platform known as Helio. Helio is currently collecting data on more than 1.2 million companies in the CPG space which filters and recommends investment opportunities in the sub-10 million-dollar range [2]. For CircleUp, this platform provides a symbiotic relationship between the investing arm and the ML platform. As the ML model provides recommendations on which companies to invest in, those companies then offer data in return, enhancing the platform’s insights.

CircleUp <> Machine Learning

CircleUp started in 2012 as a crowdfunding platform primarily focused on CPG companies. Later, seeing an opportunity to use ML to enhance investment decision-making, the company began building out a data platform. Ryan Caldbeck, CEO, stated, “In an A16Z podcast in 2016, Marc Andreessen commented that machine learning wouldn’t be helpful for tech VC because there isn’t enough data (40:04 mark). We agree. But in the consumer industry, the opposite is true.“[3]

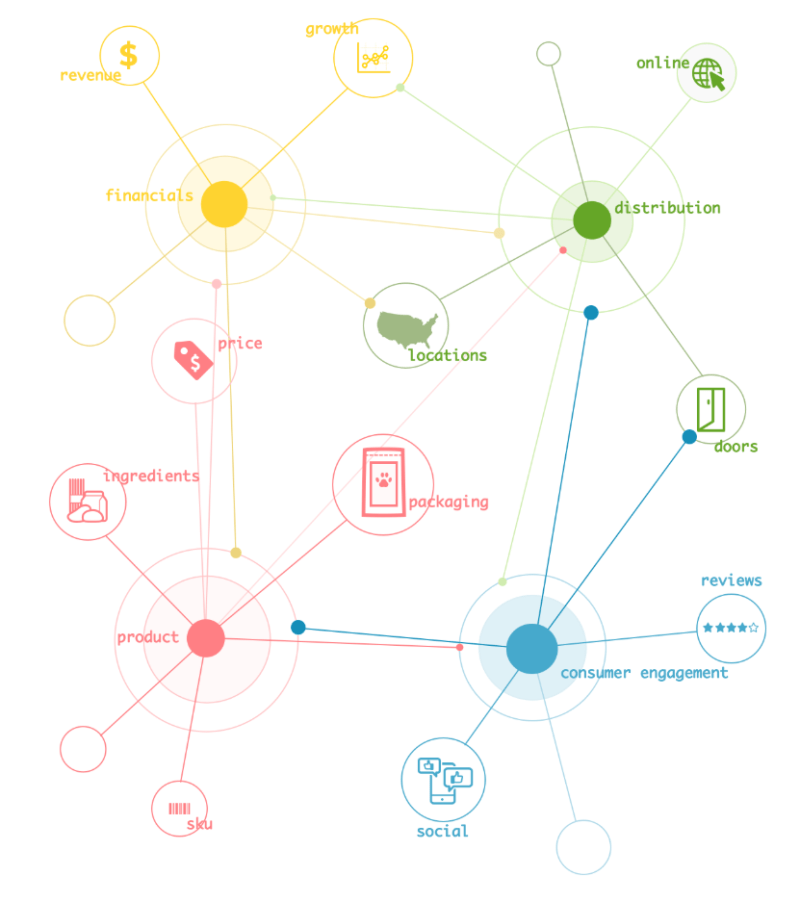

For years the company began building the ML plaform by ingesting massive amounts of unstructured and structured data into a data lake, supported by Amazon S3 [4]. On a more granular level, the company is sourcing public, partnership, and private data of over a million companies, every day. With this raw data, evaluative models are built that look at different categories like brand awareness, competitive dynamics, management team competence, and product quality. These models then help the investing team at CircleUp to filter through thousands of investment opportunities; in the past, this deal sourcing and evaluation were often cost prohibitive for other investment players, but with ML, this is no longer the case.

CircleUp’s machine learning platform is enabled by accessing web-enabled data that was unavailable before the e-commerce boom, terabytes of storage capacity offered by Amazon, and proprietary algorithms developed in-house. These factors–data scale, hardware processing capabilities, and algorithms–were predicted by Brynjolfsson and McAfeen as drivers of the Machine Learning explosion, and this certainly holds true for CircleUp [5].

In the long run, CircleUp hopes to have a built a centralized platform for CPG data that works as a data and insights hub accessible to the market. This will require Helio to continue to be scrappy in sourcing additional data as the CPG space is very fragmented and hot for new entrants, as barriers to entry are low. This will require continued, significant capital investments from CircleUp to keep up with the CPG startup scene as they source, house, and analyze data. If successful, CircleUp will be able to create a sustainable strategic advantage by having a self-adaptive algorithm can provide customized data and recommendations in CPG where there is a dearth of aggregated data [6].

Recommendations

Machine learning, like other buzzwords, has been coupled with great promise. CircleUp’s marketing corroborates this same message–big data combined with machine learning will transform the process by which capital is allocated in the CPG marketplace. In the short run, I recommend that CircleUp highlight the success of their Helio platform to aid the company in attracting more capital and more data.

In the long run, I think CircleUp could bolster their strategic edge in machine learning by (a) capturing and analyzing operational data in CPG companies and by (b) extending their platform into adjacent industries. The company has the opportunity to not only make investment recommendations with their platform but also help CPG companies operationally to understand where they might invest R&D dollars or how they can reinvigorate staid brands. As per the second recommendation, I think this same sort of platform could be applied in similar industries, such as consumer electronics.

Questions

Will the promise of machine learning come to fruition when applied to investment opportunities in the CPG space? Will the limits of ML be understood, in that it can only provide predictions, not causal relationships [7]? And lastly, will CircleUp be able to execute on their bold plans, balancing the creation of a transformative ML product while acting as a VC as well as a bank?

[Word Count: 745]

Citations

[1] CircleUp. (2018). CircleUp. [online] Available at: https://circleup.com/about-us/ [Accessed 13 Nov. 2018].

[2] Kolodny, L. (2018). A new fund uses A.I. to invest in consumer and retail products with the best chance of success. [online] CNBC. Available at: https://www.cnbc.com/2017/10/31/circleup-growth-partners-new-fund.html [Accessed 13 Nov. 2018].

[3] Caldbeck, R. (2017). Announcing The Launch of Helio. [online] Circleup.com. Available at: https://circleup.com/blog/2017/02/23/announcing-the-launch-of-helio/ [Accessed 13 Nov. 2018].

[4] Zoback, M. (2018). Why I Joined CircleUp: Building the Future of Private Investing. [Blog] The UpRound. Available at: Building A Robust Data Pipeline – A CircleUp Capability https://circleup.com/blog/2018/11/01/building-a-robust-data-pipeline-a-circleup-capability/ [Accessed 13 Nov. 2018].

[5] Brynjolfsson, E. and McAfee, A. (2017) ‘WHAT’S DRIVING THE MACHINE LEARNING EXPLOSION? Three factors make this AI’s moment’, Harvard Business Review Digital Articles, pp. 12–13. Available at: http://ezp-prod1.hul.harvard.edu/login?url=http://search.ebscohost.com/login.aspx?direct=true&db=bth&AN=124641872&site=ehost-live&scope=site (Accessed: 12 November 2018)

[6] Wilson, H. J., Alter, A. and Sachdev, S. (2016) ‘Business Processes Are Learning to Hack Themselves’, Harvard Business Review Digital Articles, pp. 2–5. Available at: http://ezp-prod1.hul.harvard.edu/login?url=http://search.ebscohost.com/login.aspx?direct=true&db=bth&AN=118678941&site=ehost-live&scope=site (Accessed: 12 November 2018).

[7] Yeomans, M. (2015) ‘What Every Manager Should Know About Machine Learning’, Harvard Business Review Digital Articles, pp. 2–6. Available at: http://ezp-prod1.hul.harvard.edu/login?url=http://search.ebscohost.com/login.aspx?direct=true&db=bth&AN=118667151&site=ehost-live&scope=site (Accessed: 12 November 2018).

Great article! I too share your concern about the misconception that machine learning is capable of discerning causal relationships. For instance helio’s may determine collections between company performance (e.g. customer satisfaction, management evaluations) and their relationships to brand awareness. Many investors may see the performance decline as the root cause for poor brand awareness. In reality, the causal relationship may be the actual reverse, absent, or confounded by associated factors that share correlations with both the dependent and independent variables.

Great work Tanner! I was curious how the relationship between CircleUp and established players in the CPG data collection space like Nielsen, was unfolding, and I found that CircleUp recently partnered to share data with Nielsen. Because of this, I think CircleUp should double down on being a machine learning company that partners with other data providers to provide actionable insights to its investing arm, and not being the primary source of data and insights. Looking forward, I think that CircleUp will have to choose between being an investor that uses Helios and a company that provides machine learning-based suggestions from Helios to other companies. I see these two business lines as being in conflict with each other: why would a company trust CircleUp to provide it solid recommendations if it is invested in its competitors? I believe that CircleUp could provide co-investment opportunities for existing companies that wish to grow their portfolio of brands, but I’m not sure that they’re best positioned to be giving those companies advice on existing products.

Wow, good find! Very interesting that they combined with Nielsen. I agree that there is potential conflict here that would need to be addressed. I’d be interested to hear what CircleUp’s outlook is on becoming a marketplace or if I’m reading into it incorrectly.