Checking Out Should Feel Like You’re Stealing

Amazon Go is changing the omnichannel landscape

Brick and mortar retail is in trouble. With the emergence of ecommerce, stiff competition, and an increasingly fragmented market, it’s no surprise that this industry has undergone drastic declines. While technology enhancements are being introduced in all areas of retail, the real transformation lies with creating a true omnichannel experience. Omnichannel customers are more valuable, spending up to 20% more than single channel customers, yet we still see stores playing a significant role; only 12.6% of retail sales are directly transacted online [1].

Tech Takeover In Stores to Save the Day?

What if you could merge the convenience of online shopping with the tangibility of a B&M store? This is a thesis Amazon is testing with their new beta concept store in Seattle, Amazon Go. By introducing technology to revitalize the in-store experience, Amazon Go has become the first “Walk Out Shopping” experience. Customers simply need to download the Amazon Go app, enter the store, take products they like, and walk out [2]. If perfected, eliminating the in-store checkout experience should make customers feel like they’re stealing.

Today’s Checkout Process and Need

Today’s checkout process in store is the source for a lot of pain for customers, and can be classified into three buckets: Traditional Point of Sale (POS), Associate mobile Checkout, and Customer Mobile Checkout (customers load cards into a retailer’s mobile app, enabling them to scan products, manage digital cart, and pay for items without interacting with store associates).

While mobile checkout has certainly improved the customer’s experience in store, checkout remains a major source of friction.

- 33% of shoppers leave a store without buying if the lines are too long [3]

- 50% of shoppers avoid stores with historically long lines [3]

- 88% of shoppers want a faster retail checkout experience [3]

Based on B&M retail sales of $22 Trillion and checkout costs of .04% [4], checkout represents an $88 Billion addressable market opportunity heading into 2020

Technology Developed to Address Need

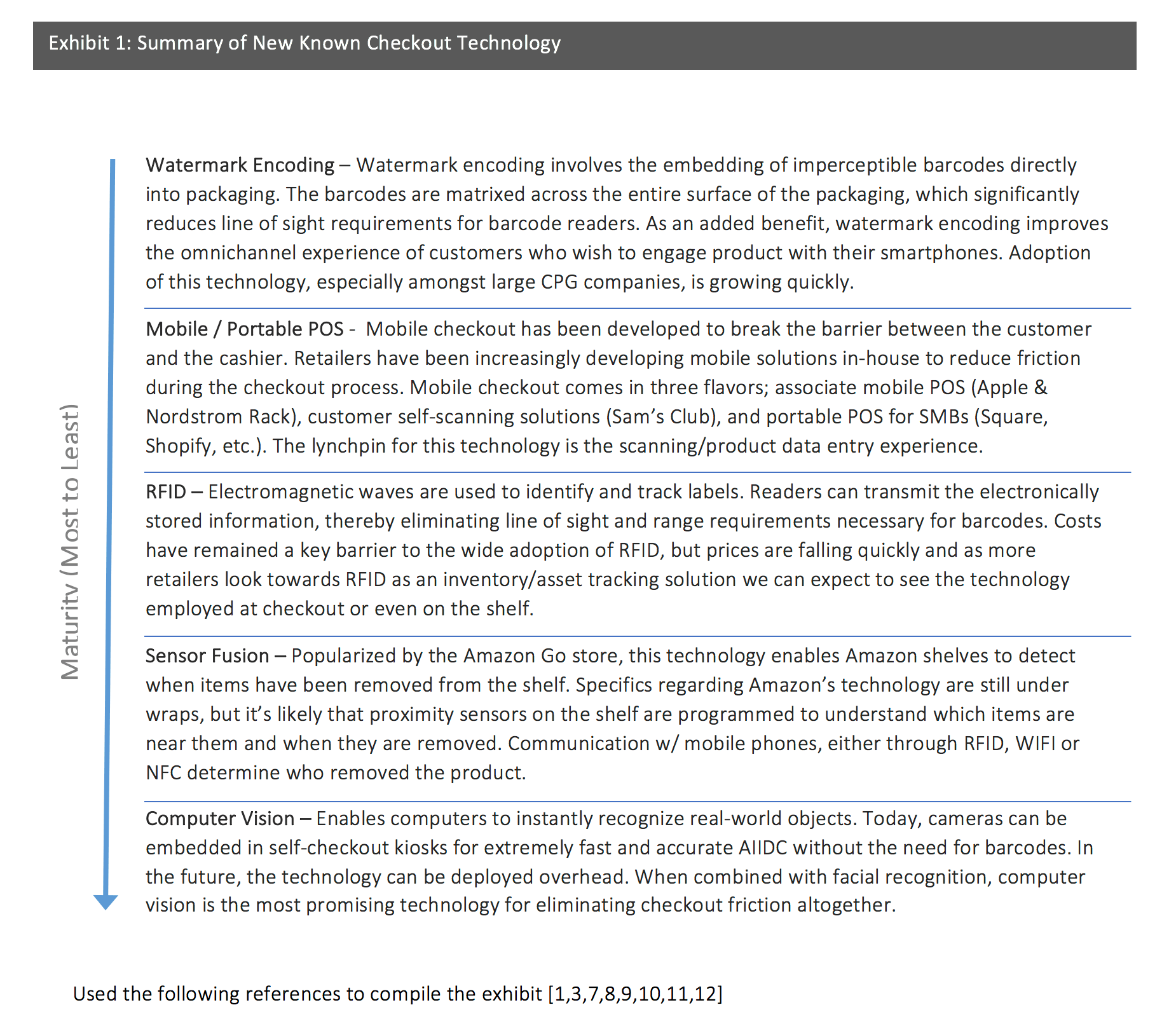

The historical bottleneck in the checkout experience has been Automatic Identification and Data Capture (AIDC). Barcode technology, invented nearly 40 years ago, is still the most prominent AIDC mechanism in the market today [3]. The key to unlocking a truly frictionless experience for customers will require further development of reduced touch AIDC technology. Different technology applications have attempted to make improvements in this space (see Exhibit 1) but currently only Amazon Go has demonstrated the ability to completely remove the need for checking out.

Amazon claims the experience is made possible by using the same technology as self-driving cars: a combination of computer vision, sensor fusion, and deep learning. They’ve created a patent on the Just Walk Out Technology that automatically detects when products are taken or returned to shelves, tracks them in your virtual app cart, and charges your Amazon account shortly after leaving the store [2].

Concerns with Megatrend

Despite the industry assumption that Amazon’s tech gives them an immediate competitive advantage, management should be concerned with the delicate nature of debuting any revolutionary technology in a physical store.

- Core competency of Amazon is tech, not retail: Entering the B&M space creates a radical departure from their current wheelhouse

- First retail play is highly visible: Messing this up would be a PR nightmare

- The store opening has already been delayed multiple times since its promised public launch in 2016, with no definitive opening date [5]

- Fraud concerns: Being a first mover in this space runs the risk of aggressive potential customer fraud

However, if Amazon can perfect and scale this technology, they will become the first checkoutless retailer. Known in the industry as the “category killer”, Amazon’s move into B&M should terrify traditional retailers.

Concerns and how to address them

In the short term, Amazon needs to focus on working through the technological kinks of the current beta store and open it to the public. Other retailers have already been scrutinizing the tech to find ways to replicate it, and have more user behavior information than Amazon given their lack of existing stores and reach. However, I believe the recent acquisition of Whole Foods stores may allow management to accelerate the machine learning process of their checkout technology through increased data capture [6] to work through some of the potential tech issues.

I would recommend that management brings in retail experts that have experience in store selection, inventory management, presentation, and general management to aid in their entrance into B&M. Additionally, they should leverage synergistic learning with Whole Foods before launching into full-scale B&M in soft-lines.

Ultimately, do we think that this technology has the potential to provide enough value in-store to reinvigorate the shopping experience? Will Amazon be the company to dominate the B&M space through superior supply chain technology? Will they eventually be the only competitor that matters?

References

- Forrester Data: Online Retail Forecast, 2016 To 2021 (US), Q4 2016 Update

- Amazon’s Corporate Website, Amazon Go FAQ, 2017

- Future of Self Checkout, A Landscape Study, Sutardja Center for Entrepreneurship & Technology led by Prof. Ikhlaq Sidhu at UC Berkeley, 2017

- Digimark study covering 120 global retail chains, 2017

- Business Insider, Amazon Go opening delayed, March 28th 2017

- Business Insider, Amazon is buying Whole Foods — here’s Amazon’s vision for the grocery store of the future, Jun 16th 2017

- Forrester TechRadarTM: Digital Store Operations Technology, Q3 2016 (Updated)

- The Forrester WaveTM: Point Of Service, Q3 2015

- Forrester TechRadarTM: Digital Store Customer Experience Technology, Q3 2016 (Updated)

- Forrester: Automation Technologies For Customer Engagement, Q2 2017

- Forrester: Commerce Technology Investment Trends: 2017 To 2018, Q2 2017

- Linneaus University Sweden, Master Thesis, Self-Service Technologies, What Influences Customers to Use Them, May 26th 2017

Thanks for the article, Mel! I vividly remember the excitement around Amazon Go’s YouTube in December 2016. Perhaps the only parties not excited were other retailers. This technology and Amazon’s pursuits in this space obviously represent a significant threat, however, I think there is still time for some companies to catch up before significant damage is done. Much of that will depend on M&A and internal development. Other large retailers have been quiet about internal efforts, but there are a number of startups pursuing similar technology, including Poly and Standard Cognition. If trends from the AR/VR and driverless car spaces hold then these startups will likely be acquired by the large companies with the most to lose as a result of Amazon Go. Therefore, we might see a hand-full of winners in the form of large companies that can afford significant investments. In my opinion, the biggest losers here will be the smaller companies who will have to wait much longer for the technology.

Aside from the obvious opportunities to leverage this technology in a few of their own stores and at Whole Foods — despite claims that they are not currently pursuing such a rollout (1) — I would think that Amazon’s end goal is to license this technology to other retailers. As you mentioned, B&M is not Amazon’s core competency and failure in this arena would be highly visible, so it is important for them to fully prove out this technology before licensing it as a service to others. But once complete, this technology allows them to become a key supplier for all retailers much in the same way they’ve done with Amazon Web Services (AWS) in the cloud, and ensures that they’ll benefit no matter where shoppers choose to transact. Similar to how they’ve become the eCommerce site for many brands online, their “walk out shopping” technology could serve as the in-store platform for major brands. Further, by essentially replacing retailers’ historical POSs with their own system, Amazon will have access to vast amounts of data on shopping habits and inventory turnover that they can incorporate into their online sales experiences. Today, online marketers are able to retarget customers who have recently browsed their sites, peppering them with discount codes and pressuring them to complete transactions. With access to in-store data, Amazon could blend online and offline marketing programs, notifying customers of in-store deals when they’re passing by retailers with products related to their Amazon browsing history or prompting customers to subscribe to regular deliveries of items they’ve seen them purchasing weekly in stores. To Grant’s point that small retailers being the biggest losers in this story, I think it depends on how/if Amazon markets this technology. Again comparing to AWS, the vast majority of companies on AWS are small and medium sized companies without the infrastructure or know-how to build systems of their own. If this technology takes off, I think the smaller retailers may be quicker to adopt while larger retailers might stubbornly believe that they can either build it better themselves (or acquire someone who can) or have a strong enough brand/shopping experience that changes aren’t needed. In that case, the larger companies would be the biggest losers.

1) https://www.bloomberg.com/news/articles/2017-11-15/amazon-s-cashierless-store-is-almost-ready-for-prime-time

Given its large scale, Amazon has strong potential to disrupt almost any space they want to play in. That said, a huge part of Amazon’s success is their optimized and easy online platform for consumer purchasing, for which the “checkout process” is a matter of seconds. While this technology could have interesting applications at Whole Foods and as a licensed products for other traditionally brick and mortar stores, I am not convinced that Amazon should enter the B&M directly given the risk and unpredictability of product mix and consumer purchasing preferences. More broadly, as Amazon continues to expand its scope of business, I wonder what (if any) monopoly regulatory concerns could become potential issues.

Thanks Mel – this is a really interesting topic. If the Amazon Go concept is successful, it will surely revolutionize retail as we know it.

I can’t help but wonder about the broader economic implications of the adoption of this technology. According to the Bureau of Labor Statistics, cashiering is the second most common occupation in the United States (3.5 million people employed) and the Amazon Go concept has the potential to eliminate most of these jobs. This outcome may just be inevitable as Amazon Go tech appears to drive significant value for the consumer – not only will these new stores save customers money (via lower priced goods supported by reduced overhead), they will also save shoppers time (who doesn’t hate standing in line), and perhaps enable retailers to optimize/personalize marketing/promotions as well. What I struggle with is that this technology targets the country’s most economically vulnerable (low-skilled labor). This is another situation where only time will tell – the “rise of the machines” has been a constant fear for decades and to-date, new technologies that were originally feared (e.g., automobile) have ended up creating new, higher-paying jobs….the question is whether the displaced labor will be suited for these new jobs.

Sources:

[1] https://medium.com/@Inside/amazon-go-special-edition-fe22cdc8ae7

[2] https://www.theverge.com/2017/2/6/14527438/amazon-go-grocery-store-six-human-employees-automation

[3] https://www.cnbc.com/2016/12/10/will-amazon-go-replace-jobs-i-dont-think-we-can-stop-it-author-says.html

Thanks Mel for an interesting read. Amazon is all about making its customers lives easier and I see this as a natural extension into retail. While e-commerce growth has been tremendous, your point that only 12.6% of retail purchases are done online suggests that disrupting the retail industry also requires an offline strategy. Some categories in particular (e.g. groceries) generate an even higher proportion of their sales at brick and mortar retail (one explanation for Amazon’s acquisition of Whole Foods). [1] Whether this checkout process ultimately becomes the new standard in retail is a question of the quality and cost of the technology. If the technology quality is truly seamless, revenue could be enhanced by driving more traffic and conversion in store; however a single bad experience or PR event could easily change a consumer’s calculus. I suspect the pursuit of technological perfection is why it is taking them so long. Cost is also a question. The economics of the technology have to ultimately make sense. Elements of that equation would include the cost of the technology (in and out of store), savings generated by requiring less staff, and the incremental revenue benefit. Of course if they are ultimately able to drive revenue and cost savings the technology will sustainable and value enhancing to both customers and retailers — thus causing disruption. Whether this is possible of course remains to be seen.

[1] Frank Newport and Megan Brenan, “So Far, American Grocery Shoppers Buck Online Shopping Trend,” Gallup News, August 8, 2017. http://news.gallup.com/poll/215597/far-american-grocery-shoppers-buck-online-shopping-trend.aspx, accessed November 2017.

Very thoughtful article. As demonstrate by customer survey statistics, this technology might greatly invigorate traditional retail, especially convenience formats. I share the concern of Amazon not being primarily in the traditional brick and mortar business. Traditional, international players, like Walmart or Tesco in Europe, are already working on similar technologies to install across thousands of stores they own. Therefore, as Amazon is lacking presence abroad (even in the digital area, not to mention brick and mortar), I would consider licensing this technology to traditional retail chains online under condition of analytics data sharing. That might be a foot in the door for Amazon to begin wider cooperation with those chains, or eventually, after aggregating enough data on consumer behavior, to enter the markets (but still focusing on e-commerce)

Loved this post, Mel! What is most fascinating to me are the ripple effects the “Walk Out Shopping” experience stands to have across all components of the grocery value chain, and the potential pushback from each angle. This is particularly dangerous for Amazon because EVERYONE is a potential Amazon customer – including the employees of the retail stores being disrupted, the grocers losing their jobs, and the suppliers forced to disrupt longstanding distribution and sales models. With its commitment to being the most “customer-centric” company in the world across its many verticals, Amazon must think holistically about who their customer is beyond the end-user of a single service, and the importance of brand equity.

One seemingly minor, yet important example of how AmazonGo serves to shake-up grocery suppliers is its potential impact on impulse buying (i.e. buying the candy bar and trashy magazine you didn’t know you needed until you went to check-out). Companies who previously thought critically about how to position for impulse purchasing must re-think the customer in-store journey, and where they play a role. [1] Without retail or grocery expertise, Amazon is at risk of alienating key players in the value chain. Hence I think your point about Whole Foods’ serving as a test-hub for AmazonGo is spot-on – not just for new technology and data capture, but for new types of supply chain relationships and understanding as well.

[1] http://time.com/money/3696197/impulse-buy-candy-hershey-online-shopping/

I used to walk by the Amazon Go storefront all the time when I lived in Seattle. I actually had no idea that it wasn’t open or that they were having such trouble getting it started. I think it’s an incredible concept and certainly addresses one of the most unpleasant parts of shopping in a B&M store. My concern with this technology is really how effective it would be and how susceptible is it to failure. If something goes wrong, you would be looking at immense loss as people walk away with goods for free. My other question about the technology is what would be the plan for the savings that occur now that registers and checkout lines have been removed from the process. Does Amazon plan to pass these savings on to the customer in the form of lower prices? Or is it another stream of revenue that will help fuel Amazon’s strive for world dominance? It will be interesting to see how this develops and if they try to run their own B&M store long-term or if they will sell the technology to other companies and capitalize on the data that is collected.

Thanks for the thoughtful article Mel. Given the retail (grocery and apparel) industry is facing so many disruptive threats, I believe that innovation which fosters a strategic and cost advantage is critical to a company’s survival. I think Amazon Go is an amazing concept because it improves the customer buying experience and reduces costs. I was surprise to learn that retail company’s lose out on the potential revenue of 33% of shoppers who leave a store without buying if the lines are too long. Amazon Go’s new operating model has the ability to recapture this loss in potential sales by creating an easier and faster check out system. Lastly, Amazon Go has the ability to streamline it cost structure as it can eliminate the need for checkout staff given that its technology makes their role redundant.

Thanks Mel! The concept of leveraging digitalization in brick and mortar check out is fascinating. From personal experience, I agree that a poor check out experience can reduce the likelihood that I walk into a given store. The fact that stores are currently using 40-year old barcode technology demonstrates that the check out market is ready to be disrupted, however I agree that Amazon, with eCommerce expertise primarily, may encounter challenges in bringing new technologies to brick and mortar stores. In order to implement a technology like Sensor Fusion, stores must be retrofitted with new furniture and structures, which would represent a significant capital investment even after acquiring a chain of stores.

Finally, as the technology progress I foresee privacy concerns from consumers. The least mature technology listed, computer vision, may discourage consumers from shopping due. I would expect there to be an unwillingness to have such detailed footage of their buying habits, physical features, and other personal information tracked by a company that already has an incredible amount of information about their online habits.

As an Australian who only discovered Amazon a few months ago I continue to be surprised by their ongoing innovation, challenging the traditional retail experience.

Solving the pain points at check-outs certainly present a huge opportunity but I feel it is just a small step in a large transition towards a fully immersive Omni-channel experience. For the projects I have been involved with trying to establish an Omni-channel experience the biggest challenge has often been stock availability and live inventory tracking. It’s no use having a store front if customer’s cannot rely on their being stock on the shelves. For Amazon in particular I think this is an interesting challenge as their supply chain model has tended to focus on holding large inventory volumes in low cost locations which are not necessarily appealing to a brick and mortar customer. Amazon’s appeal has always been to be the store with everything able to get you whatever you want in a relatively timely manner. Transitioning to a B&M channel may challenge this customer promise as it requires holding more stock in more locations.

Much like Amazon’s previous innovations in warehousing, I suspect that automation of processes such as checkouts will allow them to substitute labor costs for inventory helping them maintain a competitive cost advantage.

Awesome post! I think another important technological trend to consider in this context is how VR will transform the shopping experience. As we discussed on one of our marketing cases, people still appreciate the experience of walking through a store and seeing different items. By fulfilling aspects of this desired customer experience, VR could steer many away from certain types of retail stores. According to a recent L.E.K. Consulting study, for example, 70% of those surveyed indicted strong interest in VR shopping [1]. Ultimately, Amazon might prefer in focus its effort on creating superior VR retail platforms rather than engage in the the continuous and intensive capital investments that B&M stores would require.

To Julio’s point about consumer concern over privacy — I think that by the point this technology is developed enough, the notion of concern over privacy will be completely lost among consumers and won’t hinder the adoption of the technology. There’s already a significant generational shift in willingness to share personal information. Children today don’t know a reality in which there every move is not tracked by the GPS in their phones or digital watches.

To Ginny’s point on how this technology might impact impulse buying — That’s a fascinating consideration! For me though it highlighted a certain positive for retailers – it makes it easier in a way to be an impulse buyer. Consumers will be able to mindlessly grab a chocolate bar on their way out of the store without having to feel guilt involved in an actual physical financial transaction.

[1] Kimberly Cooper, “VR will be an essential part of retail’s future,” Venture Beat, September 8, 2017, https://venturebeat.com/2017/09/08/vr-will-be-an-essential-part-of-the-future-of-retail/

Great read Mel!

Couple of questions which struck me while reading this:

– Do you think this would see a surge of partnerships with organizations/teams with offline retail expertise? That might actually be a respite folks who’s roles have been marginalized through digitalization?

– Are deep pockets + technology enough to see through the creation of omni channels? Are there firms which can challenge Amazon’s current market position via this route?

To the question as to whether this tech has the potential to provide enough value to in-store to reinvigorate the shopping experience, I believe the answer is mixed. On the one hand, retail is never going to go away, particularly for items like clothes where some shoppers fundamentally appreciate the value of the in-store “try-on” experience. So Amazon’s new approach should make the in-store experience more pleasurable, particularly for less trial-able items like staple foods and thus should help drives sales.

On the other hand, I don’t believe that customers will sufficiently appreciate the few minutes saved by the new Amazon experience to wean themselves away from the far more convenient practice of getting the item delivered to ones doorstep. Self-check out is improving (although not as quickly as I’d hope (ahem, CVS), but nonetheless, with things like Apple Pay making check-out more convenient, I don’t see Amazon Go as being a huge differentiator.