Overcoming Material Risks: NRG’s Response to Climate Change

NRG operates one of the United States of America’s largest and most diverse power generation portfolios. However, they currently face a common challenge in their industry: the majority (~90%) of their power is generated from hydrocarbons. [1]

The process of producing electricity by combusting hydrocarbons in steam turbines contributes to increasing atmospheric concentrations of greenhouse gases. 84% of U.S. electricity was generated using fossil fuels in 2016. [2] Electrifying the national supply chain infrastructure would represent a giant step in progressing toward sustainability, but the impact would be moot if the source of that electricity contributed an equivalent amount of carbon dioxide to the atmosphere. Global interest in reducing anthropogenic greenhouse gas emissions stem from their link to an increase in recorded global temperatures, the severity and frequency of extreme weather events, and a plethora of other impacts. [3]

This trend poses a serious threat to NRG given the nature of its portfolio. NRG generates profit by purchasing hydrocarbons, generating power, and distributing electricity among a distributed grid. Several variables represent risks for this supply chain. Specifically, government regulations enacted to discourage hydrocarbon production or encourage alternative power sources threaten NRG’s ability to remain competitive. Limiting the quantity of carbon emissions would require NRG to reduce the quantity of power they supplied or pass costs on to customers. NRG recognizes the risks associated with global weather conditions and political regulations in their annual reports, noting that both are in flux due to climate change. [1] The sensitivity to each of these factors necessitated a strategy with optionality to minimize the risks associated with a business whose lifeblood has historically been sourced from coal and petroleum.

NRG responded to the evolving economic and political climates by gradually converting some of their powerplants to a cleaner, more efficient fuel source. [4] Modifying facilities to process natural gas instead of coal allowed NRG to realize multiple benefits. Augmented plants realize a 40% reduction in carbon dioxide emissions per unit of energy produced, reducing their exposure to carbon emission requirements. [5] NRG recognized a surplus of cheap gas production resulting from the shale revolution, and leveraged the commodity cycle as an opportunity to overhaul a subset of their electricity generators.

In the short term, NRG has diversified its portfolio to include renewable sources of energy. [1] By operating wind and solar power generation facilities, NRG has hedged against the volatility in coal and petroleum prices that result from traditional commodity cycles. This position decreases their sensitivity to greenhouse gas regulations while benefitting from the governmental incentives enabling renewable energy installation and operation. NRG will be able to maintain a pulse on emerging evolutions in wind and solar technologies. This timely insight on industry developments will enable NRG to respond definitively when development of new projects becomes economically viable or strategically relevant.

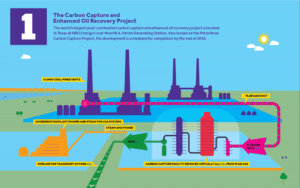

NRG is also investing in medium-term solutions to supply chain risks resulting from climate change. The company recently initiated a project that is testing the commercial viability of an emerging technology: carbon capture and storage. [6] CCS is a technology by which the exhaust gas from energy production is routed through a carbon capture process which removes nearly 90% of the carbon dioxide. [7] The residual exhaust gas is vented to the atmosphere, while the separated CO2 is deposited in a suitable storage location. While results won’t be confirmed for another 3-5 years, they could redefine the role hydrocarbons play in the global energy future.

The W.A. Parish coal-fired power plant hosts NRG’s Petra Nova CCS project. [6] This industrial-scale pilot of CCS features a unique solution for the storage of collected greenhouse gases. Concentrated carbon dioxide is transmitted 82 miles to reach the West Ranch Oil Field, where it is pumped into the oil-bearing reservoir through injection wells to improve the amount of oil recovered through a process known as enhanced oil recovery (EOR). [7] NRG worked with the operator, Hillcorp Energy, to propose the plan and acquire royalty interest in the field’s production. Creativity enabled them to mitigate their environmental impact, reduce regulatory risk, and enable economic development.

Additional actions have the potential to unlock further value for the company. Publishing the results from the Petra Nova project would encourage collaboration within the industry, and hopefully yield actionable process design improvements. NRG could also consider implementing other emerging technologies that require pilot testing. NRG is an industry leader with firsthand knowledge of policy impacts, and the company could lobby that knowledge more aggressively with policy-makers to help influence new regulations.

As an early adopter for CCS, should NRG share their insights with their industry or guard them as a competitive advantage? What criteria should NRG use to evaluate prospective power generation projects given the risks that greenhouse gases pose to the company’s supply chain (ex. economic, environmental, social, ethical)?

(798 words)

[1] NRG. 2016 Annual Report. http://phx.corporate-ir.net/External.File?item=UGFyZW50SUQ9NjYzMzExfENoaWxkSUQ9MzcwNjcxfFR5cGU9MQ==&t=1, accessed November 2017.

[2] U.S. Energy Information Administration. “Electricity in the United States.” https://www.eia.gov/energyexplained/index.cfm?page=electricity_in_the_united_states, accessed November 2017

[3] Intergovernmental Panel on Climate Change (IPCC). “Climate Change 2014: Synthesis Report – Summary for Policymakers.” 2014.

[4] NRG. “Coal.” http://www.nrg.com/generation/technologies/coal/, accessed November 2017

[5] U.S. Energy Information Administration. “Frequently Asked Questions.” https://www.eia.gov/tools/faqs/faq.php?id=73&t=11, accessed November 2017

[6] NRG. “Petra Nova.” http://www.nrg.com/generation/projects/petra-nova/, accessed November 2017

[7] Schwartz, John. “Can Carbon Capture Technology Prosper Under Trump?” New York Times, January 2, 2017. https://www.nytimes.com/2017/01/02/science/donald-trump-carbon-capture-clean-coal.html.

Utilities are in quite the precarious situation when it comes to climate change! On one hand, the majority of current infrastructure is built for fossil fuel power generation. On the other hand, renewables are rapidly becoming cost-competitive, though increasing the share of renewables in utilities’ generation portfolios will require substantial investments. Moreover, due to the intermittent nature of renewables, utilities will also have to invest in energy storage technologies, the vast majority of which are extremely expensive or still in the technology development/ pilot phase. To make matters worse, as distributed generation becomes more common through household solar and the use of electric vehicle batteries for storage, utility revenues will steadily decline as consumers generate their own electricity. Thus, utilities, like NRG, need to find other sources of revenue generation and monetization, such as CCS. As utilities will soon be battling over these additional revenue streams, I think NRG should hold its CCS knowledge as its competitive advantage, because it is almost guaranteed that all major utilities will be investing in R&D to find their own diversified revenue streams. As far as how to determine the efficacy of new renewable projects, utilities should be mindful of the rise of distributed generation so as to not over-invest in generation assets that may soon be underutilized.

http://energy.mit.edu/research/utility-future-study/

Your introduction to the topic provided a tight, complete synthesis of NRG and its business model, and how climate change and the sustainability response to that trend will affect the company itself and the wider energy industry. As you point out, both their supply chain and their production processes themselves are threatened by the impacts and reactions to climate change. I found it most interesting that NRG’s mid-term solution of developing CCS systems is in itself “sustainable” by not only reducing the carbon released into the atmosphere at production plants, but also then recycling that same carbon as an input to increase overall yields at their oil extraction operations. Finally, the as-yet-unknown impact of trends like distributed generation and clean energy storage on the demand side of the equation is absolutely of utmost concern to the company in the long-term; the question will be to what extent these technologies replace baseload generation versus fill the gap in capacity growth.

Interesting point on NRGs potential decision to license their work. Two observations lead me to believe they might be inclined to do so. First, generation is a local business. NRG could pick and choose which “competitors” to supply with IP based upon geographical overlap of their portfolios. The Southeast and Pacific Northwest appear to be ideal candidates (http://maps.nrg.com/). Second, by sharing IP, NRG would help lower industry-wide emissions, which could stave off aggressive and costly government intervention.

Great analysis Remi. I was working on a similar company before, and think there is a huge potential to reduce the energy consumption and be environment friendly even before we heavily invest in renewable energy or other forms.

What we did was to improve the energy conversion efficiency the hydrocarbon. We did it in two ways,

1. improve the efficiency of the machines that convert the hydrocarbons into power

2. improve the waste generated during the power generation process.

In the end, we manage to reduce 20% of the energy consumption in the end.

What I meant that in the short term, even by improving the operation efficiency, we can reduce the hydrocarbons by a lot.