Caterpillar – Embracing Open Innovation and Co-creation

Even though the global construction market is worth about $10 trillion, it is one of the slowest industries to adopt new technologies. To complete one construction project, many stakeholders, such as architects, engineering firms, equipment manufacturers, surveying companies and local contractors, work together. Among them, who will be the owner of new opportunities? How can Caterpillar drive the innovation?

The Future of Construction

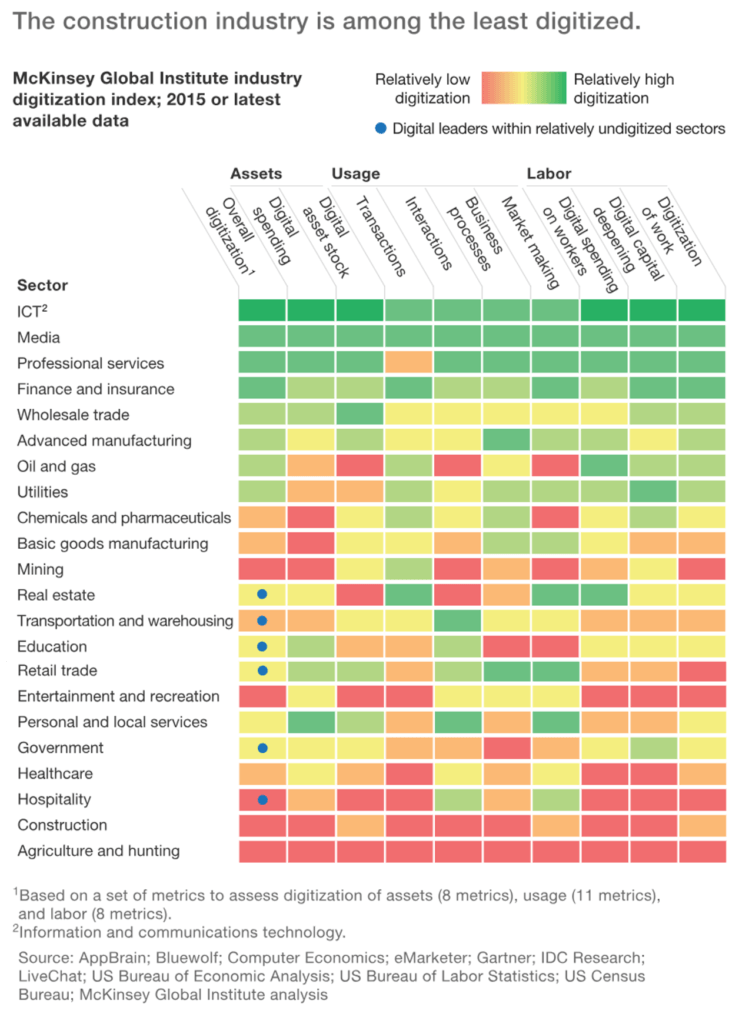

As McKinsey analyzed in its report, the construction industry is least digitized one. [1] To solve uncertainties in dusty and dangerous working environment in construction job sites, global construction experts set the next direction of the construction industry. Overall, autonomous vehicles and advanced analytics would replace human operators in job sites. [1] When will these changes happen and how companies can change the whole value chain in construction?

[1] McKinsey & Company, Imagining construction’s digital future

https://www.mckinsey.com/industries/capital-projects-and-infrastructure/our-insights/imagining-constructions-digital-future

A Perspective of the market leader, Caterpillar

Caterpillar, the No.1 manufacturer of construction equipment such as excavators, loaders, tractors, now emphasizes the role as a construction solution provider that helps its customers boost efficiency, improve safety and save time and money. [2] It’s solution, “CAT Connect”, connects every machine and human operators using IoT hardware and analyzes the data gathered from them to optimize operation. Caterpillar’s goal is to transform its hardware-based business model into more solution-based, service business.

The beginning of Open Innovation

Caterpillar felt the needs of digitalization from the late 1990s, but they did not come up with notable achievements until recent years. It was hard to change the culture of the company that focuses on the improvement of existing products they developed. Therefore, Caterpillar started to cooperate with external experts. For example, Caterpillar co-developed its fleet management system with Trimble, the industry-leading global navigation satellite system providers through a joint venture company only dedicated to building the platform for next digitalization initiatives. [3] Trimble’s expertise on industrial software enabled Caterpillar to develop a powerful equipment management system.

However, because of this partnership, Trimble entered the construction market as a total IoT solution provider and became one of the competitors of Caterpillar in solution segment. [4] And there are now over 100 startups that spotted the opportunities in the construction industry. [5] Caterpillar did not intend to make new competitors, but its initiatives are one of the key factors that affected new innovation in the industry.

Broader Open innovation – Embracing the Trend

Caterpillar brought more active initiatives on using external resources. In 2015, Caterpillar found a venture capital arm called “Caterpillar Ventures” to invest in early-stage companies operating in the energy, IoT, and advanced materials sectors. [6] Caterpillar no more focuses only on finding M&A targets to make a business impact in the short term. It spends on various early-stage startups to monitor the technology and embrace the trend. [7]

As a significant shareholder of the companies, Caterpillar can co-develop products with the startups. For instance, Uptake analyzed the data Caterpillar collected from sensors embedded on industrial equipment to build predictive maintenance solution for construction sites. [8] In 2017, Caterpillar acquired Yardclub, the online equipment rental platform designed to manage rented equipment fleet efficiently. [9] Technology of Yardclub itself was not exceptional, but Caterpillar got access to startup ecosystem in Silicon Valley by acquiring talents in start-up company located in the West coast.

Ultimately, Caterpillar’s goal is to keep track of industrial IoT trends related to the future of manufacturing. In 2017, Caterpillar funded “Startup pitch event” for SXSW. [10] The business model of the winner was about material handling robots, which was not directly relevant to Caterpillar’s business. However, after this event, Caterpillar started to invest in similar robotics technologies.

Next steps

In the short term, Caterpillar should prioritize the technologies it needs and broaden the scope of innovation – not only in construction or mining sectors but should focus more on the backbone technologies such as Robotics, Machine Learning, and Data Analytics. The company should internalize key technologies by acquiring companies with unique technologies or hiring talented experts. A partnership is essential for open innovation, but it does not mean that external players can solve every issue. In the long run, Caterpillar should collaborate with various companies to build the ecosystem. Even Caterpillar’s competitors as Komatsu can be its partner to gather data and analyze them together.

However, is it always effective to use open innovation approach for every industries and organization? What are the obstacles to manage innovation from outside? Caterpillar might choose to build an open-source environment that values collaboration with companies in the same field, even with its competitors as Komatsu, Volvo or Trimble. In that case, who will be the winner of the innovation?

Furthermore, what would be the area of innovation that Caterpillar leads the trend? There are some technologies or business models that Caterpillar cannot be the owner of technologies because of lack of relevance on its original business. For example, Trimble had dominated site monitoring software technology for over decades. Rather than allocating its limited resources on software, should Caterpillar focus on developing a specialized solution that only Caterpillar can offer as the expert in the construction industry? Alternatively, is there no need to limit the scope of innovation?

(792 words)

[Cover Photo] “Caterpillar, Innovation Past, Present and Future.”, Caterpillar Official Youtube Channel. December 01 2016. https://youtu.be/zEAhEPmVu98 Accessed via web, Nov 2018.

[1] Rajat Agarwal, Shankar Chandrasekaran, and Mukund Sridhar. “Imagining construction’s digital future.” McKinsey & Company. June 2016. https://www.mckinsey.com/industries/capital-projects-and-infrastructure/our-insights/imagining-constructions-digital-future Accessed via web, Nov 2018.

[2] CAT Connect (Official Website) https://www.cat.com/en_US/by-industry/construction/cat-connect.html Accessed via web, Nov 2018.

[3] “Caterpillar and Trimble form new joint venture.” Trimble IR. October 05 2008.

http://investor.trimble.com/news-releases/news-release-details/caterpillar-and-trimble-form-new-joint-venture-improve-customer Accessed via web, Nov 2018.

[4] Trimble Connect (Official Website) https://connect.trimble.com/ Accessed via web, Nov 2018.

[5] “Building Blocks: 100+ Startups Transforming the construction industry.” CBinsights. July 11 2017. https://www.cbinsights.com/research/construction-tech-startup-market-map/ Accessed via web, Nov 2018.

[6] Caterpillar Ventures (Official Website)

https://www.caterpillar.com/en/company/innovation/caterpillar-ventures.html Accessed via web, Nov 2018.

[7] Crunchbase: The list of investments by Caterpillar Ventures

https://www.crunchbase.com/organization/caterpillar-ventures/investments/investments_list Accessed via web, Nov 2018.

[8] Tom DiChristopher. “Tech start-up Uptake makes ‘big’ acquisition in race to digitize the industrial industry.” CNBC. April 16 2018.

https://www.cnbc.com/2018/04/16/machine-learning-firm-uptake-is-acquiring-a-huge-industrial-database.html Accessed via web, Nov 2018.

[9] Ryan Lawler. “Caterpillar acquired Yard Club, a marketplace for construction equipment.” Techcrunch. May 05 2017.

https://techcrunch.com/2017/05/05/caterpillar-yard-club-acquisition/ Accessed via web, Nov 2018.

[10] “SXSW Startup Village” (Official Website) http://www.holtventures.com/sxsw/ Accessed via web, Nov 2018.

I agree that Caterpillar should be selective about external collaborators to build an ecosystem of new construction. There are various stakeholders involved to construct a building, such as manufacturer, general contractors and sub contractors. In order to accelerate the innovation, it is better to include those stakeholders in the open innovation process. However, most of them are also connected to Caterpillar’s competitors. As you suggested, having exclusive and long-term contracts is one of the solutions. Moreover, a large advantage Caterpillar has is that it manufactures construction equipments, so that it has better insight on what is required to streamline construction process on site. I am curious about how they take advantage of their unique position, being most close to physical products, to develop new IoT system.

Very interesting article! Doing research on the construction industry, in a different context, I ran into a very similar observation – that the sector is extremely slow to innovate. I guess there is so much inherent risk to this highly cyclical industry that it is very reluctant to take on additional risk related to innovative projects. But the change is inevitable and it was fascinating to see how it might happen through open innovation. But I also agree with you that very often M&A might be a better idea. Maybe collaboration with outsiders through open innovation could be the first step (identifying potential directions of innovation) followed by finding suitable acquisition targets…

Agree with your last paragraph that Caterpillar needs to focus its energy and capital on a clear strategy. Like many industrials companies, Caterpillar seems to be taking the scattershot approach of investing in companies just for the sake of being ‘digital’. As you suggested, Caterpillar should create more defined boundaries for its VC sandbox and ensure that its investments are targeted at solving its strategic and operational problems.

I enjoyed this perspective on the construction industry. To me it is really interesting how an industry that is so dependent on machinery can be so far behind in terms of technology. That being said, given the cyclicality of the business, it makes sense that companies are extremely risk averse and hesitant to make costly changes.

Given that Caterpillar does not seem to have the technological capabilities in-house and this problem involves many stakeholders, I agree that it may make sense for them to somehow gain those capabilities through open innovation. Although, it sounds like up until this point they have not been successful in their attempts.

In the long term, surviving in construction I think will be dependent on a company’s ability to progress technologically, so an interesting question arises to me of whether Caterpillar will be able to survive if they do not get this right. Whoever is able to innovate first will be at an extreme competitive advantage.

Great article! One point that I had never previously thought about was the idea that innovation spurs competition. Once people see a giant like Caterpillar moving into an industry, they can inspire others to take a second look at those markets.

Typically when I think of Caterpillar, I think of a big old (un-innovative) company. Do you have any idea how the returns have been on Caterpillar Ventures — understanding of course, that most of the investments are for growing and staying close to strategic acquisition targets. But still curious how they are at identifying strong entrepreneurs.

Totally agree with the direction of building a software platform. Caterpillar has a broad range of construction equipment. But just because you use a Cat excavator doesn’t mean you have to use a Cat dump truck. However, if they successfully integrate everything into a *useful* system, companies may be more incentivized to buy or lease their entire suite of equipment from them.

Do you think Open innovation is a necessary part of this strategy? Could they not simply develop internally (esp. given its B2B nature)? Thanks! Awesome article.