Capturing the Fashion Unicorn: A Not-so Far-fetched Story

Farfetch, the UK-based omnichannel luxury retail platform, boasts a differentiated value proposition – the seamless integration of online and offline.

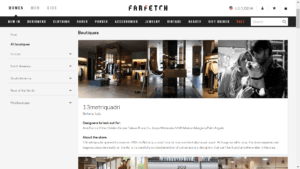

Founded in 2008 by Portuguese entrepreneur José Neves, Farfetch is a UK-based e-commerce platform connecting 500 independent luxury boutiques worldwide with shoppers in 190 countries [1][2]. With more than a million customers [4] that spend an average of $700 per order [1], Farfetch is the world’s most-frequented online luxury shopping destination [3] and was valued at $1.5bn at its last round of funding in May 2016 [3], cementing its status as one of tech’s few “fashion unicorns.” Projected to conduct over $800mm of transactions in 2016 (which translates to ~$200mm of sales) [3], the company is said to be positioning itself for a 2017-2018 IPO [5].

https://www.youtube.com/watch?v=jIAM84-DjMI

Business Model

Unlike other pureplay e-tailers who aim to replace the traditional retailing model, Farfetch recognizes and in fact embraces the value of the brick-and-mortar shopping experience [6]. Equipped with 1,500+ carefully curated brands [3], Farfetch offers a differentiated value proposition – the seamless integration of online and offline.

To the consumer, the company delivers value by granting access to an unparalleled global selection of fashion-forward pieces rivaling that of Barneys or Bergdorf. To the boutique, the platform 1) helps to clear inventory by connecting the store to a vast network of international shoppers, 2) incentivizes taking riskier merchandising bets by mitigating constraints resulting from regional style preferences, and 3) enables brick-and-mortar establishments to operate 24/7. In return, Farfetch receives a 25% commission from each transaction [6].

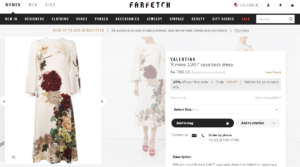

Exhibit 1: Product landing page. Farfetch.com

Operating Model

Similar to eBay, Farfetch serves as a marketplace and does not carry inventory. Given that its boutique partners are typically small-scale operations with limited or no digital experience, Farfetch ensures a smooth offline to online transition by managing the presentation of products, processing payments, and negotiating attractive rates with logistics groups. To assuage shopper concerns around committing to big-ticket purchases without having worn the item, the company offers a “Click-and-Collect” service. Customers can pick up a previously placed order at a boutique, try on items, and return any unwanted goods at any participating store in the Farfetch network [7]. In addition, the platform is available in 9 different languages to both boutique partners and shoppers [2].

For boutiques, listing products on Farfetch is a multi-step process [1]:

- Boutique checks whether the item it intends to list has previously been sold on Farfetch by another vendor. If so, the boutique can proceed with the listing and product images from Farfetch’s archives are used.

- Otherwise, the item must be sent to one of Farfetch’s studios in LA, Hong Kong, Portugal, or Brazil to be photographed.

- Four on-model shots (front, side, back, and detail) are taken. At the LA studio, for example, this step is expected to take no more than 4 minutes per item.

- Photographer takes standalone product shots.

- Photos are sent to the Portugal studio, where retouching and uploading takes place.

- Item is repackaged and sent back to the boutique, who pays for the return shipping costs. At the LA studio for example, total turnaround time averages 3-5 days.

Exhibit 2: Global boutique partners. Farfetch.com

Recently, Farfetch has made considerable investments to improve the execution of its omnichannel strategy. In May 2015, it acquired London-based boutique Browns with the goal of incubating and testing retail experience innovations at a physical store before implementing them across the broader Farfetch network [8]. Earlier this year, the company debuted its white label platform business, Farfetch Black & White, which builds e-commerce capabilities for monobrands that have historically eschewed digitization [9]. Its first client site, ManoloBlahnik.com, launched in March [9].

What’s Next?

While Farfetch is facing considerable competition from the likes of Moda Operandi that adhere to the traditional wholesale model and aggregators such as Lyst and Polyvore, few have its scale and omnichannel know-how. With more than half of luxury shoppers’ searches now being conducted via mobile [10], the logical next step would be for Farfetch to further its mobile platform. The acquisition of Browns will likely play a considerable role in helping Farfetch identify opportunities to enhance the shopping experience, from brand discovery to ultimate purchase. In fact, it is already investing in an “image-recognition software that can identify a customer entering the shop and glean from electronic records whether she’d like help, a dressing room, or a heads-up that a jacket she tried on a month ago is now on sale [11].”

E-commerce is projected to become the world’s third largest luxury market [3], and Farfetch is uniquely positioned to capitalize on favorable market trends. It is important to note that while Farfetch has enjoyed robust transaction volume growth, the retailer has yet to turn a profit. Nevertheless, by leveraging its rich experience in both offline and online, and beta-testing potential innovations at its Browns boutiques, I am confident that Farfetch is on its way to becoming the preeminent voice in luxury fashion.

(Word Count: 795)

Sources

[1] Elizabeth Holmes, “Where Luxury Fashion Is a High-Speed, High-Volume Business,” Wall Street Journal (26 October 2016), accessed 18 November 2016, http://www.wsj.com/articles/where-luxury-fashion-is-a-high-speed-high-volume-business-1477504330.

[2] “Global E-Commerce Marketplace Farfetch Announces $110 Million Series F Round,” Index Ventures (04 May 2016), accessed 17 November 2016, https://www.indexventures.com/news-room/news/global-e-commerce-marketplace-farfetch-announces-us-110-million-series-f-round.

[3] Limei Hoang, “Farfetch Appoints Chief Strategy Officer, En Route to Eventual IPO,” Business of Fashion (09 November 2016), accessed 17 November 2016, https://www.businessoffashion.com/articles/bof-exclusive/bof-exclusive-farfetch-appoints-chief-strategy-officer-en-route-to-eventual-ipo.

[4] Maghan McDowell, “Farfetch Hits One Million Customers,” Women’s Wear Daily (15 August 2016), accessed 18 November 2016, http://wwd.com/business-news/retail/farfetch-hits-one-million-customers-10506380.

[5] Ruth David and Matthew Campbell, “Fashion Startup Farfetch Said to Plan IPO as Soon as 2017,” Bloomberg (4 November 2016), accessed 17 November 2016, https://www.bloomberg.com/news/articles/2016-11-04/fashion-startup-farfetch-said-to-plan-ipo-as-soon-as-next-year.

[6] Vikram Alexei Kansara, “Farfetch’s Global Platform Play,” Business of Fashion (05 April 2015), accessed 17 November 2016, https://www.businessoffashion.com/articles/fashion-tech/farfetchs-global-platform-play.

[7] Farfetch.com, accessed 17 November 2016, https://www.farfetch.com/click-and-collect.

[8] Kate Abnett, “Browns Acquired by Farfetch as Part of Omni-Channel Growth Strategy,” Business of Fashion (12 May 2015), accessed 17 November 2016, https://www.businessoffashion.com/articles/news-analysis/browns-acquired-by-farfetch-as-part-of-omni-channel-growth-strategy.

[9] Rachel Strugatz, “Farfetch Jumps Into Monobrand E-commerce With Manolo Blahnik,” Women’s Wear Daily (30 March 2016), accessed 17 November 2016, http://wwd.com/business-news/retail/farfetch-jumps-into-monobrand-e-commerce-with-manolo-blahnik-10399673.

[10] Linda Dauriz, Nathalie Remy, and Nicola Sandri, “Luxury shopping in the digital age,” McKinsey (May 2014), accessed 17 November 2016, http://www.mckinsey.com/industries/retail/our-insights/luxury-shopping-in-the-digital-age.

[11] Amy Thomson and Matthew Campbell, “Farfetch Tries to Reach a Little Further,” BloombergBusinessWeek (12 November 2015), accessed 18 November 2016, http://www.bloomberg.com/news/articles/2015-11-12/luxury-fashion-site-farfetch-tries-to-reach-a-little-further.

This is a fascinating business model, but I’m concerned that boutiques near populated areas will bear a significantly higher than fair share burden of customer service. As customers visit to try on or make returns of goods that the visited boutique does not profit from, the incentive to provide commensurate service may fall short. At worst, I’m concerned that the staff could be overwhelmed by the demands of Farfetch customers and experience a corresponding decline rather than an increase in profitability as a result of the arrangement.

Mary- great blog! It seems that FarFetch is definitely doing a good job enabling fashion-conscious customers to order top fashion brands online, just as the average customer is able to order clothes from a mainstream retailer. I think it is a delicate balance to offer luxury online without making it seem too accessible and therefore, not luxury anymore.

I really like how FarFetch is also able to help boutiques clear out inventory by making the inventory accessible to customers all around the world, in turn motivating boutiques to be a bit more risky in their design choice. However, I am concerned about the relationship between boutique owners and FarFetch. Boutique owners are probably very aware that their merchandise will sell better online because they will be able to reach a wider customer base, thus making their brick-and-mortar establishments an unnecessary monthly rental expense. The revenue could instead be invested in more designs and SKUs. However, for boutique owners who want to maintain the physical presence of a store, might be torn between doing business with FarFetch or going it alone. How does FarFetch manage this relationship with boutique owners?

This was super interesting to read – thanks for writing, Mary! A lot of retailers talk about omnichannel strategies, but it’s cool to read about a company that is getting it right for boutiques that normally would have a hard time executing omnichannel. There’s clearly a premium placed on the consistency and high level of customer service given, from the product images and retouching to the way returns and exchanges are managed. Reading your article made me wonder – how do the various boutiques that list their products on Farfetch think about the other boutiques that list on the site? There’s a level of interdependency between various boutiques in the network to enable the return/exchange model, but some of them likely also view each other as competitors. Is this a tension that needs to be mitigated as Farfetch continues to grows, or does the online channel present such a large opportunity for boutiques that any competitive risk is overshadowed?

Great post, Mary! I had a similar thought as Ellen: how exactly do these different boutiques think of each other? I think Ellen is right that, oftentimes, these boutiques could see each other as competition while still relying on the network for the Click-and-Collect service. However, it also strikes me that they might be incentivized to treat the FarFetch customers as an opportunity for an upsell. Now, these boutiques are bringing in a new customer who’s likely in the same demographic as their existing clientele (higher income, discerning sense of fashion etc). Why not use FarFetch as an opportunity to make a new sale?

App analytics firm, SensorTower, estimates that FarFetch only received 60k downloads worldwide in October, ranking it outside the top 250 free shopping apps on the App Store. [1] If luxury shopping searches continue to move onto mobile at the rate we’ve seen, I worry that FarFetch will lose market share to a more mobile-savvy competitor.

Do you think FarFetch has the in-house technology expertise to turn around its mobile performance or do you think it needs to acquire a company in order to gain those skills?

[1] https://sensortower.com/ios/rankings/top/iphone/us/shopping?date=11/20/2016

Mary, this article is very insightful. I used to shop occasionally on Farfetch and have always wondered how they manage their internal logistics. Their customer service amazed me—fast DHL shipping and seamless return process. I was surprised to learn that Farfetch receives 25% commission from each transaction, which to be seems to be a very high amount taking into considerations additional shipping costs that boutiques stores will have bear. It makes me wonder how profitable being on Farfetch is to these small boutique stores. Given such a high commission and strict standards on product presentation, do you think Farfetch can scale its business? In addition, do you think Farfetch could partner with Barneys, Bergdorf, or other luxury US-based department stores to help expand these stores expand their online platform internationally?

Interestingly, FarFetch has recently decided to move one step forward, by creating Farfetch Black & White, which leverages the company’s technology infrastructure to offer e-commerce solutions for brands (see more at: https://www.businessoffashion.com/articles/bof-exclusive/farfetch-e-commerce-fashion-brands-omnichannel). what does that mean? that not only Farfetch operates marketplace that gives visibility to small brands that would otherwise have no exposure to the international market, but now also offer a 360 solution to major brands that need support in creating their own distinctive website (UX design capabilities), integrate POS (IT integrations), as well as fulfilling orders, payments and customer service for them. This move puts Far Fetch in direct competition with Yoox – Net a Porter, which has so far enjoyed high market share in setting up e-commerce solutions for high-end brands.