BP: Working towards a low carbon future

As a global oil and gas company, BP recognizes that the existing trend of increasing greenhouse gas emissions worldwide is not consistent with limiting the global average temperature rise to 2°C or lower. It is taking actions to meet the demand of low-carbon future.

Climate changes poses significant challenges to the oil and gas industry. Specifically, risks arise from the following aspects:

- Lack of water resources: oil and gas production relies on water resources. According to relevant research, it can take as much as 1.8 gallon of water to produce 1 MMBtu of natural gas. Climate change causes water shortage that may lead to operational disruptions.

- Dysfunctional Assets: oil industries’ existing infrastructures were designed based on normal weather and may fail to work properly under extreme climate conditions.

- Jeopardize public image: oil and gas companies generate greenhouse gases (GHG) throughout their entire working process, from exploration and production of oil and gas to refinery and delivery to end users. it will hugely damage the corporate’s public image if an oil and company does not take actions towards GHG emissions,

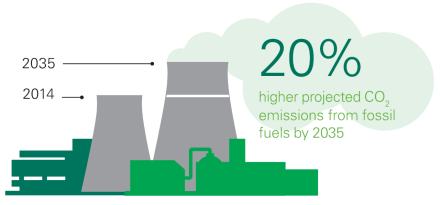

Unfortunately, GHG emission will continue to grow in the foreseeable future. It is predicted that by 2035 CO2 emission from fossil fuel will increase by 20% compared to 2014 level. BP, one of the largest international oil and gas companies, needs to come up with a plan to deal with the climate change. [1]

BP’s action plan

BP works to meet the demands of a lower-carbon future through switching to gas supply and by reducing carbon emission throughout the production process. [2]

Supplying natural gas

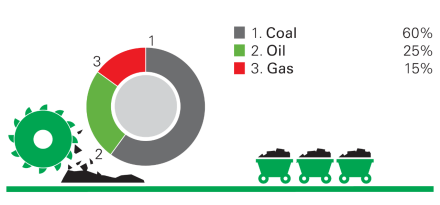

Not all fossil fuels generate the same amount of GHG. When used in power generation, natural gas generates significantly less CO2 compared to those generated by coal. Therefore, natural gas is clearly a “more sustainable energy” within the fossil fuel family and creates less climate change problems compared to other conventional energy.

Historically BP’s portfolio leaned heavily towards oil. But now it is building significant share in the gas sector. Now almost 50% of BP’s portfolio is natural gas and this percentage is expected to grow even further going forward. This trend is not surprising and is actually considered as a consensus throughout the oil and gas industry. Take Shell’s acquisition of BG as an example. One of the key reasons why Shell was interested in BG is that BG has an outstanding gas value chain throughout the world. By taking over BG, Shell has now become the No.1 Liquefied Natural Gas (LNG) supplier in the world.

Pursuing efficient operations

Efficient operations not only contribute to BP’s commitment to mitigating climate change, but also make economic sense. For instance, BP’s Zhuhai 3 petrochemicals plant produces purified terephthalic acid (PTA) with the latest technology. Compared to traditional PTA plants with conventional technology, Zhuhai 3 emits 65% lower GHG. And at the same time, even though many BP’s local competitors use low-cost feedstocks like coal, Zhuhai 3 plant still enjoys the lowest cost position in the industry.

Investment in renewables for the future

Lord Browne, Former CEO of BP, is a big supporter of renewables and under his leadership BP has already become one of leading investor in renewable energies. BP invests in wind farms in US. It owns significant interests in 16 wind farms across the country. BP also invests in biofuels in Brazil. It owns and operates three sugar cane ethanol mills, farming around 127,000 hectares. Both wind energy and sugar cane based ethanol significantly reduce GHG emission and generate sizeable benefits for the public. According to BP, the power generated by its wind farms can meet the need of a city like Dallas and avoid 2.7 million tonnes of CO2 emission. [3]

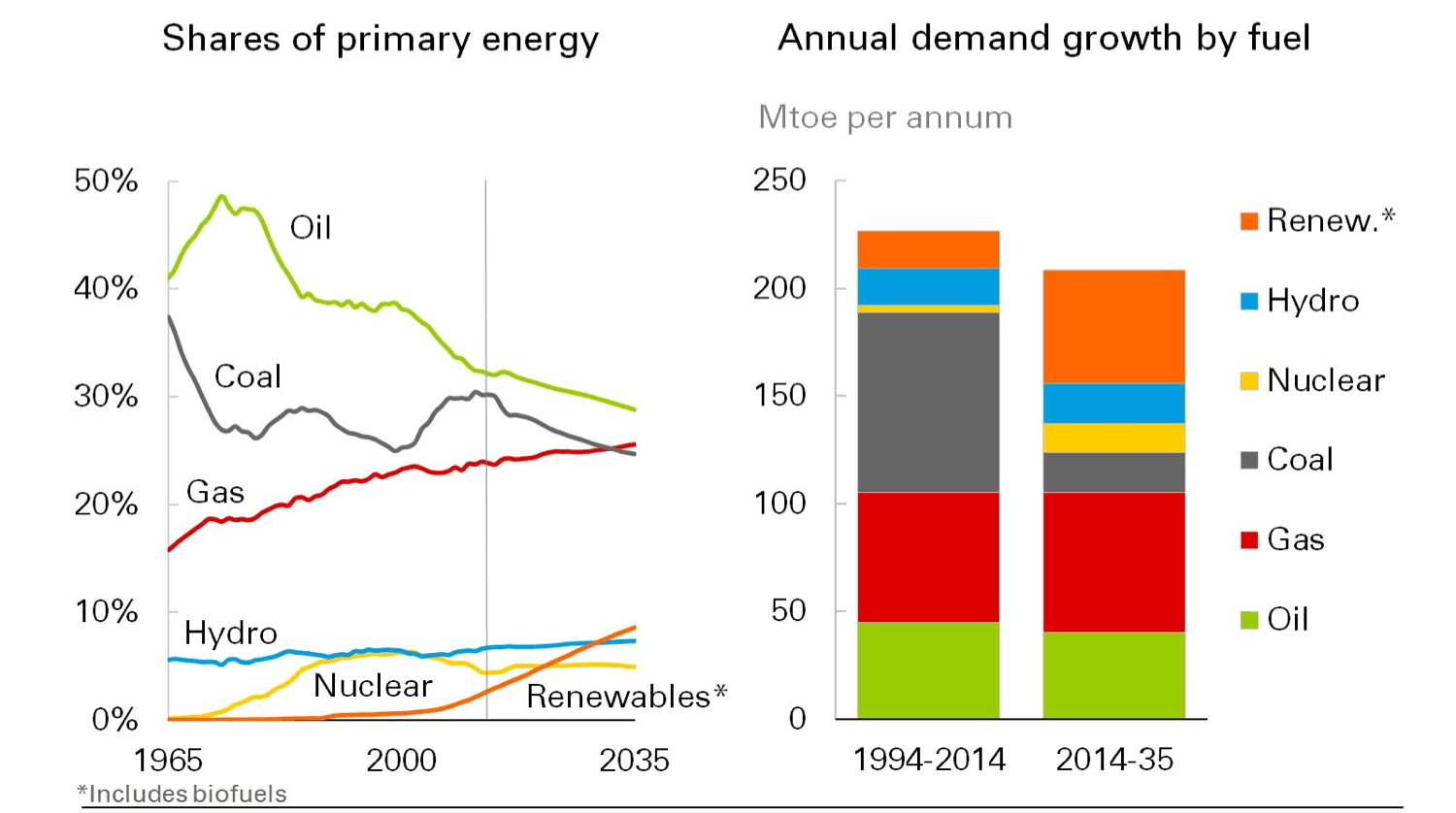

Admittedly, fossil fuel is still dominant in primary energy supply. But the consensus is that renewables will account for more and more significant shares in the future. According to BP energy outlook, the demand for renewables grows very fast. By 2035 renewables will account for 10% of primary energy in the world. BP should consider making more investment in this area. [4]

Carbon pricing and quota trading mechanism needed

One way to deal with excessive carbon emission is to put a price on its externalities. At current stage human society still cannot simply stop emitting GHG, but a pricing and trading mechanism can at least help to promote its efficient usage. For example, suppose there are two plants emitting CO2. Plant A generates $100 per unit of CO2 emitted and plant B generates $1 per unit of CO2 emitted. Without a carbon pricing and quota trading system, both plants will operate as usual and generate $101 at the cost of 2 units CO2 emission. If there is a carbon pricing and quote trading mechanism in place, then plant B can sell its quota to plant A and then in total they can generate $200 profit with the same amount of CO2 emission. [5]

Word count: 779

Sources:

[1] BP Energy Outlook: http://www.bp.com/en/global/corporate/energy-economics/energy-outlook-2035.html

[2] A Lower-carbon future: http://www.bp.com/en/global/corporate/sustainability/the-energy-challenge-and-climate-change/working-towards-a-lower-carbon-future.html

[3] BP’s initiatives on renewable energy: http://www.bp.com/en/global/corporate/sustainability/our-activities/renewables.html

[4] BP’s Statistical Review of World Energy: http://www.bp.com/en/global/corporate/energy-economics/statistical-review-of-world-energy.html

[5] World Bank: http://www.worldbank.org/en/programs/pricing-carbon

All of the renewable energy resources/acquisitions that BP is doing sound great, but I question the company’s motivation. Oil and gas are BP’s core competencies and I wonder if the sources of renewable energy will fit with the company. Perhaps I am too skeptical but I see BP’s investments in renewable energy as a PR ploy to fix their brand image. The reality is, BP makes money off of oil. Do you think that the company is actually fundamentally changing?

I think that it is great for a predominately oil-based company to be focused on sustainability. However, I question how much change BP itself can institute. If consumers demand oil – whether for transportation or other industries – will BP try to shift consumers to a more energy-efficient source, such as natural gas, or deny them their purchase? While I applaud BP’s efforts to be more sustainable, I wonder if the company will cave to the pressure of the customer and continue to provide what is demanded, no matter the environmental cost.

Incredible article! This topic is so fascinating because, exactly as Maria and Kelly describe above, we must be skeptical of BP’s commitment to sustainability when the trend towards sustainability threatens to put them out of business. However, I see BP’s investments in renewables not as a PR ploy, but as a means to mitigate business risk and move towards sectors of energy that represent the future of the industry. As a global leader in energy, it seems that BP can either keep doing the status quo, or step up and become one of the first movers in sustainable energy on a large scale. I also thought it was interesting how they are taking a multi-pronged approach – first, by trying to reduce the environmental impact of their processes, and second, by moving albeit slowly towards more sustainable products. Ultimately I think the regulation has to come from above, but I am optimistic that if governments are able to put the right incentives in place (a big if), today’s leaders in traditional energy can play a role in the innovation necessary to get to a more sustainable future.

Gyijiang makes a very important point when questioning BP’s commitment to sustainability. Even though BP has reduced its dependency on oil, it seems to have bet the house on natural gas (50% of its portfolio and set to grow bigger). The point can be made that gas is a cleaner source of energy. However, it is neither a renewable source of energy nor a clean source of energy. It simply pollutes less than oil. How would you evaluate BP’s strategy of shifting towards natural gas against one of betting on renewable sources?

Long – thanks for a great article! As already outlined by some of the comments above, there is often a tension between nominal targets, or what we might consider to be a PR stunt, and real commitment or strategic shift towards environmental sustainability in any company. My personal view is that the fact of it being a PR stunt in one period is irrelevant if it then iteratively leads to an increasing financial commitment to sustainable energy sources or processes. What I think you rightly point out is of primary importance in this industry is the appropriate pricing of externalities, which we have previously discussed in our FIN class, without which, the financial incentive to appropriately manage Co2 emissions is significantly reduced!