Allstate Insurance Group and Climate Change

Insurance and Climate Change: Will climate change be too much Allstate’s “good hands?”

Climate change. Clean Energy. Mining. Agriculture. Livestock and Fishing. Insurance? Insurance may not be the first industry that comes to mind when considering climate change, but insurance companies stand to be among the most challenged by its effects in the coming decades. Current analysis predicts that climate change induced extreme weather events could increase insurance losses by 37% within a decade, and if unchecked could bankrupt the industry. [5] While debate exists as to culpability of climate change in the current number of natural disasters, scientists at NASA predict that rising temperatures will influence the magnitude of future catastrophes. [8] Allstate Insurance Group, the second largest property casualty insurance company in the United States [2], is among world’s insurance companies addressing the challenges of climate change that threaten not only its business model, but the health of the world and its economy.

The most noticeable of Allstate’s climate change responses, limiting policies and improving predictive models, are mostly reactionary in nature and do little to change the tides of climate change. For example, since 2011, Allstate has canceled or chosen not to renew insurance policies in several Gulf Coast states. It reduced homeowner policies in Florida from 1.2 million to 400,000 and plans to eventually hold less than 100,000. [5] Allstate and the insurance industry is also improving the predictive abilities of its catastrophic weather models. [1] Allstate’s attempts to better identify high risk areas and limit its exposure to them will likely lead to higher policy premiums or areas with no policies at all. A long-term effect of Allstate’s actions could be the adjustment of consumer behavior – homeowners will eventually become financially incentivized to purchase homes in lower risk areas. But this is likely not the current goal of Allstate’s efforts.

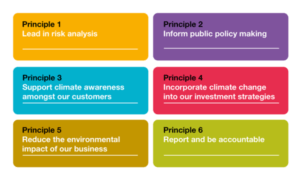

ClimateWise, a global partner within the insurance industry, leads and promotes climate change research and innovation. [6] As part of its efforts to proactively influence climate change via its 38 insurance company members, ClimateWise published six guiding principles in 2006 (See Figure 1). Although Allstate has led the U.S. insurance industry by cutting its carbon footprint [4] and currently demonstrates adequate commitments to principles 1, 5, and 6 (See http://corporateresponsibility.allstate.com/environment/climate-change for more information), it should implement strategies aligned with all six of the ClimateWise Principles.

Figure 1. ClimateWise Principles [6]

Principle 2: “Inform Public Policy Making”

Discussion: Allstate currently supports the Insurance Institute for Business & Home Safety (IBHS) which researches and promotes building practices and codes that protect homes and businesses against losses caused by natural disasters.

Recommendation: Allstate should join ClimateWise and support lobbies at the federal, state, and city levels that limit the development of land in areas most at risk of natural catastrophes. Additionally, Allstate should not rebuild homes in high risk areas after they are destroyed by natural disasters. For example, following Hurricane Sandy in which damage exceeded $126 billion [1], government flood insurance programs found it more cost effective to relocate frequently flooded areas and return the areas to nature. [3] Such actions will limit the future economic impacts to insurance companies and protect their customers from increasing natural disasters.

Principle 3: “Support Climate Awareness Amongst Our Customers”

Discussion: Allstate provides customers with its Homeowners Policy Green Improvement Reimbursement Endorsement. This program provides a discount to customers that must replace damaged appliances if they choose energy-efficient models. [7]

Recommendation: Allstate should incentivize the behaviors of its policy holders beyond property replacement. They should offer discounted premiums to homes with sustainable energy products (solar, wind, etc), to electric cars, to clean energy companies, and to LEAD certified buildings. Such policy discounts will provide added incentive for consumers to adopt these climate friendly options.

Principle 4: “Incorporate Climate Change into our Investment Strategies”

Discussion: Allstate’s investments include a renewable energy portfolio of $230 million and a socially responsible investment portfolio of $51 million which represents less than 1% of its holdings. [7] [2]

Recommendation: Allstate should expand its investment in renewable energy and climate friendly companies. Additionally, when diversifying its portfolio, Allstate should account for the market risks associated with climate change on various industries.

Despite current efforts, Allstate and the insurance industry at large will continue to encounter significant losses caused by climate change induced natural disasters if additional steps are not taken to hedge risk while adopting and influencing responsible behavior beyond the insurance industry. By adopting the ClimateWise Principles and deepening its commitments to them, Allstate will be positioned to lead change in the U.S. insurance industry.

Wordcount: 745 without citations

Citations:

[1] Toumi, Ralf, “Catastrophe Modeling and Climate Change,” Lloyd’s London ClimateWise Initiative, 2014, http://www.lloyds.com/lloyds/corporate-responsibility/environment/climatewise, accessed November 2016.

[2] Hayes, Adam, “Top 10 Insurance Companies By The Metrics,” Investopedia, November 13, 2014, http://www.investopedia.com/articles/active-trading/111314/top-10-insurance-companies-metrics.asp, accessed November 2016.

[3] Jiang, Jess, “After Hurricane Sandy, Many Chose To Move Rather Than Rebuild,” National Public Radio, August 26, 2016, http://www.npr.org/2016/08/26/491531827/after-hurricane-sandy-many-chose-to-move-rather-than-rebuild, accessed November 2016.

[4] Donash, Kyle, “CDP Recognizes Allstate as Leader in Climate Change Transparency; Only Property and Casualty Insurer to Make List,” Allstate Newsroom, September 29, 2014, https://www.allstatenewsroom.com/news/cdp-recognizes-allstate-as-leader-in-climate-change-transparency-only-property-and-casualty-insurer-to-make-list/, accessed November 2016.

[5] Mills, Evan, “Responding to Climate Change,” Lawrence Berkley National Laboratory, http://evanmills.lbl.gov/pubs/pdf/climate-action-insurance.pdf, accessed November 2016.

[6] Cambridge Institute for Sustainability Leadership, “The ClimateWise Principles,” http://www.cisl.cam.ac.uk/business-action/sustainable-finance/climatewise/principles, accessed November 2016.

[7] Allstate Insurance Company, “Corporate Responsibility,” http://corporateresponsibility.allstate.com/environment/climate-change, accessed November 2016.

[8] NASA, “The Impact of Climate Change on Natural Disasters,” The Earth Observatory, http://earthobservatory.nasa.gov/Features/RisingCost/rising_cost5.php, accessed November 2016.

Property and Casualty insurers are undoubtedly affected by climate change — their business remains viable only if they can appropriately adjust for the risk associated with catastrophic weather events.

Of ClimateWise’s six principles, which would be more important from Allstate’s perspective? I speculate the order in Principles 1, 2, 4, 3, 5, and 6. Principle 1 is a top priority if Allstate wants to protect it’s P&C insurance business (although it seems contradictory that Allstate would both improve its risk models and reduce homeowner policies in high-risk regions). Principle 2 is important because the burden to build more sophisticated predictive models matters less if fewer properties in these high-risk areas can be built built due to regulation. Principles 4 is another important hedge, although the financial impact will not be immediate. Principle 3 is also a hedge but is least quantifiable. Principle 5 would be important to companies trying to mitigate their own contributions to climate change, but I doubt that insurance companies’ operations affect the environment that greatly. Principle 6 exists to evaluate a company’s commitment to the first 5 principles and must be done anyway.

By adequately committing to Principles 1, 5, and 6, Allstate may have addressed half the guidelines, but one is perfunctory and the other is relatively less important — which is to say that Allstate could be doing more. If we look at Principles 2, 3, and 4 from the lens of resources required, Principle 4 appears easiest to commit to, and Principle 2 appears hardest, given how much time and effort goes into lobbying governments to be more stringent on land development. If Allstate truly believes it will be affected by climate change, then committing more heavily to Principles 3 and 4, along the ways you recommended, would not only show Allstate’s increased responsibility towards the effects of climate change, but also yield financial gains for the business.

In my prior job, one of my portfolio companies was in the insurance space. We spent quite a bit of time thinking through the effects of climate change on the business as a whole and how to best shield the company for future growth. The price paid by the consumer is one lever that can be utilized to compensate for the increased risk undertaken by the insurance firm. I also believe that climate change has in part contributed to the consolidation we see in the industry. Interestingly enough, companies like Allstate are trying to cut costs by implementing middlemen who are sent to visit the home after a natural disaster and can more easily triage the situation. I enjoyed reading about the six ClimateWise principles. This was new to me. Great post!

Very well written blog about the tough challenges the industry itself is facing. To go to the beginnings, it is important to remember that insurance companies rely on historical information to predict the future frequency and severity of the catastrophes.

Climate change is making historic information useless to predict those outcomes and therefore making the industry rethink about how they approach the challenge in their business models giving the rising cost that it represents. Estimations have stated that the overall cost of the risks associated with climate change represent 5% global GDP, threatening the financial performance of the sector. (1)

Another way of thinking principle 3 is to readapt their cost strategy to transfer the costs to the responsible parties, in this way they would have aligned incentives to improve their mitigation strategies and work towards a more environmentally friendly business model. In order to make this possible, they would need to use principle 2 in a more strategic way, seeking to reach consensus, and not only inform, with the regulators in order to have the approval to transfer those cost to the responsible parties.

1. https://cdn.axa.com/www-axa-com%2F1b503ed0-104e-4fe1-9b4f-cf6ea62844ae_axa_and_climaterisks_2014.pdf

Thank you for the post. I really like your recommendations and agree that Allstate needs to be proactive not reactive. I particularly agree with your view that they need to incorporate climate change in their investment strategies (Principle 4). One area that I would be curious to get your thoughts on is the impact that the rising shared economy will have on Allstate’s business. The climate implications seem favorable (e.g. less pollution) but what would happen to Allstate’s auto and home insurance businesses? I imagine they would suffer if they just offered traditional products since less cars are being used because of Uber and Lyft and more people are sharing residences via Airbnb. What steps could they take to plan ahead for this future? Does it involve reimagining what a shared-economy insurance product would look like? I did some quick research and it looks like they are going down the path of designing new products to meet this new demand.(http://www.insurancejournal.com/news/national/2016/05/25/409819.htm).