Black Friday or Red Friday?: How Macy’s Plans to Improve its Bottom Line via Digitalization

As eCommerce and fast fashion continue to disrupt the retail industry, Macy's places huge bets on supply chain digitalization to ultimately reduce costs and stay competitive.

The Challenge

Macy’s, the largest U.S department store company by retail sales, boasts an impressive 159-year history as one of the country’s oldest iconic brands1. But the rise of fast fashion, eCommerce, and supply chain digitalization have challenged Macy’s standard approach to doing business. Perhaps the most salient signal that Macy’s requires an operational step change is evidenced by their financial performance. Since 2015 Macy’s has reported net loses year-over-year as in-store sales decline and competition rises from fast-fashion competitors like Zara and off-price retailers such as TJ Maxx2. This has pushed the retail giant to close more stores but also to consider ways to digitalize its supply chain as they face working capital challenges in an industry experiencing rapid disruption. As Macy’s prepares to adopt more high-tech logistics systems to increase visibility within its supply chain, it ultimately poses two questions: can the retailer keep up with it’s tech-savvy competition and will this be enough to raise and sustain profit margins moving forward?

Short-term strategy

Earlier this year Macy’s announced that 100 percent of its inventory will be tagged using radio frequency identification technology (RFID) by the end of 2018. In a nutshell, RFID automates the tracking of inventory throughout the retail supply chain — from the warehouse to the store floor — replacing the process of employees scanning products manually3. Macy’s aims to leverage RFID in order to improve inventory accuracy, reduce out of stock incidents and, ultimately, increase sales4. Bill Connell, senior vice president of transportation, store operations and process improvement at Macy’s, adds, “With an increase in the inventory accuracy, out-of-stocks are significantly reduced. And by cutting the out-of-stocks, item availability is increased, which can lead to substantial and measurable sales increases5.” Given Macy’s net loses the past two years, these working capital improvements are very important to Macy’s bottom line and one reason why the company is investing so much in the technology. Moreover, the company plans to leverage the new tracking technology to aid its distribution center (dc) bypass strategy. DC bypass allows retailers to circumvent traditional distribution centers but requires synchronization of various information technology systems at the manufacturer and retailer level6. By incorporating RFID tracking, Macy’s hopes to further reduce transportation, inventory-carrying, and material handling costs via its dc bypass strategy and ultimately reduce throughput time in its supply chain as it speeds fulfillment requests.

Future Goals

In addition to Macy’s short-term strategy to digitize its supply chain management process, the company also plans to transition slowly from a push model of supply chain management to a pull model in the coming years. According to John S. Thorbeck, Chairman of Chainge Capital LLC and an expert on the application of Fast Fashion business principles at retailers and brands, pull models of supply chain management are characterized by:

“Procurement, production and distribution that is demand-driven rather than by a forecast. This approach follows the “supermarket model” where limited inventory is kept on hand and is requested as it is consumed. Another attribute of Pull is a supply chain where a customer purchase initiates real-time information flows through the supply chain that consequently causes movement of product through the network7.”

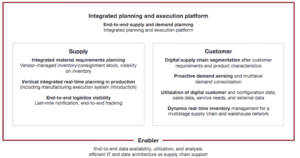

Given Macy’s investment in RFID technology, this shift in supply chain management is a natural progression for the business as it aims to compete in the fast fashion retail space and adopt an integrated, demand-driven planning and execution platform8.

Alternative Solutions

As Macy’s plans to implements it short and medium-term strategies in the coming years, the company should also consider investing more in information technology (IT) infrastructure and consistent software updates in the short term as it relies more on IT to meet consumer demand. In addition, the retailer should consider opportunities to integrate vertically in the medium term to further optimize its supply chain strategy and increase margins on private label products.

Questions Ahead

Despite the changes in supply chain management that Macy’s aims to make over the next few years, tons of questions remain unanswered. In a world increasingly becoming more crowded with fast fashion rivals such as Zara, Uniqulo, and H&M, can Macy’s regain market share given its slow move into supply chain digitalization? Furthermore, will Macy’s move to adopt more high-tech logistics systems to increase visibility within its supply chain be enough to grow and sustain profit margins moving forward? Lastly, how does Macys plan to keep costs low for customers while also implementing expensive technological enhancements?

Word count: 764

Works Cited

- National Retail Federation, “Top 100 Retailers 2016”, https://nrf.com/resources/annual-retailer-lists/top-100-retailers/stores-top-retailers-2016. Accessed November 10, 2017

- The Wall Street Journal, Dow Jones & Company, quotes.wsj.com/M/finacncials/annual/income-statement

- Thau, Barbara. “Is The ‘RFID Retail Revolution’ Finally Here? A Macy’s Case Study.” Forbes, Forbes Magazine, 15 May 2017, https://www.forbes.com/sites/barbarathau/2017/05/15/is-the-rfid-retail-revolution-finally-here-a-macys-case-study/#28bd69d43294

- McKevitt, Jennifer. “Macy’s Inventory will be 100% RFID-Tagged by 2017.” Supply Chain Dive, 25 Oct. 2016, https://www.supplychaindive.com/news/Macys-RFID-inventory-tracking/428937/. Accessed November 10, 2017

- ibid

- ARC Advisory Group. “Bypassing the Distribution Center” (PDF file), downloaded from Descartes website, [https://www.descartes.com/content/documents/bypassing_the_distribution_center.pdf], accessed November 10, 2017

- Lopez, Edwin. “Retailers are reducing on-hand Inventory for the holidays.” Supply Chain Dive, November 10, 2017, https://www.supplychaindive.com/news/retail-supply-chain-shift-turn-times-holidays/510607/. Accessed November 10, 2017

- “Digital-Transformtion-Review-5”. EBooks – Capgemini Consulting, http://ebooks.capgemini-consulting.com/Digital-Transformation-Review-5/#/52/. Accessed November 10, 2017.

- Schrauf, S. and P. Berttram, Industry 4.0: How Digitization Makes the Supply Chain More Efficient, Agile, and Customer Focused, PWC Strategy& (2016)

Interesting read!

To your last question, I believe an investment in technological advancements can directly contribute to revenue and profitability growth while keeping prices low. One consequence of poor supply chain management is stock-outs and increased discounting. By introducing more real-time supply chain technologies, Macy’s can ensure high-demand products are continually available for purchase and quickly stop production on low-demand inventory. This means they are fully capturing consumer revenue and more items will be sold at full-price, which will improve profitability. I believe Macy’s can have a competitive advantage over the fast fashion brands listed if they are able to be better attuned to consumer demands.

Thanks for posting such an interesting article. The problem that Macy’s faces reminds me of the problem that Gap faced in a marketing case that we read a few weeks ago. Like Macy’s, Gap was struggling to maintain its profit margins in the face of the changing industry dynamics: the shift from brick and mortar to e-commerce. Although the shift to fast fashion seems like the ideal solution, in Macy’s case, this seems inconsistent with its value proposition. In my opinion, Macy’s has the ability to bring together brands from different designers onto one platform while creating a unique buying experience. For many people, Macy’s is an entry point into new brands and products. With this being said, I completely agree that Macy’s should work to improve its supply chain through digitization. However, I am unsure if it should adopt shift its business strategy to compete in the crowded fast fashion space.

Great read! The previous comment from “TOM Challenge 33” regarding Macy’s value proposition of bringing together brands from different designers makes me question whether the transition from a push to pull model will actually be viable for department store retailers in the long-term. Fast fashion retailers have a greater ability to keep limited inventory and produce supply more in line with a just-in-time model because the bulk of their products are private label. Therefore, they have full control from design through production. Macy’s on the other hand pulls supply from a variety of brands, which implies that requesting inventory on a short timeframe will significantly constrain many suppliers’ current operations. To what extent can they ask of this for the hundreds of brands they stock?

Interesting reading!

I have a more pessimistic view of Macy’s ability to regain market share in the short term, and the substantiality of it’s business in the long term. Every business model – to be successful and sustainable in the long run – needs a competitive advantage, something that in retail industry is often called “a reason why”. During many years department stores, and Macy’s as the industry leader, were able to offer a variety of products from the best worldwide brands in different categories in a convenient way to consumers (selection, pricing, locations, financing, etc.). Most of this value preposition was offset and improved by fast fashion retailers and eCommerce (Amazon)

Today, after reading your essay, what struggle me is the following question: ¿Is Macys doing something fundamentally different from its competitors to create a unique competitive advantage? It seems to be that all this digitalization path is just a way to catch up what other players are already doing more than something new and unique.

Really interesting read – I worry that Macy’s is going to end up caught in the middle here. It feels like the apparel industry is gradually biforcating into 1) fast-fashion retailers like Zara who have the flexibility to keep a tight cost structure because they control their own product and can ‘pull’ as they need and 2) more upscale department stores / e-commerce retailers that carry a variety of upscale brands and excite customers with new innovative pieces. It feels like Macy’s is trying to ‘have their cake and eat it too’ by playing in both camps and I feel like they risk not being able to achieve the cost structure benefits of 1 (and / or having resistance from brands as mentioned above) and dampening their ability to deliver 2 in the process. It feels scarily analogous to the moves made at J.C. Penney that led to their downfall, but let’s hope they are more effective in execution at Macy’s!