Associated British Foods: Mmmmm…Brexit

Impact of trade isolationism on Associated British Foods

June 23rd 2016: the UK voted to leave the EU, a pan-European political union and economic union with a single market (in which the EU is one territory without any internal borders or regulatory obstacles to free movement of goods and services) [1]. Since then, “Brexit” has become a divisive issue, hailed by some as the first step to improved economic growth and others as a destructive step away from globalization [2]. Regardless of political views, as the terms of Brexit are negotiated, a great deal of uncertainty exists regarding future trade relationships between the UK and the EU [3]. There is a wide spectrum of potential outcomes, from the UK continuing to stay in the single market to a situation of widespread tariffs and customs barriers [4]. It is in this environment that Associated British Foods (ABF) operates.

ABF is a major producer of Grocery products, Ingredients (e.g., yeast), Sugar, and Agricultural products, and owns fashion retailer Primark (see image below for example of ABF products and Primark fascia).

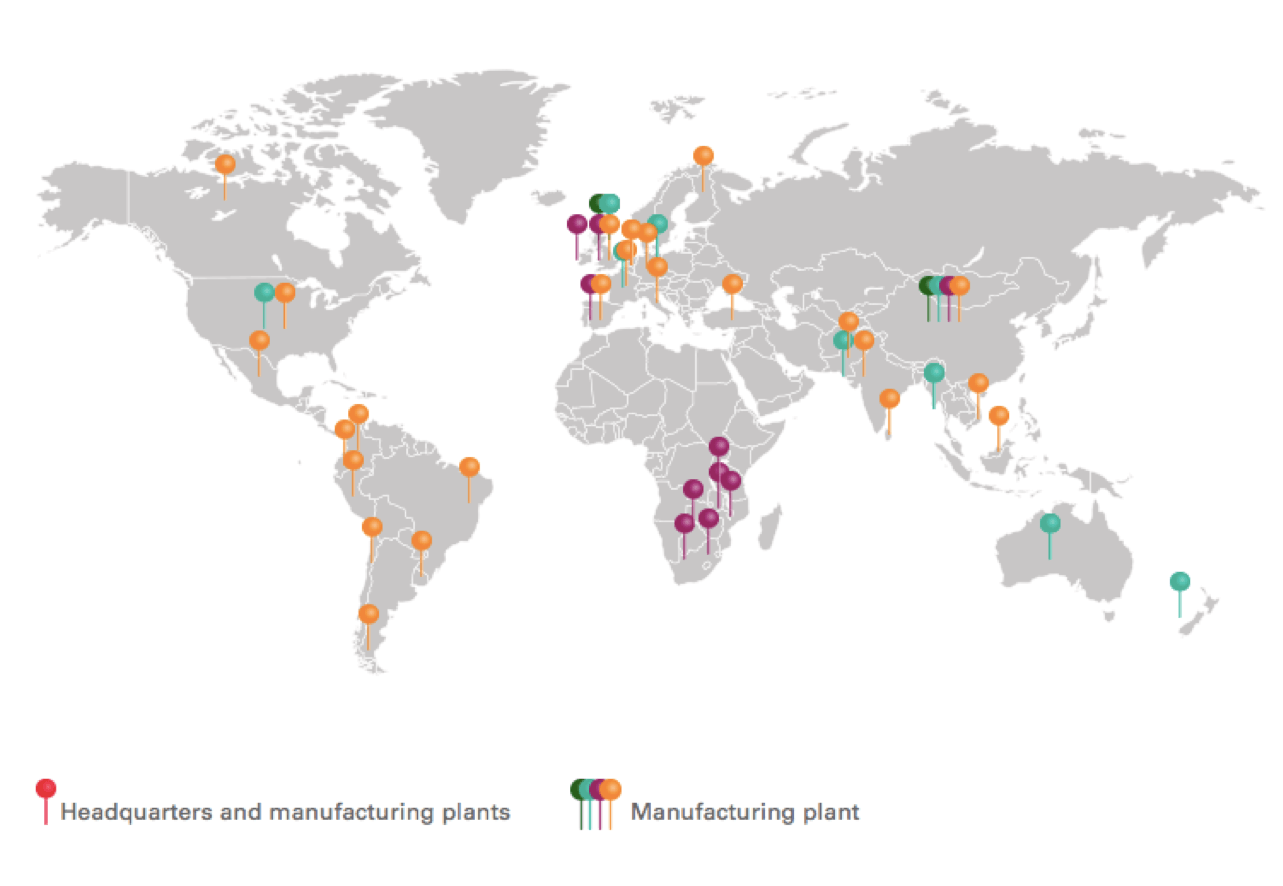

As an international business, it operates in 50 countries, generating £15.4bn sales (2017) with £1.4bn operating profit [5]. Although the UK is ABF’s primary market, operating factories across the EU and internationally and importing goods to the UK to supply retail customers (see map below showing location of factories), the company also exports goods across the EU and internationally with 2/3 of sales and profit made outside the UK [6]

Given its high dependence on trade, ABF is vulnerable to uncertainty around Brexit. In the short-term, as the value of pound sterling to euro has decreased, input costs have substantially increased for ABF [7]. In the longer-term, ABF’s supply chain has been designed to work within the EU context, a borderless trade regime with little paperwork and no tariffs [8]. Depending on how Brexit unfolds, ABF may incur additional costs in navigating complex customs processes as well as possible import/ export duties, impacting profit margins. In addition, the speed and flexibility of ABF’s supply chain will likely decrease, as customs between borders becomes a bottleneck. Increased lead times reduces ABF’s responsiveness to customers (key part of its customer value proposition), reduces its ability to accurately forecast demand, and may lead to requirement for additional costly inventory across its supply chain.

To address uncertainty, ABF’s management is currently focusing on two key short-term levers:

- Minimizing exposure to non-UK suppliers. To offset increased raw material costs, ABF is re-examining its supplier contracts to understand their viability post-Brexit, consequently sourcing more from the UK. For instance, it is expecting to buy more British wheat, switching away from German suppliers [9].

- Selectively pass on cost inflation to retail customers. Like many other packaged goods companies, ABF is also exploring how to increase prices of its products, sharing the burden of higher costs with retailers [10].

Although levers above have been deployed in the short-term, they are likely to remain part of ABF’s toolkit in dealing with Brexit longer-term. At the moment ABF is bearing the burden of much of the cost inflation, causing unsustainable losses in categories such as ‘bread’; in the future, it is likely that more of this burden will be shared with retailers [11]. However, in addition to the above, management is also focused on the following mid- to long-term levers:

- Reducing manufacturing costs. With slimmer profit margins, ABF is in the midst of deploying long-term cost reduction programs across its manufacturing facilities [12]. While many of these programs were initiated before Brexit, implementation is significantly more important in a post-Brexit environment.

- Increasing focus on its retail business (Primark). Primark is less impacted by Brexit uncertainty, as it sources products from outside the EU. Primark has continued to be identified as critical to ABF’s long-term strategy [13].

In addition to above, I believe ABF should also consider potentially more radical changes in its business model in supply chain to drive further cost savings:

- Move to a ‘direct to consumer’ model. To remain competitive, ABF needs to deliver products to end-users at low prices. By circumventing retailers and offering products directly to consumers (e.g., via an ecommerce model), ABF can offer low prices to consumers (avoiding the margin taken by retailers) while also increasing their own margins.

- Work with suppliers/ customers to minimize costs through supply chain. On the other hand, ABF can also enter agreements to share financial and forecast data with suppliers and retail customers – moving to ‘activity based pricing’, whereby behavioral changes can result in cost-savings realized by both parties.

there are two questions I would like to ask. Firstly, should businesses be allowed to lobby government decisions and is it always right for businesses to do so? Secondly, what responsibility does ABF have to its workers, as it reorganizes its supply chain?

(800 words)

[1] European Commision. “The European Single Market”. Europa. https://ec.europa.eu/growth/single-market_en

[2] Noack, Rick. “A year after a divisive vote, doubts are mounting in a town that went overwhelmingly for Brexit”. Washington Post. (June 23, 2017). https://www.washingtonpost.com/news/worldviews/wp/2017/06/23/one-year-after-a-divisive-vote-doubts-are-mounting-in-a-town-that-voted-overwhelmingly-for-brexit/?utm_term=.d7862e56d428

[3] “The long-term cost of uncertainty on Brexit.” Financial Times. (August 3, 2017). https://www.ft.com/content/5e330540-784a-11e7-90c0-90a9d1bc9691

[4] “Supply Chain: Your Brexit Competitive Advantage”. PWC. (February 2017). https://www.pwc.com/gx/en/issues/assets/brexit-supply-chain-paper.pdf

[5] “Associated British Foods: Annual Results Announcement. Year ended 16 September 2017”. Associated British Foods. (September 16, 2017). https://www.abf.co.uk/documents/pdfs/arcr-2017/annual_results_announcement_2017.pdf

[6] Thompson, Jennifer. “Primark boosts profits at Associated British Foods”. Financial Times. (July 6, 2017). https://www.ft.com/content/b887a174-ecf5-330c-967b-ff88cee4e75b

[7] “Cost of British grocery brands to rise due to fall in value of sterling”. The Guardian. (November 8, 2016). https://www.theguardian.com/business/2016/nov/08/british-grocery-brands-sterling-associated-british-foods-jordans-twinings

[8] Bain Insights. “How will Brexit Affect Your Supply Chain”. Forbes. (March 30, 2017).

[9] “Cost of British grocery brands to rise due to fall in value of sterling”. The Guardian. (November 8, 2016). https://www.theguardian.com/business/2016/nov/08/british-grocery-brands-sterling-associated-british-foods-jordans-twinings

[10] Ibid.

[11] Butler, Sarah. “As sliced bread sales fall and costs rise, are UK’s leading bakers toast?”. The Guardian. (November 11, 2017). https://www.theguardian.com/business/2017/nov/11/are-uks-leading-bakers-toast-bread-sales-fall-costs-rise

[12] “Associated British Foods: Annual Report and Accounts, 2017”. Associated British Foods. (2017). https://www.theguardian.com/business/2016/nov/08/british-grocery-brands-sterling-associated-british-foods-jordans-twinings

[13] Bradshaw, Julia. “Primark owner ABF sees bright side from Brexit but warns sterling could hit margins”. The Telegraph. (November 8, 2016). http://www.telegraph.co.uk/business/2016/11/08/abf-shares-jump-on-unexpectedly-sweet-profits/

There are many advantages to allowing businesses to lobby government decisions. One of the foremost benefits is that it enables issues to surface that impact the lay consumer, however that the lay consumer probably would not be aware of. For example, if most civilians are unaware that Brexit would result in higher commodity prices, it is to the populace’s benefit that trade organizations and firms are able to surface this issue with lawmakers. The disadvantage to this, of course, is that oftentimes the masses would need to be highly organized, share a common view, and willing to pool resources in order to have the same share of voice as one business, which serves as a single point of communication and resources.

To the point at which businesses have a far disproportionate voice to the people, and moreover can coerce politicians though massive campaign donations, businesses carry an unfair weight in politics. However, this brightline is extremely difficult to draw and therefore I am sympathetic to a flat ‘no lobbying’ policy.

The immediate and potential long-term effects of Brexit certainly cause companies like ABF to reevaluate their business model. Instituting important supply chain shifts are likely required, but I’m doubtful that one so drastic as eliminating retailers and distributing directly from ABF to consumers may be successful. At a moment when business margins are tight and the costs of doing business in the UK are increasing, should ABF vertically integrate a resource and capital intensive part of the supply chain? The benefits to this change are clear, as you outlined in your post, including eliminating profits paid to retailers. But I believe that the costs and risks of this change likely outweigh the benefits.

To take over the role of the retailer, ABF would have to invest huge amounts of capital resources in retail facilities. Even if the company considered an e-commerce model, the cost of developing an internet service for food products would be a significant investment. Additionally, ABF would bear the cost and legal responsibility for many, many workers required to staff the retail roles and responsibilities. As the cost of labor is rising in the UK post-Brexit, I view this personnel obligation as especially risky. Finally, ABF would assume the risk and obligation of all inventory transferred to the retailers, possibly lengthening its financial product chain and cash conversion cycle. For me, the wide-spread financial risks of assuming such a significant part of the supply chain in the wake of Brexit are cause for concern.

What responsibility ABF has to its employees when it is forced to reorganize it’s supply chain due to the change in the political climate is a tough question. I believe any company should strive to do what’s best for their employees, but ultimately is held accountable to the bottom line. If they are forced to lay off some employees in order to cut costs, that is a better outcome, than keeping all employees, not remaining profitable and then having to file bankruptcy.

I think it is interesting to note that the UK vote to leave the EU has in fact had negative repercussions for UK citizens. The second short term lever you mention, in which ABF will “selectively pass on cost inflation to retail customers,” begs the question of why UK citizens would vote for a policy that ultimately leads to higher consumer prices.

At the national level, countries have an incentive to establish trade barriers that protect domestic workers. History tells us that protectionism has the potential to lead to trade wars that result in a worse collective outcome for countries involved. Such has been the case for the unwinding of NAFTA on the American auto industry, for example. [1]

Thus, in regards to your first question, I think that it is critical that businesses have the right to lobby against government decisions. First of all, I think it would be very difficult to prevent or even restrict lobbying from occurring. But secondly, entities should be able to promote policies that are beneficial to them. This doesn’t necessarily mean that the policies businesses support are in the consumers’ best interest, but I believe that companies have a right to support whichever policies are in their best interest financially. In turn, consumers have the right to vote for their political preferences.

Regarding your second question on ABF’s responsibility to workers, I think that throughout this shift in supply chain, ABF will likely need to reduce its headcount in order to reduce manufacturing costs and compete with lower cost manufacturers. That said, I think that the company has a responsibility to support its employees and should thus reallocate workers where possible and train them in different services and divisions, such as eCommerce.

[1] Eisenstein, Paul A. “Auto Industry Declares War on Trump Over NAFTA.” NBCNews.com, NBCUniversal News Group, 31 Oct. 2017, http://www.nbcnews.com/business/autos/auto-industry-declares-war-trump-over-nafta-n815996.

I agree that Primark is an important piece of the puzzle here given it is more insulated than the rest of the business from Brexit uncertainty. Rather than simply increasing its focus on Primark, I wonder if ABF should take it a step further and spin-off the business altogether. Given all of the uncertainty around ABF as a result of Brexit, I would want to know if Primark’s potential and true value is being hidden or dragged down by its parent. According to BBC, Primark is the fastest growing top 10 clothing player in the past five years [1]. I wonder if investors are artificially undervaluing Primark based on legitimate concerns around the rest of ABF’s business as it relates to Brexit. Spinning Primark off could be a way to combat the impact of isolationist policies on the value of ABF’s business.

[1] “Primark owner Associated British Foods sees profits jump,” November 7, 2017, BBC, http://www.bbc.com/news/business-41898276, accessed November 2017.

Dan, I enjoyed reading your thoughts on ABF and also share in the belief that drastic measures have to be taken to combat the potential impact of Brexit. However, I wanted to point out that a “direct to consumer model” likely will not improve margins. In fact, most ecommerce businesses, including the retail operations of Amazon, are actually unprofitable (https://www.forbes.com/sites/stevendennis/2017/03/17/the-inconvenient-truth-about-e-commerce/#4e00617c1bb2). While you are definitely correct in reasoning that ecommerce businesses save money by cutting out the retailer’s share in the margins, the fulfillment and delivery aspects of these businesses are prohibitively expensive. Especially in the EU post Brexit, if ABF needs to ship products internationally, delivery costs can mount up very quickly. In fact, some direct to consumer stores such as Warby Parker are trying to grow margins by opening brick and mortar stores. A brick and mortar store purchase is actually more profitable than an e-commerce order, as factors like shipping and handling charges, and the costs associated with increased returns, eat into margins (https://www.forbes.com/sites/barbarathau/2017/06/27/five-signs-that-stores-not-online-shopping-are-the-future-of-retail/#54ba048e4641).

Dan, thanks very much for this interesting perspective on ABF. Your point on Primark was particularly notable, as it raised a benefit of isolationism that is often overlooked. By leaving the EU, Britain has the opportunity to restructure trade agreements with countries such as Sri Lanka that serve as key suppliers to companies like ABF [1]. This could actually lower the cost of supplies for ABF given trade restrictions traditionally imposed by the EU.

Is there potential for ABF to leverage its European suppliers for its European operations, and improve its global supply arrangements for operations in geographies outside of the EU? Would this be the kind of economic benefit many in the UK hoped for when they voted for Brexit in the first place?

[1] http://www.telegraph.co.uk/business/2016/11/08/abf-shares-jump-on-unexpectedly-sweet-profits/

Mr.Waldron,

You raise a major concern about ABF’s future in light of BREXIT and the UK’s secession from the European Union. Although ABF operates in the UK, 2/3 of its sales are outside the UK as you mention, and that makes up a significant portion of their business.

Your first point about BREXIT’s impact on trade is very important. In a business such as ABF’s, which generally does not have the highest margins on many of its SKU’s, the price of raw materials and input costs is incredibly important. Having spent time in the Balkans when there were trade disagreements between Serbia and Western Europe, I understand the detrimental effects that this can have on complex customs processes and more expensive import/export duties. Nightmare!

I do however, believe that there is hope for the UK. I think the UK is still too large of a market and too powerful of a player in the EU. Although lots of agreements with the EU are still pending, I believe that the EU and the UK will reach a favorable agreement on customs and trade by the time the UK formally withdraws in March 2019. I also believe that the UK is still too big of a market for many European producers to stop trading with. This will cause many European producers to put enormous pressure on legislature that ensures that their supply chains are not effected in a material way. Furthermore, the trade rules between UK and EU may revert back to WTO rules in case either side does not wish to sign the trade agreement that will be proposed. Reverting back to the WTO rules will provide more stability for trade between UK and EU and be more similar to what was in place before BREXIT.

To answer the first of your questions at the end, I do believe that business, particularly those as large as ABF does have the right to lobby governments. With such a large amount of people that could be effected and total distribution and supply systems that face serious risk, it is the role of the government to listen to its people and understand the effect that it would have.

Dan, thanks for posting about this topic. In addition to the points raised above about representing the interests of the relevant private sector actors, lobbying also plays an important role in cost-effectively providing legislators with access to key research and information. Lobbyists often-times have more resources and time than the government to analyze and distill large amounts of information, and present key conclusions. Given that there are usually lobbyists on both sides of an issue, the government is thus able to receive key pieces of information both in support and against a specific legislation from lobbyists, enabling more evidence-based decision making. Given that the government does not have to set aside public funds to gain access to this information, it is doubly valuable.

While the consequences of Brexit remain unknown (and at the moment, troublesome for many companies with UK exposure), Brexit might actually be a useful catalyst for ABF to pursue the value-maximizing strategies you outlined (reducing operating costs, going deeper into retail, DTC, integration with suppliers), which seem to be reasonable in any economic environment. Regardless of the political outcome, these seem like sensible decisions to make.

Your questions are very thought provoking. Regarding your question on lobbying, as significant tax payers, I think businesses should have a stake in the allocation of government resources. The magnitude of their voice, however, should be restricted (in terms of a cap on dollars donated and/or access to politicians) as a way to preserve the voice of private individuals, who cannot wield the same resources to advocate their agendas.

As ABF considers reorganizing its supply chain, I think ABF is being put in a really tough situation by the UK government with respect to its current employees. It´s unfortunate that shareholder friendly actions may require moving jobs away from the UK. Ultimately, I think the government should be held responsible for the consequences of such a move, and hopefully such behaviors will be an awakening to those who voted against inclusiveness and the free flow of capital, people, and ideas in Europe.

Dan, thank for this article, I had no idea that ABF owned such a different business as Primark. The latest is my main topic of discussion.

Primark customer promise is medium quality articles (clothes, shoes, home decorations, etc) for a very low price. Primark current competitors are not Zara or H&M because they are definitely more expensive. However, Brexit may significantly increase Primark’s products, given the hit on the exchange rate and potential tariffs as you mentioned. Given that Primark is owned by ABF, can they leverage this fact and increase the competitive advantage over other brands, if a special deal with the British Government is achieved? Since Primark is sourcing most of their supply from outside the EU, as you mentioned, it can reinforce its competitive advantage to brands like Zara (that have higher productions in Europe). [1]

If this agreement is not good enough, I would spin-off the business to an EU country or to the US. In this scenario, the prices of all the major clothes companies would increase in a similar way – maintaining the price differential in the UK while protecting all the other markets. Additionally, there are several countries willing to receive all the companies that are leaving the UK and offering incredible trade conditions, which could offset some disruptions that a change in headquarter’s country could bring.

Finally, and answering to your concerns with Government lobbying, I think that what companies are doing now doesn’t count as lobbying. As the UK decided to leave the EU, it must negotiate all the trade agreements and it is fair for companies to talk to the Government to better understand their options and decide on their future.

—

[1] The Economist (2005, June 16) “The future of fast fashion”. Retrieved from: http://www.economist.com/node/4086117, accessed on November 2017

This was a great case study into some of the difficult dilemmas facing British corporations in the highly uncertain environment created by the Brexit vote outcome. At the highest level, it’s clear that any deal at this point is better than no deal, and all decision making is currently suspended until the final terms of the divorce are formulated. This is why ABF, like many other businesses in the UK, is still operating as if nothing happened, awaiting its fate and planning for several different eventualities.

There are two secondary effects on ABF that might be interesting to think about. The first is that, from the entire retailer space, Primark is probably going to get hit the hardest, due to their discounter model and lack of wiggle room in terms of margins. Any variation in their cost structure will have to be transferred to the consumer, and their highly price sensitive audience will not be forgiving, flocking to other mid-price retailers who can take the margin hit to maintain their volumes. In this sense, their hand is forced with regards to which levers they can pull. The second is a further complication likely to arise due to their operations abroad: their daughter companies will be able to price more competitively in the continent than in their home country, and are likely to be seen as price gauging by UK consumers who will bear the cost (ironically, as in many other areas, probably the same demographic clusters that voted for Brexit in the first place…). This may have a deleterious effect on their brand value and further erode market share.

On your thought-provoking question regarding the lobbying powers of corporations, I believe there should be channels of communication across the government / business divide, but not to the extent that private institutions are effectively handed policy power. Rather, they should be used to effectively communicate the financial implications of decisions through regulated bodies such as chambers of commerce and industry representatives. The UK probably has that balance about right at present (unlike the USA, where campaign contributions tied to corporate favours are routine). I can’t help but think, however, how the outcome of that fateful vote could have been different if only business leaders were given more credence in their warnings for the dire impact Brexit will have.

Dan,

Brexit will undoubtedly have a significant impact on many UK companies, particularly those like ABF that sell commodity goods and grocery products. I think the challenge for ABF is even greater than for other companies because of the nature of the goods they are selling – many consumers of grocery products are highly price sensitive (especially for items like bread), and demand can drastically diminish given even the slightest increase in price. Therefore, to mitigate these pricing risks, it is important for ABF to search for new customers within the UK in order to avoid the implications of Brexit. This may require ABF to work with smaller, independent customers who order less volume, forcing ABF to rethink and redesign its distribution and/or manufacturing processes. This may require building more warehouses, hiring more sales people, and/or strengthening its distributor relationships in order to reach this new customer base and expand its market within the UK. Thinking more internationally, I do believe that influential corporations should work with national and foreign governments to create a regulatory environment that benefits both parties. ABF needs to focus on these efforts given the highly politicized nature of Brexit and its implications on cross-border trade.