Amazon, Mexico and Trumponomics- Is the bet too high?

Amazon has lately put heavy resources in Mexico, aiming to open a 1 million square-foot mega-warehouse near Mexico City to gain market share and reinforce its supply chain in North America. However, the political tension between the U.S and Mexico, fueled by President Trump's threat to cancel NAFTA, casts serious doubt on this strategy.

Introduction- Amazon’s supply chain and Mexico’s potential

Source: President Donald Trump’s Twitter account

Amazon spent in 2016 $11.5B on shipping- nearly twice than in 2014 [1]. For handling an efficient supply chain, the largest internet-based retailer [2] opens new sorting centers, delivery stations and hubs. Each warehouse pools demand over a large geographical area, leading to more stable forecasts and lower total inventory [3]. Yet, Amazon aims to improve its inventory turnover of 8.13 in 2016 that is similar to Walmart’s 8.26 [4].

Lately, Amazon has targeted Mexico a growth engine [5][1]. In September 2017 it was published [6] that Amazon aims to open a 1 million square-foot mega-warehouse near Mexico City that will enable it to store 15 million products and to distribute 1 million deliveries a day nationwide. It will also enable Amazon to serve American customers due to its convenient geographic location [7].

NAFTA renegotiation- will Trump help Amazon?

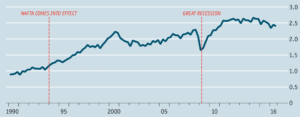

United States’ trade with Mexico has been heavily influenced by NAFTA[2]. Signed in 1992, NAFTA has created a comprehensive structure for trade and investment [8]. However, NAFTA has not favored e-commerce: Mexicans who buy on Amazon goods in more than $50 still pay duty to the Mexican government. These policies represent a severe constraint on the ability of U.S. e-commerce platforms to achieve their full potential in Mexico [9]. If the duty free threshold is pushed, as might be proposed by the U.S in the renegotiation process started on July 2017, Amazon big-ticket products will boost [10].

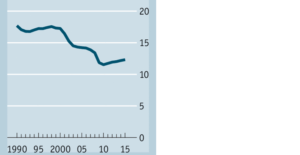

Trump, elected based on his nationalist promises, has targeted NAFTA, blaming it for destroying the manufacturing industry and expanding the U.S deficit trade with Mexico [11].

Graph 1- U.S-Mexico Merchandise Trade, as % of U.S combined GDP, 1990-2016

Source: The Economist, based on U.S International Trade Commission and Haver Analytics

Graph 2- U.S Manufacturing Employment Jobs (M), 1990-2015

Source: The Economist, based on Bureau of Labor Statistics (BLS)

All eggs in Trump’s basket?

Making a major capital investment in a country that American trade with is based on a fragile trade agreement seems risky. Ironically, the new warehouse is located along the so-called “NAFTA” highway, an industrial belt that runs through Mexico’s factory regions to the U.S. border [12]. When it comes to the future of the U.S-Mexico trade, the consequences of the negotiation- and of additional disputes between Trump and Mexico- may be harsh. Earlier this year we had a glance at this instability when consumers launched social media campaigns urging Mexicans to boycott American based brands such as Walmart, after Trump signed an executive order for the construction of the wall [13]. This casts a serious doubt on the logic behind Amazon’s decision to build a major distribution hub near Mexico City.

The concealed assumption– to triple sales

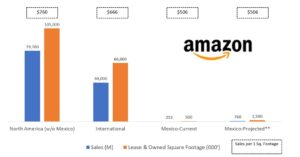

Amazon usually builds its operational centers in regions in which it owns a solid market share and bright future. My analysis, presented in Graph 3, demonstrates that in North America (Mexico excluded) and in its International segment, Amazon’s average sales-per-Square Footage is $760 and $666, respectively. We can see that currently, Amazon’s sales-per-Square Footage in Mexico [14, 15] are $506- 24% lower than International’s. To maintain the current $506 ratio, Amazon will have to triple its current sales in Mexico to $760M. Even if we consider the company’s desire to serve the U.S market with the new Mexican hub, it seems very challenging to reach these goals.

Graph 3- Analysis of Amazon sales (2016,$M) and total square footage (2016, 000’)*

Source: Author’s analysis, based on Amazon’s 2016 financial reports and Reuter’s breakdown of Amazon’s sales in Mexico

*North America segment for Amazon included the U.S, Canada and Mexico, for this analysis Mexico’s data (derived from Reuters) were excluded both for sales and for sq. footage

**In order to preserve the $506 sales-per-Square footage, sales in Mexico will have to triple to $760M; to reach the average North America’s $760, the new hub will have to generate sales of $1.1B by serving both Mexican and American customers

Stakeholders left outside

One should expect that Amazon’s management will address the NAFTA risk. But it has not. Amazon’s financial reports [16] do not reflect any concerns regarding NAFTA or the U.S-Mexico tension. One might claim that since the new project deals with a single distribution center that mainly aim to serve a niche market, the risk is low and not substantive. This claim, however, is not compatible with the enormous spending of Amazon on lobbyists to make its case about NAFTA in Washington [17], probably trying to push the duty-free limit on imports.

Consequently, I will advise Amazon’s management to reconsider its decision to open a mega-warehouse in Mexico and to implicitly include the NAFTA risk within its financial reports. A long run bet on Mexico can be reconsidered when political uncertainty diminishes.

Open issues

Yet, several questions remain open . It is interesting to understand whether Amazon or other online retailers faced a similar dilemma, took the risk- and succeeded. It is also significant to refine the projected results of NAFTA cancellation: Are Mexican projected to boycott American brands? Is it feasible? Finally, should Amazon reflect this geo-political threat in its reports? Is it sufficiently substantial?

Word Count: 791

Endnotes

- Devin Leonard, “Will Amazon Kill Fedex”, Bloomberg Businessweek, August 31, 2016, https://www.bloomberg.com/features/2016-amazon-delivery, accessed November 2017

- Wikipedia,“Amazon”,https://en.wikipedia.org/wiki/Amazon_(company),accessed November 2017

- Sodhi, ManMohan S., Tang, Christopher S.: Managing Supply Chain Risk, (Springer New York Dordrecht Heidelberg London, 2012), P. 25

- Nasdaq, “Amazon.com, Inc. Stock Report”, http://www.nasdaq.com/symbol/amzn/stock-report, “Wal-Mart Stores, Inc Stock Report”, http://www.nasdaq.com/symbol/wmt/stock-report, accessed November 2017

- “Amazon Is Planning to Open a Mega-Warehouse in Mexico”, September 13, 2017, Fortune, http://fortune.com/2017/09/13/amazon-warehouse-mexico/

- Ibid

- Daina Beth Solomon, “Exclusive: Amazon plans mega-warehouse for Mexico growth spurt”, September 13, 2017, https://www.reuters.com/article/us-amazon-mexico-exclusive/exclusive-amazon-plans-mega-warehouse-for-mexico-growth-spurt-idUSKCN1BO1RD, accessed November 2017

- Dean C. Alexander, “The North American Free Trade Agreement: An Overview”, 11 Int’l Tax & Bus. Law. 48 (1993), http://scholarship.law.berkeley.edu/bjil/vol11/iss1/3, accessed November 2017

- Patrick Gillespie, “Trump’s NAFTA could be big win for Amazon, e-commerce”, CNN Money, July 20, 2017, http://money.cnn.com/2017/07/20/news/economy/nafta-ecommerce-amazon/index.html, accessed November 2017

- Ibid

- David Alton Clark, “Trump Just Threw Kinder Morgan Smack Dab In The Middle Of A Good Ole Mexican Standoff”, Seeking Alpha, January 27, 2017, https://seekingalpha.com/article/4039934-trump-just-threw-kinder-morgan-smack-dab-middle-good-ole-mexican-standoff, accessed November 2017

- Daina Beth Solomon, “Exclusive: Amazon plans mega-warehouse for Mexico growth spurt”, September 13, 2017, https://www.reuters.com/article/us-amazon-mexico-exclusive/exclusive-amazon-plans-mega-warehouse-for-mexico-growth-spurt-idUSKCN1BO1RD, accessed November 2017

- Shasta Darlington and Flora Charner, “#AdiosStarbucks: Mexicans threaten to boycott American goods”, CNN Money, February 2, 2017, http://money.cnn.com/2017/02/02/news/economy/mexico-boycott-america-trump/index.html, accessed November 2017

- com, INC., 2016 Annual Report, p.15, http://phx.corporate-ir.net/phoenix.zhtml?c=97664&p=irol-reportsannual, accessed November 2017

- “Amazon Is Planning to Open a Mega-Warehouse in Mexico”, September 13, 2017, Fortune, http://fortune.com/2017/09/13/amazon-warehouse-mexico/

- com, INC., 2016 Annual Report, p.6, http://phx.corporate-ir.net/phoenix.zhtml?c=97664&p=irol-reportsannual, accessed November 2017

- Josh Lipton, “Tech companies are suddenly spending much more on lobbying as NAFTA negotiations loom”, CNBC, October 19, 2017, https://www.cnbc.com/2017/10/18/tech-companies-spend-more-on-lobbying-as-changes-to-nafta-loom.html, accessed November 2017

[1] Amazon’s current presence in Mexico is relatively minor- the company is the third-largest online retailer with revenues of $253M[1] in this 120 million people country

[2] North American Free Trade Agreement

You raise an interesting broader question that many companies are facing today – does a company change their strategy to immediately accommodate major political changes or wait it out until the tides turn? In relation to Amazon and specifically their planned warehouse in Mexico, I think the answer depends based on how much warehouse capacity Amazon expects to use for the U.S. market vs. Mexico and other countries in North and Central America. While the options presented in the essay are binary (either go forward with building the warehouse or cancel the project), I think there is a middle group of building a portion of the warehouse in the near term that allows to serve domestic Mexican demand and potentially other nearby countries besides the U.S., leaving the option to build out the rest of the facility later on when there is more certainty of NAFTA policy changes. This strategy allows Amazon to preserve the momentum of expansion and leverage all the work done so far on this project, while hedging potential political risk.

Interesting article and great analysis, Oded! A question to me is whether a political policy intending to boost its economy is really helping the businesses in its economy. With such policy implemented, companies like Amazon might be hindered on its global expansion and spending more money on lobbying the government, thus in the end causing a loss for the society.

From Amazon’s perspective, although it might be challenging to triple the sales to meet the sales per square foot benchmark, I believe by building a warehouse in Mexico, it will bring financial benefits to its bottom-line. Meanwhile, future expansion to other central america counties by fully leveraging Mexico mega warehouse will contribute to Amazon’s topline and bottom line eventually.

Another important question to consider: how difficult will it be for Amazon to exit from its investment in Mexico if the policy environment makes operating in the country economically untenable? Given the global rise of e-commerce, it seems feasible that some company will eventually serve an Amazon-like function in Mexico, even if Amazon fails to capture the market. If this is true, Amazon may be able to resell its warehouses to domestic companies if it decides to exit. This option reduces Amazon’s downside risk. On the other hand, Amazon is surely anticipating the risk of a competitor capturing the Mexican market before it does – which would explain its decision to invest even in an uncertain political environment. Ultimately, Amazon faces risks both ways, and it seems reasonable for them to make a calculated bet to invest.

I’m intrigued by this question, Oded, and it’s one that many companies will be facing as they consider investment outside of the US with NAFTA’s future remaining uncertain. Of note is that Amazon has made this move in full recognition of Trump’s views and it is a company that has historically been bold in investing in areas it views as having potential. I believe Mexican e-commerce must be one of these considered bets the company is making. An additional backdrop I think it is interesting to consider is the global land grab that is happening in e-commerce. Amazon is competing on a global scale with increasingly global competition, such as AliBaba. For Amazon not to move quickly and aggressively into a neighboring market to the US may leave it exposed and creating a first-mover advantage in Mexico may be a strategic bet that the company is willing to make despite the political uncertainty Daniel mentions above [1]. For me an important question is whether the risk of doing nothing in Mexico is higher than the risk of operating in an uncertain political environment?

[1] – https://www.reuters.com/article/us-amazon-mexico-exclusive/exclusive-amazon-plans-mega-warehouse-for-mexico-growth-spurt-idUSKCN1BO1RD

Thanks for your analysis, Oded! Given Amazon’s size and dominance, I imagine that the company should have enough political / lobbying power to ensure that the NAFTA renegotiations do benefit its core business of retail and retail distribution. If the Trump administration renegotiates NAFTA as you’ve outlined above, there would definitely be resulting advantages to Mexican consumers, since they wouldn’t have to pay the NAFTA-related duty on goods under $50 as they do today. This should encourage them to shop online more, and will boost Amazon’s sales to the emerging middle class in Mexico.

On the flipside, I do worry about Trump’s proposed 20% tariff on goods imported into the U.S. from Mexico (https://www.theatlantic.com/business/archive/2017/01/trump-tariff-mexico-border-wall/514766/), which he believes would be a key way to fund the border wall. If the tariff is put in place, then the Mexico-based warehouse makes less economic sense as a location to supplement Amazon’s existing warehouses in the U.S., since all goods sent across the border to the U.S. would be 20% more expensive. If faced with this issue, I think Amazon could position the Mexico-based warehouse as a center to serve other emerging markets in Central America and South America, which could serve as avenues for Amazon’s future growth as the U.S. market matures. Exporting the goods to such countries will help Amazon avoid the tariff on the one hand, and will help the company gain better understanding of international e-commerce.

Thanks Oded for an interesting post!

I tend to agree with other commenters that the Mexico warehouse is strategically important given the access it provides to Mexican and other Latin American consumers, regardless of how access to the US consumer may change.

It is interesting that the some of Trump’s proposals surrounding NAFTA changes may actually benefit Amazon – e.g. raising the $50 duty threshold to $800 [1]. These benefits may offset some of the costs of importing to the U.S. from their new Mexico warehouse.

Between this and the access to Mexican and Latin American consumers, I think the Mexico warehouse is still a good bet.

[1] http://money.cnn.com/2017/07/20/news/economy/nafta-ecommerce-amazon/index.html

Oded great article. I would like to add that NAFTA has a very high importance to Mexico’s government. Mexico’s president, Enrique Pena Nieto, has constantly expressed his interest in reaching a deal with the US government. 75% of Mexico’s exports are to the USA and the country cant afford not to make a deal. Because of how much negotiation power the US has I am pretty positive they will reach an agreement good enough in Trump’s perspective.

Thanks for your article, Oded! I appreciate your view on the future of Amazon in Mexico and the impact of Trump and potential changes In the NAFTA regime on it – particularly the view that Amazon would serve the US from Mexico.

I agree with your conclusion that Amazon not open a new warehouse in Mexico, and the analysis that is behind it.

To answer your questions – I think it is a very real geopolitical risk that should absolutely be reflected in Amazon’s financial statements. However, given that Amazon’s profit and a big portion of value generally comes from AWS, it is unlikely that a change in profit from the Mexican warehouse will change the outlook of Amazon too much. Will Mexico boycott American brands? I sincerely doubt this – American brands are at the core of the consumer world and it would be difficult to change brands such as Coca Cola, Nike, and others.