Airbus: Digitization on the fly

Airbus needs to achieve one of its steepest production increases since World War II to keep abreast with surging demand. Its answer: revolutionize the industry through digitization.

Airbus: A decade behind

If Airbus were to stop selling new aircraft today, it would still take the company an entire decade to fulfill its existing orders[1].

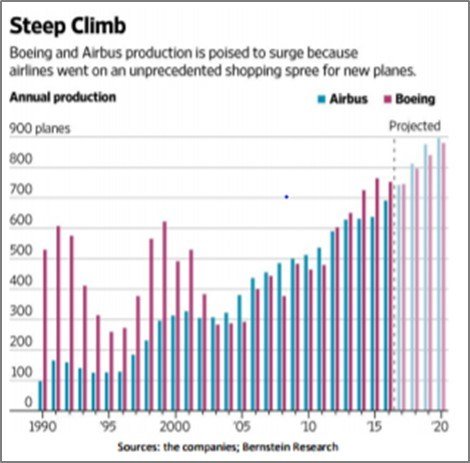

The cause of this significant backlog is threefold. Firstly, demand for aircraft has surged due to increases in global passenger traffic – 3.8 billion passengers used a plane in 2016, and this number is expected to double within the next 20 years[2]. This growth means that Airbus and Boeing need to produce 30% more planes annually by 2020 to meet existing orders (see Figure 1).

Figure 1: Airbus and Boeing annual aircraft production (1990 – 2020). Source: Wall Street Journal [3]

Secondly, aircraft production plants lack the automation and industrial maturity of motor vehicle manufacturers due to their limited involvement in mass production to date[4].

Thirdly, aircraft producers rely on a complex global supply chain of tier 1-3 suppliers and sub-contractors for components (e.g. engine parts, seats, toilets) in which delays are highly common.

With customer loyalty increasingly being based on on-time delivery[5], it is critical that Airbus ramp up production rapidly in the face of strong competition from Boeing and emerging aircraft producers from China, Russia and Canada.

Digitization at Airbus

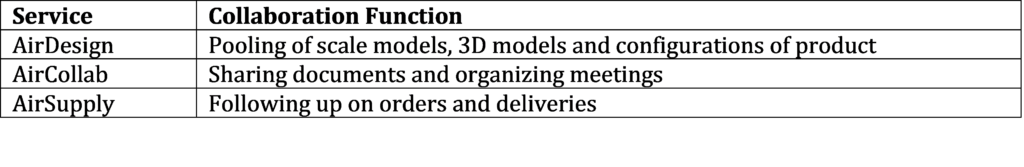

Resolving this production pressure requires more than just incremental improvements. Airbus needs to “disrupt its productivity” by setting up a different mode of organization and employing new means of production[6]. To this end, Airbus has kick-started a digital transformation that will impact the complete lifecycle of an aircraft (see Figure 2).

Figure 2: Selection of digital solutions and cross-functional technologies by stage of aircraft lifecycle. Source: AIAC [7]

An initiative currently underway is BoostAerospace, a joint venture between Airbus, Dassault, Safran and Thales. It is a cloud-based digital platform (see Table 1) that provides a common collaboration tool for industry stakeholders who currently need to manage 5-6 different systems. Its AirSupply service in particular enables a much higher level of interaction between customers and suppliers, which leads to “increased responsiveness when collaborating over quantities and delivery time frames, fewer supply disruptions, reduced stock levels, fewer outstanding amounts, and improved reputations.” Estimated benefits of current services include an average time-saving of 10% with regards to administrative activities, and supplier performance improvement of 5%.

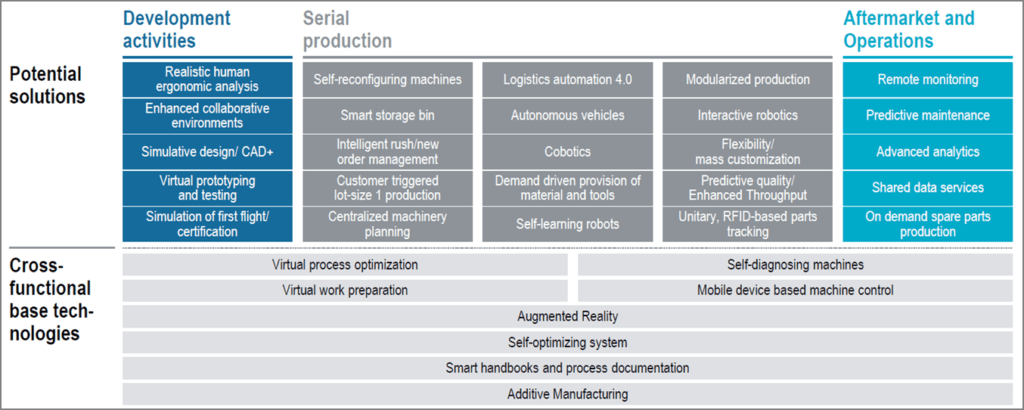

Table 1: Cloud-based services provided on BoostAerospace platform.

In addition to continuing to develop its service offering, the focus for BoostAerospace over the next few years will be extending use of the portal to all levels of the supply chain in order to create a completely connected ecosystem. It aims to do this by using an adaptive pricing model and offering free limited access to very small suppliers[8].

In addition to continuing to develop its service offering, the focus for BoostAerospace over the next few years will be extending use of the portal to all levels of the supply chain in order to create a completely connected ecosystem. It aims to do this by using an adaptive pricing model and offering free limited access to very small suppliers[8].

What does the next decade hold?

Over the next decade Airbus will continue to focus on building its digital supply chain, and complementing it with the development of a “Factory of the Future” that fully integrates Enterprise Resource Planning (ERP), manufacturing and engineering resource management, and factory floor systems[9] using sensor-generated data. The factory floor itself will be transformed through the “use of Augmented and Virtual Reality devices for employees to improve methods of working, use of Internet of Things for logistics equipment in Final Assembly Lines, and use of Cobots (collaborative robots) to increase the efficiency of workers with improved ergonomics[10]” (see Figure 3).

Figure 3: Cobots under development for use in Airbus assembly lines. Source: Deeside.com [11]

Is having the right technology all that’s required for success?

Success of digitization at Airbus rests on whether the company and its collaborators can make the radical shift to a completely digital mindset[12]. This will require a comprehensive realignment of the company’s internal organizational components – namely its operating model (structure and systems), people (skills and characteristics), culture (values and norms) and critical tasks – as well as securing cooperation across its entire supply chain. It is critical that management prioritize these efforts in conjunction with deploying the right technology to ensure long-term sustainability of its digital transformation[13].

Can they do it?

Airbus is currently juggling multiple vital imperatives – reducing existing backlog, managing immediate-term financials, digitally transforming global operations, whilst simultaneously realigning its organization and supply chain. This is no mean feat. So the key question is: how should Airbus prioritize and allocate resources such that it ensures ongoing commercial viability whilst also completely revolutionizing its ways of working?

[775 words]

[1] Adrian Bridgwater, “Airbus: engineering the future of intelligent factories,” Internet of Business (blog), February 10, 2017, https://internetofbusiness.com/airbus-engineering-intelligent-factories/, accessed November 2017

[2] Altran, “Industry 4.0: Why the aeronautical industry must reinvent itself?” http://ignition.altran.com/en/article/industry-4-0-why-the-aeronautical-industry-must-reinvent-itself/, accessed November 2017

[3] Robert Wall and Doug Cameron, “Where Are the Toilets? Order Glut Stretches Giant Jet Makers to Limit,” Wall Street Journal, February 23, 2017, https://www.wsj.com/articles/where-are-the-toilets-order-glut-stretches-giant-jet-makers-to-limit-1487885428, accessed November 2017

[4] Altran, “Industry 4.0: Why the aeronautical industry must reinvent itself?”

[5] Wall and Cameron, “Where Are the Toilets? Order Glut Stretches Giant Jet Makers to Limit”

[6] Altran, “Industry 4.0: Why the aeronautical industry must reinvent itself?”

[7] Thibault Dupont, “Digitization and Industry 4.0 in Aerospace and Defense: Boosting the Transformation”, AIAC, May 10, 2017, http://aiac.ca/blog_posts/digitization-industry-4-0-aerospace-defense-boosting-transformation/, accessed November 2017

[8] Cornelia Staib, “Digital transformation in the aerospace industry”, SupplyOn Blog, August 10, 2016, https://www.supplyon.com/en/blog/digital-transformation-in-the-aerospace-industry/, accessed November 2017

[9] Bridgwater, “Airbus: engineering the future of intelligent factories”

[10] Airbus, 2016 Annual Report, http://company.airbus.com/investors/Annual-reports-and-registration-documents.html, accessed November 2017

[11] Deeside.com, “Airbus are working on humanoid ‘Cobots’ to work on assembly lines”, May 12, 2016, http://www.deeside.com/airbus-are-working-on-humanoid-cobots-to-work-on-assembly-lines/, accessed November 2017

[12] Dupont, “Digitization and Industry 4.0 in Aerospace and Defense: Boosting the Transformation”

[13] Dr. Reinhard Geissbauer, Jesper Vedso and Stefan Schrauf, “Industry 4.0: Building the digital enterprise”, PWC (2016), https://www.pwc.com/gx/en/industries/industries-4.0/landing-page/industry-4.0-building-your-digital-enterprise-april-2016.pdf, accessed November 2017

Nothing better for an essay on digital trends than our good old humanoid robots!

A big challenge I see for the cloud-based platform is safety. Most of the data tied to the supply chain of aerospace technologies is highly sensitive. In addition, it seems that its application is not only civil but also for the defense industry (Dassault). Thales, which is part of the JV is a big player in data security [1] and I would have loved seeing what their take is on this supply chain revolution.

In addition, you could have given more details on your suggestion to realign the organization.

To answer your question, I would suggest: focusing on data security and investing on further digital supply chain innovations.

With new competition from emerging markets (as you mentioned), it is critical that the top players maintain their technical and operational advantage. Due to the complexity of the supply chain in the aerospace industry, BoostAerospace and similar initiatives will be critical.

[1]: Thales Security, https://www.thalesesecurity.com, Accessed November 2017

I agree with you that the technology is not enough on its own to fix the problems facing the Airbus supply chain. As observed at Boeing when it tried to make drastic changes to manufacturing of the 787 aircraft – introducing design or processes shifts can create significant unforeseen challenges, no matter how beneficial they are in theory. A full scale transformation will require coordination of both new technologies and human capital, in addition to monitoring quality standards.

I agree with the comment above that focus on technological advancement will be paramount to the future of aerospace companies. Not only will digitalization help reduce long term costs, it will also help maintain competitive advantage in the market. There will always be pressures to improve short term financial performance, but I believe that forgetting to slowly work towards the long term goal of digitalization would be a mistake for Airbus.

Will be interesting to see how this plays out. I thought it was very interesting to compare the ways that Airbus and Boeing are each working to inject digitalization into their supply chains.