A “Eureka” Moment for Barrick Gold Corporation

A Golden Idea: Barrick Gold Corporation, the world’s largest gold mining and production company, partners with Cisco to revolutionize a century-old mining process through technological innovation.

Barrick Gold Corporation is one of the biggest industry leaders in the metals mining and production space. Headquartered in Toronto, Canada, Barrick generated $9 billion in annual revenue and produced 6.12 million ounces of gold in 2015 [1]. With mining operations across the world, Barrick has the world’s largest inventory of gold reserves [1].

Gold Mining Industry

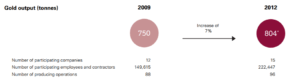

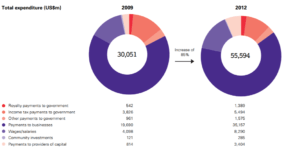

The gold mining industry is one that is time, capital, and labor-intensive. According to the World Gold Council’s comprehensive survey, which was conducted across 15 key gold mining players, the industry has experienced outsized expenditure growth relative to total gold output; expenditures increased 85% from 2009 to 2012, whereas gold output increased by a mere 7% in the 3-year timeframe [2]. Moreover, since the California Gold Rush, over 90% of the world’s gold has already been mined [3].

Gold Mining Process [4]

The gold mining process involves extracting ore (metal-rich rock) from the earth. The first step in gold mining and production is the exploration phase. This step can take up to ten years and requires significant resources and technical expertise. Geologists need to analyze a location in depth, focusing on concentration and grade of potential gold as well as the technical feasibility of mining in that specific location. On average, a deposit contains only 1.01 grams of gold per metric ton of ore [8].

The development phase takes anywhere from 1-5 years, and involves acquiring necessary licenses based on local regulation and determining the size and type of the mine at that location.

Once the ore has been extracted from the ground, gold must be extracted from the ore itself. This step requires additional processing, such as leeching, which is a chemical process to separate the minerals from the ore.

Barrick’s Digital Evolution

Gold mining has undergone minimal changes over the past century. In fact, the way we extract gold is the same as the process undertaken 100 years ago. To position itself as a trailblazing leader, Barrick has heavily invested in digital technology; in the words of John Thornton, executive chairman of Barrick, digitization has “dramatic applicability for the mining industry…this is like the 19th century meets the 21st century” [5].

In 2012, Barrick partnered with Cisco and installed solar-powered wireless mesh technology around and inside its mines in New South Wales, Australia [6]. This technology provides internet connectivity across mine pits at all locations and depths; the mobility of the wireless network enables Barrick to enhance communications for its mining dispatch operations [6].

This past September, Barrick partnered again with Cisco to digitize the traditional mining process. Piloting at Cortez mine in Nevada, the new initiative involves advanced sensing technology, real-time operational data, predictive algorithms and automated equipment to improve efficiency and productivity in the mines – in fact, every single piece of data, from fuel use to tailings waste, would ultimately be digitized [5] [7]. Real-time data will enable Barrick to revolutionize what is currently an antiquated, manual operating model, shifting from human-driven processes to technology-driven processes. Instead of wasting time manually diagnosing conditions in the mine, Barrick is able to immediately pinpoint issues and solutions through the technology – thereby eliminating time-consuming steps along its operating model.

Being able to react quickly to factors such as weather patterns and market prices will fundamentally impact its business model in a powerful way. Barrick will not only generate cost savings on improving manual processes, but will also be able to expand into less efficient mines – those that were previously overlooked due to economic infeasibility – and turn them around [7] with the technological enhancements.

Barrick ultimately aims to expand the digital technology across all of its mines. The alignment in communications across the entire mining chain allows for informed, optimal business decisions. Moreover, the digital technology will enable Barrick to better manage its use of energy, water, and emissions and build stronger partnerships with local stakeholders – key to its core business.

Though digitization is crucial to revamp the gold mining process, Barrick must address the potential ramifications of its technology investment. First, Barrick must consider how it will incorporate its existing human capital into the new technology-centric operating model. Second, as mining can never become 100% digital due to its manual nature, Barrick must figure out how to best balance its existing, human-led processes with the digital platform. Third, the new platform appears to add the most value to the extraction step in the mining process; ultimately, Barrick should look into technology that also drives efficiencies in the exploration and development phases, which can take more than a decade.

Despite the upfront investment, it is important that Barrick follows through with such an ambitious plan. By being a pioneer in the industry, Barrick will be able to influence other key players to follow suit.

Word count: 790

Sources:

[1] Barrick Gold Corporation 2015 Annual Report, Barrick. March 2016. http://quote.morningstar.com/stock-filing/Annual-Report/2015/12/31/t.aspx?t=:ABX&ft=&d=f2ba3b3a93310edfb8cefa36eb5fc37f Accessed November 2016.

[2] “Responsible gold mining and value distribution: A global assessment of the economic value created and distributed by members of the World Gold Council,” World Gold Council. October 2013. http://www.gold.org/download/file/3212/Responsible_gold_mining_and_value.pdf Accessed November 2016.

[3] “Facts about gold,” World Gold Council. http://www.gold.org/history-and-facts/facts-about-gold Accessed November 2016.

[4] “How gold is mined and the project life-cycle,” World Gold Council. http://www.gold.org/gold-mining/how-gold-mined-and-project-life-cycle Accessed November 2016.

[5] Bochove, Danielle. “Car Talk Triggered Barrick-Cisco Plan to Add Tech to Mining,” Bloomberg. September 12, 2016. http://www.bloomberg.com/news/articles/2016-09-12/car-talk-spurred-barrick-cisco-plan-to-reshape-mining-with-tech Accessed November 2016.

[6] “Gold Mining Company Lowers Costs and Improves Productivity,” Cisco. http://www.cisco.com/c/dam/en/us/products/collateral/wireless/barrick_gold_cs.pdf Accessed November 2016.

[7] “Barrick and Cisco Partner for the Digital Reinvention of Mining,” Barrick. September 12, 2016. http://www.barrick.com/investors/news/news-details/2016/Barrick-and-Cisco-Partner-for-the-Digital-Reinvention-of-Mining/default.aspx Accessed November 2016.

[8] Fickling, David. “Fool’s Gold in High Tech,” Bloomberg. September 13, 2016. https://www.bloomberg.com/gadfly/articles/2016-09-13/fool-s-gold-in-high-tech Accessed November 2016.

Image Sources:

http://www.gold.org/download/file/3212/Responsible_gold_mining_and_value.pdf

http://www.gold.org/gold-mining/modern-gold-mining

This raises a very interesting question about first mover advantage in digitization, especially in old, traditional industries like mining. It certainly seems that firms like Barrick are able to define what digitization means for their industry and force competitors to follow suit. I wonder if this comes with some risk due to the huge up-front investment should there turn out to be a better solution. Could a competitor discover a better solution and force Barrick to need to double down on an additional investment just to remain competitive?

LR – Thanks for the article. The growing role of technology and automation in mining is a fascinating industry-wide trend. For miners, this digitization trend was catalyzed by (i) dramatic declines in commodity prices (e.g., iron ore prices fell ~60% over the last 5 years) and (ii) increasing costs of extraction. Gold is particularly interesting, however, given that technology is impacting both the supply and demand sides of the equation. As you note, on the supply side, technology is increasing the efficiency and reducing the cost of gold mining. Technology, however, is having an equivalently large impact on the demand side of the equation given shifting consumer preferences, in particular for gold jewelry. Gold demand for jewelry production has declined from ~2,500 net tons to ~1,000 net tons per year from 2000-2014. [1] In fact, gold jewelry production declined ~14% year-over-year in Q2 ’16, with end-market demand growth seen only in gold investments. [2] While this trend is partially explained by rising gold prices, jewelers (e.g., Signet Jewelers) have also noted shifting demand preferences away from the jewelry category (which represented ~56% of gold demand in Q2 ’15). [2] This is particularly evident with Chinese consumers and U.S. Millennials, who are increasingly forced to prioritize between technology spend (e.g., iPhone, iPad) and jewelry (e.g., gold necklace, bracelet). While the future remains uncertain, technology could either be the next boom or bust for gold miners globally.

[1] http://www.gold.org/download/file/3691/GDT_Q4_2014.pdf

[2] http://www.gold.org/download/file/5107/GDT_Q2_2016.pdf