Under Armour

How did Under Armour enter the sportswear market that was dominated by Nike and Adidas and become a legitimate competitor?

Business Model

Under Armour is a publicly traded company that was founded in 1996 and revenue has increased from $17,000 the first year to over $3 Billion in 2014 [1]. It creates value by selling sportswear products that leads to improved athletic performance. Under Armour captures this value by focusing on targeted segments of the sportswear market.

Operating Model

Under Armour combines these key assets to achieve their vision of “empowering athletes everywhere.”

- Targeted Market Segments

Under Armour’s business model focuses on specific segments of the sportswear market, starting with compression shirts in 1996. The companies growth drivers have expanded a lot since then and the company’s currently focuses on innovative all weather clothing, women’s sportswear, footwear and international. These focuses speak to the strength of the competition, like Nike and Adidas, who try to compete across virtually all sports segments simultaneously. It is a brilliant choice on Under Armour’s part to focus on one area at a time so they can craft a clear marketing message, engineer competitive products, establish the required manufacturing and delivery capabilities, attack gaps in the market, and sign stars that represent these specific messages.

- Women’s Sportswear

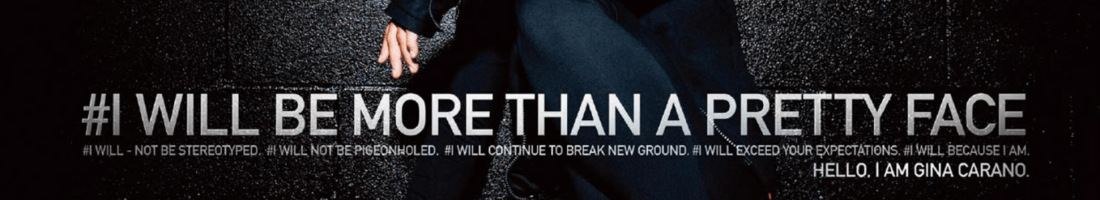

The women’s segment currently earns $1 billion in revenue and is expected to expand to 50% of the company’s revenue in the future [1]. The women’s segment has not been traditionally focused on by sportswear brands. With women being half the potential customers this is a mistake by the competitors. Under Armour pursued this opportunity gap by signing many women’s sports and pop culture stars and crafted a compelling message around Missy Copeland, a ballet star who overcame adversity to become one of the first African American soloists at the American Ballet Theatre [1]. It was an interesting choice to lead with a non-household name from a sport many have not tried, but the messaging spoke to the edgy, risk taking, younger audience Under Armour was trying to reach.

- Footwear

The footwear segment, another key market Under Armour is expanding into is very different than women’s sportswear in that it is extremely competitive and requires significant engineering and manufacturing capabilities. Under Armour needed to be re-branded away from a compression clothing company to a company who was innovative enough to be able to compete in the extremely popular footwear segment. Hiring top design and engineering talent, signing sports superstars such as Stephen Curry, Tom Brady and Jordan Spieth and establishing new manufacturing techniques were all key to the footwear expansion plan. Consumers will be willing to purchase shoes from Under Armour because of the innovation and superstar talent vouching for the products.

- Headquarters

The Under Armour campus in Baltimore has many amenities, including many gourmet food options, extensive indoor and outdoor sports facilities and even a military tank pointed at their competition out west. They also recently purchased a lot of land surrounding the current facility as part of their expansion plans [1]. This helps them recruit the best talent and ensures employees socialize more and spend more time at work.

- Digital Technology

Once of Under Armour’s biggest differentiator in the sportswear market is their digital initiative, called “connected fitness”. It is a customizable application that has over 150 million users, 40 million of which are active [1]. The company hires a lot of though leaders in the digital technology space and plans to be on the cutting edge, ahead of the competitors in this regard. Athletes recognize that by combining sportswear with digital technology their performance can improve – a fact Under Armour plans to capitalize on.

- Direct-To-Consumer

Direct-to-consumer sales, which earn much higher margins, make up 30% of Under Armour sales, and the company is looking to grow that percentage [1]. Consumers want products that are readily available and are shopping more and more online. Under Armour draws a higher percentage of its sales direct-to-consumer than any of it’s main competitors [1], which gives them a competitive advantage because their customers are more willing to buy online, a huge cost of sales advantage for the company.

- International Sales

Under Armour has experienced rapid growth since it’s inception and one big question is if they can continue this expansion into the future. Currently, international sales are 12% of overall sales [1]. This a positive sign that the company has a lot of space to grow into. The company has a very purposeful geographic expansion plan that moves country by country and often leverages international partners to help with the expansion [1]. This allows the company to focus all their efforts on one place at a time to ensure they understand the geographies culture, distribution channels, and local laws. Consumers in these locations will be more likely to purchase Under Armour because of the due diligence they performed prior to selling in each location.

Conclusion

Under Armour’s business model and operating models compliment each other, which has allowed the company to rapidly grow and provide value to its customers.

Citation

[1] Otis, Jeff. Under Armour Director of Strategy for North America. December 8th, 2015. Presentation.

I wonder if they were really able to differentiate. They claim that they understand customers better than Nike, but the messages from their commercial have the same Nike’s insights. They definitely need to find their own niche otherwise they will be perceived as just a cheaper version of Nike.

It seems interesting that Under Armour chose to focus on women’s sportwear instead of both genders. I wonder why they chose to do so, and how other brands focused on women (e.g. Lululemon and Fabletics) have affected Under Armour’s success.

Another key strength at Under Armour is how the basic fitness and performance tenets of their core products are so interwoven with the culture of the firm. I remember driving by their headquarters and seeing employees outside in 100 degree heat running sprints in the parking lot on their lunch break. Kevin Plank has made a huge investment in Baltimore, and with the 128-acre acquisition at Port Covington, Under Amour is looking to build a mixed-use campus that rivals anything offered at Nike’s World Headquarters in Beaverton. As evidenced by your anecdote about the military tank pointed west, it’s clear they have Nike in their crosshairs, but to Teti’s point, I do wonder how pervasive their “me too” attitude is and whether it will cause them to lose sight of their own competitive strengths. With plans to launch another flagship store on Newbury Street, what is your take on how this brand house expansion strategy fits with other aspects of their business and operating models?