BMW – Drive now, analyze later?

Car sharing is disrupting the automotive industry. BMW has established car sharing company DriveNow in 2011 which quickly gained substantial market share in Europe and is expanding to the US now. Should BMW be more active in its digitization efforts and if so, how?

BMW is one of largest automotive conglomerates in the world with over 120,000 employees and 2 million cars delivered in 2015. [i] Founded more than 100 years ago in Munich, Germany, the automotive giant’s most recent initiative is a service called “DriveNow”.

DriveNow is a car sharing joint venture between BMW and rental car company Sixt which was started in 2011 in Munich and has since expanded to many major European cities, including London, Copenhagen, and Brussels.[ii] Customers can download a mobile app and register for a one-time nominal fee (EUR 29 in Germany at the moment) on the DriveNow platform which will do a quick background check and require credit card information for billing purposes. After registration, the customer is immediately able to use the GPS based technology in order to find rental cars in their vicinity (please see below).

These can be reserved for up to 30 minutes and (as soon as the customer has unlocked the car with the help of a custom code within the app) cars are billed by the minute with parking, gas, and insurance included[iii]. Prices are competitive at ~EUR 0.50 per minute which makes DriveNow very attractive for classic taxi journeys, such as airport transfers, which are regularly overpriced in many European cities[iv].

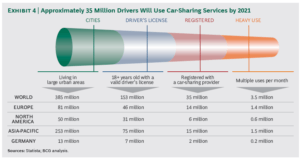

DriveNow is a classic example of how digital transformation – in this case, the powerful processing capabilities of GPS data via cloud infrastructures – can disrupt established markets, such as the automotive industry. This has not been limited to Europe only, and BMW was not the first mover in this market with competitor Car2Go, a Daimler initiative, launched in 2008[v] and ZipCar as the main US competitor. A Deloitte study estimated US membership in car sharing inititives at 1.3 million members in 2014[vi]. BMW currently counts roughly 580,000 members on DriveNow [vii], roughly half of which is in its home market in Germany. However, these numbers are expected to grow significantly with future market estimates at 35 million users worldwide by 2021 and annual revenue of ~EUR 5bn[viii], largely driven by urbanization (please see below).[ix]

However, one should keep in mind that this is expected to go hand in hand with a decrease in overall car sales (BCG estimate in 2016: net revenue loss of EUR 7.4bn to car manufacturers)[x] which points at a potential root cause for BMW’s aggressive expansion in the car sharing space. Brand exclusive car sharing is not only a built in insurance policy against general digital market disruption, it can also be deemed a great opportunity for marketing purposes[xi]. First of all, BMW is able to reach non-core customers in cities, such as young professionals or students, who might not necessarily have the financial means to afford an expensive car, but might be potential customers in the future[xii]. With DriveNow, these new customers can also experience new technologies[xiii], such as hybrid and electro cars. Especially the latter has been used extensively by BMW in Germany where electric cars now constitute for 20% of its total fleet[xiv].

When evaluating DriveNow’s potential, one has to remember that the competitive landscape in Europe is vastly different from the US. Ridesharing companies, such as Uber, have faced major legal obstacles in Europe. Furthermore, strict data security laws are restricting companies from collecting and analyzing customer data, in this case speed, outside temperatures, etc. which could be useful for insurance companies in evaluating traffic accidents. One step in this direction is the ongoing cooperation with insurance company Allianz in the UK[xv] with a focus on telematics. Their most recent collaboration with Silicon Valley based Nauto explores AI technologies in order to analyze driving behavior, including texting or drunk driving.[xvi]

DriveNow recently turned profitable[xvii] and entered the US market under the name ReachNow in April 2016[xviii]. However, it remains to be seen whether BMW will be able to turn digitization into an ultimate success story. In my opinion, digitization will lead to increasing consolidation pressure as new car sales shrink. Therefore, BMW will need to scale DriveNow quickly and find innovative ways to monetize its access to data in order to compensate for this revenue gap in the future.

Word count: 800 words

[i] See https://www.bmwgroup.com/en/company.html, accessed November 18, 2016

[ii] See https://de.drive-now.com/en/#!/carsharing/international, accessed November 18, 2016

[iii] See http://www.bmw-welt.com/de/visitor_information/drive_now.html, accessed November 18, 2016; and https://www.bmwgroup.com/de/marken/drivenow.html, accessed November 18, 2016

[iv] See Boston Consulting Group Study: Bert et al (2016), “What’s Ahead for Car Sharing?”, p. 5, http://www.bcg.de/documents/file206078.pdf,: Study estimates price savings of an average car sharing trip in Berlin at roughly EUR 14 compared to a taxi.

[v] See https://cleantechnica.com/2016/02/23/bmws-i3-carsharing-program-drivenow-arrives-in-seattle/, accessed on November 18, 2016

[vi] See https://dupress.deloitte.com/dup-us-en/industry/public-sector/smart-mobility-trends-carsharing-market.html

[vii] See Annual Report 2015, page 42, https://www.bmwgroup.com/content/dam/bmw-group-websites/bmwgroup_com/ir/downloads/en/2016/Annual_Report_2015.pdf, accessed November 18, 2016

[viii] See Boston Consulting Group Study: Bert et al (2016), “What’s Ahead for Car Sharing?”, p. 2, http://www.bcg.de/documents/file206078.pdf, accessed on November 18, 2016

[ix] See Boston Consulting Group Study: Bert et al (2016), “What’s Ahead for Car Sharing?”, p. 10, http://www.bcg.de/documents/file206078.pdf, accessed on November 18, 2016

[x] Ibid.

[xi] See Porter and Heppelmann (2014), “How Smart, Connected Products are Transforming Competition”, HBR, February 2014, p. 15

[xii] See Boston Consulting Group Study: Bert et al (2016), “What’s Ahead for Car Sharing?”, p. 3, http://www.bcg.de/documents/file206078.pdf, accessed on November 18, 2016

[xiii] See Zoepf and Keith (2015), “User Decision-Marking and Technology Choices in the U.S. Carsharing Market”, http://web.mit.edu/sloan-auto-lab/research/beforeh2/files/Zoepf%20and%20Keith%20Transportation%20Policy%20for%20Review.pdf, accessed on November 18, 2016

[xiv] See Annual Report 2015, p. 42, https://www.bmwgroup.com/content/dam/bmw-group-websites/bmwgroup_com/ir/downloads/en/2016/Annual_Report_2015.pdf, accessed November 18, 2016

[xv] See https://www.towerswatson.com/en-GB/Insights/Newsletters/Global/emphasis/2014/the-internet-of-things-is-transforming-the-insurance-industry, accessed November 18, 2016

[xvi] See http://fortune.com/2016/10/07/bmw-toyota-nauto/, accessed November 18, 2016

[xvii] See http://www.autonews.com/article/20161003/GLOBAL/310039970/bmws-drivenow-is-profitable-now, accessed November 18, 2016

[xviii] See http://reachnow.com, accessed November 18, 2016

I wonder how will services like DriveNow be affected by self driving capabilities. The example that naturally comes to mind is Uber with its newly deployed self driving cars in Pittsburgh. Even though this is an exciting innovation, it relies on the model of having a self driving car for the sake of providing a service to move people around (1). On the other hand, I think Elon Musk’s plans for Tesla self driving capabilities are a step beyond, given that it will rather focus on a model of having your private car, whose main purpose is your own movement and recreation, go and provide a transportation service for other people. In my opinion, that will be a game changer and will further improve the overall efficiency of the car fleet, given that the line dividing the private and public usage of a car will be blurred (2).

(1) Tech Crunch, “Uber starts self-driving car pickups in Pittsburgh,” https://techcrunch.com/2016/09/14/1386711/, accessed November 18, 2016

(2) CNBC, “Elon Musk says: ‘It’s not Tesla vs Uber. It is the people vs Uber’,” http://www.cnbc.com/2016/10/26/elon-musk-says-its-not-tesla-vs-uber-it-is-the-people-vs-uber.html, accessed November 18, 2016

Samuel, that’s an interesting thought, thanks for commenting! Regarding Uber in particular, I do not think that DriveNow has to worry too much about competition. Uber has been substantially less successful in Europe, be it due to our strong taxi unions and associations or stricter labour laws (for instance, regarding part time employment, social security including insurance for employees, etc.). In the UK, one of DriveNow’s European core markets via the city of London, taxi driver are required to pass an exam and enroll in special taxi driving programs which can take up to 4 years of full time instruction. From my own experience, I can attest that taxi drivers in both Germany and the UK are way more knowledgeable and professional than their Uber counterparts and many people value these qualities enough in order to justify the price markup versus Uber.

So much for ride sharing facilities. Regarding self-driving cars, I too wonder whether this innovation might change the game for the car sharing industry. In the end it comes down to the fundamental question whether you believe that a GPS based system is superior to human knowledge/skills. DriveNow is a car sharing service where you rent a BMW and drive the car yourself, i.e. it is not directly comparable to either Uber or a taxi service. If regulation allows self driving cars on Europe’s streets (and in my mind this is the biggest IF), BMW might as well enter this market themselves and provide a self-driving car option, similar to their hybrid and electric vehicles. And if Tesla were to offer a similar program, I would be surprised if they could do it at a low cost similar to DriveNow.

Josefin – Thank you for such an interesting post! I had no idea that BMW had entered the car-sharing business. As a millennial and recovering New Yorker who has never owned a car, I strongly believe that car-sharing (and the “sharing economy” more broadly) will be increasingly important over the coming decades. I think that offerings like this one are a great way for BMW to hedge against that industry shift and the potential reduction in demand for personal vehicles as millennials get older.

I’m reminded of the dynamic pricing case we had in Marketing on Thursday. One of the examples we discussed in class was car insurers’ use of tracking technology to evaluate customers’ driving abilities—and charge them accordingly. I wonder if there is an opportunity to apply that sort of technology in a car-sharing context: would BMW and American companies like Zipcar be able to identify good and bad drivers and allocate those customers a discount (or surcharge)? What would the customer and competitive response be to such an initiative?

Thank you, Elizabeth, and I agree! Car sharing is made for Millennials living in urban environments where car ownership becomes futile due to high cost of parking and insurance or simply due to very good public transport and infrastructure. DriveNow is definitely one of the services I miss most in the US and I was very happy to hear that DriveNow entered the US market in April this year (in pilot cities on the West Cost, Portland and Seattle among them). In my opinion, BMW did a great job at spotting the transformative power of the sharing economy and recognized that there was a potential for disruption in their business model. Partnering with one of the largest rental companies in Europe, Sixt, was also genius in my opinion, because car rental companies might as well have responded with starting a price war on this market in order to save their business model.

Regarding your thought on tracking users’ driving ability, BMW and Allianz have actually partnered with a Silicon valley based start up called Nauto which is using camera equipment place on the car’s windshield in order to track drivers’ behavior. This could be used to detect harmful behavior, such as texting or drunk driving, and help insurance companies to detect fraudulent claims. It remains to be seen, however, if European regulators will allow the collection and usage of this data. From a customer point of view, I think it would be a great idea to participate in this system, if insurance companies adjusted their premiums accordingly. We have seen similar developments in the health insurance business, where companies offer discounts if employees participate in certain health initiatives or allow tracking of their health status regularly, one of the most prominent examples being Italian insurance company Generali, see link below.

https://generalivitality.com

Thanks for such an interesting article, Josefin.

It would be interesting to see how DriveNow intends to gain market share in the US from existing competitors in the space such as Zipcar. It would really need to place their cars at very strategic locations where there is high demand or affinity for consumers to utilize such application. I am also concerned, as with Zipcar, with the utilization rates. I often see Zipcar vehicles parked for days at the same location with nobody renting it. Therefore, analytics could be the differentiating factor that provides competitive advantage to these companies.

I think that like Uber, DriveNow would need to incur losses for several years in attempt to gain market adoption at sufficient volume or mass, before it can turn profitable.

Kenny, thanks for your comment. I think the most interesting part of the US market entry here is the fact that DriveNow has actually tried entering the US market in San Francisco a couple of years ago already. At the time, restrictive parking permits and similar regulations have prevented DriveNow from successfully expanding operation so that they left the market again.

I agree that scale and price are the two most important value components of this model. One of the studies, I cited above (Zoepf and Keith (2015)), looked at the relative importance of these value components and found that “for an average user obtaining a vehicle when and where they want it is of greatest importance. Traveling one mile for a vehicle or rescheduling a trip by up to one hour are each worth approximately $2/hour in vehicle price”. Regarding utilization rates, DriveNow has been quoted in AutoNews recently saying “The utilization is two, three, four hours a day — so that’s about four times what the average is.” http://www.autonews.com/article/20161003/GLOBAL/310039970/bmws-drivenow-is-profitable-now

Therefore, I disagree that DriveNow faces the same challenges as ZipCar, at least for the European market. It remains to be seen if they can repeat this success story for the American market where fundamentals are arguably different: competitors, such as Uber and Lift are stronger, brand recognition is lower than in Germany, and cities don’t follow the common European hub and spokes structure so that you will need to employ a larger number of vehicles in order to guarantee sufficient coverage.

Great post. As you mentioned, BMW has a steep hill to climb in order to gain marketshare in the US. Uber and Zip Car have first mover advantage, and unless they mess up I think they’ll continue to dominate in the Ride-Share space. The one clear advantage that I see to Reachnow vs all the other competitors is the BMW brand. According to Statista, BMW is ranked 7th in luxury car Market Share [1]. 7th might seem like a poor spot to be, but as we learned in the longchamp case in marketing – broad dispersion of your brand takes away from the luxury appeal. Time will tell whether driving a BMW will be enough to persuade people to use ReachNow instead of Zip Car.

[1] https://www-statista-com.ezp-prod1.hul.harvard.edu/statistics/287620/luxury-vehicles-united-states-premium-vehicle-market-share/

I agree, the BMW brand recognition is substantially lower here than it is in Europe. One of the reason why many people use DriveNow in Germany is the fact that driving a BMW is considered really cool. I think that ReachNow might work in certain environments which are more ‘European’, if that makes sense. They have entered the US market in Portland and Seattle this time which are definitely more liberal and environmentally friendly cities. A large portion of the ReachNow cars are electric vehicles catering to eco conscious crowds in Portland. I am excited to see how ReachNow will develop in the future and whether they’ll be able to take market share from Zip Car.

Josefin, fantastic post and response to the comments. While BMW may have a weaker market share position in the US, I think it might serve as a strength to them as they are still relatively uncommon compared to their peers. Instead of just having the target market of those who need to rent a car, they will also be able to target those who would like to try out a BMW for eventual purchase. When I look at Mercedes-Benz, I think that they have a reduced brand value because of their market share.

In regards to their potential to take market share from Zip Car, I think they will have a fair amount of success because the quality of their cars is so much higher than those on the Zip Car platform. My concern for that is regarding whether they will be able to find parking spaces to put the cars.

Whereas many car companies are facing these existential issues with respect to the future of car ownership and autonomous technology, it seems BMW may be hit harder. Their entire “Ultimate Driving Machine” brand image implies that the majority of the value is in how great it is to drive the car – the “luxury” of the car is more heavily weighted toward the driving experience itself than other luxury car companies.

If customers aren’t the ones driving the car, then much of the BMW differentiation is lost vs. brands like Mercedes that focus more on comfort and quality materials. Therefore, it is interesting to see BMW choose a type of ride sharing that involves the customer actually driving the car (as opposed to General Motors investing $500mm into Lyft[1]). In an Uber-style ride share, in which the customer is attempting to maximize value for the end consumer (who is being driven), a BMW would lose many of its advantages. It would therefore be in a worse position from a value perspective since the driver would not be able to pass through as much of the purchase cost.

This same effect will have an even bigger impact on the value of their brand in the impending self driving car revolution. Customers are not buying a car for the driving experience anymore, so comfort and utility become more important factors. In the short term, this should help them outperform other non-autonomous cars as the market loses share to autonomous. Customers will cling to BMWs longer than they will brands that do not focus on the driving experience because those customers clearly see value in driving. While this can only last so long, it does give BMW a nice cash flow cushion to help them make the transition. Long term, they may have to start thinking about a shift in their brand positioning.

[1] “General Motors, Gazing at Future, Invests $500 Million in Lyft.” New York Times [http://www.nytimes.com/2016/01/05/technology/gm-invests-in-lyft.html]

Thanks for your comment, Michael! I agree that the most imminent threat to BMW is probably not coming from obvious American competitors, such as Lyft and Uber, but rather from groundbreaking innovation in the self driving car business. BMW is definitely associated with their driving experience and technicality in Europe, where large parts of the population, especially in Germany, actually still prefer driving non-automatic cars.

I think it is commendable how BMW was one of the first car companies to accurately recognize the looming danger of car sharing on future car sales. Furthermore, their strategy of partnering with car rental companies instead of trying to get market share from them was genius, in my opinion. I have been an enthusiastic DriveNow user for years and hope that BMW will be successful at their second attempt at entering the US market. So far, they are only active on the West Coast (in Portland and Seattle), but I hope they’ll expand to the East Coast soon.

Drive Now is such a smart move for a BMW – European company to address European markets in general and other markets where car sharing platforms such as Uber or Lyft have been struggling to penetrate. As far as I am concerned, the business has been very successful in Europe, where in Berlin for example, its fleet of almost 1000 cars got used five to six times a day. [1] However, I would like to know more about how the company’s plans to achieve growth in US market which is arguably one of the biggest potential market for this type of service. In 2015 BMW had to suspend its business in San Francisco which was the first and only US city that DriveNow operated in due to many problems and one of them being car sharing regulations. Do you think the business model has to be adjusted in this case since what made this business idea great in Europe is not necessarily great in a market saturated with many different car sharing options and platforms?

[1] http://fortune.com/2015/10/12/san-francisco-bmw-car-sharing/

[2]http://www.wsj.com/articles/bmw-to-launch-car-sharing-service-in-u-s-1460131271

Thank you for your comment. Yes, I agree, I think BMW has to adjust their model to the American market. When they first entered the market in San Francisco, their biggest problem was the strict parking regulations in San Francisco. Parking is included in the DriveNow price, so this model ended up being very expensive for BMW. Now they rebranded as ReachNow and actually started out in two different cities: Portland and Seattle. Their focus also seems to have shifted more towards a clean car value proposition with a large number of cars being hybrid or electric. I think that the tech savvy, but environmentally conscious citizens of Portland and Seattle are the perfect customers for BMW: they probably don’t remember the DriveNow experience of 2015 which was only rolled out in San Francisco as you correctly mentioned above, so they view ReachNow as a new player in the market which offers a convenient eco-friendly, but stylish car sharing alternative to Zip Car and Uber. I am very excited for ReachNow in the US and hope they’ll roll out the initiative to Boston, soon!

Thanks for an interesting article Josefin. I was struck by the stats in the infographic you posted from the BCG report; the anticipated market size for car sharing in Europe is c.3X that of the US. I understand that is largely a function of having a higher proportion of the population living in dense urban environments, which is the only place this model can really work effectively. Presumably the trend towards urbanization in many corners of the world will serve to create a fertile market for this type of service, as owning a car makes less and less sense.

I imagine the move to autonomous vehicles will attract other auto makers into this fleet management role. Given this is so different to their traditional function as a manufacturer (i.e. working out how many cars to deploy, where, pricing for short journeys etc.) I think BMW has played a masterstroke by making an early entrance into the market, and will be able to develop knowledge and capability now, which will provide it with an advantage over competitors in the years to come. (I note BMW is pursuing this venture in partnership with rental firm Sixt, and I would have thought similar strategic partnerships will be commonplace in the future)

Great post! It reminded me of an article that I read earlier this year that really captured my attention. http://fortune.com/2016/03/13/cars-parked-95-percent-of-time/ On average, cars are parked 95% of their lifespan. The article’s author mentions how there will be a shift away from car ownership and a shift towards car-sharing opportunities. I really like that BMW is considering this car-sharing program. It seems that there is a lot of green space opportunity here for car companies. It also hedges their bets against a possible decline in car ownership. Something that I would be interested in would be how BMW and other car-sharing companies would track responsibility for certain incidents such as fender-benders.