Zillow: Bringing Data and Transparency to the Neighborhood

Zillow brings data and transparency to neighborhoods across the U.S.

Zillow, the online real estate marketplace that launched in 2006 and went public in 2011, is a digital winner. Zillow’s transparency enables home owners, home sellers, home buyers, and home renters to access real estate data that was previously widely dispersed or even completely inaccessible. The company’s mission “is to build the largest, most trusted and vibrant home-related marketplace to empower consumers with information and tools to make smart decisions about homes, real estate and mortgages.” With access to Zillow’s database, people are no longer reliant on the traditional realtor to source, show, and sell/rent properties. The data is so robust and accessible that traditional realtors use the database to better inform their business. User can now log into the database from anywhere with an internet connection and access home prices in neighborhoods across the country.

In addition to the database (110 million U.S. properties) housed on Zillow.com, the parent company owns and operates: Zillow Mobile, a suite of home-related mobile applications; Zillow Mortgages, which connects lenders and borrowers interested in competitive mortgages; Zillow Digs, a marketplace that provide home improvement visual inspiration and cost estimates; and, Zillow Rentals, a marketplace targeted at rental professionals.

These features create value for users, as they now possess transparent information on real estate properties, including property value, taxes, and transaction history.

Zillow estimated 76.7 million average monthly unique visitors (across all platforms) in the fourth quarter of 2013, which represented year-over-year growth of 41%. In December of 2014, 420 million homes were viewed (which obviously includes multiple views by different users of the same home). Zillow’s suite of solutions, specifically the marketplaces, benefit greatly from network effects. More homes added to the site will attract more users, which in turn will attract more real estate, rental, mortgage and home improvement professionals, and advertisers to the site. It is through the marketplace solutions and advertising that enables Zillow to generate revenue.

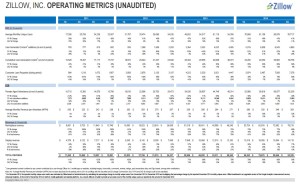

According to its most recent annual statement, Zillow captures value: “…from local real estate professionals, mortgage professionals, rental professionals and brand advertisers. Our revenue includes marketplace revenue, consisting primarily of sales to real estate agents based on the number of impressions delivered on our buyer’s agent list in zip codes purchased, and advertising primarily sold on a cost per click, or CPC, basis to mortgage lenders, as well as display revenue, which consists of advertising placements sold primarily on a cost per thousand impressions, or CPM, basis.” In FY2014, Zillow generated revenue of $325.9 million, a year-over-year increase of 65%.

Zillow also offers widgets, badges, and access to its data via APIs for developers and other website owners. All developments using the APIs must link back to Zillow.

Zillow has managed to disrupt the home property market and provide users transparent access to data on millions of homes in the U.S., and connections to thousands of various professionals. In my opinion, its ability to create and capture value has allowed the company to become a digital winner.

Thank you for the post, Noah. I agree that Zillow has done an incredible job attracting 77 million users in such a short time period (it was at just 17 million users in early 2011). I also agree that it is disrupting a huge market – there are ~$1 trillion of home sales each year, real estate broker/agent commissions are ~$60 billion per year, and real estate brokers spend ~$10 billion on advertising per year. Zillow’s revenues for 2015 are expected to be ~$665 million, suggesting that it has meaningful growth runway in penetrating the $10 billion advertising opportunity. The opportunity is even greater if Zillow can eventually circumvent real estate brokers altogether and target the $60 billion of commissions. However, the company faces several challenges to realizing its promise.

First, it is unclear what share of Zillow’s users and user growth is comprised of consumers actually looking to buy or sell real estate. Its pitch to brokers is that its website’s visitors are “transaction ready.” If the supermajority of Zillow’s users just have fun with the site’s slick valuation tool without any intent to transact, they users are much less valuable to brokers. If, in fact, its users are “transaction ready,” Zillow must find more effective ways to prove it than they have to date.

Perhaps even more concerning is that brokers who are Zillow’s primary customers are equipping their own websites with more relevant data and easy-to-use interfaces (http://www.barrons.com/articles/SB50001424053111904329504580071503076700616). For example, Realogy (which owns real estate brands such as Century 21, Coldwell Banker, and Corcoran Group) is growing leads from its own sites at almost twice the rate of third-party sites (46% vs. 27%) and converting them into purchases at almost triple the rate (5.6% vs. 2.0%) [source: Realogy investor presentation: http://ir.realogy.com/phoenix.zhtml?c=198414&p=irol-presentations%5D. Granted, this is only possible for the very largest real estate brokers who have the scale to add sophisticated features and drive traffic to their websites. However, the largest brokers such as Realogy and ReMax have been taking share from smaller ones – if they continue to do so and/or if there is increased M&A activity in the space, their proprietary platforms could pose a challenge to Zillow. Indeed, this dynamic played out in the airline reservations space. While online travel agencies (OTAs) like Expedia, Travelocity, and Priceline were initially consumers’ websites of choice for online air bookings, the airline industry consolidated and airline websites improved to the point where it became more convenient for consumers to book direct. As such, although OTAs are still very relevant in the hotel space, online air bookings have been shifting away from OTAs to airline websites.

Furthermore, while Zillow’s business model may lend itself to network effects, it is unclear whether the market has “tipped.” That is, the market may be nascent enough that it has not yet entered the virtuous cycle whereby the existing leader becomes the sole winner. Leads from the internet still produce less than 10% of property buyers and 5% of property sellers, including those who find real estate agents online (http://www.barrons.com/articles/SB50001424053111904329504580071503076700616). Given the low existing penetration, there is plenty of room for a competitor with meaningful housing data to develop an attractive alternative. Indeed, Realogy is working on just such a tool replete with listings from other brokers as well as a pricing tool comparable to Zillow’s. Realtor.com and others have also introduced similar offerings. If one can emerge as superior to Zillow in the eyes of users for whatever reason, Zillow may lose its early lead much as Myspace ceded its commanding perch atop the social networking world to Facebook.