Zillow — A Strong Study in Defying Disruption

How Zillow has created a difficult to disrupt platform through strong complementary services

Background

Zillow – the Seattle-based platform for home showing, renting, and buying – has achieved major success over the past 15 years by capitalizing on clever ad sales and listing services. Since its inception in February 2006, Zillow has grown its market capitalization to $7.2 billion, despite its original failure as a public home auctions website. Its name is a portmanteau of “zillions” and pillow” and has taken the US home market by storm by harnessing troves of data it uses to provide targeting advertising to customers of the site (e.g., property companies). The company, founded by former Microsoft executives and founders of Microsoft spin-off Expedia, reached $8.1 billion in revenue in 2021, a 2.4x increase over $3.3 billion generated in 2020, and boasted over 68 million monthly visitors in 2021, compared to 3rd ranked real estate website Trulia, which only had 15.1 million monthly visitors in 2021.

How It Makes Money

Zillow effectively makes money via four revenue streams: 1) ad sales to property management companies, 2) house flipping (i.e., iBuying), 3) premier services for real estate agents, 4) ad sales to mortgage lenders and other businesses.

Ad Sales to Property Managers – First, Zillow charges property management companies to advertise their listings on Zillow. Second, it sends qualified leads (i.e., prospective renters) to advertisers to allow more efficient targeting of potential leads. Because renters are more frequent repeat customers than homeowners / buyers, Zillow makes more reliable profits from this segment.

House Flipping / iBuying – Using its massive amounts of home data, Zillow can automatically price houses that hopeful sellers post on the platform, usually creating an offer within days. Once a customer accepts Zillow’s bid, they fix it up, relist it, and hope to sell it within 90 days.

Premier Services for Real Estate Agents – Budding or established real estate agents use Zillow to promote their personal brand. Agents can post their listings, reviews, past sales, bios, photos, and videos. Agents can also purchase targeting advertising to boost their presence in the local market, as well as a customer management system to make client management easier.

Ad Sales to Mortgage Lenders – Similar to property managers, Zillow also sells ad space to mortgage lenders and other home-related merchants (e.g., interior designers, general contractors) to boost their ability to acquire customers.

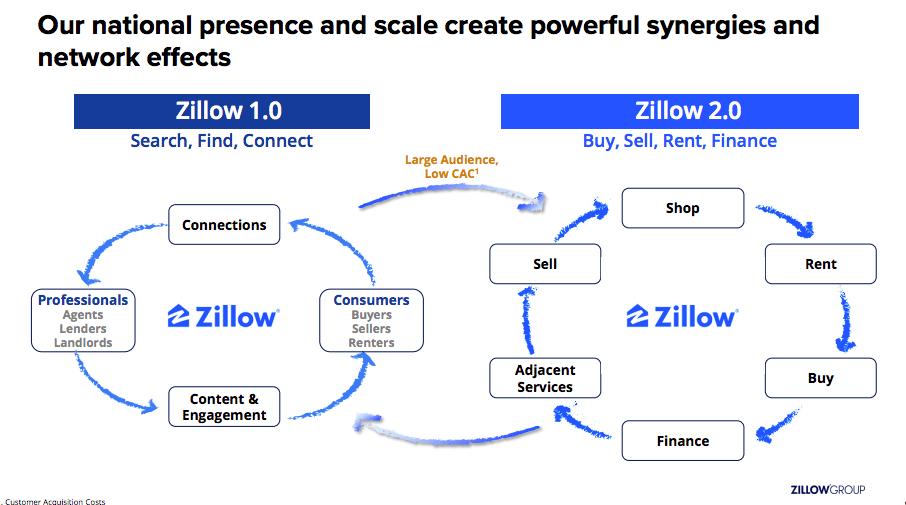

How Does Zillow Capture Value

Zillow captures value by leveraging strong cross-side (i.e., indirect) network effects: the more houses that are on Zillow, the more users come to Zillow. This creates a virtuous cycle with relation to its advertisement business: as more users flock to the platform, the more firepower Zillow can lend to customers who want to target those users. To attract users, Zillow offers a suite of free products: users can post and view home listings for free; they can view house sizes and past sales data (including their own homes); calculate mortgage payments (Zillow Mortgage Calculator); etc. The beauty of the platform is the vast majority of its fundamental data is nonproprietary public information. By simplifying and packaging this information in an easy-to-understand format, Zillow created an attractive suite of products that garnered a massive user base which served as the foundation for Zillow to build the bulk of its digital empire (i.e., the services mentioned above).

Network Analysis

Because of the synergies it enjoys from cross-side network effects, Zillow can be said to have strong overall network effects. Furthermore, while most of Zillow’s customers are looking for homes in a local market – a feature that usually indicates an easily-penetrable, fragmented market – its strong array of other features available to users and advertisers gives it a more global network, making it harder to disrupt. Beyond the complementary services it offers, Zillow also faces little threat from disintermediation because home buyers and sellers rarely interact more than once. Finally, while there are other websites that allow users to sell their homes (e.g., Trulia), the threat of multi-homing looms small for Zillow because it offers so much more than just house viewing and buying, which creates strong network effects for home buyers, sellers, renters, and advertisers.

Zillow is inherently scalable, because it uses publicly amassed data, of which there is no shortage, given that its based on the housing market. While the availability of publicly held information may not prove true in other markets, the enduring brand Zillow has created ensures that users and customers will continue to flock to it. The virtuous cycle Zillow has created also ensures it is a sustainable model. As long as there is a market for home renters and buyers (which we expect to last effectively forever) Zillow can continue to offer value.

References:

https://www.zillow.com/tech/building-a-data-streaming-platform/

https://www.sec.gov/ix?doc=/Archives/edgar/data/1617640/000161764022000013/z-20211231.htm

https://insights.daffodilsw.com/blog/how-zillow-works-business-model-and-revenue-streams

Interesting post, Jonathan! The blog post perfectly illustrated what we learned in this module about platform businesses, such as cross-side network effect, disintermediation, scalability, etc. And the exhibits are very helpful for readers to understand the essence and evolution of Zillow’s business model. In the graph, it mentions the adjacent services in the loop – what kind of adjacent services do you think can be relevant for Zillow if it wants to maintain the network effect in the future?