Gympass: Classpass reimagined for B2B

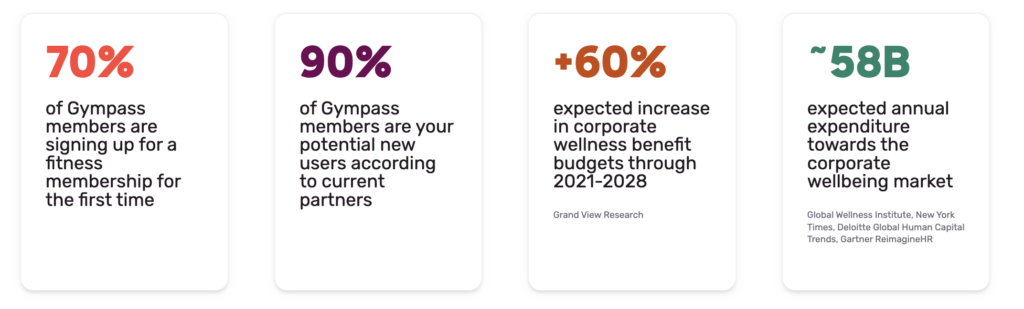

Gympass offers a solution to provide wellness as a benefit to corporations and their employees, as firms are competing to attract, support and retain top talent.

Gympass: high-quality wellness as a benefit

Gympass is an employee fitness and wellness platform that allows corporations to offer a competitive benefit to their team: an all-in-one subscription to access gyms, fitness studios and wellness apps for a discounted (or unbundled) price. Gympass has partnered with high-profile fitness brands like Soulcycle, Barry’s, Orangetheory, F45 and highly-utilized apps like Calm and Strava. Founded in 2015, Gympass has raised more than $525M in venture funding, most recently raising a $220M Series E round with participation from credible firms like General Atlantic and Softbank.

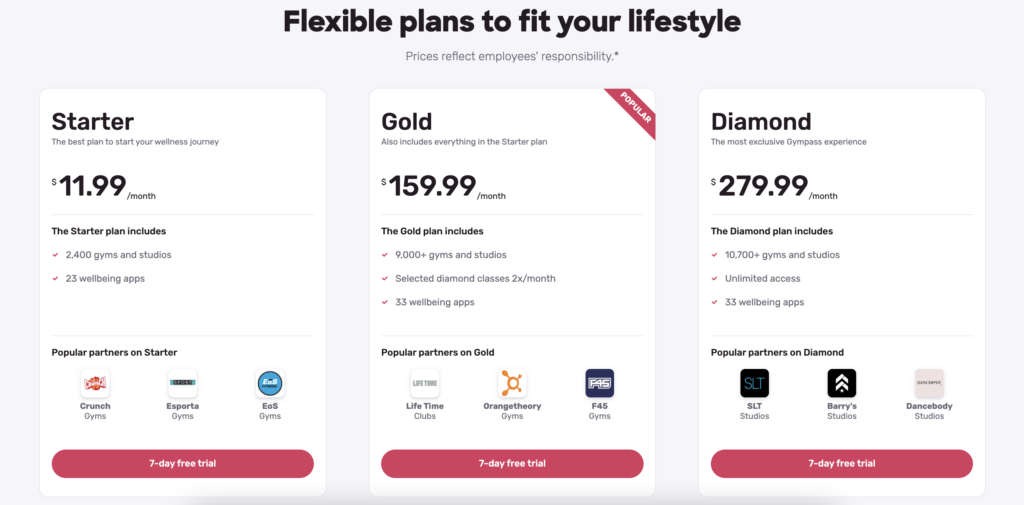

Gympass contracts with employers, so that employees can access memberships according to their spending preference (all which are severely discounted from the employee accessing the market rates for classes/gyms/apps on their own). They seek to replace the “traditional” wellness benefit models, where employers either (a) subsidize the cost of a specific gym (or two), (b) provide basic (but limited) reimbursement of limited wellness expenses, or (c) offer nothing at all. They have signed major clients such as SAP and Kraft Heinz.

A winner in a crowded space?

Gympass prides itself on being the “largest network of gyms, studios and wellbeing apps,” so even though they loosely compete with other consumer offerings like Classpass and B2C subscriptions or bundles, Gympass differentiates itself in three main ways:

- Price: For individuals, a Gympass membership is significantly cheaper than a consumer attempting to bundle studio classes, gym memberships and/or apps on their own. For employers, though the benefit is definitely premium, they are expected to have a higher willingness to pay due to Gympass’s program’s higher utilization and engagement than most other benefits offered.

- Variety: The large network allows ultimate choice for the individual, whereby by participating in the network, they don’t sacrifice the ability to attend their favorite classes or gyms. For example, Barry’s would never join Classpass due to brand dilution and their business model of limited revenue share to the fitness studios. But, Barry’s is on Gympass to have access to the large, deep-pocketed customer-base of corporate employees, better brand implications, and revenue share.

- Access: Many B2C fitness bundles only offer a few spots (typically surplus) within certain classes at studios (e.g., Classpass’ value proposition to studios is to fill un-booked spots in classes). Gympass, on the other hand, allows individuals to access studios equally to how they would be able to access them outside of the network (rather than on a limited bases), but still do so for a significantly cheaper price.

Value creation in a three-sided marketplace

Though consumers’ time is getting more expensive with the proliferation of activities (online and otherwise) that they can participate in in a limited leisure-window, Gympass benefits immensely from the scale it has achieved to offer such strong value to individuals, employers and partners. Their comprehensive approach to value creation will surely continue to support the defensibility of their business, even in tough macroeconomic conditions like those we see today.

But just how do they create value for each of the stakeholders in this complex platform ecosystem?

- Individuals: As described above, the crux of what Gympass offers is ultimate affordability and access, without sacrificing much-wanted variety. The value is obvious: consumers get their employers to heavily subsidize their wellness expenses, without constraining their ability to choose how they spend their wellness dollars. Gympass also offers the added benefit of simplicity: instead of managing multiple subscriptions and confusing contacts with specific gyms or studios, individuals have a singular wellness hub that houses all the bookings and resources they need.

- Partners: Gympass rewards partners who participate in the program with revenue sharing, proportional to bookings at their studio (or service) through the Gympass platform. Since a size-able portion of the high-earning working population (who these studios/gyms/apps would typically target) are covered with Gympass through their employers, partners are heavily incentivized to participate in the network as to not lose out on this segment of the market. At scale, partners also don’t have to worry about brand dilution and can actually participate in Gympass to increase brand awareness, as individuals can peruse and discover a wide range of offerings they might not have heard of before.

- Employers: Gympass appears a savvy choice for employers, who are finding it increasingly more difficult to attract and retain top talent. HR and People Ops departments are always on the search for high-quality benefit offerings that show true value, but the disappointing reality is that most benefits go unused as employees lack awareness or don’t find them necessarily applicable to their situations. Gympass solves these issues by providing a high-quality employee experience that is highly demanded among this population, and is able to prove high engagement to support HR spend ROI (unlike other benefit options).

Gympass has strong reason for creating value for these disparate stakeholders, in that their participation and engagement feeds the network and strengthens the value proposition for each of the individual actors. The more employers that sign up, the more value prospective partners see in joining the network (to be rewarded with revenue sharing). The more partners that participate, the more value individuals find in the benefit and the more they use and benefit from the program. (Additionally, with more partners brings more prospective partners — given partners are brand-motivated, and only want to participate if there are other strong fitness brands already playing). Lastly, the more individuals that sign up, the more value employers see in offering this service to their organizations to increase employee engagement, wellness, satisfaction and retention.

Though Gympass faced a multi-faceted chicken-and-egg problem at the outset, the founders commitment to signing high-quality employers and partners has since paid off, and they are now at a scale where the network is “up the curve.”

Uncertainties ahead?

Though covid was a major setback to business growth, as many fitness brands shut down or fell into major distress, Gympass continued confidently with its strategy (with a new digital spin, which added even more value for consumers) and was able to retain its customer base enough to weather the storm. Now, as we head into an uncertain economic climate, where employers are likely cutting benefits and the workforce (and therefore Gympass’ TAM) may contract, Gympass may face additional challenges retaining customers and partner contracts. However, their strong business fundamentals and unprecedented value offered to each part of the network should protect them over the next few years.

Hi Steph, thanks for sharing this! I was a previous user of Gympass and can speak from my own experience that this is a platform which brings value to customers as it deletes the barriers that new joiners have when they want to attend the most popular fitness centers. Barriers usually include high prices and lack of options, but as you mentioned, Gympass allows users to access its extensive network of gyms. My only concern with this platform is that customer churn could increase and be high with time? Usually, users get excited when they initially join a fitness center, but after a couple of classes, they just stop going. I would be curious about the data that Gympass has regarding the number of months that users kept attending their initial centers, would customer retention be high for the longer term?

Thanks for sharing this post and information! I liked the section about how Gympass is different than Classpass. As I’m reading these blog posts, I’m struck by how many competitors are in all of these markets and how small the “moat” seems to be. Do you know how Gympass adds value to their suppliers/gyms compared to ClassPass? I see the value prop for customers but I’m curious why suppliers would want to be with gympass over classpass.