Zencare: Modernizing the search for mental health care

Zencare is a digital platform that helps match people with high-quality, vetted mental health professionals.

Can a platform really help me with that?

The ubiquity of platforms for ordering goods and services in modern society is quite remarkable. Need a ride? Open your Uber app. A place to stay for a long weekend? Check out Airbnb. A new paintball gun? Amazon’s got you covered. But what about something as personal and critical as your mental health? Can a digital platform really help match you with a high-quality therapist tailored to your specific individual needs? Zencare, a Brooklyn-based start-up founded in 2015, believes the answer is a resounding yes.

What is Zencare?

Zencare is a two-sided online marketplace that matches users with mental health professionals. It was launched after its founder, Yuri Tomikawa, became frustrated with her own journey finding a therapist, which consisted of unanswered phone calls/e-mails, confusion about provider expertise, and opaque costs.

For users, Zencare creates value in several ways. First, it enables searching and filtering based on a variety of parameters such as location, price, insurance, availability, and specialty in a manner that is extremely familiar for anyone who has used Airbnb, OpenTable, or a variety of other platforms. Second, it provides vetted therapist profiles with extensive logistical and clinical details as well as photos, videos, and a means to easily schedule an introductory call online. Finally, it’s completely free.

Check out Zencare’s user site!

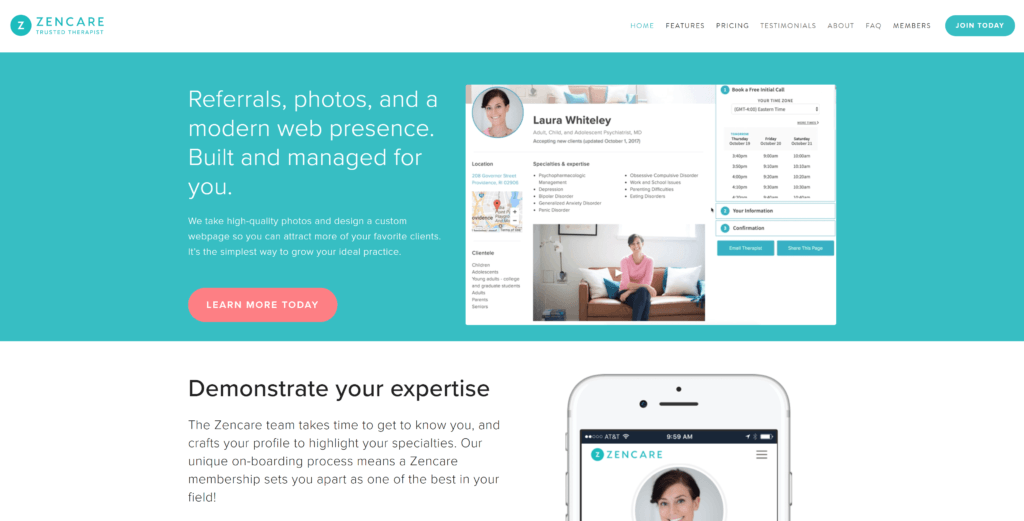

For therapists, Zencare primarily promises to both streamline marketing efforts and enable the acquisition of new, highly motivated patients. Not only does Zencare help with their online marketing presence by actively co-developing and managing the content for the therapists’ profiles – including taking photos/videos and writing personalized bios – but it also provides value by virtue of being an exclusive network that thoroughly vets its providers and thereby helps therapists stand-out in an otherwise noisy environment. However, unlike for users, therapists pay to be on the platform, with monthly rates starting at $49-$79 and a one-time set-up fee of $129-199.

Check out Zencare’s therapist site!

Can Zencare scale?

While Zencare has successfully expanded to eight geographies within the US, it’s important to consider how the features of the platform and market will impact its future scalability and sustainability.

Network Effects

Zencare has strong cross-side network effects – since having more users will attract more therapists and vice versa – but weak or non-existent same-side network effects. Notably, there are a few properties specific to the mental health space that create interesting network dynamics for Zencare:

- Satisfied User Churn: While most platforms can reasonably expect that satisfied users will become repeat customers, Zencare has a unique challenge: if it is successful in matching a user to an ideal therapist, that user’s need for the platform is eliminated. As a result, to sustain at scale, Zencare needs to constantly replenish the pool of users.

- Adverse Selection: Zencare risks adverse selection from therapists. That is, if the best therapists already have full schedules or strong word-of-mouth referral channels, they may not be interested in the platform. Alternatively, therapists with worse references or high patient turnover may be more likely to sign-up.

- Exclusivity: Since one key value proposition for therapists is the prestige of being on an exclusive network, Zencare must optimize to its “Goldilocks” point of exclusivity: too little and it risks diluting the value for therapists; too much and it risks users leaving dissatisfied with the range of options and availability.

Clustering

Zencare’s network is highly fragmented into local clusters, since it focuses primarily on in-person therapy offerings and users naturally want therapists that are accessible. This reality, along with Zencare’s strategy of thorough vetting and in-person on-boarding of each therapist, explains its slow and steady expansion into new cities and states over the last several years. This cluster localization and hands-on expansion strategy leave Zencare somewhat vulnerable to a competitor that figures out how to scale in a faster or more automated manner.

Disintermediation

Disintermediation should not be a concern for Zencare, since it simply monetizes the therapists’ presence on the platform rather than taking a percentage of user payments for therapy sessions. However, a related concern could be therapists jumping on and off the platform from month to month depending on if their schedule is full for that particular month. To combat this, Zencare deftly charges therapists annually to create a stickier relationship.

Multi-Homing

There are no disincentives for either users or therapists to multi-home since the cost of using an incremental platform is negligible. To minimize propensity of therapists to multi-home, Zencare can focus on (1) improving the quality of recommendations/matches and (2) incorporating complementary services into the therapist interface – such as customer relationship management tools – so that therapists come to prefer patient leads from Zencare over other platforms.

Conclusion

Zencare is an innovative company addressing a critically important but fundamentally complicated problem. The digital platform provides a compelling value proposition for both users and mental health professionals, though scaling and sustaining the model will certainly be challenging given both traditional platform business issues as well as additional nuances related to operating in the mental health space.

_________________

Sources

- Fernandes, Deirdre. “Tech firms enter the business of campus mental health care.” The Boston Globe. 11 December 2018. https://www.bostonglobe.com/business/2018/12/11/tech-firms-entering-business-campus-mental-health-care/aLbOmGTvnu7Tfc7jKPdS8N/story.html.

- Gabrielson, Courtney. “The ‘Power of a Really Good Therapist’: How Zencare Makes Finding One Easy. 13 March 2018. https://www.americaninno.com/rhodeisland/rhode-island-startup/the-power-of-a-really-good-therapist-how-zencare-makes-finding-one-easy/.

- Nilsson, Casey. “Zencare Connects People to Mental Health Services.” Rhode Island Monthly. 23 April 2018. https://www.rimonthly.com/zencare-connects-people-mental-health-services/.

- “Website Strives to Make the Therapist Search Process More Zen.” Medtech Boston. 21 November 2016. https://medtechboston.medstro.com/blog/2016/11/21/website-strives-to-add-zen-to-the-therapist-search-process/.

- Zencare website. Retrieved March 17th, 2020. https://zencare.co/.

- Zencare therapist website. Retrieved March 17th, 2020. https://therapist.zencare.co/.

Thanks for this – super interesting and thought your analysis was spot on! This space sounds incredibly nuanced – it actually reminded me a lot of dating platforms like Hinge and Bumble, and how they could face similar problems in their scaling. Specifically with highly clustered/local markets, and the realization that a successful use of the platform takes users off of it for good, in theory. Because of the nuances and challenges you outlined above, I think this might make for a slightly more defensible business. Because it’s challenging, it could deter many entrants (hopefully!). That being said, I do worry about their scalability – creating value by taking photos of the therapists and helping them to write personalized bios sounds manually intensive. Although, these efforts to make the platform stickier do seem to be in the right trajectory to better defend their business and reduce risks associated with disintermediation, multi-homing, and clustering. Looking forward to see how they scale & sustain!

Super interesting and very well written blog! I agree with all your scalablity concerns. It seems that the value proposition they are offering is not that strong making it susceptible to disintermediation. Maybe they can strengthen their competitive advantage but providing services beyond just “matching”. For example, they can add proprietary online self-help online courses (for a charge) or maybe plan meditation trips somewhere. I love the idea of digitizing mental health services and would love to see Zencare succeed!

Your insights into Zencare and the mental health / therapy space are very interesting and insightful. I wonder how to solve the ringfencing issues of keeping both therapists and clients on the platform — seems like it would either have to be a lead generation solution, or it would have to find a way to more closely integrate with a therapist’s needs (renting space, insurance billing, automating booking). I wonder also how this intersects with tele-therapy in terms of quality and delivery, and how Zencare can build a “brand” fo the platform itself vs. the significant number of up-and-coming competitors in this space, as well as strong incumbents in the form of PsychologyToday and insurance panels.

Zencare sounds like a great way to digitize the process of finding a therapist without augmenting the therapy itself – thanks for sharing! I appreciate that Zencare breaks down the barriers to finding a therapist (e.g., therapists often don’t have an online presence, insurance coverage can be confusing), but it doesn’t require the user to connect with the therapist over video chat. My group for MSO last semester proposed a similar service and we found that many therapists and users do not find tele-therapy to be as effective as in-person therapy. In terms of creating a “stickier” platform that is not disintermediated, Zencare could provide additional services to make therapists and users want to stay on the platform; this could include scheduling support for therapists so that they can fill last-minute cancellations, billing support between users, therapists, and insurance to simplify the complicated billing process, and access to user history data, so that users can switch therapists and transfer the information that they have already shared/discussed to their new therapist.

Super interesting post! In addition to the scalability challenges Leah H mentioned, I also wonder what methods they will employ to both create and capture value going forward. While in-person therapy is generally considered more effective currently, given the current crisis and the general trend we’ve seen in the last two decades of many things moving online, I hope they find ways to move with that trend rather than get left in the dust when talk therapy does become more commonly practiced online.

Great read! I was wondering if Zencare would scale beyond its local clustering and in-person consultations constraints in order to deliver online therapy sessions. It could potentially give therapists access to clients they would have otherwise not been able to reach, and also solves the demand side problem that some people cannot find therapists in their underserved area. Might also be a way to keep the platform sticky.

Very interesting company and well-written blog post! I love that the company is breaking down barriers to accessing mental health care, especially given the stigma associated with receiving care. I am curious how Zencare screens therapists to be on the platform to ensure adequate training and quality. Perhaps another monetization move might be targeting companies and offering the platform as an employee benefit while getting paid on a PMPM basis.

Great article – you articulated many of the concerns perfectly. As an idea, this sounds really incredible, however, the economics and incentives do seem to have issues when it comes to scale. The curation cost appears to be high and might prevent the sort of scale that one likes to envision with a platform. As many of the comments have suggested, finding ways to keep therapists on the platform with other value propositions will help boost lifetime value and help offset the acquisition costs. I also see adverse incentives as perhaps a roadblock to scaling. If a patient finds a good therapist on the platform, ideally you would have some organic growth from referrals. However, patients can be rather territorial with therapists, meaning they have the incentive of hiding the good ones to keep their scedules more available and open.

Thank you for this very interesting post! Zencare seems to have a very compelling proposition for patients and professionals. My only fear for the company to scale further is the threat of payers in this space. Because payers are the stakeholders that have most control over clients (as they are the ones that pay the bills), they could create a similar or even more integrated tool – that included physicians -, force it to patients and make Zencare obsolete. I would try to somehow tie payers’ success to Zencare success as to guarantee that such move would not happen (maybe selling some equity).

Thanks for the post! Upon reading it, I was immediately reminded of ZocDoc, which also matches patients with medical professionals. I think the reason ZocDoc is a better offering is that it is not limited to one type of practice like ZenCare. I use ZocDoc several times per year because my need for primary care, dentist, eye doctor, etc change more frequently than any one of those individually. I wonder if ZenCare will continue to face high attrition because of the user churn issues you mentioned. Perhaps they would be a stickier platform if they expanded to more mental-health related content like blogs, webinars, etc. Maybe they already do this, but that’s just one thought!

Thanks for a great post! I’m so glad companies like Zencare finally exist as they offer such value both to therapists and to customers.

My first worry however is that I think disintermediation potentially is a larger threat than you mention. Although signing up for a year to make membership sticky, it seems reasonably that therapists -particularly new practitioners- use that year to build a strong customer base. This poses a threat because such customer base and a potential word-of-mouth spread may be sufficient for the therapists to exit the platform in the following year. Moreover, as for more established therapists that use Zencare as a back-up when they have openings in their schedules, it may be more beneficial and attractive for them to find another platform that does not charge a yearly fee but e.g. a per-use fee, making me question the strength of Zencare’s value proposition.

Although Zencare has an incredibly important offering, I have yet to understand how it differentiates enough from existing and potential competitors to provide a superior one. I’m not convinced that the current cross-side effects you mention are strong enough, particularly at this stage, to deter competitors.

Nevertheless, excited to see its journey going forward!