WHOOP: A wearable to unlock human potential

ABOUT

WHOOP (yes, you have to capitalize it every single time) is a Boston-based start-up that produces wearables to track, record, and analyze one’s heart rate, heart rate variability (HRV), skin conductivity (touch), ambient temperature, and accelerometry (motion). The device straps around one’s wrist, is water-proof, and perhaps best of all, while charged, is always on and continuously tracking. Thus, you never need to worry about missing data because you did not press the start button on your smartphone via an app or on a different device.

Founder and CEO Will Ahmed started the company out of the Harvard Innovation Lab in 2012 while a student at Harvard College. Captain of Harvard’s squash team, Will often found himself overtrained. He became curious about how he could better prepare his body to reach his optimal performance and eventually found himself diving deep into medical papers and research studies on HRV along with other “secrets” about the human body.

Today, WHOOP has been worn by 20 Olympic athletes, among them including Michael Phelps and LeBron James. In addition, it is worn by collegiate teams, professional sports teams, and other organizations such as the Navy SEALS.

Click here to see a 3-min CNN video about WHOOP’s Successes

VALUE CREATION

WHOOP’s mission is to “unlock human potential”. More concretely, the company creates value for athletes by providing them with technology to prevent over / under training, injury, and underperformance. However, more important than “what” value WHOOP creates for individuals is “how” it is able to do so – therein lies the company’s magic.

Proprietary technology. WHOOP’s device, called the Strap, continuously tracks five key measurements – heart rate, heart rate variability, capacitive touch, ambient temperature, and accelerometry – a hundred times a second. And it’s done all from the wrist. This is one large way WHOOP’s device differs from other HRV devices, many of which involve placing a cumbersome strap around the chest. In addition, the Strap was one of the first HRV devices that is always on. That is, once on the wrist, the device continuously tracks data 24/7 which can be reviewed on one’s phone or computer. Also, the waterproof strap means that one can wear the device all day in all conditions. The Strap’s battery life is 44 hours, however unlike other wearables on the market, the device comes with an external battery pack, which conveniently slides onto the device.

Personalized analytics. Of course, WHOOP also creates value for customers through complex algorithms, providing individuals with data that is comprehensive, accurate, and actionable.

- Comprehensive. As mentioned, because of the device’s proprietary technology and unique features, users have access to an abundance of data. While beneficial for historical analyses, more data also improves WHOOP’s algorithms and helps the company provide users with relevant and customized feedback.

- Accurate. Part of WHOOP’s accuracy stems from the Strap’s ability to collect a ton of data; however, another part comes from the Straps’ ability to triangulate data from a number of sensors. These sensors include four LEDs, one photodiode, a 3-axis accelerometer, a capacitive touch sensor, and an ambient temperature sensor.

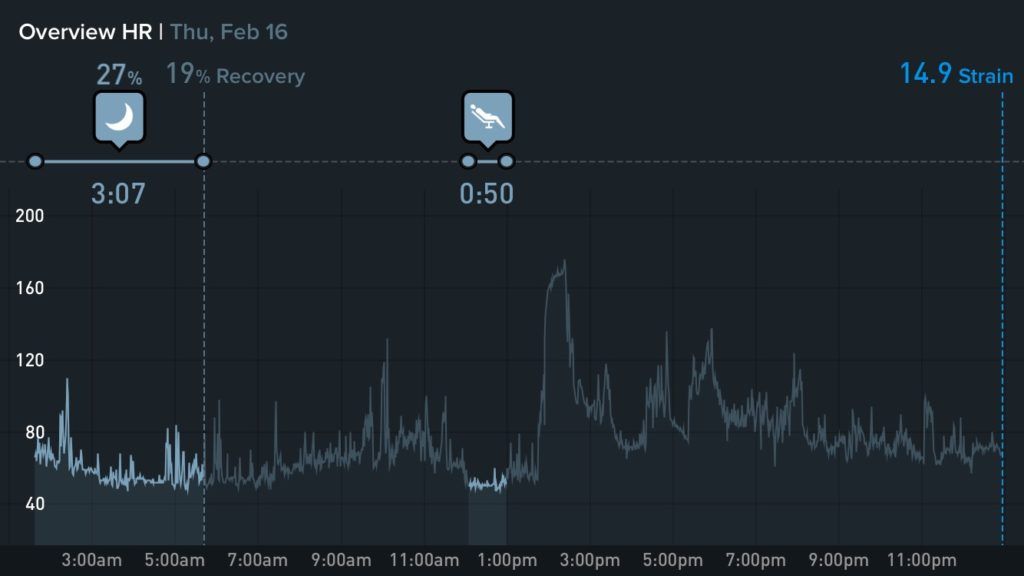

- Actionable. WHOOPs’ algorithms analyzes data and then simplifies it in a way that is easy for users to interpret and act on. In fact, it boils the universe of data that it collects down into three metrics: strain, recovery, and sleep. The strain score can be thought of as the intensity of a workout or an overall day, the recovery score can be thought of as how prepared the body is for the strain, and the sleep score indicates the amount of sleep one gets as a function of the total amount of sleep needed.

VALUE CAPTURE

WHOOP has two business models targeting two different customer segments, individuals and teams.

Individuals. Anyone can purchase a WHOOP Strap via the company’s website, www.whoop.com. The Strap costs $500. WHOOP also sells additional bands for $15. While WHOOP does some advertising via social media (Facebook, Google Ads, and Instagram), most of its marketing is through word of mouth and earned advertisements. WHOOP has gained a lot of attention in online articles such as SportsIllustrated.com and ESPN.com. Most recently, WHOOP was featured in the Observer in an article titled, “This Harvard-Backed Athletic Wearable Is the MLB’s Favorite New Toy”.

Teams. WHOOP also offers a subscription-based business model for teams, charging $1500 per player per year. In exchange, WHOOP provides teams with software and performs more customized analysis for them on a regular basis.

Perhaps just as important as monetary incentives, by providing athletes with useful and actionable data, WHOOP is able to capture user trust and brand equity. WHOOP has a loyal base of customers. For instance, Robbie Davis, basketball professional DeAndre Jordan’s trainer, stated in an interview with ESPN, “I refer to it daily with DJ…The instant feedback he gets each morning about how his body is recovering is fantastic.”

CHALLENGES

Educating customers. While known as a key metric among top athletes, what HRV is, and the benefits of tracking it, have yet to catch on in the market. Many individuals assume average heart rate and heart rate variability are similar, if not the same, and are unaware of how a lower HRV can indicate problems with one’s autonomic nervous system, respiratory system, and even digestive system. Furthermore, studies are still emerging and evolving on how to interpret and use HRV data. Thus, educating athletes on how to use the Strap and how to access and interpret its data takes time, can be costly, and is ongoing.

Click here to read more about the differences between average heart rate and heart rate variability

Scaling. WHOOP is not currently profitable and faces the classic problem of how to scale: should the company focus on elite athletes or expand into other verticals? Is the elite athlete market large enough for WHOOP to be sustainable? If WHOOP expands into other verticals, what verticals should it expand into? Should it focus on adding features to appeal to a new vertical? Would this mean monitoring additional biometrics?

Marketing. It is much easier to market one’s self as a device for athletes than as a data-oriented company. It is also a lot easier for consumers to understand the brand. Hence, WHOOP is often perceived as a company for elite athletes. However, along with pigeon-holding WHOOP in one market, this risks excluding a wide-range of customers in different industries who could benefit from WHOOP’s data and analytics.

ROOT CAUSES OF FAILURES FOR DATA-DRIVEN BUSINESS MODELS

Understandable data. What WHOOP does well is that it simplifies the complexity of the data that it gathers into three digestible metrics: a strain score, a recovery score, and a sleep score.

Actionable data. It is one thing to know how to interpret data, but what do you do with that knowledge? Many devices track how long one sleeps each night. However, the WHOOP app takes sleep to the next level and recommends what time one should be in bed and how much sleep one should get in order to reach low, medium, or peak performance.

Market size. What WHOOP struggles with is identifying a large enough market for its data.

Competition. Other wearables such as Garmin also track HRV. Garmin offers a significant number of watch-related features, but it might not track HRV as accurately as WHOOP. Many data-driven businesses like WHOOP need to determine how much consumers value having a device with one very accurate measurement over another device with many decently accurate measurements.

RESOURCES:

http://observer.com/2017/03/whoop-wearable-mlb-harvard/

https://bengreenfieldfitness.com/2017/01/transcript-what-is-whoop/

http://www.espn.com/nba/story/_/id/18801090/deandre-jordan-plays-hidden-device

Great article, Alex. I wrote about Fitbit in one of my previous posts and looked into how the company announced its transition to become a healthcare platform business. Do you think WHOOP has the potential of changing its business model from a hardware one to a platform one by integrating with other devices and wearables (adjusts the ambient light if you are in recovery mode for example), or with other businesses (insurance companies, hospitals, other healthcare providers)? If they transition to a platform, what needs to change?

Do you see WHOOP going beyond just professional athletes and more into lifestyle tracking – simply by reducing the price point with its newer/cheaper/maybe more limited versions? Would it make sense for them to compete head-to-head with the more popular fitness trackers like Garmin or Fitbit? Would be great to hear your thoughts.

Hi LiDe! Thanks for your comment. In brief, yes, I do believe that WHOOP can become a health platform business, but I don’t think it will – at least not anytime soon.

First, WHOOP just released its second generation product a few months ago, and so data on the wearable’s health benefits (and, in general, the benefits of tracking HRV) are still coming in. Thus, even if the company wanted to say that the product reduces injury, it doesn’t yet have the data to back it up.

This runs into my second point. For WHOOP to be a healthcare platform, it needs to be certain that the device really does lead to health benefits. As you know, there are so many factors that go into people’s health – people’s diet, stress levels, environmental conditions, etc. How much credit can WHOOP really take for preventing injury? There are a lot of legal risks that come with entering the healthcare industry, and I’m not certain WHOOP has the results to enter into the industry unscathed.

Thirdly, the company has so much momentum behind it in sports, that, for good or for bad, it’s going to be difficult to convince its team of 50-100 people to change its branding from anything outside of a wearable for athletes. After all, the MLB just approved wearables for in-game use.

I do think your instinct to broaden its customer base is a right one, however. If it makes you feel any better, in the past, the company has explored other verticals such as the military; thus, there may be hope that it will branch out.

Finally, love your idea about lowering the price of older generations and marketing the product to non-elite athletes. Do you think that doing so may cause some sports team to purchase the less expensive devices? If this happens, would it reduce WHOOP’s brand as the gold standard, super accurate product for serious athletes? Other things I wonder is if WHOOP even has the capacity (in terms of number of employees and capital) to focus on multiple brands and devices.

Thanks for the article, Alex. Very insightful!

Similar to Lidiya’s question, and in the light of some of the criticism received by FitBit, Jawbone and the likes, I’m concerned that the abundance of data consumers have access to often doesn’t translate into actionable takeaways or significant insights beyond data itself.

You mentioned how WHOOP takes data to the next level by attempting to read the health impact and recommending actionable steps. Given the variety of factors affecting our health, wellbeing, etc I wonder what type of collaboration is needed to grasp the synergies of services WHOOP and other companies operating in adjacent areas provide and whether individual disruptors have a competitive advantage compared to walled gardens like Google and Facebook that already collect a myriad of customer data. It will be interesting to see whether walled gardens enter into this space or it will remain fragmented going forward.