WeWork: “A Platform for Creators”

WeWork: A platform for work space, community, and business services

WeWork’s Value Creation and Capture

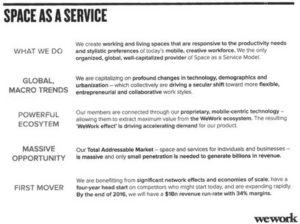

WeWork, launched in 2010, is a platform that leases shared work space to communities of entrepreneurs, freelancers, and small businesses and connects that community to business service providers. WeWork typically leases office space wholesale and subleases that space to its members at a profit. Valued at $16 billion in its latest fundraising round (1), WeWork operates office space in 15 countries and has ambitious growth plans over the next few years.

WeWork creates value in three critical ways:

- Providing physical workspace for its members, including the ability to travel and work in WeWork locations around the world

- Connecting members to business service providers at negotiated discounts, allowing members to access healthcare, HR solutions, payments processing, and more at reduced rates (2)

- Serving as a platform for local and virtual community: WeWork facilitates social events, workshops, and industry meetups to allow members to expand their networks and ultimately enhance their business

WeWork captures value by charging membership rates ranging from baseline membership in the network (which allows members to access daily space rentals and services for rates starting at $45 / month) to renting dedicated desks and private offices (starting at $400 / month and varying based on office location). Although more recent revenue figures from the company have not been made publically available, CEO Neumann said in July of 2016 that he expected the company to hit a run-rate revenue of $1 billion in 2017. (3)

Network Effects in the WeWork Model

WeWork creates network effects by serving as a platform for members to engage with each other and for business service providers to connect with WeWork members.

Same-side Network Effects:

- Each new member that joins WeWork helps contribute to the “creative culture” and member diversity, which benefits other members. Members have the opportunity to form business partnerships with their neighbors in the WeWork space or via the global community, or connect with customers in the network.

- More members could lead to better scale discounts offered by WeWork partners, while more service providers offering competing services could put downward pressure on prices.

- As more members join, the cost / member in a given workspace should go down (due to higher utilization of a given space). Yet, increased demand could also put upward pressure on prices for all members.

- Additional members could also lead to a more crowded work environment and longer wait times for shared resources like printing or conference rooms.

Indirect Network Effects:

- More services offered on the WeWork platform benefits members through expanded offerings, while more members increase the customer pool for service providers

- If there is competition among service providers, that could drive prices down (for example, if there are multiple banking partners, they would likely compete on price for WeWork customers). Similarly, greater member numbers could drive prices up without a commensurate increase in service providers. (again, basic supply and demand)

Do WeWork’s network effects offer a sustainable advantage?

In my view, although WeWork has pioneered the model of flexible, shared office space, the network effects created by the model are not strong enough to sustain WeWork’s advantage in the long-run. Fundamentally, do members chose WeWork because of the network it offers, or because the workspace itself is superior (or in some cases, the only option)? Moreover, how much do the negative effects of crowding offset the positive network effects?

The WeWork model is highly replicable, and several competitors have already emerged. For example, real estate developers are using LiquidSpace to market flexible spaces directly to tenants and provide a quick, standard lease that saves developers and tenants time and legal expenses. LiquidSpace takes a 10% cut of the rent every month. (4) Moreover, if WeWork’s margins are sufficiently attractive, commercial real estate developers could directly replicate its offerings and cut out WeWork alltogether. Given that WeWork rents office space via long-term lease contracts and subleases the space at higher prices shorter periods of time, it would be interesting to see how many of WeWork’s long-term leases are up for renewal in the next ~5 years. Shorter lease agreements would make them more vulnerable to property owners pushing WeWork out of established locations.

Multihoming is also simple and low-cost on both sides of the platform: WeWork service providers have no barriers to work with other platforms or directly with businesses, and WeWork members (customers) could easily rent space from other providers as they expand.

In summary, as demand for flexible workspaces continues to increase in the US and globally, WeWork is well-positioned for continued growth. Yet, the network effects created by the platform do not seem sufficient to prevent new entrants from entering the market, which seems poised to evolve into a fragmented market of multiple successful players.

- (1) https://www.bisnow.com/national/news/office/everything-you-need-to-know-about-wework-61951

- (2) https://www.wework.com/benefits

- (3) https://therealdeal.com/2016/07/13/weworks-neumann-takes-more-cautious-tone-on-unicorns-revenue-projections/

- (4) https://www.fastcompany.com/3058351/as-wework-rises-so-does-the-airbnb-of-office-space

- (5) https://www.wework.com/plans/private-office

Great post, Lacy. I completely agree with your assessment that the network effects of the WeWork model are weak or challenged in most circumstances. I think there is a clear analog here to wholesale and retail data centers. If I’m a managed hosting client, the only case in which I’d care what other clients use my data center is if they are in my industry, and the resulting application ecosystem is built to support workloads similar to my own (e.g. if I’m a hotel with lots of casino/gaming data, I’d want to use the data center that hosts everyone else’s casino/gaming data, to leverage whatever applications and industry-specific support the data center offers to that community). Similarly, the only reason I’d find WeWork more attractive than a competitor is if the other tenants are relevant to my own business. That doesn’t mean the model itself isn’t attractive and profitable, it just means it can’t rely as much on network effects for growth as other platforms can.

Interesting read! I just wrote a post about LiquidSpace and WeWork myself, arguing that the former is more a platform than the latter. In reading this, I agree with the network effects that you mention for people working in the WeWork community. You also make a fair point about connecting business service providers with renters. At a higher level, however, when it comes to its role as a matchmaker between office owners and renters, I still do not really see it as a multisided platform. Given that WeWork signs leases itself, as you mentioned, it completely controls the supply side and is more like a traditional company that buys inputs in bulk, invests in them, then sells them in smaller batches. My concern is that this asset-heavy approach will make it suffer when there is a market downturn and tenants can’t afford its prices, while it is locked into long-term leases.