Vouch – Revolutionazing Lending

Leverage your social network to obtain better loan terms

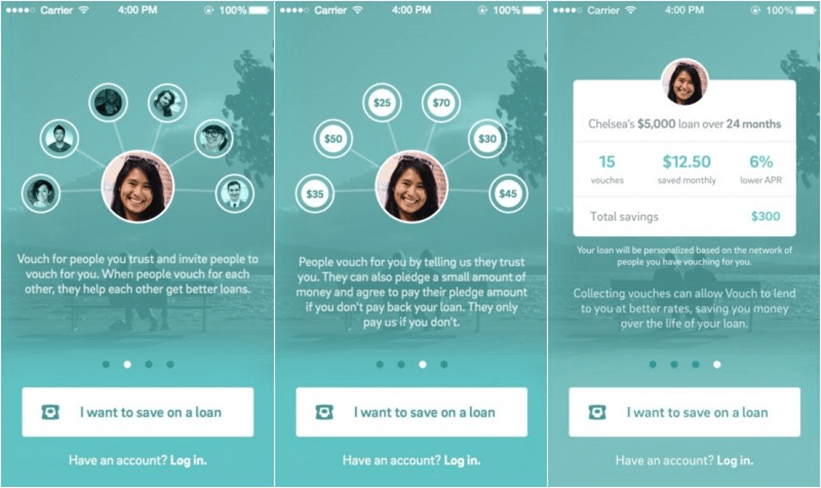

Vouch is offering favorable personal term loans in exchange for letting your personal contacts “vouch” you and increase your creditworthiness. The borrower’s personal references not only endorse the borrower as a good credit candidate but also can offer to absorb some of the lending risk by agreeing to pay certain amount of money in case the borrower defaults on the debt. The application process require the borrower to send invitations to her family and friends (vouchers) through email by importing your google contacts or by just typing their email addresses. Once the vouchers receive the invitations, they will go through 5 questions and decide the amount of money that they are willing to risk in case the borrower defaults on the debt, so far an average of $110 according to the firm. The company will consider the number of references that endorsed the borrower, the total dollar value they risked for your reference, their own credit worthiness and the borrower’s personal data (including the credit score) to evaluate the loan application and set the terms.

Unlocking the Personal Loan Market

The traditional personal loan process requires applicants to have an established credit score and to provide a co-signer to absorb the whole loan balance in case of default. As a consequence, this structure excludes a vast portion of the population such as students, recent grads or immigrants who have not yet had a chance to build up their credit scores for years and/or people who may not have a trusted co-signer with the financial capability to risk the full loan balance. As so, Vouch’s operating model is unlocking a huge pool of creditworthy people in need for personal loans.

Transferring Capital from Lending Institutions to Consumers

The origination costs are comparatively higher (relative to loan size) for small loans than for big loans. Therefore, traditional small loan denials are not necessarily due to the borrower’s higher default risk but to low expected profitability given the high origination costs relative to the loan size. By automating the loan application process, the company is decreasing the transaction costs in the low margin small personal loans segment. Therefore, these cost reductions are translated into lower interest rates ultimately transferring capital from the traditional lending institutions to the consumers.

Pooling and Sharing Creditworthiness

The model is transforming the rigid nature of personal lending by creating a marketplace that allows participants to pool and share creditworthiness with people they actually know and care about, as opposed to the peer-to-peer lending model in which lenders and borrowers don’t actually know each other and possibly don’t care about defaulting on the counterparty. This is an important differentiator as past microfinance experiences utilizing group lending models suggest that social pressure is highly effective to prevent defaulting.

Platform Growth & Network Effects

Given that the platform was just recently released to the general public (previously under pilot test until April 2015), I expect the growth to be exponential as loan applicants are required to send invitations to sponsors (or vouchers) during the application. As the company grows its user base and collects performance data, it will be able to map an online trust network of users creating more data points for future applications and reducing costs even further.

Further Applications

Additionally, the applications that could develop by leveraging this trust network data seem almost unlimited. Not only could it push the B2C online transactions but also could unlock the C2C online transactions market (in particular for non-frequent transaction platforms where user ratings are not available). Consider for example users leveraging their creditworthiness score to obtain lower fees for insurance, or obtaining better prices when transacting though ebay or selling/buying used car online.