ViacomCBS: Here to Stream, Here to Stay

The Covid-19 pandemic only accelerated longstanding industry trends of chord-cutting, as viewers devour content while quarantining at home. ViacomCBS is aptly poised to create and capture enormous value in a post-pandemic world.

In December 2019, CBS Corporation merged with Viacom Inc to form global media and entertainment company ViacomCBS Inc (VIAC) [NASDAQ][1]. The merger combined CBS network, often dubbed the “The Tiffany Network” for its legacy broadcasts, with the likes of MTV, Nickelodeon, Comedy Central and the Paramount movie studios. Together, ViacomCBS would own more than 140,000 TV episodes and 3,600 film titles. The company estimated that it would generate $28 billion in revenue annually [2]. But by early 2020, ViacomCBS’ headquarters in New York City was whirling with news of the Coronavirus pandemic. The future for the newly merged company was uncertain.

In the early months of the pandemic, ViacomCBS lost over $120 million due to the abandonment of certain incomplete programs resulting from production shutdowns related to COVID-19. Advertising revenue decreased 11% year-over-year, primarily reflecting weakness in the advertising market as a result of COVID-19. The company generated little of the expected theatrical revenue due to the closure or reduction in capacity of movie theaters. The same was true for sports programming revenue for which the CBS has broadcast rights, due to rescheduling or cancellation of in-person sporting events.

ViacomCBS swiftly underwent cost-cutting and cash-generating efforts to stop the hemorrhaging. In staying true to CEO Robert Bakish’s [3] mission to lead the market in video on demand, ViacomCBS sold off Simon & Schuster publishing house for $2.175 billion in November 2020, following a strategic review of non-core assets [4]. ViacomCBS undertook numerous rounds of layoffs, some due to the planned restructuring after the merger, but many cuts were pandemic-related. Looking ahead, the company plans to sell off CBS’ New York headquarters “Black Rock” for at least $1 billion after the coronavirus pandemic declines. But the pandemic’s long-term impact on urban real estate prices market remains to be seen, and thus, so does the amount of cash generated by this asset-sale.

Offensively, the company was intent on creating value proactively. ViacomCBS offset the decreased revenue from advertising with the strength in political advertising leading up to the 2020 U.S. Presidential Election and the 2021 SuperBowl. The company aggressively built out expanded distribution agreements, which placed ViacomCBS’ leading portfolio of content providers on YouTube, Hulu, and more [5]. And in response to the production delays and abandonments, ViacomCBS leveraged its deep library of existing content, which helped to offset anticipated revenue losses [6].

Notably, SuperBowl 55 was an optimal stage for ViacomCBS to leverage its own network’s airtime to position Paramount+’s success. Before an audience of 100 million viewers only one month ahead of the launch of its March 4 launch date, ViacomCBS prominently featured Paramount+ promotions in pregame and postgame promos, digital and social exposure, spoken ads from on-air talent, and even in-game content teases.

The coronavirus pandemic only accelerated longstanding industry trends of chord-cutting, as people are devouring content while quarantining at home. Given that the streaming wars will continue long after the pandemic declines, Paramount+ is aptly positioned to create and capture enormous value in a post-pandemic world. It has strategically differentiated itself from competitors by being the home hundreds of iconic American titles, such as “The Godfather,” “The Titanic,” and “SpongeBob,” the National Football League (NFL), and a full array of CBS News content. Subscribers can expect to pay $5.99 per month for limited commercials or $9.99 per month for the more premium option with no commercials, which is cheaper than its competitors Netflix, Disney+, Hulu, and HBO Max [7].

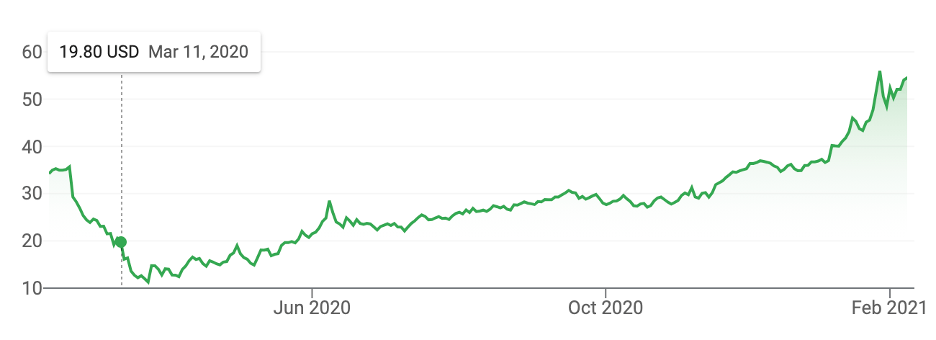

ViacomCBS stock has consistently trended upward since the merger was finalized. In December 2019, ViacomCBS was trading at approximately $36. It consistently climbed to $54 by early February 2020, with the exception of the market’s ubiquitous plummet at the onset of the pandemic in February and March of 2020 [8].

Figure 1- ViacomCBS share price history

At the end of 2020 Q3, amid the worst of the Covid-19 pandemic, Bakish celebrated ViacomCBS’s success. “As we near the first anniversary of the ViacomCBS merger, I’m thrilled about the way our organization has come together to realize the power of the combination and seize our unique global opportunity in streaming… We achieved strong user growth across our streaming platforms as we continue to build our linked ecosystem of pay and free services – with big steps taken, including the preview and brand reveal of Paramount+ ahead of its launch in early 2021… Our company’s transformation is ahead of schedule and we are incredibly excited by the opportunities ahead.” [9]

[1] ViacomCBS inc (VIAC) – financial and strategic SWOT analysis review. 2020. GlobalData Company Profiles – Financial and Strategic SWOT Analysis Review: 45, https://login.ezproxy.library.tufts.edu/login?url=https://www-proquest-com.ezproxy.library.tufts.edu/reports/viacomcbs-inc-viac-financial-strategic-swot/docview/2475768768/se-2?accountid=14434 (accessed February 8, 2021).

[2] Reuters Staff. “CBS, Viacom Complete Merger in a Win for Shari Redstone.” Reuters, Thomson Reuters, 4 Dec. 2019, www.reuters.com/article/us-viacom-m-a-cbs/cbs-viacom-complete-merger-in-a-win-for-shari-redstone-idUSKBN1Y82ZF.

[3] “ViacomCBS”. The Official Board. January 15, 2021. https://advance-lexis-com.ezproxy.library.tufts.edu/api/document?collection=company-financial&id=urn:contentItem:550C-H351-JB14-G3GY-00000-00&context=1516831.

[4] “ViacomCBS to Sell Simon & Schuster to Penguin Random House for $2.175 Billion.” 25 Nov. 2020, ir.viacomcbs.com/news-releases/news-release-details/viacomcbs-sell-simon-schuster-penguin-random-house-2175-billion.

[5] “ViacomCBS and Google Announce Expanded Distribution Agreement.” 7 May 2020, ir.viacomcbs.com/news-releases/news-release-details/viacomcbs-and-google-announce-expanded-distribution-agreement.

[6] “ViacomCBS Statement on COVID-19.” 27 Mar. 2020, ir.viacomcbs.com/news-releases/news-release-details/viacomcbs-statement-covid-19.

[7] “How Much Will It Cost to Subscribe to the Ever-Expanding Streaming Universe?” Los Angeles Times, 10 Oct. 2019, www.latimes.com/entertainment-arts/tv/story/2019-10-10/streaming-wars-per-month-total-shocking-apple-hbo-disney-netflix.

[8] “ ViacomCBS Inc. (VIAC) Stock Historical Prices & Data.” Yahooo Finance, 8 Feb. 2021, finance.yahoo.com/quote/VIAC/history/.

[9] 2020, Earnings Press Release: VIACOMCBS REPORTS Q3 2020 EARNINGS RESULTS, ir.viacomcbs.com/static-files/5c94dbc3-a0b0-438e-97e3-1b3fa5f9c38e.

ViacomCBS has had a really interesting trajectory over the last few years. They were one of the first traditional networks to launch their own streamer in CBS All Access instead of selling content to pure play streamers like Netflix or Hulu. CBS All Access created some critically acclaimed, exclusive content for their online subscribers in shows like “The Good Fight,” but it never seemed to get a strong following among users. What is really interesting to me is their shift in strategy from a CBS All Access streaming service to the Paramount Plus offering. With the same exact pricing model and few truly new content offerings, I question whether Paramount Plus will be able to find footing where CBS All Access failed, especially given the proliferation of competitors since CBS All Access first launched. To your points above, it seems like they are relying on a classic or “iconic American titles” to draw in customers, supported by an aggressive marketing and re-branding push. It will be interesting to see how the success of Paramount Plus plays out, especially as it is likely to draw comparisons to the recent launches of streamers like HBO Max, Disney Plus, or even Quibi!

I’m interested to know if ViacomCBS despite it’s core content offerings will believe consumers will add another subscription service. The folks who are drawn to their network because of their live programming are likely the core target customer as it is. As the streaming wars continue, it will be interesting to see how this company pivots when it needs to as a historically last-mover network.

Great article! I find it fascinating how ViacomCBS managed to leverage the combined brand values of CBS and Paramount to offer a high-value subscription service, hopefully competing head to head with other major players in the space.

One thing that concerns me is the seemingly increasing reliance on past successes (ie. “iconic titles”), allegedly making it a strong competitive advantage. I am not sure this will be a big enough differentiator in the long-run, as people are deciding which VOD service to subscribe to (or keep subscribing to). Iconic titles may be enough to acquire initial customers or occasional users, but I doubt they provide enough value in terms of retention. If that’s true, the streaming war may eventually come down to who has the biggest budget to produce enough quality new content… and in this case, Paramount+ already is lagging a bit behind.