Uber: Revolutionizing transport – one ride at a time!!

Uber started out in San Francisco as a simple on demand cab service. Today, no company better exemplifies the power of platforms in an era where digital and physical environments are beginning to merge.

No other company till date has been able to create a global operating system for a predominantly physical sector at the scale which has Uber has done. AirBnB and WeWork have done the same for the real estate space but as of now Uber is more ubiquitous than either of them.

Uber is a digital operating layer over the transport and logistics industries. Let us see how has Uber arrived at the scale it is today (though it still can scale a lot in the transportation and logistics space) and what propels it.

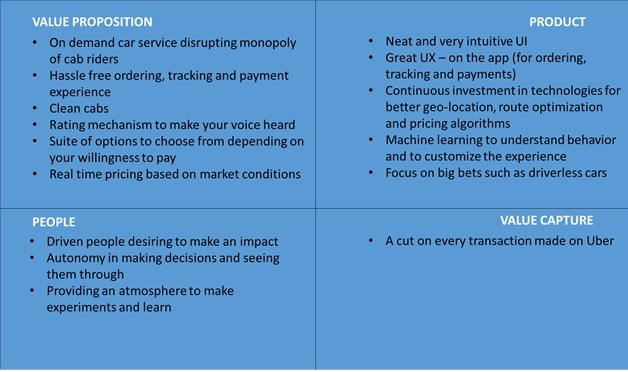

Clear value proposition: Uber right from its inception has identified and served a job to be done for riders “a hassle free on demand car”. It has identified and diversified into various transportation modes such that as a rider, for going from my dorm to a friend’s place, it provides options which vary from $ 2.75 to $ 25 – thus, there is a car to fit almost everyone’s needs! In addition, it allows drivers (both professional and occasional) a hassle free experience of when they want to ride and whom they want to ride with.

Product: Uber has invested a lot in the product. Both from UI and UX perspective it is neat and seamless. Uber’s continuous investment in technology is evident in geo location techniques to match riders to the nearby cabs, features to improve safety, optimizing routes, surge pricing schemes to balance supply and demand.[b][e] To top it all it continues to invest in technologies which will make the experience more seamless and integrated – setting up of the AI lab in Dec 2016 is one of the many examples to prove the same. Uber does a lot of structured product experiments to see what works and what not.

People: Uber has a reputation of hiring driven people, who desire to create an impact on the world and are some of the smartest people in the various geographies it operates in. Uber is very selective and gives its teams a lot of autonomy. The surge pricing which is built on supply and demand economics was built by the Boston city team to check if more drivers were on the roads in the chilly winter nights because of higher payouts.[a] It worked and rest as they say is history!

Value Capture: Uber takes a cut out of every ride that is taken by the riders. This is it’s primary revenue source.

These elements are captured in this diagram below

Today Uber servers in over half a thousand cities across the world. Being the operating layer between drivers and riders, it has reached this scale by relying on indirect network effects.

Initially, Uber took time in rolling out to new geographies and with time its ability to launch a new city became a lot better. Being a two sided market place, in its first market SF, Uber relied on a combination of clear value proposition, great product, free rides and word of mouth publicity to attract riders to its platform[c][d]. Simultaneously it attracted drivers. It followed a similar playbook in subsequent cities, with its brand value getting added to the list of reasons. The diagram below does a great job of explaining the Uber launch playbook.

Source: GrowthHackers.com [d]

Uber relied not only on indirect network effects to get more drivers but also had schemes such as low interest car loans for drivers. This not only allowed it to attract drivers but also enabled it to get the drivers stick to its platform thus further strengthening its network.

What does the future have in store?

Although these network effects are local and several players (such as Fasten) are trying to take market share away from Uber by employing different business models, I would bet that Uber will triumph.

Concerns of multi-homing are valid but if one looks at the history, Uber is becoming more entrenched in the transportation fabric of today’s world not only through its simple on demand car app, but by diversifying into UberEATS, Uber for Business, Uber Freight and its ambitious investments into AI for making the dream of driverless cars come true – and this will allow it to always stay leaps ahead of competition.[f]

I believe Uber’s primary reason for triumph would not just be a better app but because a few years down the line we would not remember Uber as an on demand car app but we will recognize it as an intelligent platform simplifying transportation and logistics at unimaginable scale.

=====================================================================================

Sources:

[a] https://qz.com/603600/ubers-former-head-of-growth-on-the-early-days-surge-pricing-and-on-demand-ice-cream/

[b] https://newsroom.uber.com/securityselfies/

[c] http://www.inc.com/nicole-carter-and-tim-rice/how-uber-grows-internationally-city-by-city.html

[d] https://growthhackers.com/growth-studies/uber

[e] https://newsroom.uber.com/safety-on-the-road-july-2016/

[f] http://www.businessinsider.com/uber-to-launch-uberfreight-for-long-haul-trucking-2016-10

Great post Sidharth. I’m very excited to see where Uber will end up 5-10 years from now with the advent of autonomous vehicles. Its interesting to see what was a two-sided marketplace turn into a massive transportation company tackling a variety of logistics issues. Network effects really turned Uber into what it is today and I think they will be even more important as they roll out autonomous vehicles which will initially be an expensive technology bet. Uber Pool made on demand ride-sharing a reality and added massive efficiencies in the market. This requires a large number of people on the platform though and I wonder if fragmentation in the market will prevent one or more of the market competitors (including Uber) from reaching the network scale they need to successfully implement their future ideas.

Thanks Nupur. I agree that this will be scale business requiring a critical mass. But the way I see it – fragmentation is visible today but a decade from now one or max two global scale players would be surviving and thriving. The reason – even though network effects are at play at a local level, a lot of the optimization of algorithms is based on ingestion of more data. The platform which owns more data will have better algorithms leading to a superior experience for every stakeholder – this in turn will lead to attracting better talent and the virtuous cycle will continue. However, if anyone comes with a significantly (10x) better algorithm to do everything – geo locating riders, drivers, other assets; optimizing routes; matching supply and demand; pricing – then they can upset the status quo. But considering Uber’s differentiated mindset of looking at things I will bet Uber will be that company and will upset the status quo by disrupting itself.

Love this discussion! Question: Isn’t there a limit to how much better an algorithm can get? I’d think that at a certain point, throwing more data in doesn’t yield significant improvements in yields. I realize the question is probably a matter of “well yes, but at what point?” So, for instance, if after 10 years in 50 cities Uber is still improving its algorithm, then I think I’d agree with you that only a few winners are likely to emerge. If, on the other hand, Fasten can offer an algorithm with data from just one city, for just a few years, which offers a comparable experience for drivers and riders, then I would argue that the “returns to data-scale” are actually quite low. In that case, Uber’s algorithm won’t provide a barrier to entry to protect it from upstarts. In sum, my concern is that a 10X better algorithm isn’t really possible. If not, I’m not sure what barriers exist to keep Uber from suffering the airlines fate. Am I thinking about it the right way?

Hi James, completely agree.

As far as the algorithms are concerned they will be optimized based on data and Uber will always have more of that. Any other company won’t be able to provide more optimized algorithms (just based on data since they won’t have more data). However, if someone tomorrow comes with an entirely different way of looking at all the aspects which make an on demand car ride possible and makes us think why were things not this way with Uber / Lyft / Fasten – that would be a 10x improvement on algorithm. (Consider Google’s backlinks based pagerank algorithm to Alta Vista’s search algorithm). Till that happens the better algorithm would just be the one which can play with more data – that would be Uber.

In addition, Uber’s approach of looking at the entire transportation industry allows it to collect and act on more data. Secondly it continues to be the first app to be recalled for a vast majority of the population because of its scale and attempts at targeting other aspects of transportation industry.

I am not sure how old, but there is a product Uber Movement (https://movement.uber.com/cities) – which Uber offers for the city planners for better planning of city infrastructure. This is another of the several Uber products showcasing how scale and diversification allows it to become more entrenched in the city’s ecosystems across the world.

Sidharth,

This is great, thank you for posting this. It’s helped me to continue to think about the ride-sharing discussion that we started in class with the Fasten case. It was interesting for me to speak with the Fasten founders after class and they reiterated that investors were losing confidence that Uber would be the overall winner in this transportation game of the future. His logic was that if Fasten can grow using levers of value sharing and a more driver/rider-friendly experience, then they could potentially partner with an automotive company to take on Uber in the driverless car race. I definitely agree that Uber is way ahead now, but do to fast-changing industry, I wouldn’t be surprised if there are other big winners that successfully challenge them.

Tyler, I agree that there will be big winners but there cannot be multiple big winners. It would be couple of them in each major geography – at this point Uber and Lyft are the ones and if they keep their act together they will win. For example RideAustin and Fasten who operate in Austin were not able to keep up during SXSW event because they never really had that kind of performance testing for peak demand which Uber and Lyft are subjected to in real life scenarios – so one which has more scale, keeps the user focus and keeps its acts together will win.