Twitch: the ESPN of Esports

Twitch – a live streaming platform for video games – has gained viewership that rivals CNN and MSNBC. With the help of its parent (Amazon), Twitch has a good chance of becoming the ESPN of Esports.

Despite incumbents like YouTube, Netflix, and Prime Video, Twitch has stealthily grown into a streaming juggernaut… although it helps to have Amazon as your parent company, who bought the startup in 2014 for $970 million [1].

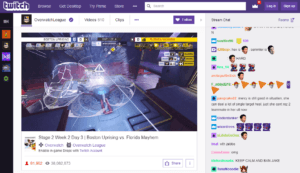

Twitch is an online streaming platform that allows video game enthusiasts to watch and interact with a community of 2.2 million streaming gamer-creators. In January 2018, more than 100 million people tuned in to Twitch, and their average viewership (962,000) was on par with CNN (783,000) and MSNBC (885,000) [2]. Twitch has achieved this viewership by creating the preeminent social experience for the video game community, and by sharing the value Twitch’s platform creates with its partners and customers.

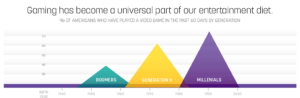

Source: http://twitchadvertising.tv/audience

Fighting Multi-Homing through Network Effects. Free online streaming will always be susceptible to multi-homing, since switching costs are as cheap as a few clicks or an app download. While Twitch can’t stop customers from multi-homing on other free online streaming platforms, Twitch has been able to build network effects by focusing on niche content (video games). A breadth of video game content was already available on YouTube, but Twitch realized gamers are very social, and thus focused on creating an immersive, live streaming experience. Over time, Twitch refined its interface so it specifically appealed to gamers, including live chat, channels organized by game, and the ability to see live viewership stats so gamers can tune in to the hottest streams. Twitch also is agnostic to content, allowing streams of the latest, most popular games, as well as nostalgic relics from the days of NES and Playstation.

Sharing Value with its Partners and Customers. Realizing that the value and defensibility of its community depends on content creators, Twitch has tried to share value with its broadcasters. Broadcasters who meet a certain viewership threshold earn a share of ad revenues from the broadcast [3]. Broadcasters also can enable channel subscriptions, which if purchased by viewers grant those viewers special perks like subscriber-only chat, custom emoticons, and ad-free viewing. Twitch also partners with game developers to provide subscription fans with custom characters, vehicles and skins for their favorite video games, and Twitch recently announced that it will enable fans to purchase games on Twitch, gaining a commission from game developers and sharing that commission with the broadcaster who linked the sale [4].

Blizzard Overwatch League. Now, Twitch is making its biggest bet yet on the future of esports. In January 2018, Twitch announced a two-year deal for the rights to stream Blizzard’s Overwatch League, at a reported price tag of $90 million [5]. Overwatch League is an attempt to professionalize esports, and some big names have already purchased Overwatch League teams for reportedly $20 million, including Robert Kraft (Owner, New England Patriots) and Jeff Wilpon (COO, New York Mets) [6]. Similar to professional sports like the NFL and MLB, Overwatch League has sought to create geographic rivalries, with teams like “Boston Uprising” and “Dallas Fuel,” but also has international teams like “Seoul Dynasty” [7].

Will the Superbowl of the future be played on a virtual battlefield? Nobody knows for sure, but there’s a good chance you’ll see it play out on Twitch in years to come…

[1] “Amazon, not Google, is buying Twitch for $970 million,” TheVerge.com (Aug. 25, 2014), https://www.theverge.com/2014/8/25/6066295/amazon-reportedly-buying-twitch-for-over-1-billion

[2] “Amazon’s streaming service Twitch is pulling in as many viewers as CNN and MSNBC,” Business Insider (Feb. 13, 2018), http://www.businessinsider.com/twitch-is-bigger-than-cnn-msnbc-2018-2

[3] Twitch Partner Program, Twitch.com (accessed March 1, 2018), https://www.twitch.tv/p/partners

[4] “Amazon’s video game boss gave us the best answer for why it spent $970 million to buy Twitch,” Business Insider (Mar. 4, 2017), http://www.businessinsider.com/amazon-vp-mike-frazzini-explains-twitch-and-amazon-web-services-2017-3

[5] “Sources: Overwatch League-Twitch Deal Worth at least $90M,” Sports Business Daily (Jan. 9, 2018), https://www.sportsbusinessdaily.com/Daily/Closing-Bell/2018/01/09/overwatch.aspx

[6] “Bob Kraft, Jeff Wilpon Now Own Professional Overwatch League Teams,” Kotaku.com (July 12, 2017), https://compete.kotaku.com/bob-kraft-jeff-wilpon-now-own-professional-overwatch-l-1796847336

[7] “Overwatch League outperforms Thursday Night Football livestream on opening day,” ESPN.com (Jan. 17, 2018), http://www.espn.com/esports/story/_/id/22132542/overwatch-league-outperforms-thursday-night-football-livestream-opening-day

Thanks for a great post. I think that you tapped into a great insight.. deeply understanding a niche customer persona and building a product specifically for that vertical can help overcome multi-homing and allows platforms to build network effects. By focusing on gamers, Twitch was able to grow into a major platform despite incumbent free video platforms such as YouTube. Secondly, I think it is interesting that Twitch is moving into video game sales and investing so heavily in eSports. It seems that Twitch is positioning itself as the center platform for video gamers, and creating monetization opportunities for all different stakeholders in the value chain.

Thanks for the post! I don’t know much about this industry and find this fascinating.

I’m curious if with their revenue sharing, and clearly high investments into developing a higher quality product if Twitch has been able to be profitable with this current model. It seems as though they need to keep investing in the quality of the platform to maintain marketshare, need to keep the platform free to users to compete with YouTube and share profits with their broadcasters to keep them on the site as well.

But, with Amazon as a parent company, it may not be important for them to be profitable. Maybe this will get bundled with Prime, or power other live video experiences across the Amazon platform that will drive more value for Amazon overall than being profitable on the platform itself.

That’s an interesting question about profitability. My guess is that Twitch is not very profitable, and may be losing money. We saw in the simulation that the race to gain and secure network effects sometimes requires companies to forego profits now for market power later.

Also a great point on bundling with Prime. “Twitch Prime” membership is already bundled for free for Amazon Prime members, and offers the following premium items: free in-game loot every month plus exclusives and surprises (“characters, vehicles, skins, virtual currency and boosts, free games”), and ad-free viewing plus a free channel subscription every 30 days (“support your favorite streamer, plus get exclusive emotes, more chat colors, and crown yourself with the chat badge of royalty”). https://twitch.amazon.com/prime?ref_=sm_tw_tup_ntp_t_all

Great post. It is hard to disagree with Twitch’s success to date, especially as they really have come to own the gamer market. That being said, the potentially final outcome of going niche is that Twitch reaches a ceiling in terms of the users it can attract. Is their a limit to the gamer market, and if so, is Twitch satisfied with plateauing or does it look elsewhere to capture more growth? In addition, what’s to stop the hardware makers like XBOX and Playstation from creating Twitch-like platforms of their own, and limiting their game content exclusively to those platforms?

Interesting post! Another way that some of the content providers are battling with multi-homing is by signing exclusive distribution contracts with specific distribution platforms (i.e. Twitch, YouTube or Facebook). By signing these agreements, the content providers and distribution platform providers are partnering to reduce the high level of multi-homing.

Thanks Hans! There’s a lot of literature (read: argument) out there among pro gamers comparing Twitch with YouTube, but one distinct advantage of Twitch is in its relationship with licensing rights. To prevent pirated content, YouTube has a bunch of algorithms constantly looking for distinctive visual and audio signals that mark copyrighted video, and will send pre-emptive C&D letters if detected. However, this same technology has also been the cause of a lot of interrupted gaming streams and frustrated live-streamers, who have begun to transition out of the platform due to cumulative frustration. The fact that YouTube has a lot of content across a lot of different types of media to protect can actually be a disadvantage in terms of maintaining its relationships to its most important personalities.

A bit late to the party, but thanks for the great post! Given the title of the post, I wonder if Twitch has studio programming related to Esports? The great majority of ESPN’s content spend goes to live rights, but the majority of its programming is studio content such as SportsCenter, etc. Secondly, has YouTube’s creation of YouTube Gaming made any negative impact on Twitch? Interesting point Will L made above about streams being shut down, but I wonder if that has improved as YouTube has made a more deliberate effort on the gaming front. In any case, ESPN’s president saying that “Esports is not a sport” a few years ago has proven to be a disastrous strategic move as this continues to grow.

Thanks for this! Although I agree with most of your points, I would argue that Twitch is not susceptible to multi-homing tendencies. It is true that a number of platforms offering e-sports exist, however Twitch continue to be a clear winner due to its first mover advantage. From a player’s standpoint, using Twitch gives them access to a large, already established fun base. As such, their switching costs are actually higher than it seems. Building a fun base from scratch is a lengthy process. For this reason, I believe Twitch is well positioned to continue to ride the fast growth of e-sports.