Turo: the Airbnb for Cars

Turo is a two-sided platform, a peer-to-peer car sharing marketplace, that enables users to rent their cars out to others.

In the last years, several companies have tried to solve short-distance, short-term transportation with platforms offering scooters, bikes or drivers. Multiple companies have emerged with similar business models, such as Uber, Lyft, Didi, Grab, etc.

But the longer-distance, medium-term transportation market is less crowded. Usually, a customer looking to book a car for a few days will default to a rental car company.

But car rental companies offer a limited selection of models, most of the time with confusing pricing and add-ons, no confirmation of the specific car to be delivered, and limited pick-up locations.

Turo solves this problem.

What is Turo

Turo is a two-sided platform, a peer-to-peer car sharing marketplace, that enables users to rent their cars out to others.

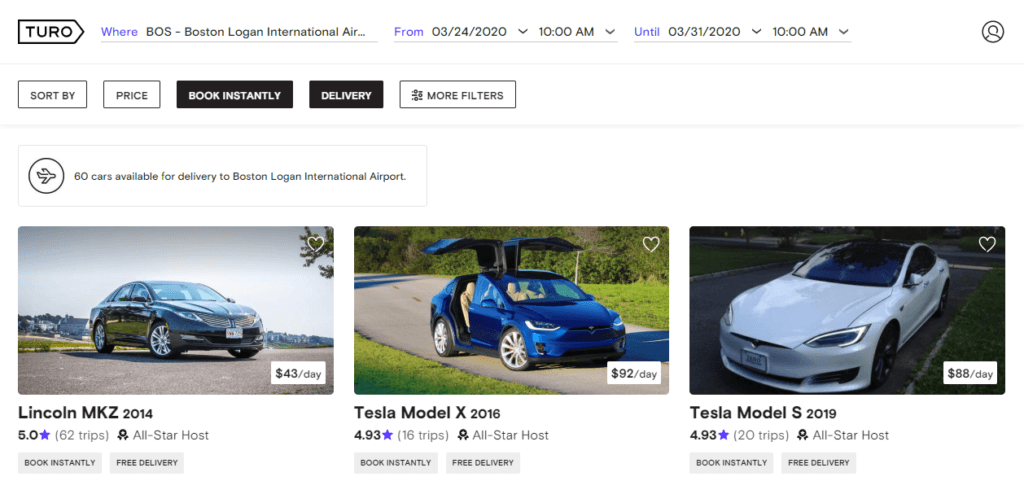

Turo is available in more than 5,500 cities across the US, Canada, UK, and Germany. It has more than 10 million users and 350,000 vehicles listed, offering 850 makes and models (1).

Users can search for their desired car on the Turo website or app, and book directly from there. When the traveler arrives, they can choose how to pick their car: the owner delivers the car to a custom location designated by the traveler, owner delivers to an airport or traveler picks up the car directly at the owner’s location. Returns are as easy and flexible.

Turo makes money on the difference between what the customer is willing to pay and what the owner charges for their car.

As more customers and owners are attracted to the platform, the stronger is the cross-side network effect. Also, reviews from happy customers help owners to gain better rankings on the search algorithms.

Benefits

The platform offers several benefits for each side of the market. Travelers have access to a huge mix of cars, with characteristics that match their preferences much better than rental cars. The booking process is simple and flexible, and they know exactly what they’re paying for. Turo argues that it’s also cheaper, about 25% less than a traditional rental car. (2)

For car owners, Turo offers a simple listing process and includes several benefits: up to $1 million in liability insurance, contractual protection for damage and theft, and 24/7 roadside assistance. Owners of popular models can make more than $600 per month. More importantly, it opens up the possibility of making money with an asset parked in their homes. Andre Haddad, Turo CEO, says that “many more [owners] are realizing they can share their car when they’re not using it or rent it out to recover the big costs of ownership” (3).

Competition

A few competitors, such as Getaround and Maven, the GM shared vehicle platform, are playing in the same field. But the biggest threat is legislation: rental car companies have responded in a similar way as taxi drivers did against Uber, arguing that Turo is not following the current regulations and is being charged lower taxes.

Sam Zaid, CEO of Getaround says that “car rental companies have turned to legislation as a competitive tactic…” (2). Similar remarks have been done by Haddad in interviews (4).

Is Turo sustainable?

Network Effects

Turo has cross-sided network effects but weak same-side network effects. More travelers attract more owners, but having more new owners doesn’t benefit current owners (as it increases the supply of cars, and decreases the chances of YOUR car being picked). Balanced growth in each side of the market is important to generate positive feedback loops.

Clustering

Similar to Airbnb, Turo can operate on a global scale. As travelers visit different cities, states or countries during a year, Turo can help them connect with owners of cars around the world using the exact same process and platform.

Risk of disintermediation

Disintermediation risk is low (it may be possible but not frequently). Owners need to accept bookings through the platform to access the insurance and safety services, the same for travelers.

Vulnerability to multi-homing

Multihoming is an issue. Turo has tried to create some moats in the form of technologies such as “Turo Go”: installing hardware in cars to unlock cars using just a phone. This can increase barriers to entry as competitors would have a hard time trying to imitate the user experience and convincing car owners to install multiple hardware in their cars.

Bridging to multiple networks

Bridging it’s a difficult option. Turo could hypothetically expand to bikes and scooters, but huge companies are already fighting for those markets (Uber, Lyft, Didi). The opposite might be more reasonable, Uber acquiring a peer-to-peer rental car platform.

Probably multiple companies are going to coexist across different regions (US & Europe, China, Asia) and if antitrust permits, consolidation of peer-to-peer transportation platforms might happen in the future.

References

- Turo.com. 2020. How The Turo Car Sharing Marketplace Works. [online] Available at: <https://turo.com/us/en/how-turo-works> [Accessed 24 March 2020].

- Bell, L., 2020. Don’T Want To Buy A Car? Rent Your Neighbor’S. [online] Fox Business. Available at: <https://www.foxbusiness.com/small-business/dont-want-to-own-a-car-rent-your-neighbors> [Accessed 24 March 2020].

- U.S. 2020. Uber And Lyft To Turn The Wheels On Car Ownership: Industry Experts. [online] Available at: <https://www.reuters.com/article/us-autos-ownership/uber-and-lyft-to-turn-the-wheels-on-car-ownership-industry-experts-idUSKCN1SS33A> [Accessed 24 March 2020].

- TODAY.com. 2020. Car Sharing App Turo Is Changing The Industry – And Rental Giants Aren’T Happy. [online] Available at: <https://www.today.com/video/car-sharing-app-turo-is-changing-the-industry-and-rental-giants-aren-t-happy-59891269999> [Accessed 24 March 2020].

Great article!

Having more users could help Turo to improve their services. As a former user of Turo, their biggest problem was their insurance that was not really great (notably because it includes a high deductible). More and more users would give more bargain power to the company to deal with insurance companies. The network effect could have a direct impact for users.

Great read! When I first heard of Turo I was excited about what they were doing, but after trying to use it I just found it to be more complicated than going to a traditional car rental. Each car has its own pricing structure in terms of fee + mileage drive, on top of different options for insurance, so the final value proposition was not clear, as opposed to Airbnb which has the same structure for all their listings. I think this would be a hurdle to overcome to get more users onto the platform.

Thanks for sharing! The risk of car owner multi-homing seems to be quite high, as you mentioned (similar to Uber vs Lyft). I would also think that customer multi-homing would be very high, since customers have many different options for car rental, ranging from Getaround to traditional car rental companies like Avis and Hertz. In order to prevent multi-homing, Turo needs to differentiate in some way, which they seem to be doing through price and car selection. In order to maintain a variety of cars, Turo needs to remain attractive to car owners, which seems to be difficult.

Great article ! I have had my fair share of experience with rental car companies and find them to have poor customer service. I feel if Turo really hones into making sure customers are well taken care of at every step of the way that can become a real competitive advantage and help them build a strong brand image – creating value.

Thanks for sharing. With regard to clustering, as younger people are now less likely to own cars than in the past, I’m wondering if there now may be more local network effects similar to Uber – where people might rent cars in their area for weekend trips or tasks would be inconvenient to do through ride-sharing or public transportation (e.g. going furniture shopping). This may lead to an opening for competitors to thrive in this particular customer segment if they can build a stronger presence in a given city.