Turning Paper into Gold: How EquityZen helps create markets for illiquid stocks

EquityZen has created a platform that helps employees get value from their equity compensation and investors get access to some of the most sought after opportunities in the economy.

Prompted by the problematic confluence of two key trends in the corporate landscape, EquityZen’s (“EZ”) investing platform seeks to create benefits through value-added intermediation for both sellers and buyers of non-listed equities. The twin trends in question are the increased proliferation of equity compensation as a key component of employee benefit packages[1]; the decision by many private businesses to delay going public for years longer than was previously the case[2]. For employees holding private company stock, these trends have served to significantly reduce their ability to draw upon a significant share of their personal wealth. For interested potential investors in the companies in question, these trends have reduced the avenues through which they can get stakes in some of the most sought-after investment opportunities in the economy. And for private Companies, these trends have reduced the value employees ascribe to the equity compensation component of their pay packages.

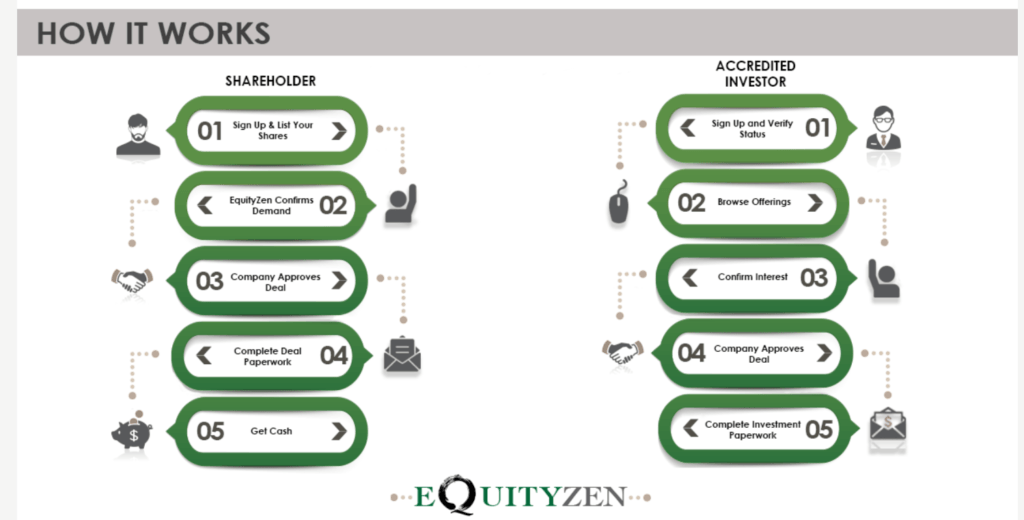

Stepping into that void, EZ’s private market investment platform seeks to bridge some of the structural issues preventing private company equity from being traded. The illustration below lays out how the platform works for both potential buyers and sellers[3].

For the Companies whose shares are being traded, EZ offers two key benefits. First, it cleans up the cap table by aggregating the shares held by disparate holders into one owner. Second it simplifies control matters by only granting economic value rights to its underlying shareholders allowing the Company to keep voting and information rights.[4]

Value Creation & Value Capture

For a handful of reasons, the transactions that EZ facilitates would be much more difficult to execute outside of the platform (if at all practicable). As the Company explains[5]:

Secondary investments in private companies require much more legwork than your typical public stock transaction (for example on Fidelity or Charles Schwab). For one, every transaction must go through the company when shares change hands (imagine telling IBM or Microsoft every time you bought their shares). And the process requires providing specific language governing the transaction; each company’s process is different. Finally, a number of documents must be compiled by the shareholder (a lot that shareholders don’t even know about, which is why we made a shareholder checklist on our blog).

As a result of these difficulties, investors are well served by making their purchases through demand aggregators like EZ because such aggregators can get blanket consent from companies and then facilitate separate transactions with individual investors without having to go back to the target company for additional consent. In a sense therefore, EZ is truly creating value for both sides of the transactions it facilitates as opposed to re-allocating extant value. In order to capture a portion of the value it creates, EZ collects a 3-5% investment fee from investors on each transaction. Additionally, EZ collects a placement fee from equity sellers. To mitigate cash strain on sellers, the company nets out its fees from the sale proceeds and delivers a net proceed amount to sellers.

Scale Benefits

Like many platform businesses seeking to prevent disintermediation and/or obsolescence, EZ benefits from tremendous scale advantages, which it can share with the 3 key stakeholders in the platform. As EZ increases the number of employee-sellers on its platform (both in terms of breath of firms and depth at a given firm), it increases its attractiveness to investors for both the selection of opportunities available and the size of purchase a given investor can make. The more liquid the market becomes for equity in each company, the more valuable that stock becomes as a compensation component to that company as it seeks to manage the cash portion of its compensation packages. As the ecosystem becomes more liquid, would-be employee-sellers get more freedom to accept jobs based on interest rather than liquid wealth creation because of a renewed confidence that they can access the value of their shares if need be.

Given that company consent is needed with each transaction, the more transactions EZ processes, the more it becomes a “known player” by companies considering whether to grant consent. As a result, at scale, EZ’s consent process should be much shorter than that of a one-off buyer. The presence of a contractually mandated approval process and the comparatively more straightforward consent process for EZ should provide some protection from sellers and buyers attempting to execute transactions off its platform; with that protection becoming more effective as the platform scales.

[1] https://www.holloway.com/g/equity-compensation/sections/history-and-significance

[2] https://money.usnews.com/investing/stock-market-news/articles/2019-09-24/ipo-delays-why-unicorns-other-giants-pushing-back-public-debuts

[3] https://equityzen.com/faq/