Trim: Doing More With Your Data

Trim is a personal financial assistant that turns your financial data into real cost savings.

These days there are all kinds of companies tracking our spending habits. Banks and credit card companies. Online retailers like Amazon. Personal financial management software, like Mint. These vendors analyze our data to create values in all kinds of ways. They prevent identity theft, suggest new products, and help us track our spending. But none are able to actively help us manage our financial lives.

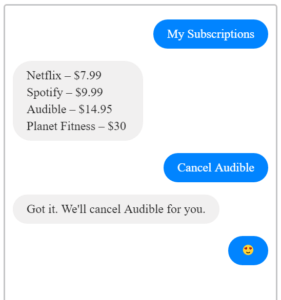

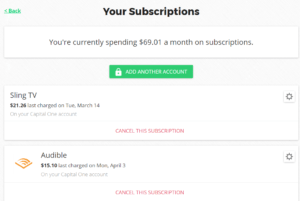

Trim does more. Trim is a personal assistant that saves money for you. The software takes the same data as Mint, but does much more with it. Trim’s bot can identify recurring subscriptions you might not be aware of, ask you if you’d like them cancel them, and in some cases, cancel them for you. It can tell you your checking account balance, or how much you spent on Amazon, which a quick text. The bot can even negotiating discounts on your Comcast bill (if you happen to be a customer). In the future, Trim will help you refinance loans, and navigate things like  saving for retirement. [1]

saving for retirement. [1]

Trim makes it easier to get the information customers need. Like most financial management programs, Trim offers an online dashboard to can track your spending. But Trim’s real innovation is in its SMS chatbot, which can provide customers the same information with just a quick text. You don’t have to turn on your computer or download some new app.

Trim doesn’t stop at providing useful information, however. They take concrete action. In many cases, Trim can activity help you manage your financial life but canceling subscriptions for you. Recently the company launched a campaign to help Comcast customers lower their bills. It’s once Trim has logged into your Comcast account that the magic really happens. Here, the Trim chatbot speaks with the Comcast chatbot, and tries to secure you a discount. The company has reported a 70% success rate. [3]

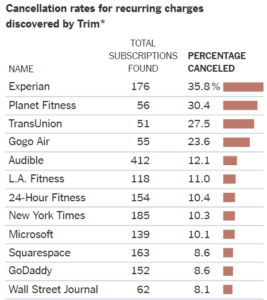

Trim has been able to cancel all kinds of subscriptions, the most common of which have been credit checking services Experian and Transunion, Planet Fitness, and Audible (see left). New functionalities are in the pipeline as well. Recently, for instance, Trim started helping customers find cheaper car insurance.

Trim has been able to cancel all kinds of subscriptions, the most common of which have been credit checking services Experian and Transunion, Planet Fitness, and Audible (see left). New functionalities are in the pipeline as well. Recently, for instance, Trim started helping customers find cheaper car insurance.

Value Capture

For now, Trim seems to be modeling itself as a Mint 2.0. In fact, the Trim co-founders seemed to suggest as much in an interview in 2015[3]. This means customers will enjoy the service for free as long as they are willing to accept a few ads from companies marketing various financial products. (The site’s disclaimer includes the warning that they, “may be compensated through third party advertisers”.) Of course, this approach could make it difficult for customers to know where the help ends, and the selling begins.

As the Trim platform grows, the company may also have opportunities to market customer data analysis. While the data Trim collects is no different than data collected by credit card companies of finance software, there maybe more innovative uses for these data. On its blog last year Trim featured heat maps of customer spending, and a list of the biggest spending restaurants in San Francisco.

The Future For Trim

It’s been less than a year since Trim raised their first significant round of funding ($2.2M) [5], and at the time the start up reported over 25,000 active users. It seems likely that media-grabbing campaigns like their Comcast effort should have helped Trim grow users significantly. If Trim can continue to target companies that drive customers bonkers and deliver value, they should be able to grow rapidly.

at the time the start up reported over 25,000 active users. It seems likely that media-grabbing campaigns like their Comcast effort should have helped Trim grow users significantly. If Trim can continue to target companies that drive customers bonkers and deliver value, they should be able to grow rapidly.

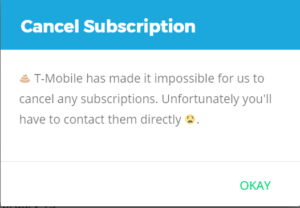

But continuing to churn out nifty tricks like these will be difficult. The more attention each one gets, the more companies whose business models rely on passive subscriptions will fight back. Already there are many subscriptions Trim can do nothing about (see right). Further, Trim’s shallow user interface and relatively limited SMS functionality will make it difficult to keep customers engaged in the platform. Last, it will be difficult to get customers to switch from other personal financial management tools they’ve used for years. So its unclear if Trim will be Mint 2.0.

Competition with companies like Mint, however, could be a red herring. The two products are hardly mutually exclusive. In fact, Trim is the perfect compliment to the incumbent platform. While Mint offers a stellar customer dashboard with lots of useful tools, Trim’s intelligence SMS bot is unmatched. Put the two together, and the bot could become even more powerful. All this suggests talk of Mint 2.0 could be rhetoric. Perhaps Trim’s real strategy is to position itself for a high-priced acquisition.

[1] http://www.asktrim.com/blog/

[2] http://fortune.com/2016/11/16/trim-comcast-bot/

[3] http://www.theverge.com/2015/12/20/10597788/trim-subscription-canceller-forgotten-bills-texts

[4] http://money.cnn.com/2016/04/21/technology/trim-truebill-subscriptions/

[5] https://techcrunch.com/2016/07/20/trim-personal-finance-bot-raises-2-2-million-to-save-you-money/

Really interesting concept! To me, this seems to fit better as an addition to Mint than as an independent company. Using the analytics tools, it seems that Mint could do much more than cancel subscriptions. They have tried to create data mining tools that look for large payments or unusual transactions, but if the analytics could expand into automated budgeting and financial management, I think there would be a lot more value. Ironically, it seems like something they might be able to charge a monthly fee for if done right.

James – Interesting concept. Thanks for sharing the information. Few thoughts: let me know your response to them:

1. You mentioned Mint is already helping users manage personal finances. I understand Trim is providing additional features like cancelling subscriptions, negotiating bills etc. But as a user, what is expected out of me? Am I expected to multi-home? A typical user would already have a checking account and a few credit card accounts to manage. On top of that, I am using Mint and probably a few other finance / expense management tools. In this scenario, how is Trim trying to acquire users?

2. What is the competitive advantage Trim has? Mint, with much more data, can any day start doing what they do.

I love that the chatbot can interface directly with Comcast’s to secure a discount – way cool. Aside from that, do you have any idea if Trim is angling to position itself much deeper in consumer financial analysis and spending habits to help them save money? It seems like that could be a great way to both create and capture a ton of value for cost-conscious consumers. Aside from that, I’m also interested in how things play out between them and mint. As you say, it seems that data is really the ultimate value here, and I’m sure Mint must have more…

Great post. I can personally use Trim! Do you think the existing value capture model is sustainable? I wonder if a freemium model might be better suited, though perhaps the company has tested that and found reasons not to pursue it.