The Trade Desk: The Leading Independent Platform for Programmatic Advertising

The Trade Desk has built a powerful programmatic platform for marketers to buy ads – helping them reach more customers, in more places, with best-in-class transparency and return on investment

Over the past 10 years, audiences have gradually moved their attention (viewership / listenership) from traditional, offline formats, to digitally connected ecosystems. At the same time, advertising has moved from traditional formats (print, radio, broadcast) to online (Source: Emarketer). With this shift to digital, programmatic advertising – the use of automated technology for buying advertising space – has emerged as a new, more efficient method of advertising. Programmatic ad buying uses data insights and algorithms to optimize ad placements – serving ads to the right individual, at the right time, at the right price, to generate the highest ROI for the advertiser.

With this new trend, an opportunity emerged to build a best-in-class platform to allow advertising buyers – e.g., brands – to bid across digital ad inventory – available through publishers and inventory aggregators – in an automated fashion, leveraging internal and external data on target audiences. Founded in 2009, The Trade Desk (TTD) capitalized on this opportunity, and has built the leading global advertising platform to help marketers reach more customers, in more places, with more transparency at every stage (planning, pricing, and performance) (Source: The Trade Desk).

Here is a simple visual that explains how programmatic advertising works. (1) A user visits a website; (2) the site owner (e.g., ESPN, WSJ, etc.) puts the website’s ad slots up for auction on a supply-side platform (SSP); (3) multiple advertisers bid on that impression via registered demand-side platforms (DSP); (4) the winning ad is displayed on the website for the user; and (5) the advertiser hopes that the user converts to a click (and eventual purchase). Bidding and ad display occur in a fraction of a second – with the goal for advertisers to generate the highest return on investment – every time you visit a web page! (Source: Brid.TV).

DSPs not only enable the buying of ads but also offer the ability for advertisers to target specific audiences, set parameters around their bids, collect and leverage data, and optimize their advertising campaign performance.

As a platform, TTD interacts with several parties in its ecosystem. Advertising buyers use the platform to bid on inventory; SSPs (supply side exchanges) offer their inventory up for bidding; and data providers connect their data to be purchased or used by bidders to make more informed purchases. TTD allows its buyers to purchase ad inventory from many well known exchanges and publishers – including Google, Amazon, Roku, Spotify, TikTok, and others – and it gathers data from external vendors as well. Some of these key publishers and data vendors are shown in the graphics below (Source: The Trade Desk).

TTD’s largest differentiator is its neutrality – it does not own content, unlike many of its competitors. Google, Amazon and Facebook, on the other hand, are walled gardens – closed platforms where most tools and resources are controlled by the operator (Source: Yahoo). Walled gardens represent a conflict of interest for advertiser buyers. Each of these companies own content platforms (e.g., Facebook, Instagram, YouTube), each of which have ad inventory that must be filled. At the same time, these companies provide tools to help ad buyers purchase inventory both on and off their platforms. The walled gardens are thus incentivized to steer advertisers to purchase the inventory on their platforms (Source: MediaMath).

Walled gardens also restrict third-party tools from accessing their network. Facebook does not allow integration with third-party DSPs, for example – if an advertiser wants to buy ads on Facebook or Instagram, they must use Facebook’s tools. They control their data, and they do not allow advertisers to extract it from their platform, thereby preventing advertisers from leveraging that data in other media-buying platforms or gaining a unified view of individual consumers (Source: MediaMath).

On the other hand, TTD is an independent DSP, that only represents advertiser buyers. TTD does not own ad inventory, and therefore it doesn’t have the same conflicts of interests as its competitors. TTD also leverages artificial intelligence to help advertisers use data to make better bids on inventory. As each new client brings data to and generates data on TTD’s platform, its algorithm becomes more intelligent, benefiting all clients on the platform. Clients also own their data, allowing them to leverage it in other campaigns outside of the platform (Source: The Trade Desk).

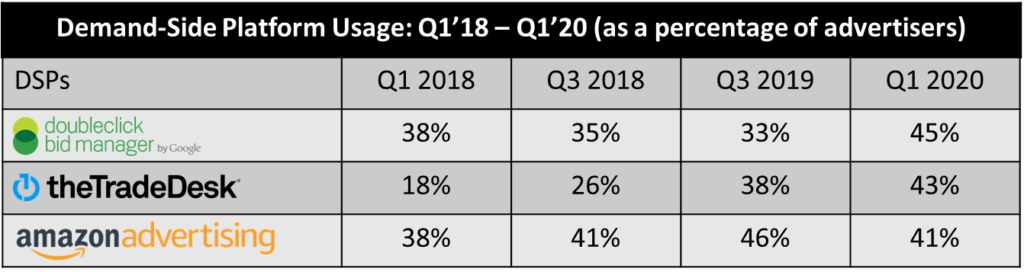

Advertisers are recognizing the benefits to TTD’s neutral, open approach, and it has gained meaningful share over the past few years. The table below shows the percentage of surveyed advertisers who used a particular DSP in the last 12 months, highlighting that TTD is gaining share meaningfully quicker than legacy incumbents.

This unique approach has led TTD to build an incredible business. Since its IPO in 2016, TTD has grown from $1.2 billion in market capitalization to nearly $40 billion. Revenues have grown from $200 million in 2016 to $1.2 billion in 2021, and the Company is expecting to grow revenue another 30% in 2022 (Source: CapitalIQ).

The different approaches that the major walled gardens and TTD have taken towards building their advertising capabilities highlight interesting implications around the concepts of network effects, multi-homing, value creation, and value capture. By recognizing the advertiser’s need for an independent platform, by embracing the advertiser’s desire for flexibility and data ownership, TTD has found an opportunity to create more value for its users, and I would argue is building one of the most robust tools available for advertisers to reach their consumers.

Thank you for your concise synopsis and sharing how TTD is different, Alex. The walled garden definition is new for me but one I am particularly interested in topics concerning the future of policy and privacy management moving forward. I wonder if the neutral strategy adopted by TTD will be a long-term winning strategy if juggernaut content companies at any point come under similar mandates that ISP providers faced with net neutrality? Additionally, while unknown right now in the U.S. given a lack of uniformity, I also wonder how data privacy mandates bolster or hinder TTD’s approach given that they operate globally. Specifically, I am thinking about Europe’s strict GDPR requirements and how this must be implemented into product management. Lastly, the companies listed provide a great introduction to the value creation TTD offers across platforms. I wonder where TTD is hedging its bets in terms of the future of what it wants to focus on (web, mobile, tv, other) and allocate more resources towards (AI, partnerships, human capital, etc)? Very interesting to be made aware of the ever-changing ecosystem invisible to the intended audience/ web user.