The New York Times: Outwitted in the Digital Age?

The New York Times struggles to maintain its market leadership position against innovative upstarts in the digital media industry.

The embattled newspaper industry is experiencing nothing short of an existential crisis. As traditional newspaper organizations attempt to transform themselves into digital media companies, the decline of their print business has coincided with the rise of digital “native” media platforms (such as Buzzfeed, the Huffington Post, and Vox Media) that are better equipped to capture value in the digital age. The New York Times, the most respected of all American newspapers, is a classic case study of Clayton Christensen’s theory on innovation and disruption. The discussion below summarizes why TNYT’s business model is not aligned with the evolving news industry, despite the fact that it continues to generate the highest quality reporting of any news publication. TNYT is fighting a battle it won’t win.

Value creation

TNYT creates value in two fundamental ways: (1) generating high quality content and (2) delivering that content to as many readers as possible.

On the first point, TNYT is the undisputed leader in journalism. Since its inception, TNYT has been awarded 117 Pulitzer prizes, more than any other newspaper, and it has received a Pulitzer every year for the last fifteen years. In addition to creating excellent content, TNYT is renowned for its curation of content – positioning and prioritizing articles meticulously so as to create the optimal experience for the reader. Unfortunately, the value of these core capabilities is being eroded in the marketplace. The news industry today is built around speed and virality, rather than thoroughness and quality. More on this later.

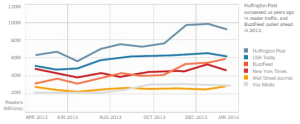

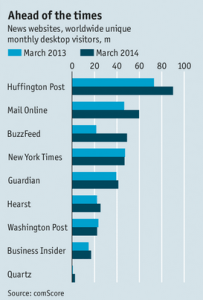

On the second point, TNYT boasts 1.1 million print-and-digital subscribers and 1.0 million digital-only subscribers, surpassing every other U.S. newspaper other than The Wall Street Journal. However, TNYT’s stiffest online competition is not from other newspapers, but rather from digital media platforms like The Huffington Post (see graphic below).

These digital media platforms are attracting more readers than TNYT, even when they are simply repackaging TNYT’s own content. Their success is due to the transformation of the online content distribution model in two key ways: 1) leverage of big data and trending algorithms to prioritize article placement in real time, and 2) utilization of social media to spread content. Additionally, the digital media companies specialize in shareable, informal quick reads –the written equivalent of news bites—in contrast to TNYT’s emphasis on deep analysis and original thought pieces. The content and distribution model of TNYT’s digital competitors are very well aligned with the nature of the news industry today: a 24-hour news cycle in which news is disseminated rapidly and digested quickly, usually online, and increasingly on mobile vs. desktop.

Value capture

TNYT captures value in two ways: subscriptions and ad sales. TNYT offers two types of subscriptions (print-and-digital or digital only) and sells ads both in its print editions and on its website.

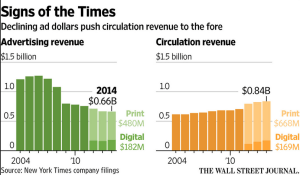

As TNYT’s print circulation has declined over the last two decades, so too have print subscription revenue and print ad sales. The value of each ad in the newspaper drops as the number of eyeballs reached falls. Not surprisingly, TNYT saw the writing on the wall and aggressively built a digital presence.

Digital

To be sure, the NYT has compensated for some of its losses on the print side with growth in the digital business. However, given the intense competitive dynamics in digital news (numerous digital media outlets offering free content, combined with low switching costs) and consumer behavior that favors shareable short pieces, TNYT is not competitively well positioned to capture value on the digital side. The graphic below from The Economist shows that TNYT is in a neck-and-neck race for digital eyeballs, despite its superior journalism. The second graphic demonstrates that TNYT has not been able to compensate for its print circulation decline with an increase in digital ad revenue.

These dynamics are reflected in TNYT’s financials: in 2003, TNYT generated $551M in net operating profit, compared to $92M in 2014. TNYT’s weakened position in the news industry is also reflected in its declining market capitalization, which has fallen to $2.0B from a peak of $7.2B in 2002.

The writing is on the wall for TNYT, and they know it. In May 2014, an internal report written by TNYT strategists was leaked to the public: “With the endless upheaval in technology, reader habits and the entire business model, The Times needs to pursue smart new strategies for growing our audience. The urgency is only growing because digital media is getting more crowded, better funded and far more innovative.” It will require significant ingenuity for the NYT to halt its own disruption.

Although I believe NYT is at a crossroads with its digital vs print offering I remain bullish on the agency for two reasons. First I believe that the drop off of print subscriptions will eventually level out and there will always be a flat percentage of customers who value a hard print edition over digital and NYT will be able to charge a premium for the service. Second, with the proliferation of content on the web, I believe users are beginning to place higher and higher value on the quality of content and if NYT can become better at understanding how to price its content and advertise effectively, it will increase digital viewership.

Great piece.

My question is this: what happens when the content generators collapse? The businesses which are succeeding in this space seem to be platforms, aggregators, or sites like Huff Post which as you point out repackage chunks of content from other outlets.

Coming to this course from the media sector, I often wonder where the content will come from when the traditional brands in both print and broadcast are so crippled they can no longer mass generate content. The vast quantities of cheap & recycled content upon which most new brands are built will dry-up. Will there be a recalibration in the sector? Will platforms start to create content themselves?

Good stuff. One place where I’m both optimistic and pessimistic about NYT is in its news app, NYTNow. It’s a killer news app. It’s got a good voice, great story selection, and its selection of stories from other sites its editors believe are worth reading make it pretty much a one-stop shop for newsies like me. That’s great. Where I’m pessimistic is in the opportunity they have to capture and use data about its audience and their behaviors to customize the app experience to each user. So far, they don’t seem to be taking it.

I really enjoyed this piece and agree that NYT has clearly been losing in the news/publishing industry; however, I wonder how much of this is really due to a failure to innovate and embrace digital. As you mentioned, the NYT has amassed more digital subscribers than any other publication except the WSJ. Moreover, as mentioned in another comment, the NYTNow app offers high quality journalism and curated stories in an easily digestible format. I have to wonder if the NYT is losing simply because it charges for content, unlike its new digital competitors which simply aggregate and repackage content (or produce low quality content) and generate revenues through advertising alone. The level of quality NYT offers in its journalism is likely not sustainable without subscription revenues, so I too wonder who will generate quality content (not just in publishing, but in TV and other media) when the traditional players no longer have the deep pockets to do so.