Tesla: More than just autopilot

An exploration of Tesla’s true competitive advantage: its data

While Tesla’s hardware has received both consumer and critical acclaim, its robust applications of a near endless stream of relevant and real-time data has been what propelled it to its current position as the world’s most valuable auto company1, creating an innovation engine that has enabled it to leapfrog traditional competitors who have been unable to leverage data as aggressively in their respective business models.

Data collection:

Through the vehicle’s “battery of sensors, including cameras and radars, that capture data about their drivers, other road users, and their surroundings”2, Tesla finds itself in the enviable position of receiving a clear and continuous stream of data every time their customers engage with the product. However, whereas some companies face a tension with their end user in getting permission to collect sensitive data, Tesla users welcome the technology’s ability to constantly improve and power built-in features like collision warnings and autopilot.

Value creation and caption:

Armed with this trove of information, Tesla continuously rolls out new features (via the always-on 4G connection) that enhance the driving experience for their customers, while capturing value for itself:

Auto-pilot:

Arguably its most popular feature, Tesla offers a variety of autonomous driving (AD) functions, including its baseline Autopilot, and beta versions of their Fully Self Driving (FSD) package. At its core, both sets of software make use of road and situational data gathered from both test environments and real users, alongside live driving conditions data, to make decisions that enable the vehicle to operate autonomously under most scenarios. It takes millions of miles of driving experiences to train these systems, and Tesla’s ongoing data collection flywheel not only allows it to develop these capabilities, but improve them over time, especially for triaging long tail events that most AD system struggle with7. In addition to drawing in new purchases, Tesla also offers their higher end FSD features at additional costs of $6-12k5.

Insurance:

Tesla can use a driver’s driving statistics to gauge their habits and tendencies, which then allows Tesla to offer competitively priced insurance products. The holy grail of insurance pricing is to be able to accurately assess the risk of the underlying asset/event, and since Tesla can measure almost every aspect of a driver’s driving experience, it gains an understanding of a person’s risk profile that rivals that of most traditional insurers, including those that already use (less-sophisticated) telematics systems6.

By pricing insurance more accurately, Tesla can reduce the cost of Tesla ownership, while also lowering repair costs as it gathers a critical mass of policies. This not only gives consumer a financial reason to purchase, but it also allows Tesla to create another revenue stream due to its competitive data advantage.

Operations:

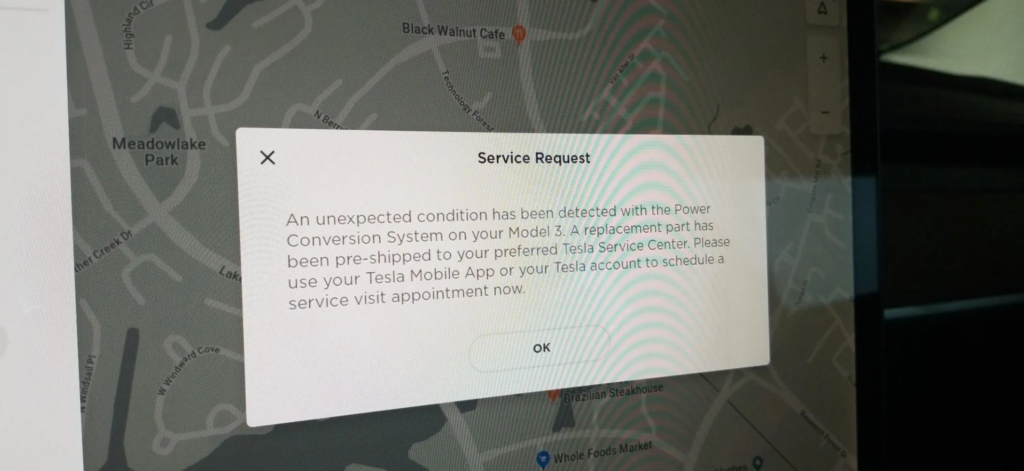

Tesla’s software works hand in hand with its “live issue detection” feature to ensure that both the driver and Tesla always has full visibility into any mechanical or operational issues with the vehicle8. While most modern vehicles contain sensors that flag these issues, Tesla’s operating system allows the company to detect issues at scale, which then gives them the tools to determine a resolution.

Tesla’s integrated hardware and software suite enables it to resolve many issues without the need for an expensive recall—for example, in 2023, they were able to resolve a FSD issue with ~360k vehicles through a simple software update3. For customers, this was a non-intrusive way to ensure their vehicles had the latest functionality, while for Tesla, it avoided the need for widespread physical repairs that could drag for years. Separately, when Tesla detects new parts are needed, it can also automatically order the parts to nearest service center, significantly reducing the long lead time of repairs8.

Challenges:

In the future, the thorny issues of regulations and data privacy loom large for Tesla. There are still many uncertainties around how autonomous driving will be regulated, especially in cases that mix human and mechanical errors. Tesla needs to be careful in training its FSD models and ensure that it remains complicit with both the court of law, and the court of public opinion.

Separately, there are concerns around the extent to which Tesla can collect, store, and make use of data gathered from non-US sources, especially in cases where national security may be involved (ex. driving a Tesla through a military base), or storing US data abroad, where it may be seized and used. Tesla needs to be transparent about its data usage, but even that may be insufficient, as policies can swing drastically in this politically charged climate.

- Statista. “The 100 largest companies in the world by market capitalization in 2023”, 2023. https://www.statista.com/statistics/263264/top-companies-in-the-world-by-market-capitalization/

- Harris, Mark. “The Radical Scope of Tesla’s Data Hoard”, IEEE Spectrum, Aug 3, 2022. https://spectrum.ieee.org/tesla-autopilot-data-scope

- Kolodny, Lora. “Tesla recalls 362,758 vehicles, says Full Self-Driving Beta software may cause crashes”, IEEE Spectrum, Aug 3, 2022. https://www.cnbc.com/2023/02/16/tesla-recalls-362758-vehicles-says-full-self-driving-beta-software-may-cause-crashes.html

- Robinson, Daniel. “A Look at Tesla’s Plan To Reduce Car Insurance Rates”, MarketWatch, Sep. 5, 2023. https://www.marketwatch.com/guides/insurance-services/tesla-reducing-car-insurance-rates/

- Weber, Harri. “Tesla decreases the price of FSD beta to $12,000”, TechCrunch, Sep. 1, 2023. https://techcrunch.com/2023/09/01/tesla-decreases-the-price-of-fsd-beta-to-12000/

- Progressive Insurance, 2023. https://www.progressive.com/answers/telematics-devices-car-insurance/

- Harris, Mark. “Tesla’s Autopilot Depends on a Deluge of Data”, IEEE Spectrum, Aug 4, 2022. https://spectrum.ieee.org/tesla-autopilot-data-deluge

- Tangermann, Victor. “Teslas can now detect broken parts and pre-order replacements”, IEEE Spectrum, Aug 3, 2022.https://futurism.com/the-byte/tesla-detect-broken-parts-pre-order

This is a very interesting post. I also wrote about how big data is used by Tesla but we offer different points of views. I am particularly interested in your mentioning about how Tesla lowers the insurance price by using more precise/accurate driving behavior predictions through data gathered from advanced sensors in the vehcles. I have heard about the Tesla Insurance before but have a relatively negative oppinions on its implementation. Tesla judges the way you drive in almost all aspects: did you speed, did you drive recklessly (maybe determined through how often you turns for no reason?), did you park accurately, etc. However, such judgement for a perfect driver only lies in ideal conditions where every single drivers on the road are assumed to be perfect. There are always others who are just driving like they owned the road (honorable mention: Boston drivers). Exception could also happen when you may also need to go through the red light for emergency vehcles. While I do not have any documentation backing this point up, I have heard that it is really hard to appealyour “reckless driving” behavior judged by the AI to be of others’ faults instead of yours. I could see that if Tesla become very friendly with the appeals, people might just lie for lower insurance money and it is really hard to judge without more data from more advanced sensors. I would not use its insurance unless I absolutely have to.

Great work! Previously, when talking about Tesla, I could only think about its self-driving algorithms and safety concerns. This blog introduces more use of big data from Tesla. I found how Tesla uses drivers’ driving statistics to gauge their habits and then recommend insurance products is very interesting. I first learned that Tesla has such insurance service. So I’m curious about how much revenue insurance contributes to Tesla.

Besides, with the surge of interest in self-driving cars, many auto and technology companies began developing such products. What’s Tesla’s competitive advantage in the market? (For me, I think I’ll choose Tesla since it’s the most popular self-driving car and seems the most reliable.)

This is a super interesting post, thanks David! I’m keen to hear your view on how Tesla will overcome growing geo-political tensions between its major markets? In particular, it’s critical to the Tesla business model to have a DTC business model enabling them to control the full customer journey and associated pricing. Part of that equation also involves reliance on owning all the data along that journey. As different territories become increasingly paranoid about what data firms can and cannot own, will Tesla have to de-couple its approach and adopt a dealership model in some places e.g. China? If so, how might that break their model and R&D trajectory?