Teladoc: Why the biggest and most successful telemedicine company ultimately will lose

Telemedicine is not a new idea. Since the birth of video-calling, experts thought that telemedicine will revolutionize the industry. Analysts bullishly have suggested that the market could be worth $4.5B by 2018 (IHS, 2014). Back in 2002, a small start-up called “Teladoc” saw this opportunity .

Fast forward to this summer, the summer of 2015, and Teladoc had grown to be the biggest player in the telemedicine industry. With 8.1 million members on its books, $44M in revenue in 2014, and a 119% growth versus the prior year, no one could argue that Teladoc was the company to beat in this space. Then, on July 1st 2015, The company IPO’d with enterprise value of $620 million. Has the revolution really finally happened and has Teledoc won? Far from it in my opinion.

Before tackling that questions, lets first think through why telemedicine has been highlighted as a potential game changing digital innovation. In theory the model is beautiful, as all current stakeholders in the system benefit due to the increase efficiencies:

- Patients. Patients have many complaints about visiting the doctor, but one major one is the time and inconvenience of the effort. Patients looking to book appointments with their local doctor might have to wait days for an appointment, and then sit in a waiting room for an average of 30-60minutes before seeing the doctor. Telemedicine allows a patient to be connected to the next available doctor almost instantly allowing for quick diagnosis and prescriptions for minor and common complaints.

- MD. For the MD, the opportunity is great additional source of income – MD adoption has been extremely high! Although they are paid less per visit, they can utilize downtime to make money, and have lower costs then an in-office setting.

- Payers. Insurance companies / employers love it, because they pay a lower amount per patient visit

Value creation is not where I think Teladoc will lose the battle in this industry, but rather through their plan for monetization. Teladoc decided from the start to go for a subscription-based model, selling directly to the payers. This seems like a great business model. Companies would pay an annual subscription per member to be covered. In one contract, thousands and thousands of patients can be brought on board and instantly monetized! Enterprise clients tend to renew contracts higher than consumers, so churn was expected to be low.

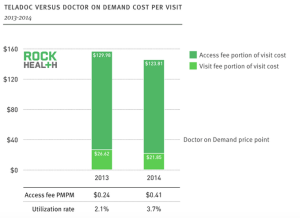

However, I believe that this initial choice of business model will ultimately lead to the downfall of Teladoc, thanks to one simple metric – utilization. In order for this model to work successfully, the payer needs to see value. If they are paying for this service at a fixed rate, and no-one is using the service, the person writing the check is likely to feel ripped off. From looking at the data, utilization has been terrible – <5% of people are using the service in the companies who have signed up.

Source: https://rockhealth.com/deconstructing-teladoc-ipo-s-1/

With such a low utilization rate, the payers are not seeing the value promised. But why is the utilization rate low? One large reason is awareness. Patients in the signed up companies are either not aware of the program, or if they are aware, do not see the value in using this service vs. visiting the doctor (“I need to see a real doctor, not just one a screen”). Awareness will only increase through spending. As payers are on the fence as to the value, so they will not spend to get increased adoption. Teladoc’s model does not have a direct to consumer sales effort, and they cannot afford to do so – their valuation is based on growth of signing up more enterprise clients. They are backed into a corner.

Enter a new type of player in this market: Doctor-on-Demand. With Doctor-on-Demand, for a flat fee of $40 per “visit” patients get the same service instant service offered by Teladoc. Initially focused on the direct-to-consumer market, it seemed as if this would be a minnow compared to Teladoc. In a stroke of genius in 2014 the company pivoted to work in the B2B market. They have been able to win huge contracts with companies such as ComCast, by offering to take the risk out of adoption. If no one uses it, the company pays nothing. If lots of people use it, the paying company still saves money (as $40 is less than a face-to-face consultation price). The model has been so successful that numerous competitors have appeared in this space.

Only time will tell who will win the market but I believe Teladoc will lose. A business model decision taken 10 years ago, which is now difficult for them to pivot away from, will ultimately be their downfall.

I completely agree. Teladoc was genius to IPO when they did because I fully believe that their valuation is going to fall substantially over the next couple of years. You touched on the PMPM vs. pay-as-you-use difference, which I do agree is huge for employers. However, I also think that Teladoc is just a decade behind the new players (Doctor on Demand very much leading the pack) when it comes to the design of their UI and the overall customer experience of their service platform. This is one of the pitfalls of being the first mover in a space that is evolving as rapidly as telemedicine, and really, digital health in general.

Time will tell if the customer-focused models of the new telemedicine companies will be compelling enough to change generations of ingrained patient behavior (i.e. going to see a doc at a brick-and-mortar institution), but I agree with your analysis that Teladoc has already lost the race.

KMY, absolutely agree about the hyped valuation. The price has already fallen significantly since the IPO (but maybe we shouldn’t read too much into that yet due to the overall frothiness of the market in the Q3 2015).

I’m really interested to see how this one plays out. If this is a UI game / customer experience play as you suggest (now that a dominant business model seems to have emerged), then we are entering a whole new area of marketing opportunity in healthcare not seen previously.

P.s. I also like the HealthTap UI :). I wouldn’t write them off yet…

Great post! I agree with your arguments and you did a great job of outlining the specifics of why Teladoc’s model hasn’t driven adoption for customers or employers. The one thing I think Teladoc does really well, however, is to use big data to create sophisticated predictive models to identify who super-users/high-utilizers of the healthcare system are, and offer triaged care accordingly. For instance, a very high utilizer patient who has a history of presenting to the ED for unjustified visits might be directed to a video consultation first, whereas patients with a history of chronically serious or life threatening diseases will be fast tracked into the hospital. The ability to gather this type of data is the type of benefits Teladoc has from being the largest telemedicine provider, and this is ultimately where providers and payers will care about these services. Much of the costs to our healthcare system are from overuse of urgent care or ED facilities, and the ability to reduce unnecessary visits or readmissions using customized predictive analytics is going to be crucial for the success of any telemedicine company.