Stripe: Increasing the GDP of the Internet

When commerce was forced to shift online overnight businesses of all sizes needed help making the change. Stripe filled the void.

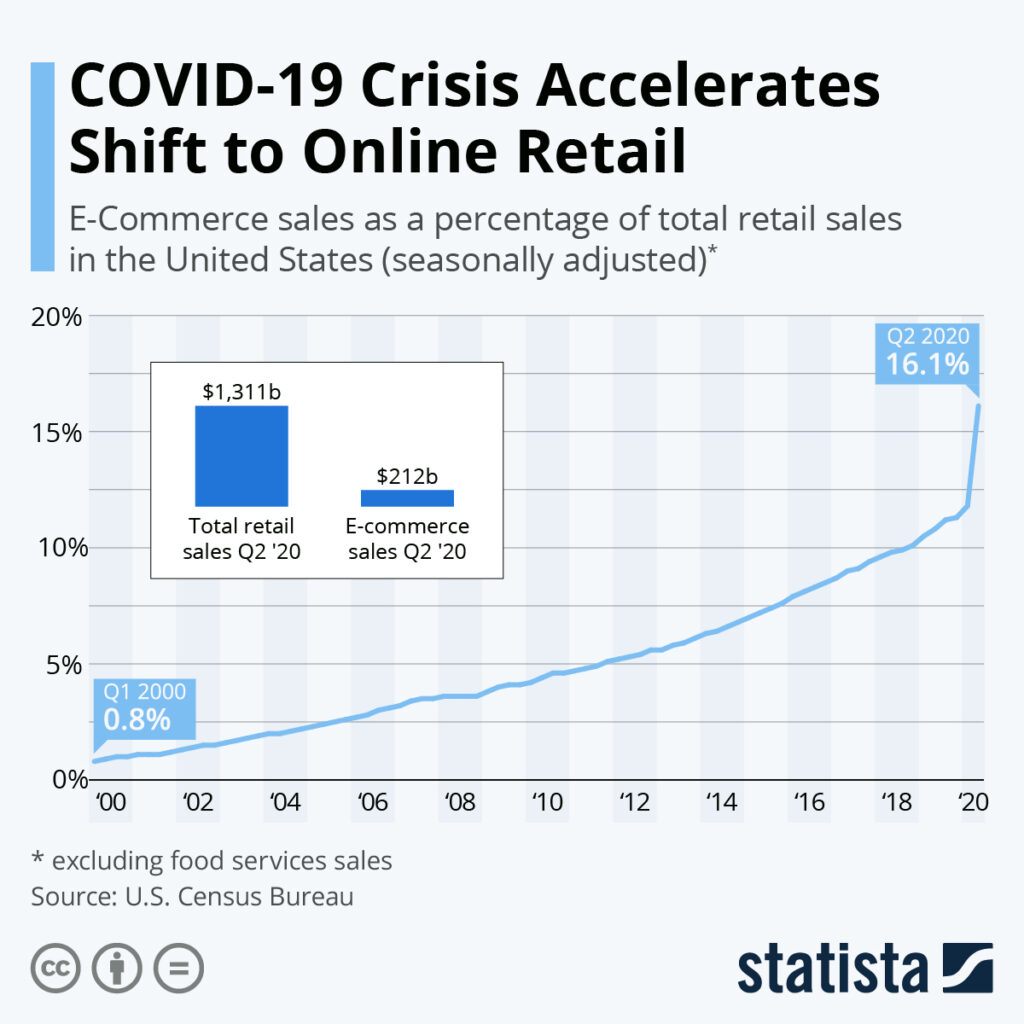

As the pandemic raged, society was forced to conduct much of the commerce we have grown accustomed to doing in person, via the internet (during the early stages of the pandemic we went from doing 11% of commerce online to 16%). While many vertical commerce providers have undoubtedly thrived, it is difficult to think of a company better positioned than Stripe to benefit from a pandemic tide that lifts all internet commerce boats.

Stripe is an online payments solution, and the most valuable private technology company in the United States. It is also one the least understood highly successful mega unicorns of the past decade. Stipe began as a pure online payments facilitator focused on making it easier for new and small companies to accept payments online. It is has since expanded into a variety of new and adjacent business areas including:

- Connect: Payments facilitation for online platforms. For example, Uber can use Stripe to both accept payments from riders and make payments out to drivers.

- Billing: Subscription and invoice payments for businesses with recurring customer relationships.

- Issuing: Virtual or physical payment cards for specific uses. For example, if you need to give an employee a certain amount of money to complete a job related task.

- Corporate Card: Pay, centralize, and organize all company expenses.

- Radar: Fraud and risk management.

- Atlas: Company incorporation.

- Sigma: Business intelligence and analytics.

- Capital: Stripe analyzes payments data to intelligently offer growth capital to its customers.

This is just a snapshot of the services Stripe offers its customers. Stripe has leveraged the broad adoption of its first product to build and distribute a full suite of commerce, capital, and intelligence solutions for internet first companies.

Stripe creates value for its customers (ranging from small upstart companies to massive multinationals like Shopify) by making commerce on the internet painless, efficient, and reliable. It captures value through the processing fee it charges on any payment that runs through its system. Stripe charges 2.9% of the transaction value, and a flat $.30 for each transaction. After paying out to other parties along the value chain Stripe keeps roughly .5-1% of each transaction.

Once you deeply examine Stripe’s business model, it is not difficult to see why COVID-19 was a robust accelerant to their growth. Stripe has benefited in three key ways:

- Through the growth of their existing customers. Even if Stripe didn’t add a single customer during the COVID pandemic they likely would’ve still benefited greatly. Most of the e-commerce gains sparked by the pandemic have accrued to well established online businesses, and Stripe processes payments for many of those businesses (most notably Shopify).

- Through the expansion of existing customer needs. Customers who may have partly relied on Stripe to help with their internet payments had to shift their entire business online overnight. This means more existing payments customers tacking on other Stripe services like Billing, Issuing, and Capital. While it is hard to fully quantify the shift here it is now estimated that 94% of Stripe customers use multiple services, up from ~80% pre-pandemic.

- New online first business creation. Pretty much the only path for new small business creation over the past year has been through the internet. This helped expand Stripe’s customer base.

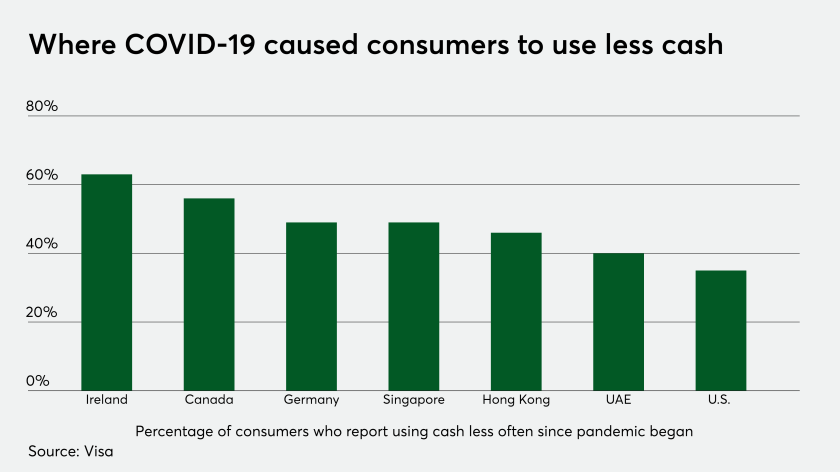

More acutely Stripe has seen its two most significant competitors (cash and legacy in-store credit card processors) basically made illegal overnight via shutdowns and lockdowns. It is difficult to think of a more ideal regulatory environment for Stripe.

Looking forward I believe Stripe is well positioned to consolidate and retain the gains it has made during the pandemic. For starters I believe many of the commerce behavioral shifts we have seen will persist even when society re-opens. Customers enjoy buying online and businesses are able to reach more people by selling there. Even the businesses that are likely to return to doing a significant portion of their business in person can continue to transact with Stripe via its new offline terminal offering. Relative to their competitors, like Paypal and Adyen, Stipe has the most complete set of product offerings. This helps to raise switching costs for their customers as they grow accustomed to using Stripe in many parts of their business.

Stripe provides the infrastructure needed to power the digital transformation of our commerce, and is well positioned to continue to extract value from that still growing value pool.

Sources:

https://stripe.com/files/payments/IDC_Business_Value_of_Stripe_Platform_Full%20Study.pdf

https://stripe.com/about

https://www.cnbc.com/2020/06/16/why-online-payments-start-up-stripe-is-the-no-1-disruptor-50-company.html

I always wondered which company processed all these e-commerce transactions, mystery solved! Stripe sounds appears to have been uniquely well positioned to benefit from the change in context resulting from the public health crisis. The pandemic has forced countless businesses to accelerate their digitization efforts, with Mckinsey study indicated business digitized 25-40 times faster. This means that Stripe has the right product, at the right time, uniquely positioning it to erode away market share from the market leader PayPal.

I think Stripe adds a ton of value through the services they provide beyond simply facilitating a transaction. But that 2.9% fee based on transaction value seems really high and perhaps likely deter many small businesses. Is the “payment stack” of the various players who take a portion of the transaction at risk of blockchain technologies that simplify and speed up transactions?

I agree with Kyle regarding Stripe’s transaction fee in the context of small businesses – especially the impact that would have with the backdrop of a pandemic. A competitive concern I have is within Square, who is well positioned in providing solutions to small businesses in an arguably more intuitive way.

An incredible company riding the eCommerce wave that I agree will not subside post-Covid. Our habits have fundamentally changed regarding what we are comfortable purchasing online (i.e., much more comfort, much more online spend), having been forced to do so for the past year. I agree with John V’s concerns regarding Square, which is now coming after the consumer with Square Cash and ultimately seems focused on building a “super app” of the likes we see in China.