StockX: The Stock Market for Things

StockX is an e-commerce platform on the rise due to it’s unique stock market approach to resale. Strong network effects, superior platform design, and “sticky” features have and will continue to help StockX grow in the future.

StockX is an ecommerce platform redefining the future of retail. The platform is designed as a “stock market for things”, on which sellers can list excellent condition items and let the market of buyers determine the appropriate prices. StockX began as a shoe reselling site, but has expanded into additional verticals and has begun releasing products directly onto its site. Already valued at $1B, StockX has proven itself to be both scalable and sustainable in the increasingly competitive reselling space [1].

ALWAYS AVAILABLE. ALWAYS AUTHENTIC. NEVER SOLD OUT.

Finding an authentic pair of sold out shoes at a fair price was basically impossible before StockX. Buyers would have to sift through hundreds of unique listings just to risk receiving a counterfeit, and sellers would lose time and money trying to sell products of which they didn’t know the real value. StockX tries to solve these issues by bringing transparency, authenticity, and simplicity to the purchase process.

Sellers post products on the website and set an “Ask” amount that must reached by a buyer’s “Bid” for a sale to automatically process, or they can sell immediately to the current highest bidder for the product. All listings for a given product (e.g. Adidas Yeezy 700 V3 Azael shoes) are compiled on a single page where sellers can see past sale data and outstanding bids/asks, which they can use to inform their own submission. These platform features create value for sellers by providing anonymity and eliminating the need to take pictures or communicate back-and-forth with bidders. Additionally, StockX ensures that buyers are legitimate by tying purchases directly to their PayPal accounts and guarantees no returns [2].

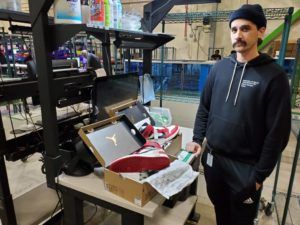

Buyers also benefit from the site’s detailed information and one-page-per-product layout, as it reduces their search time and assuages pricing fears. Perhaps the biggest benefit of the platform, however, is its rigorous authentication process that happens after a product has been sold. Everything sold on StockX is guaranteed to be “deadstock” (i.e. brand new) except a limited number of luxury items, which must be in “pre-owned excellent condition”. The company authenticates all sales at authentication centers around the world, where professional in-house authenticators rigorously verify each product [3].

The value created by StockX comes at a price to sellers, with a 3% processing fee and a transaction fee taken from the final price of each sale. The transaction price depends on the type of product and decreases as sellers sell more/higher value products through StockX. The fee starts at 9.5% for items like shoes and goes as high as 14.5% for handbags [4].

NOT JUST FOR SNEAKERHEADS

StockX’s rapid growth can be attributed to its strong network effects and replicability across different product verticals. By providing significant value to buyers at no cost, StockX was able to rapidly ramp-up its base of bidders, making the platform more attractive to sellers. Additionally, many buyers are also sellers (and vice versa) so growth on one side automatically drives growth on the other side of the platform. Same-side network effects are also present, as more users provide greater pricing data accuracy.

The scalability of StockX’s business model has been proven through successful expansions into the watch, handbag, streetwear, and collectibles markets. The stock market model works for any supply constrained product whose current value is not equal to its original price. Additionally, StockX has been able to leverage its existing authentication processes to make expansion cost-efficient.

The next frontier for StockX’s growth will come in the form of IPOs, which are first-time product launches directly on their site using a blind Dutch auction. Companies that are currently selling limited edition products far below market value can alternatively do a StockX IPO to increase revenue while maintaining the exclusivity halo that comes from low volume product runs. The platform has already completed a successful IPO with adidas and expects to move more in this direction in the future [5].

HERE TO STAY

StockX is positioned to continue dominating in the resale market despite a growing number of competitors because of its early excellence and “sticky” platform design. The simplicity and transparency of StockX addressed key issues with incumbent platforms (e.g. Ebay, Amazon), and continue to differentiate it from newer competitors (e.g. GOAT, Flight Club, and Stadium Goods) [6][7][8]. These newer platforms charge similar or higher commission fees, but don’t provide the same level of information to buyers or ease-of-sale for sellers. By offering a superior product early and continually evolving, StockX has managed to keep buyers from defecting.

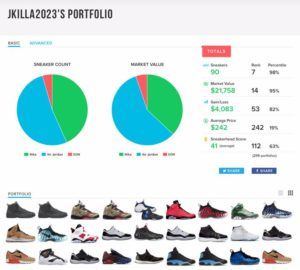

Additionally, StockX has designed features to further help keep users just on their side. On the seller side, the transaction fee structure rewards loyalty with lower fees and the “My Portfolio” tracking features help sellers assess the value of all their goods and determine when’s right to sell. The portfolio feature is also appealing to buyers for similar reasons and so they can track their portfolios against others [9]. Additionally, the platform’s new IPO feature forces users to only use StockX for certain shoe releases. The last powerful feature of StockX is that it’s hard to be disintermediated due to the financial risk, customer service, and authentication capabilities the platform provides. With all these features in mind, it’s little wonder why StockX has a promising future in online retail.

[1] https://www.cnbc.com/video/2020/01/31/how-stockx-built-a-1-billion-sneaker-resale-empire.html

[3] https://www.cnbc.com/video/2020/01/31/how-stockx-built-a-1-billion-sneaker-resale-empire.html

[5] https://www.glossy.co/fashion/under-new-ceo-scott-cutler-stockx-explores-new-categories

[7] https://www.flightclub.com/

Thanks a lot for sharing this article – very interesting.

I particularly like the fact that StockX is not distinguishing between experienced sellers and new sellers – because StockX takes care of the authentication of shoes and the delivery and most of the service elements, a buyer is not concerned to purchase a shoes from a new seller. That, in the past for other platforms such as eBay was a major issue – sellers who were new did not have a chance to stand against experienced sellers who have a lot of positive reviews.

I wonder though, whether there is space for multi-homing and whether the network effects for this platform are very strong? I do see some indirect/ cross-side network effects, but I am not sure if the same-side network effects are strong? What do you think?

It seems to me like the same-side network effects are very weak, if not negative, for the users of this site. The more buyers there are, the more demand there is for products, and the higher the price is likely to be. So it seems like it’s actually the case that sharing the site with someone might actually be a bad idea as a buyer. Similarly for sellers – if more sellers use the site, the more supply there is, and so the prices will drop and you won’t make as much money.

So I’m very surprised that this site has many users. My guess from the article is that its ease of use is so nice that people share based off of that. Or, alternatively, StockX may heavily advertise.

But it seems like it’s not in the best interest of users of the site to introduce more users like themselves.

I’m curious if maybe a group purchasing model like Pinduoduo might alleviate this on the buyer side, but that seems difficult to pull off if the main product is single pairs of shoes.

Very interesting article and StockX is definitely solving some of the problems associated with its predecessors like eBay. For me, I think disintermediation or some other aspect of low end disruption might be a threat particularly because these items can be so high priced. A 10% commission can feel fairly steep from a dollar amount if the luxury items like handbags or watches are being sold. For example, someone looking to sell a 10k watch, I might be just as suited to use StockX as a price check and then try sell it through my local watch shop. However, it seems as though StockX is trying to protect against this by providing anonymity for sellers and not providing any sort of direct messaging system between buyers and sellers which allows for more swift disintermediation.

I think the IPO idea is very unique and definitely! However, I wonder if this could actually be detrimental so some brands if the shoes do not sell quickly or at a lower price than anticipated (similar to companies on the stock market). For some companies, that might be a risk worth taking. However, I can see companies like Nike building these capabilities through their SNKRS app that allows them to test and “set” the price and have full control over the demand data.