Dingdong– 29 mins vegetable delivery to door

Dingdong Maicai (vegetable delivery) is a fresh vegetable e-commerce platform that provides 29 mins door to door delivery in major cities in China.

Introduction

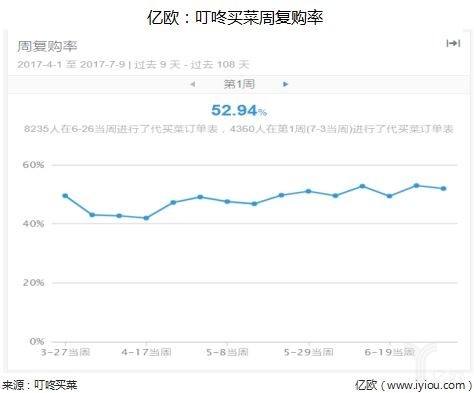

Dingdong Maicai (vegetable delivery) is a fresh vegetable e-commerce platform that provides distribution service, focusing on urban cities. The main products offered are vegetables, soy products, fruits, sea food, rice, flour and oils and snack foods. By adopting a big data-driven approach, predicting future orders through self-developed data models, Dingdong achieved 700 million RMB ($100 million) revenue per month in 2019 with over 52% repurchase rate. It is now one of the fastest growing vegetable delivery startups in China.

Value creation for consumers – easy and convenient

Food delivery service has been life changing for many Chinese, but some still prefer to cook by themselves. Those people may not have enough time to pick up fresh ingredients from supermarkets after long working hours. So many Chinese startups and large companies are making home-cooked meals more effortless for busy people by sending vegetables and meats to apartment doors.

Food delivery service has been life changing for many Chinese, but some still prefer to cook by themselves. Those people may not have enough time to pick up fresh ingredients from supermarkets after long working hours. So many Chinese startups and large companies are making home-cooked meals more effortless for busy people by sending vegetables and meats to apartment doors.

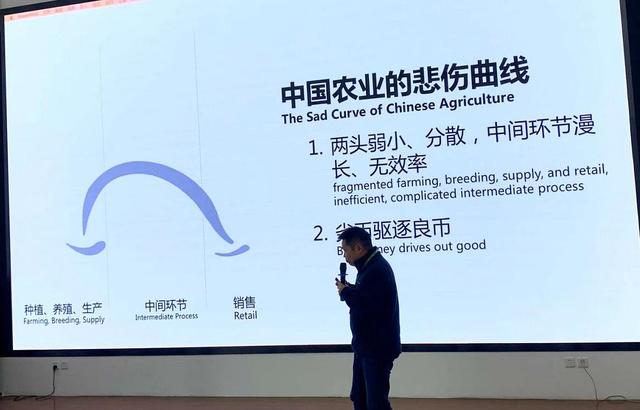

Value creation for farmers – the sad curve of Chinese agriculture

China’s agriculture industry was famous for low efficiency and low profit. There are over 70% rural population. in China. Rural economy was always a key focus for China.

From the sad curve of Chinese Agriculture, we can see that farming, breeding, supply and retail are very weak in the whole supply chain, while the intermediate process can be very complicated. By reducing the intermediate process in the whole supply chain, fresh vegetable delivery could make the whole agriculture industry more efficient.

Competition – who will win in fresh food delivery in China?

Fresh food delivery was booming in 2018 and 2019, with increasing investment in different companies. Capital market favorite fresh food delivery companies because of huge market, high frequency consumption, rigid demand, and there is no big player in China until now.

The fresh grocery sector in China recorded over 5 trillion RMB ($ 750 billion) in 2019, according to Euromonitor. Most of these transactions still happened offline, with less than 5% online. This means huge growth room for online fresh food shopping.

E-commerce leaders Alibaba and JD.com both added grocery to their comprehensive online shopping malls. Tencent-backed MissFresh (Mei Ri You Xian), which has raised over $1.5 billion to date, is also a big player in fresh food delivery. The field became more and more crowded when Meituan entered the market.

What’s the competitive advantage of Dingdong?

With all these big players in market, Dingdong enjoyed a unique position with (1) a focus on vegetable rather than fruit (2) front warehouses (small warehouse near neighborhood) to guarantee 29 mins delivery (3) 52% repurchase rate and 30% gross margin, which is the highest in the industry.

How can Dingdong achieve these as a new startup founded in 2017? We can get a sense from its daily operation. The founder Changlin Liang is a series entrepreneur, who worked for the army before his several startup experiences. During my visit to his company, I found that all the employees are working in a military liked environment, with clear KPI, lots of incentives, frequent check and quick execution. A delivery person could delivery 100 package per day, while industry average is only 60 packages per day. The operation efficiency of Dingdong is the highest in the whole industry.

Liang has a clear calculation of delivery efficiency and profit. As he mentioned, front warehouses cost more than a big warehouse, so he must reduce the delivery cost and management cost to make a reasonable profit. The average delivery per order is 5 RMB, transportation is 4 RMB, average order revenue is around 21 RMB, then there will be 16 RMB as a profit for one order. It is not a huge profit business and it requires detail focused operation management.

How is the future of Dingdong?

Dingdong survived extremely well and did fantastic job during the corona virus spread in China. The delivery people of Dingdong work days and nights to provide fresh vegetables and meats to door to support the quarantined people in China. Many consumers started to become loyal consumers after enjoying the convenient and quick service. User habit was created and sustained during and after the quarantine time.

The network effect is very obvious for Dingdong. Just as JD.com started from electronic products and expand to other products. Dingdong could expand its business by including bottle water, toilet paper and other daily consumption products, besides their focused fresh vegetables. For users, it is very convenient to add some toilet paper and beers to the shopping bag when they want to buy vegetables. This is also the reason why capital market really favorite the fresh food delivery platform.

Although multi homing still exists, more and more users switched from JD.com (one day delivery) to Dingdong Maicai (29 mins delivery) after enjoyed the convenience for fresh food and daily consumption goods. Dingdong will not take the full market of JD.com and Alibaba for shopping, but it could definitely occupy a big amount of fresh food shopping of consumers.

I feel very positive about Dingdong’s future based on the increasing users number, the reasonable gross margin and the efficient operation in this company.

For the longer term, will the marginal operation cost decrease overtime? Will there be a true net positive profit with a 30% gross margin? I think they are taking a more difficult path by offering 29-min delivery, rather than a planned order and a second day delivery, which might be much more cost efficient. I am happy user of this app, but I do wonder if they can survive in the longer term.

This is a fascinating company – thank you for sharing! Interesting to hear that Corona virus has been a big opportunity to acquire new customers. I wonder how the network effects will change over time, and whether its digital competitors will be able to use network-bridge to overcome a lack of scale?