Starbucks – The best customers in the world?

If imitation is the most sincere form of flattery the Starbucks Rewards program is a glowing success story. Read on to learn how it also turned Starbucks into one of the bigger “banks” in the US.

Nowadays cash back and reward programs are ubiquitous in customer-facing industries. The humble beginnings of one of the industries pioneers can be traced back to the 2001 holiday season when Starbucks launched its first re-loadable gift cards. The cards featured imagery of white snowflakes, potentially foreshadowing that soon, just like no two snowflakes, no two Starbucks customers’ experiences would be alike!

While the re-loadable card program was a success and laid important groundwork the real success story starts 10 year later with the launch of the Starbucks Card mobile app which enabled mobile payment and assigned a persistent digital identity to each customer.

How does the Starbucks Rewards program work?

The in-app currency Stars is the centerpiece of the Rewards program. Customers are rewarded stars for completing specific actions. The primary action is simply spending money in the Starbucks ecosystem. Per dollar spent customers are awarded 1-3 Stars, depending on the payment method (more on that later). Stars can finally be redeemed to purchase products e.g. 25 Stars for a drink customization, 50 Stars for a brewed hot coffee or bakery item or 400 Stars for select merchandise items. Customers can earn additional Stars by completing challenges (e.g. buy a coffee every day of the week, buy a lunch box on Wednesday), making use of Double Star Days or by taking part in games.

The Rewards system gives customers a clear incentive to link every purchase in the Starbucks ecosystem to their Rewards account. This gives Starbucks the holy grail of customer data: Full transaction history of personally identifiable customers across their entire ecosystem.

Traditional marketing approaches rely on segmenting the customer base into a subgroups (e.g. by age, gender, estimated household income, zip code) and then targeting each subgroup with hand-designed marketing strategies. Objectively estimating and comparing the effect of different marketing strategies is a time-consuming and inaccurate endeavor. Their enormous amount of data allows Starbucks to revolutionize every aspect of this process. Each customer can be individually targeted with a marketing strategy (challenges, double reward opportunities, games, etc. offered at the most opportune time) that is automatically designed by a marketing engine based on analysis of existing data. By analyzing the resulting transaction data the strategy can be clearly evaluated with regards to any metric (e.g. revenue, profit margin, customer retention). The resulting leanings are fed back to the engine and will be used for more effective targeting of all customers.

Effects of the Rewards programs

If imitation is the sincerest form of flattery, then the current ubiquitousness of reward apps and programs is the strongest testament to the success of Starbucks pioneering Rewards program. Looking at the numbers further supports that sentiment.

As of 2020, almost 20 million customers have signed up for the Starbucks Rewards program and it accounts for an impressive 50% of their entire revenue (https://stories.starbucks.com/press/2020/starbucks-reports-q4-fiscal-2020-results/).The Rewards program contributes to Starbucks strong customer retention and brand loyalty. 71% of Starbucks app users are visiting a store at least once a week and furthermore, app users are 5.6 times more likely to visit a Starbucks every day (https://www.numerator.com/resources/blog/mobile-mastery-insights-starbucks-app).This can be attributed to the improved customer experience. Their data-driven approach allows Starbucks to show customers only offer that are relevant to them and the strong gamification provides another engaging element.

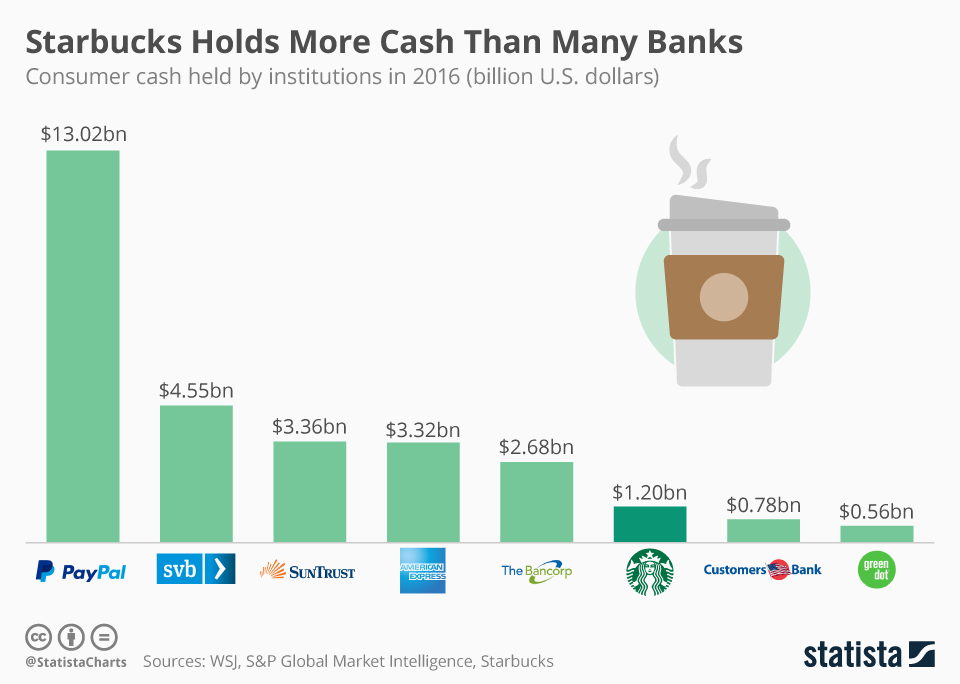

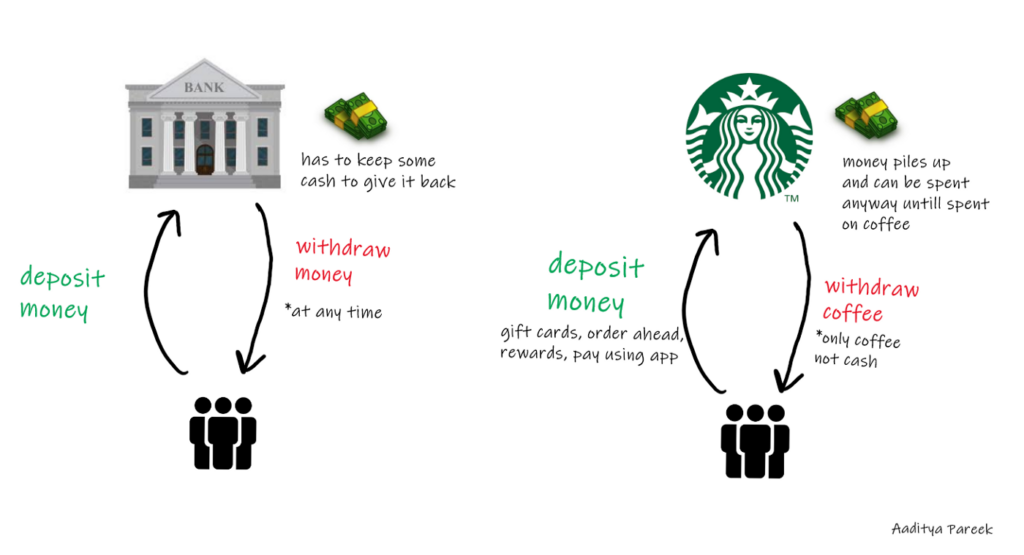

Lastly, the Rewards program has lead to an unique side effect that deserves to be mentioned. Starbucks encourages customers to preload money on their account or Starbucks-associated credit card by offering increased Star rewards per $. The sum of this pre-paid money across the user base amounted to an incredible $1.2bn in 2016 and has since grown to $1.5bn which means Starbucks holds more cash than most banks and payment providers in the US!

This money is basically an interest-free 1.2 billion dollar loan. Yet, it is not subject to any of the usual regulation for loans and securities – there are no minimum liquidity requirements and creditors may be paid back exclusively in coffee, bagels and mugs.

To sweeten that money frappuccino even further, around 10% of that money will end up being breakage, i.e. it will be entirely forgotten/lost by the customers and never redeemed. Each year Starbucks reports more than $100 million of breakage income (https://stories.starbucks.com/press/2020/starbucks-reports-q4-fiscal-2020-results/). Who wouldn’t want to have such generous customers?

This is a super interesting post, thanks Chris. As I read this, I realized it’s been some time since I last used my Starbucks app, and turns out I forgot I have $17 sitting in the app that I need to use…thanks for the reminder. I wonder if the Company has ever gotten any push-back on this model from customers? While I’m certainly not angry with Starbucks for the fact that I forgot I had money sitting in their app, $100 million of breakage income a year is significant…

I would also be curious to learn more about their Treasury strategy with all of this extra cash. I assume they invest it in very safe, low-yielding assets like U.S. Treasury securities to generate some income on the capital. But as I think through it further, a “run on banks” is far more likely to ever occur than a “run on coffee” — do you think they could get more aggressive with a Treasury strategy than a typical bank, and have they tried this before?

(This comment is from Kevin Lam) • Chris – Starbucks: Thanks for detailing the Starbucks Rewards program Chris. I knew that Starbucks had become a large “bank” just from gift card sales, but how this links to their rewards program was very insightful. I wonder how Starbucks could use their rewards data combined with user data, purchases, and location data to help them tailor their services to different market segments and attracting new customers beyond just targeting their existing Rewards customers individually.

Thank you for the post, Chris. Undoubtedly this program helped the company to learn more about its customers. I am curious to learn if Starbucks has leveraged the insights generated from the data to provide localized products, deals and services and if this has already contributed to the capture of a larger share of customers

Thanks for this post! It’s cool to see how successful this program has been, and how it’s paved the way for so many organizations to try out systems of their own. I wonder how well rewards systems will scale now that most retails are trying to do this. I personally have trouble keeping track of my various accounts…

On an unrelated note, I travelled to the original Starbucks store last summer, and was interested to hear that the chain was originally a single store for quite some time (5+ years). It’s cool that an old, establish organization can become a digital leader in this way.

This was so interesting – I had no idea this is how much Starbucks had and how little regulation is around it. Makes me wonder how much money MBTA holds through Charlie cards and if that might also be enough to constitute a “bank” – or honestly just any of the other kinds of cards we hold. Given that a lot of coffee chains are experimenting with the same + more (coffee subscriptions like Panera) — I’m wondering how Starbucks would react to this kind of competiton…

Really great post. Interesting to see how Starbucks has managed to stay competitive and relevant especially as Millennials and Gen Z move more towards brands that align with their social purposes, making positive social and environmental change.

I know that with a lot of loyalty programs, once you reach a certain status you are secure. Is the same true for Starbucks? If not, I wonder if this also helps fuels the purchasing practices of their customers.

Thanks for the post!

Great post, Chris! It’s a fascinating point about how much cash Starbucks holds.

I wonder how they take advantage of this liquidity and if it alters their overall strategy?

I also heard years back that Starbucks try to encourage customers to buy more of their food products, I wonder how the rewards scheme is used to push this?

Great post, Chris! One thing I couldn’t stop thinking about reading this, as a non-Starbucks regular, was how the app could alleviate the anxiety of ordering at Starbucks, which I always seem to mess up. This anecdote is notable only because it’s just one more avenue for a non-traditional user like myself to find the app. Anything that simplifies a process is likely to catch users’ attention, and next time I go to Starbucks I might have to try this out, even if I’m not in it for the loyalty.