Spotify’s winning data strategy may be hampered by operational challenges

Spotify is leveraging loads of data to enhance the music listening experience

As my husband starts to use my Spotify account more, I’m realizing our taste in music is quite different. The number of P!nk songs in my daily and weekly playlists is getting smaller and smaller. And I’m sure Spotify is confused by my newfound obsession with Macklemore. But even that last sentence alone is a pretty cool concept.

Spotify’s Use of Data

While I highlight a small limitation, in general, Spotify’s use of data to create unique playlists for each user is incredible. Not only do they track what songs you listen to, but they also note when you’ve skipped a song before the end. Further, in partnership with different apps, devices and wearables, Spotify has started noting the time of day and your location during each song played so they can curate playlists based on whether you’re at the gym, on your morning commute, or just hanging out at home.(1) And that is just the data they gather from the user.

Other data collection efforts that feed their playlist engine stem from intense analysis of songs and artists. Spotify uses natural language processing to analyze not only the metadata of an audio track, but also blog posts and news articles about songs or artists.(2) This data is used to assign “top terms” to each song that help connect the song to the user. These top terms are constantly updating as the conversation shifts.

Spotify is using all of this data in hopes of turning the concept of searching for that perfect next song into a thing of the past, and I’m rooting them on from the sidelines!

Value Creation

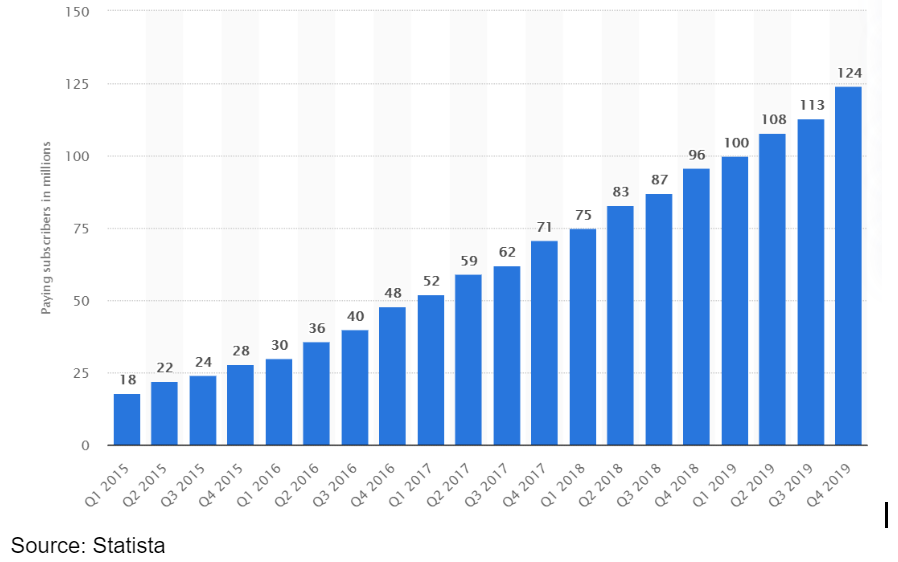

From the consumer’s perspective, there’s a ton of value creation in a great playlist ready for each of the different parts of one’s day. Instead of buying an individual song on iTunes for $0.99, Spotify has 271 million users and 124M subscribers who have drastically changed their listening habits over the past 10 years.(3)

Spotify’s Paying Subscriber Growth

From an artists’ perspective, the value creation arguments run the gamut. Taylor Swifts’ (in)famous move of pulling her music off Spotify fueled the fire on one end of the spectrum and Spotify’s argument of “us or piracy” makes a case for the other.(4) I land somewhere in the middle.

I think it’s safe to say that for unknown artists, trying to get discovered, Spotify creates value. An artist must acquire 1,000 listens to be considered for inclusion in playlists and Spotify pays per play. Better than the free beers an artist might get for doing a gig at the local tavern.

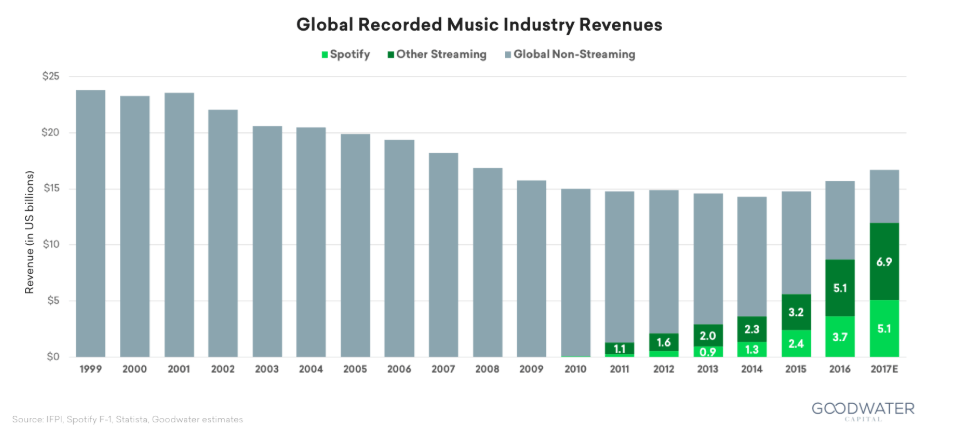

For the Swifts of the world, value creation from Spotify is a bit murkier, but I believe it has created value for the big artists. The music industry has changed, and Spotify is offering an alternative to free, stolen downloads, which is what many of us may have resorted to in the early 2000s. This leads me to a correlation vs causation argument, one that reminds me of the Mercer Corridor dilemma. An increase in streaming did not necessarily cause the decrease in record sales/downloads. Our comparison point should be what we believe would have happened to record sales without the intervention of streaming.

Value Capture

And here’s the real cherry on top, Spotify has made huge investments to the front end technology. The Freemium model with an excellent consumer experience has captured millions of premium subscribers, essentially converting people who have never paid for music in their lives to people willing to shell out $10 per month.

Moving Forward

While the basic business model is attractive and Spotify’s use of data is helping them win, there are a number of business model challenges they need to continue to work through.

To ensure fewer Swift fiascos, Spotify needs to create and maintain a positive dynamic with both the record labels and major artists. Many of Spotify’s business operations and financial choices interfere with how satisfied (or unsatisfied) these suppliers will be, and Spotify’s success hinges on their participation.

In addition, Spotify’s financial results have turned the corner to profitability, but as large streaming services add music or new players enter the space, Spotify needs to be prepared to manage the price war that may ensue.(5)

There are some switching costs associated for a listener of moving from one listening platform to another, but I don’t believe this is a winner-take-all market. Spotify needs to continue to invest in R&D to stay ahead of the curve as the music streaming landscape continues to change.

Finally, in 2019 Spotify’s ad-generated-revenue is ~10% of total revenue, yet nearly half of their users are on the free version of the platform.(6) Especially as Spotify acquired Gimlet Media, a podcasting arm, they must find ways to leverage ads more effectively without diminishing the user experience.(7)

Sources

1 The Amazing Ways Spotify Uses Big Data, AI And Machine Learning To Drive Business Success, https://www.forbes.com/sites/bernardmarr/2017/10/30/the-amazing-ways-spotify-uses-big-data-ai-and-machine-learning-to-drive-business-success/#1849bc1d4bd2, accessed 4/19/20

2 How AI helps Spotify win in the music streaming world, https://outsideinsight.com/insights/how-ai-helps-spotify-win-in-the-music-streaming-world/, accessed 4/20/20

3 Company info, https://newsroom.spotify.com/company-info/, accessed 4/19/20

4 $2B and Counting, https://artists.spotify.com/blog/2-billion-and-counting, accessed 4/19/20

5 Shareholder Letter, Q4 2018, https://s22.q4cdn.com/540910603/files/doc_financials/quarterly/2018/q4/Shareholder-Letter-Q4-2018.pdf, accessed 4/21/20

6 Spotify Segment Revenues 2012 – 2012, https://www.statista.com/statistics/245125/revenue-distribution-of-spotify-by-segment/, accessed 4/21/20

7 Spotify says it paid $340M to buy Gimlet and Anchor, https://techcrunch.com/2019/02/14/spotify-gimlet-anchor-340-million/, accessed 4/21/20

I thought this was a really interesting perspective because when I thought about value creation and value capture I was only thinking of the user side and not the artist. It makes sense to me that the artists could also have alot to gain by getting a deeper understanding of who their target fans are should Spotify start to collaborate with artists.

Thanks a lot for sharing this article.

I think it is very interesting to see how Spotify leverages recommendations engines and particularly cluster-analytics in order to identify your music taste. I think it will be very interesting to see how artists can leverage those insights and I agree with Austen that we need to find ways that artists get access to these data-sets in order to create more targeted user experiences. The main issue that I am seeing here is thought that this may lead to a divergence to the mean taste of users e.g. what masses love, rather than self-produced content by inspiring artists.

Great article! I do think sharing the listening patterns and data collected with artists can help them improve their creations and drive demand. Although this may squash creativity. In the hope of getting more hits, artists will tend to release similar songs that have been proven to work in the past. Another tension I see with the model is financial. While Spotify charges users $10 a month, it pays artists and labels for each play. Superusers, in this case, become loss-leaders. And as the product better recommends songs that users love, the time spent listening on Spotify will increase. It remains to be seen whether their stickiness can help them negotiate better terms with creators or does this drive their financials to the ground.