SoFi – An Illustrative Tale of Why Fintech Disruption is So Difficult

SoFi – An Illustrative Tale of Why Fintech Disruption is So Difficult

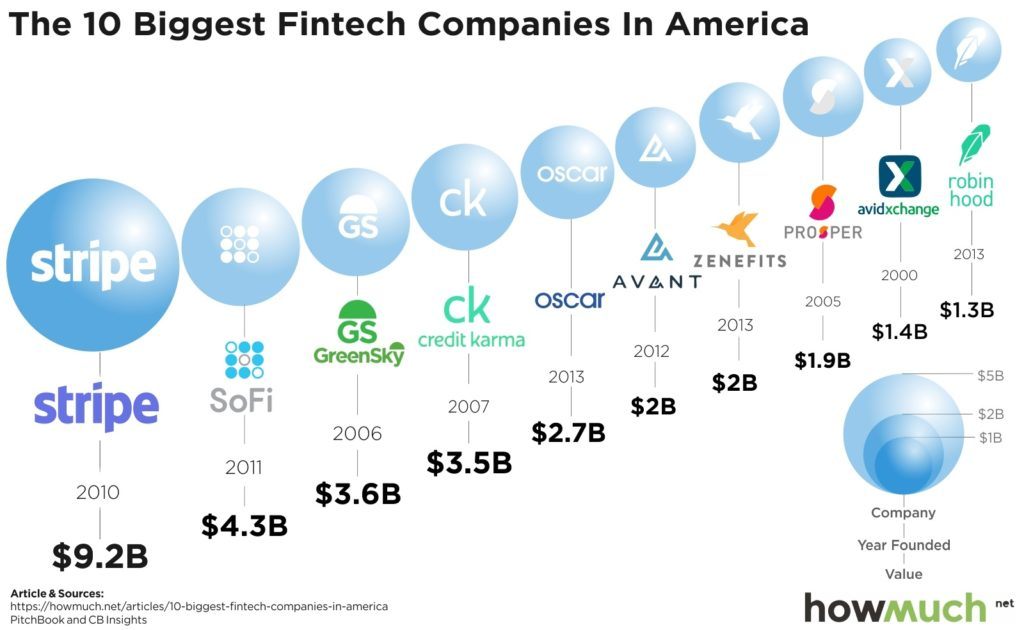

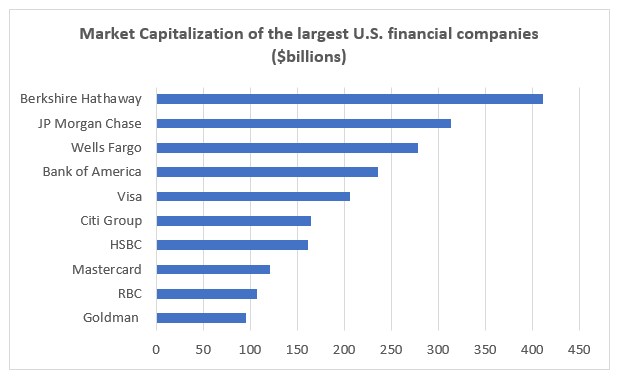

The past two decades have witnessed enormous investments into fintech to disrupt the financial services sector, an industry that has been slow to change in the face of advancement in technology during the same period. Last year alone, fintech companies attracted over $31billion in investments globally[i] and over $15.2 billion in the U.S. This represents more than 20% of the $70billion in total funding to startups last year[ii]. Over the past three years, investments in fintech have exceeded $122 billion. Despite these massive investments, however, independent fintech companies have struggled to achieve significant market penetration or generate valuations that seriously challenge the large incumbents. The valuations of the two largest fintech players (Stripe at $9.2 Billion and SoFi at c. $4.4 billion) [iii] pale in comparison to the largest financial services companies which have been growing at record rates over the past decade. For instance, JPMorgan has a valuation of over $376 billion and generated nearly $27billion in net income in 2017 alone[iv]. For reference, only 11 fintech companies in the U.S. have generated valuations of over $1billion over the past decade.

Source: HowMuch[v]

Source: PWC[vi]

By analyzing SoFi, we can understand many of the challenges that fintech companies are facing in truly disrupting the market, and how they can respond to many of the incumbents to truly have a disruptive impact.

SoFi started in 2012 as “Social Finance”, and initially sought to disrupt the student loan market. The student loan market is enormous, with nearly $107 billion in originations annually. This market is dominated by the U.S. Education Department which issues more than $90bilion of student loans annually[vii], with the rest of the market led by large incumbent banks, particularly Citi and Citizens Bank. The student loan market has been particularly slow to respond, and SoFi sought to disrupt two key challenges in the space. First, loans on student interest rates were disconnected from market rates because before 2014, the federal government set interest rates on student loans without regard to prevailing market rates, presenting an arbitrage opportunity for a player like SoFi. Secondly, interest rates were not customized to reflect the default patterns of different pools of students and there was an opportunity to tap into the high end of the market to offer better products for students with lower default rates. SoFi therefore started off by offering alumni at top business schools to offer loans to students in their alma maters, benefiting both sides of the market: the students got lower rates while the alumni received double-digit double-bottom-line returns[viii].

Despite the promise and the hype, SoFi has proven very limited in its capability to adequately disrupt the student loan market and has been forced to diversify into other lending products, including mortgages, wealth management and personal loans and term-life insurance[ix]. This comes despite SoFi’s very low market penetration in the student loans business. Assessing the challenges that SoFi has faced, and continues to face, provides some very relevant insights for other fintech companies seeking to truly disrupt the financial services space.

Business Model: The first question to consider is whether the business model is truly disruptive, or whether it merely provides a sustaining innovation. SoFi started off by skimming off the high end of the market. Graduates at top-business schools naturally have lower default rates, and their alumni have deeper pockets to provide students at their alma maters with loan financing. However, this market is very small and SoFi was forced to enter the broader student loan market for which it had no discernable competitive advantage vis-à-vis the incumbents. It is reported that the average approved borrower at SoFi has an income of over $130,000 and a credit score of 766[x].

Regulatory environment: SoFi’s business model was also buoyed by exceptionally low interest rates across the board, allowing it to refinance loans at a lower rate than they had. In 2013, federal rates were as low as 0%, providing lenders an opportunity to refinance student loans at levels significantly below the federal student-loan rates of 5% to 7%. This enabled SoFi to grow very quickly, but this advantage was not only temporary, but also not unique to SoFi. Starting in 2013, the Federal government changed how it set interest rates on student loans, moving from fixed rates to floating rates indexed to the 10-year Treasury. This has led to a decrease in Stafford loan rates which have declined to 3.76%[xi]. As federal student loan rates decline, and prime rates increase, the delta between government rates and student rates becomes so minuscule that there is no longer a material savings opportunity for students to refinance using SoFi or other alternatives.

Incumbent response: The response by incumbents to new entrants such as SoFi has been quick and severe. In 2017, SoFi announced it had filed an application for an Industrial Loan Company (ILC) charter in the state of Utah. This license would enable SoFi to get a commercial banking license and the resultant benefits enjoyed by many of its peers, particularly an ability to take customer deposits and access to the Federal Deposit Insurance Corporation (FDIC)[xii] which backs consumer deposits to create confidence in the financial sector. The incumbents responded by lobbying aggressively to prevent SoFi from obtaining this license. The ICBA (Independent Community Bankers Association) argued that SoFi was merely “tak[ing] advantage of a loophole that would allow it access to a federal safety net, without having to comply withal the laws a regular bank faces.”[xiii] The ICBA and other lobbying groups have been active in preventing new entrants into the financial services space, partly evidenced by the fact that they have successfully lobbied to ensure zero new ICL licenses in the past eight years.

Access to cheap balance sheet financing: One of the biggest and under-appreciated challenges facing fintech companies is access to a sufficiently large balance sheet with low-cost of capital to facilitate competitive loans. As a non-banking lender, SoFi lacks access to the cheapest sources of financing that are available to the incumbents, namely customer deposits that offer nearly 0% cost of capital, and ability to borrow directly from federal reserve at the discount rate[xiv], or directly from other commercial banks at PRIME[xv] or LIBOR rates[xvi]. This offers the incumbents a significant advantage in a market where the primary means of generating value is through the maximizing the spread between the interest rates charged to customers and the cost of capital to build the balance sheet.

To support its balance sheet, SoFi set up its own hedge fund to buy up student loans. This move offers a short-term reprieve that enables it to sell its existing loan book to free up capital for growth. However, this issue only compounds SoFi’s long-term challenges since hedge funds, whether internal or not, command even higher cost of capital. SoFi’s internal hedge fund, for instance, plans to charge a performance fee of 25% of returns after clearing a hurdle rate of “three percentage points plus the rates of short-term government debt”. Having an internal hedge-fund also imposes limits on SoFi’s ability to attract third-party buyers of its loans due to conflicts of interest that arise due to having an internal fund[xvii].

Conclusion

The challenges that SoFi faces highlight important takeaways for fintech companies seeking to create a real dent in the financial services space.

First, even in the age of AI and big-data, it is important to note that smart data science is not sufficient by itself to disrupt the financial services industry. Non-technological factors play a bigger role in this space, and successful fintech startups will be those that fully understand the ‘offline’ challenges.

Second, it is not sufficient to have a state-of-the art interface without having a truly disruptive business model in the background. In SoFi’s case, the fundamental business model remains is unchanged from that of banks five centuries ago, i.e. generating income through the spread between rates charged to customers and SoFi’s borrowing rates. Without access to cheap sources of funding e.g. customer deposits and federal reserve loans, SoFi is at a significant financing disadvantage that threatens its entire business model.

Third, regulatory changes and retaliation by incumbents can make or break the success of fintech players. SoFi has been unable to get a banking license and this puts a real cap on how large, or how quickly, it can grow.

To succeed in this space, it is important for fintech players to partner even more closely with incumbents. In SoFi’s case, this could involve acquiring a small banking player that already has a banking license or folding up into a unit of one of the much larger incumbents. Without an effective means of addressing ‘offline’ challenges, it is very unlikely that (m)any of the U.S. fintech startups will ever reach the multi-hundred billion-dollar valuations enjoyed by many of the incumbents in the financial services space. In this sector, perhaps more than others, it appears that much of the growth and value creation will be driven by incumbents, at least in the near-to-midterm.

[i] https://home.kpmg.com/xx/en/home/media/press-releases/2018/02/global-fintech-funding-tops-us-31b-for-2017-fueled-by-us-in-q4-kpmg-pulse-of-fintech-report.html

[ii] https://www.cbinsights.com/research/report/venture-capital-q4-2017/

[iii] https://www.inc.com/business-insider/fintech-unicorn-startups-most-valuable-clover-health-stripe-coinbase-sofi-robinhood-oscar.html

[iv] https://reports.jpmorganchase.com/investor-relations/2017/ar-ceo-letters.htm

[v] https://howmuch.net/articles/10-biggest-fintech-companies-in-america

[vi] https://www.pwc.com/gx/en/audit-services/assets/pdf/global-top-100-companies-2017-final.pdf

[vii] https://www.wsj.com/articles/banks-look-to-break-governments-hold-on-student-loan-market-1520418600

[viii] https://www.lendacademy.com/sofi-adding-leverage-for-their-alumni-investors/

[ix] https://www.sofi.com/products/

[x] http://fortune.com/2017/10/27/student-loans-sofi-refinance-federal/

[xi] http://fortune.com/2017/10/27/student-loans-sofi-refinance-federal/

[xii] https://www.ft.com/content/aa47898e-5544-11e7-9fed-c19e2700005f

[xiii] https://www.ft.com/content/aa47898e-5544-11e7-9fed-c19e2700005f

[xiv] http://www.nbcnews.com/id/8566097/ns/business-answer_desk/t/why-cant-i-borrow-bank/#.Wud9b4jwaUk

[xv] https://www.bankrate.com/rates/interest-rates/prime-rate.aspx

[xvi] https://www.investopedia.com/terms/l/libor.asp

[xvii] https://www.wsj.com/articles/online-lender-sofi-launches-hedge-fund-1457480960

Fascinating post. As a potential customer of SoFi, I have been really excited to see their work. However, I did not realize all the challenges they face. It is interesting to think about in these days were loan balances are shifting. I think in the past, it was very much predictable with people having a mortgage, some school loans etc… But now there are so many other aspects to our spending habits.

I think they will need to differentiate much more on the customer service element and ease of use/transactions as they move forward. I don’t think it will be enough to simply try to compete on prices and competitive offerings. Thanks for the post!