Seamless: The Cost of Convenience

As food-delivery services become more popular for their convenience, restaurants suffer.

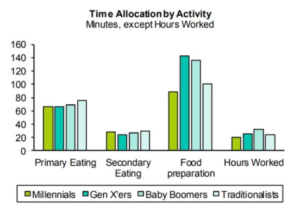

The food industry is changing to accommodate younger generations’ eating habits. The U.S. Department of Agriculture reported that millennials (those born between 1981 to mid-2000s) are most likely to eat in restaurants and to buy prepared meals. They increasingly value convenience over other factors when making meal choices, spending less time on food prep than any other generation. This has made room for a rise in meal delivery services, among which Seamless has established itself as a major player [1]. In 2016, 7% of total U.S. restaurant sales was comprised of delivery transactions. Analysts believe this could rise to as high as 40% [2].

Now part of GrubHub’s portfolio of brands, Seamless was one of the earliest platforms in the space. Launched in 1999, Seamless aggregates menus from various local restaurants onto a single platform, which can be accessed by web browser or mobile app. Customers select their food choices from an online menu, pay via the platform, and then receive their food at a designated location [3]. As of May 2013, Seamless worked with 12,000 restaurants in 40 cities [4]. Their parent company, GrubHub, owns a portfolio or brands encompassing over 80,000 takeout restaurants in 1,600 U.S. cities (and London) [5].

Focusing on the direct-to-consumer business (it is also offered to businesses), Seamless creates value for customers by aggregating multiple restaurants’ menus into a single place. Prior to Seamless, customers depended on drawers full of paper menus or knowledge of local restaurants; their options were limited. The experience of placing an order could also be painful, from placing the order to making payment. Customers had to call and speak on the phone with restaurants, which could lead to miscommunication or order errors, and they had to hope that they had enough cash on hand to pay and tip. With the online platform, customers could access a greater variety of restaurants beyond their immediate neighborhoods, improve order precision via online menus and written instructions, and select their preferred payment method.

For restaurants, Seamless creates value by expanding their customer base to new potential customers. For the same reasons (order precision, clear instructions), they can improve the customer experience. The platform lowers barriers for customers to purchase from restaurants they might not have reached in the past. In addition, it can be a marketing tool to attract new customers.

As Seamless has grown and scaled, the way it captures value has proven challenging to the restaurant side of the platform. Seamless collects a fee, averaging 13.5%, from restaurants for each transaction, but restaurants must also staff couriers to carry out the deliveries [6]. Mulberry & Vine, a restaurant in NYC, estimated that 20-40% of revenue goes to platforms like Seamless and “that in the past three years [their] over-all profit margin has shrunk by a third, and that the only obvious contributing factor is the shift toward delivery.” Seamless exerts additional power by favoring restaurants based on the commission they pay; restaurants can appear higher in search results by paying a higher fee. However, since the cross-side network effects can be quite strong – more users attract more restaurants – restaurants cannot afford to stay off of a platform like Seamless. A restaurant representative said, “sometimes it seems like we’re making food to make Seamless profitable,” but “it’s really becoming a bulk part of our business, so it’s not something we can cut” [7].

These tensions in the restaurant industry echo tensions rising in other platform-dominated spaces, such as in the ride-sharing or home rental space. More and more, these platforms have a “tendency to metastasize from transaction enablers to, with sufficient success, participation gatekeepers” [8].

Sources:

[1] Oyedele, Akin. “Millennials’ eating habits are wildly different from their parents’ — and the food industry has to face urgent consequences.” Business Insider, 4 Mar. 2018, http://www.businessinsider.com/how-millennials-eating-habits-differ-from-baby-boomers-2018-3.

[2] Dunn, Elizabeth. “How delivery apps may put your favorite restaurant out of business.” The New Yorker, 3 Feb. 2018. https://www.newyorker.com/culture/annals-of-gastronomy/are-delivery-apps-killing-restaurants.

[3] Seamless website, “About Me.” Accessed 4 Mar. 2018. https://www.seamless.com/about.

[4] McBride, Sarah. “Online takeout companies GrubHub and Seamless to merge.” Reuters, 20 May 2013. https://www.reuters.com/article/net-us-grubhubb-seamless/online-takeout-companies-grubhub-and-seamless-to-merge-idUSBRE94J0N320130520.

[5] GrubHub website, “Investors: What Is GrubHub?” Accessed 4 Mar. 2018. https://investors.grubhub.com/investors/overview/default.aspx?LanguageId=1.

[6] Seward, Zachary. “GrubHub and Seamless take a 13.5% cut of their average delivery order.” Quartz, 1 Mar. 2014. https://qz.com/182961/grubhub-and-seamless-take-a-13-5-cut-of-their-average-delivery-order/.

[7] Dunn, Elizabeth. “How delivery apps may put your favorite restaurant out of business.” The New Yorker, 3 Feb. 2018. https://www.newyorker.com/culture/annals-of-gastronomy/are-delivery-apps-killing-restaurants.

[8] Herrman, John. “Platform Companies Are Becoming More Powerful – but What Exactly Do They Want?” The New York Times, 21 Mar. 2017. https://www.nytimes.com/2017/03/21/magazine/platform-companies-are-becoming-more-powerful-but-what-exactly-do-they-want.html.

Thanks for this post! As a user of the service, I was certainly interested in seeing what you had to say. It seems, at this point in time, that the power sits with Seamless, rather than the restaurants. That being said, I could see this changing quickly. More and more, I believe there will be restaurants that are delivery-only, essentially large kitchens pumping out food to deliver, with no in-restaurant seating, capturing the growing delivery market you mentioned in the post. The market will then become a split, with restaurant dining establishments and delivery only places. If this happens, the number of places willing to deliver could become fewer in number, but higher in individual importance, and thus create some leverage against Seamless.

It was really interesting to hear your thoughts. Amazon and UberEats have come into the market and have offered to provide the drivers. This could lower the delivery barriers for restaurants. While there are some adjustments that still need to be made to their models, they could present a real challenge to Seamless. I wonder if the prevalence of more delivery platforms will decrease the fees for restaurants (in order to attract more restaurants to their platform).

It seems that as the power shifts from the restaurants to the delivery platform, the economics of delivery food slowly erode to the point where deploying on the platform is economically infeasible. I wonder if by taking margin like Seamless does in a notoriously lean margin business may negatively reinforce the network effects that Seamless is working so hard to enable. I’d imagine that once the restaurant has sized their kitchen to deliver food as well as serve its in-restaurant customers, leaning on these platforms is a necessity, but I wonder if savvy restauranteurs will start to figure out how to effectively run a restaurant without getting addicted to this additional volume.

Great post! This echoes the issues we saw in the X-Fire case with Amazon, where retailers cannot afford to stay off of Amazon because it has become such an important source of business and expanded their customer base. However, the dine-in experience will always be important in ways that shopping might not. People want to go out and eat with their friends/family or want to take a break during their lunch hour. These trends can be alternative methods for restaurants to market, and thus pushing people searching for their restaurant directly to their website to purchase directly from the site and cutting out Seamless. So, it appears Seamless would be the platform for finding new restaurants in the area. However, other competitors like Yelp Eat24 and UberEats might help to push Seamless margins down.