Roku: From Product, to Product Platform, to Software Platform

Roku has been able to stay relevant over the years by shifting its business model

Roku was spun out of Netflix in 2008 as a standalone hardware company. Netflix was originally going to launch the device as the “Netflix Player” to allow users to watch their new streaming service on televisions. Reed Hastings decided several weeks before launch of the device that Netflix should not get into the hardware business because it would conflict with partnerships with other hardware manufacturers that could carry Netflix.[i] That last minute decision to spin out Roku as a separate company kept Netflix from becoming a product-centric company and instead allowed Netflix to be a platform between users and content producers. Meanwhile, Roku was created as a platform between users and content providers.

Value Creation

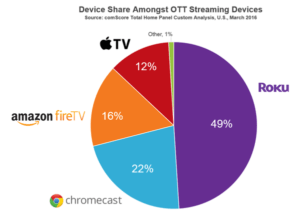

As a standalone company, Roku expanded the value created by the device. In addition to the initial value of allowing users to view content on televisions, Roku could be an aggregator of many different content providers, not just Netflix. The Roku was one of the first movers that allowed users to watch streaming content on televisions, but many competing devices have entered the market since, including other dongles, DVD players, game consoles, and smart TVs. Roku remains competitive in the marketplace because of the depth of content channels, with 4,500 available on the platform as of December 2016.[ii] Roku is trying to be the “Switzerland” of streaming devices by not having proprietary content that compete with 3rd party channels on its platform. On the other hand, Amazon Fire TV heavily promotes the Amazon Prime Video app, creating tension with other apps on its platform.

The more recent risk to Roku is the ease at which consumers can now watch streaming content on their televisions. For example, smart TVs now imbed the streaming apps on the television with no need for an attachment. To mitigate the risk of smart TVs replacing Roku devices, the company has shifted from a hardware-centric platform to a software-centric platform by licensing its platform technology to television hardware manufacturers to produce Roku TVs that use the Roku player as the OS.[iii] Roku “aspires to power every TV in the world” and will therefore partner with any television manufacturer.[iv] Roku TVs accounted for 13% of smart TV sales in 2016.[v] Television manufacturers benefit from using the Roku OS rather than proprietary smart TV technology because the manufacturers do not need to negotiate separate deals with content providers such as Netflix and HBO Go/Now.

Value Capture

Roku captures value from both sides of the platform. The company generates hardware revenue for each streaming device that it sells or earns a licensing fee for the Roku OS from Roku TV manufacturers such as Sharp, Hitachi, and TCL. On the other side of the platform, it is free to launch a channel on Roku (aside from app development costs), but Roku has increasingly been negotiating revenue share deals with content providers for a share of subscription, advertising, and pay-per-view revenue.[vi] Roku also generated revenue for advertisements on the home screen. Roku needed to build a large installed base initially to have negotiating power with the content providers. The content side of the platform is much more profitable than the hardware side.

Network Effects

The Roku platform creates high indirect network effects between the users and content providers, but little to no direct network effects. Users benefit from having a lot of apps and content on the Roku device so they can aggregate all of their viewing through streaming services subscriptions and content downloads. App developers (content providers) benefit from having a large installed base to view their content on the Roku. Roku benefits from scale as the largest installed base to justify the additional development cost for app developers to create and maintain a channel on Roku.

Multi-Homing

Streaming devices exhibit high multi-homing for both users and for content providers. The high multi-homing allows for multiple platforms to compete in the market simultaneously. For example, I have a Roku, Chromecast, and smart TV that all let me stream content on my TV, but I also watch content on my iPad and laptop. On the other side, content apps are platform agnostic, allowing users to access their content on many different devices. Interestingly, Rokus and other streaming devices are valuable to users because of multi-homing of streaming services by users because content is typically exclusive to a single streaming service (no multi-homing of content).

Conclusion

The streaming device market is not winner-take-all, but the company with the highest installed base will benefit from attracting more content apps, which will in turn attract more users. Roku has been able to stay relevant over the years by shifting its business model, first to a product platform and second to a software platform. And it still has room to grow as smart TV penetration continues to expand.

Sources

[i] https://www.fastcompany.com/3004709/inside-netflixs-project-griffin-forgotten-history-roku-under-reed-hastings

[ii] http://newsroom.roku.com/press-release/press-releases-usa/roku-sees-record-growth-roku-tv-program-1-out-8-smart-tvs-sold-us

[iii] https://www.cnet.com/news/roku-tv-unveiled-television-sets-with-roku-streaming-built-in/

[iv] https://www.wired.com/2016/03/rokus-plan-survive-live-inside-television/

[v] http://newsroom.roku.com/press-release/press-releases-usa/roku-sees-record-growth-roku-tv-program-1-out-8-smart-tvs-sold-us

[vi] https://gigaom.com/2014/09/26/as-roku-grows-its-moving-towards-pay-to-play-for-successful-channels/

Hi Natalie. Great post! Your point about how Roku transitioned from a pure hardware device to a software platform/ Operating system for Smart TVs is fascinating. I had a question about the data ownership of viewer’s watching history. We all know that one of the main reasons we all use Netflix is its very strong recommendation engine. In the case of Roku, who owns the data about the shows and content that the user viewed to be used for better recommendation. Does Roku compartmentalize this data and use it to improve recommendation only within the different content providers (like Netflix, HBO Now) or does it combine the data from the different content providers to improve overall recommendation for the user across all content providers? Given Roku is related to Netflix (although they are different companies), how does it assuage the concerns of other content providers that their data would not be shared with Netflix?

Hi Bipul, thanks for the comment! Great clarification on the aggregation of content. Roku compartmentalizes the “channels” so users need to enter each channel in order to view the content and see the recommendations. Some streaming device competitors, including Amazon Fire TV, have taken the approach of aggregating all of the content from different apps and showing recommendations (as of September 2016) on the home screen instead of having to enter the app. The streaming services were one of the main barriers for this in the past because they wanted to control the user experience, but this may be the beginning of a shift. I would be interested to see if Roku follows suit.

Roku has been completely independent from Netflix since the spin off in 2008, so there are no longer conflict of interest issues. That was the rational for the spin off and why it was such an important decision that has allowed Roku to grow its platform.

Thanks Natalie, great post! It will be very interesting to see how this industry shakes up. As you point out, the streaming device market has both high multi-homing characteristics and high network effects, putting it in the top right of our 2×2 matrix. Typically we see companies in this area competing on differentiating features. If competitive streaming devices end up having relatively the same content, I wonder how Roku will evolve in the future to differentiate itself. Right now I feel like it is one of the low-cost players in the market, but Amazon Fire seems also to play in this space. Also, if the “connected home” trend becomes platform dependent than Roku could end up being at a disadvantage because it does not have an ecosystem to connect to the way that Amazon has Alexa, Google has Google Home and Apple has Siri.

Thanks Natalie! You made an interesting comment in class that this is a platform of other platforms (e.g., Netflix is a platform business that sits within platform based streaming devices like Roku). It is interesting because the content does not really multi-home, therefore users must subscribe to different streaming services (Netflix, Hulu, HBO Go). However I wonder how that extends to users multi-homing across streaming devices. Surely if one device offers access to all the different streaming services, there is no need for a user to keep multiple devices? I was wondering what your rationale is for using multiple streaming devices and whether that is influenced by this “platform within a platform” problem.