Ripple, the disruptor to the forty years old cross-border payment system

Ripple uses blockchain technology to disrupt an old industry – cross-border payment

Cross-border payments today are inefficient, expensive and opaque.

The Global Interbank Financial Telecommunication Company (SWIFT) established in 1973 is still the most widely used method to send cross-border payment using the transmission of financial messages via the international SWIFTNet network.

However, the SWIFT financial messages do not hold accounts for its members nor make any form of clearing or settlement. It essentially only sends payment orders which need to be settled by the correspondent account that the institution has with each other. For this reason, each financial institution needs to have a banking relationship to exchange banking transactions.

This is why it requires 6 players linked up – payer, payer’s bank, payer’s bank’s correspondent, beneficiary bank’s correspondent, beneficiary bank, beneficiary to complete cross-border payments.

There are many obvious drawbacks of such system:

- Cross-border payments can be expensive and sometimes even charged a percentage fees

- Extra fees such as “lifting fees” or correspondent banking fees by intermediary banks are common

- Bank keep the money for extra time and delay the payout “float money theft”

- Exchange rate can have big spread

The high processing costs, lengthy settlement times and a poor customer experience prevents many new usage scenarios such as on-demand, low-value cross-border payment or mobile wallets. It is estimated that $1.6T per year for all parties in the ecosystem has spent yet unable to meet today’s cross-border payment need[2].

Ripple Labs (formerly OpenCoin) launched in 2012 with a mission to build a cross-border, interbank payment and settlement network using the concepts behind bitcoin. Ripple offers sub-second cross-border payments with automated best pricing from its network. As payments are nearly instant, it helps to remove the credit and liquidity risk from the process, lowering overall costs considerably.

How is it done?

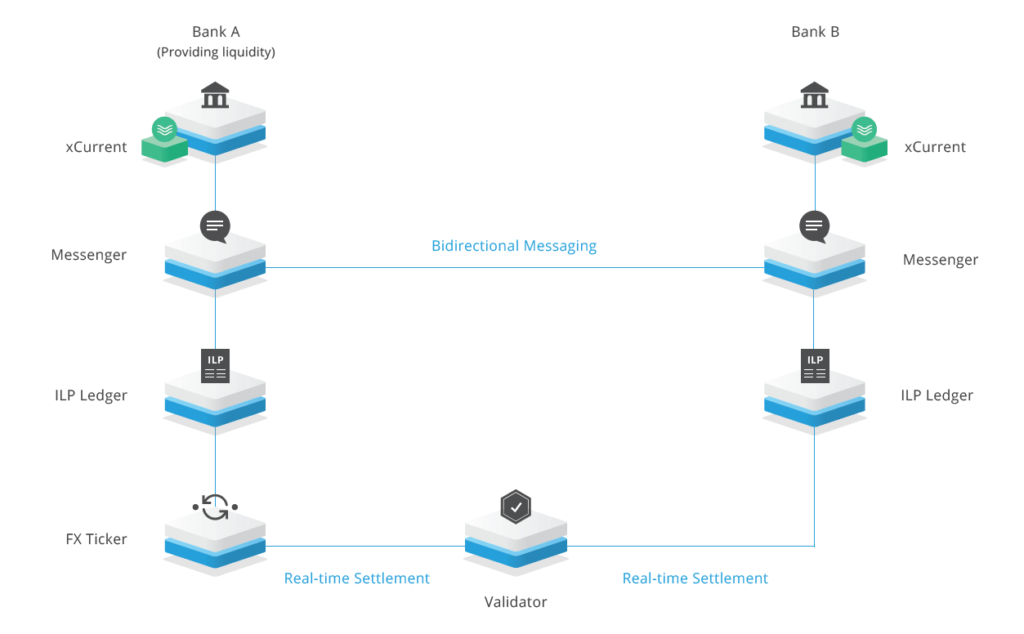

The core of its solution is RippleNet, a single, global network of banks that send and receive payments via Ripple’s distributed financial technology — providing real-time messaging, clearing and settlement of transactions.

RippleNet utilizes a subset of blockchain technology used in bitcoin. It uses the consensual validation of encrypted hashes to secure the messages across the Ripple network but does not hold the ledger, unlike bitcoin. Ripple names this open, neural protocol Interledger Protocol (ILP). ILP allows Ripple to connect existing bank ledgers, similarly to how banks connect their core system to the SWIFT network.

Key Benefits

- Enhance Customer Acquisition And Retention

Offering this on-demand, high-speed payment services to retail and corporate customers, it provides an opportunity to attract and retain customers.

- Lower Operational Costs

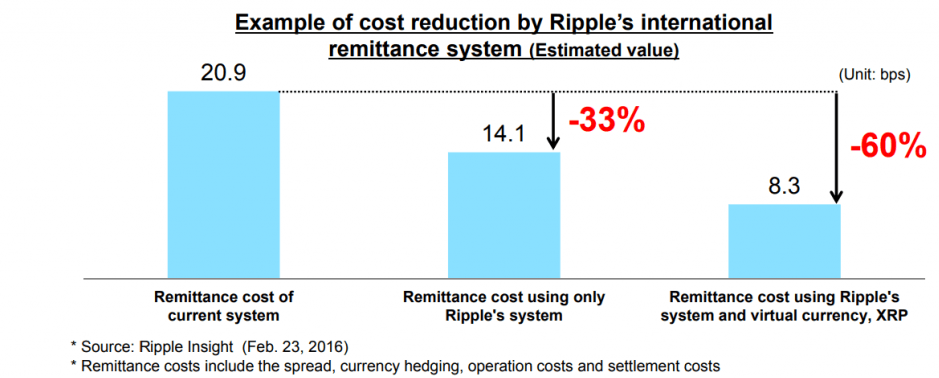

Payment processing cost is significantly reduced by eliminating SWIFT fees and other inefficiencies in the system such as liquidity costs, counterparty risks and compliance costs. It is estimated that the overall cost per payment can be reduced 60%, from $5.56 to $2.21.

Further Innovation

Ripple Labs also issues its own digital currency XRP. XRP can be used on the Ripple network to lower liquidity costs while minimizing settlement risk and delays. Using XRP, bank and non-bank payment providers can source on-demand liquidity from digital asset exchanges to process cross-border payments.

According to Ripple [2], XRP offers extra advantages on top of existing RippleNet:

Payment provider: Non-bank providers of cross-border payments allows customers to route payments through XRP, an improved experience at the lowest cost.

Exchange: Exchanges listing XRP can increase volume by enabling payment providers to send payments using XRP.

Banks: Using XRP, banks can source liquidity on demand in real time without having to pre-fund nostro accounts.

Generally the international remittance is 20.9 bps against the settlement amount. Using Riiple’s digital currency XRP, it can reduce to 8.3 bps, 60% cost reduction.

[1] Ripple vs GPII © David Blair 2016

[2] https://ripple.com/files/ripple_solutions_guide.pdf

Very interesting! I had just heard of Ripple in terms of the coin that was most favored by financial institutions, but didn’t really understand the background of why. Curious to hear your thoughts on how Ripple competes with many of the other startups that are focusing on cross-border payments and how they are differentiating themselves?