Renaissance Technologies: Generating Alpha without Wall Street Veterans or MBAs

How a team of mathematicians, computer scientists, and physicists is beating the market

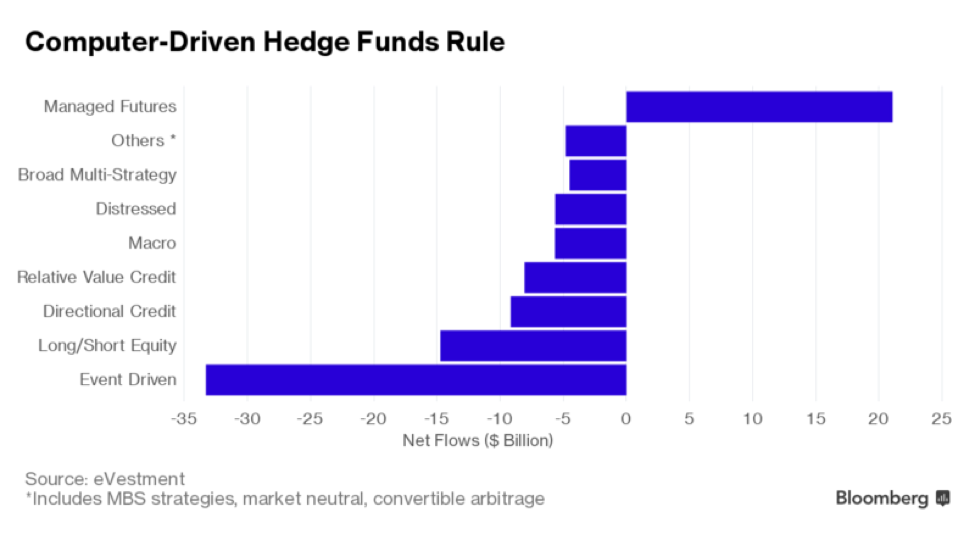

Since 2011, excess returns in the hedge fund industry have been lackluster. 2016 was no exception; the average fund returned 6.1% versus 12% for the S&P 500. Consequently, investors removed $39 billion in aggregate from hedge funds during 2016. But if capital flows and excess returns are indicators of “winning” in the investment universe, quantitative funds that rely heavily on mathematical models, data, computing power, and scientists are beating more traditional strategies.

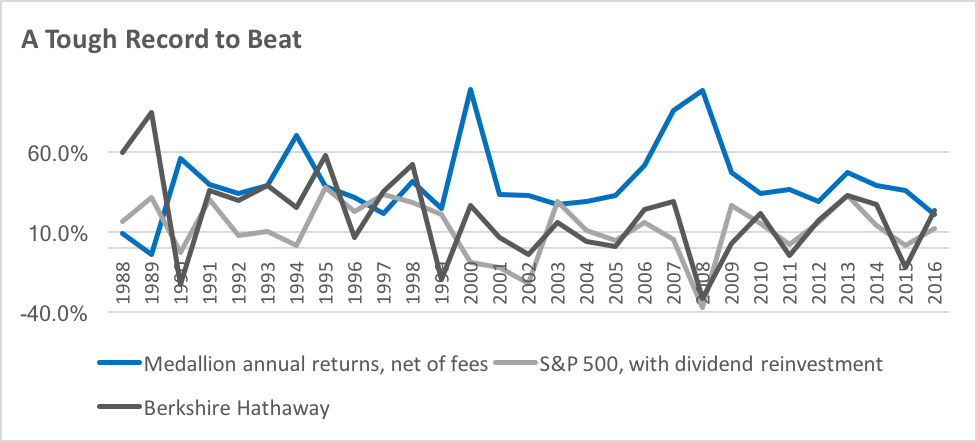

Perhaps the most successful—and, somewhat unsurprisingly, the most mysterious—“quant” fund is Renaissance Technologies. Since inception, its Medallion Fund has returned an astonishing 71.8% per annum (or around 38% net of fees) over its 29 years, versus about 10% for the S&P 500.

All portfolio managers rely on data and technology in one form or another when making an investment decision. A traditional value-oriented hedge fund manager, for example, may employ proprietary software to sift through financial statements in an effort to identify mispriced securities, but ultimately, traditional hedge funds, though technology-enabled, depend heavily on human judgement to generate alpha. Quant funds, however, rely substantially—in some cases entirely—on technology-driven systematic strategies. At a foundational level, such strategies are built on deep statistical analyses that identify signals in noisy markets, and by shaping these mathematical models into actionable algorithms, quant managers can automate trades and reduce their fund’s exposure to the “human element.”

Building successful quant strategies is extraordinarily complex. It requires extensive computational power, access to massive quantities of sufficiently organized data, and a team of mathematicians, computer scientists, and physicists to develop ideas and stich the pieces together. Despite the complexity, Renaissance has demonstrated that its methods are effective and repeatable.

Founded by Berkley-trained mathematician Jim Simons in 1982, Renaissance has a remarkable track record of consistent, market-beating returns. The firm’s early adoption of technology-driven strategies has paid off enormously: one dollar invested in its Medallion Fund in 1988 would be worth nearly $14 thousand today, net of fees (the same dollar invested in the S&P 500 would be worth about $17 today). Precisely how Simons, who retired in late 2009, and Medallion’s managers achieved such high returns is largely a mystery. What is clear, however, is that Medallion’s string of successes would not have been possible without access to cheap data storage and powerful, cost-effective computing. In the late 1990s, the firm’s “total CPU power grew by a factor of 50,” while data bandwidth expanded “by a factor of 45” (Bloomberg). Today, details of Renaissance’s computing power are patchy, but Two Sigma Investments, a $40B quant fund of similar noteworthiness, reportedly has access to “more than 100 teraflops of power—more than 100 trillion calculations a second—and more than 11 petabytes of storage, the equivalent of five times the data stored in all U.S. academic libraries.” If Renaissance’s team of PhDs is the guidance system, the firm’s computing power and databases are the rocket fuel that propels returns into orbit.

Other attributes of the firm contribute to its ability to create value for investors. Renaissance limits Medallion’s assets to between $9 billion and $10 billion in order to reduce the likelihood of moving markets with large trades, thereby dragging down returns, and since 1993, the fund has been open only to employees and their families, diminishing the threat of redemption and easing fund managers’ client facing responsibilities. Lastly, the firm recruits almost exclusively scientists for its frontline work. In a 2008 interview with Bloomberg, former employee and Berkley mathematician Elwyn Berlekamp said, “I’ve always said Renaissance’s secret is that it didn’t hire MBAs.” In an interview with the Wall Street Journal, Simons said scientists are less valuable for their “mathematical or computational skills than for their ability to think scientifically…They are less likely to accept an apparent winning strategy that might be a mere statistical fluke.” When it comes to capturing value, Medallion charges a whopping 5% of assets under management and 44% of profits, well in excess of the industry standard 2 and 20.

Renaissance’s future competition may not come from extant hedge funds looking to copy its tactics. Rather, artificial intelligence research teams at Facebook, Google, or any number of small startups could upend the investment management industry by unleashing constructs on financial markets. Nonetheless, investors are clearly hungry for technology-driven strategies like those employed by Renaissance, but they should be cautious of the impossibly high standard set by Medallion. The democratization of computing power, low cost of storage, and development of AI technologies could soon start dragging those numbers down.

Interesting. I’m sure Renaissance is not the only one taking advantage of cheap computing power right now. What do you think “the dollar” is still on the side of the street? One hypothesis is the mission driven nature of tech companies where this superior computing power is likely to lie. I imagine engineers at facebook are less likely to be motivated by gaming the market as much as they do about “connecting the world”. But I could totally be wrong. I wonder if Renaissance and the likes are creating barriers to entry for others, as I imagine if a few other as good players enter the market, there will be no arbitrage opportunities left (perfect market yay!)

Super impressive. Can’t believe I haven’t heard of them before. The returns charting is especially impressive given it is net of fees and Medallion has fees that are twice as high as the industry average. Their out performance in 2008 is also pretty amazing. I wonder how sustainable the returns would be if many more similar “quant” funds entered the market though. Even though their algorithms would be different, presumably they would all reach similar conclusions about attractive and unattractive investments. Would returns continue to be sustainable at these levels?

It’s a good thought experiment to run. Markets are incredibly fickle, complex, and sometimes irrational. In that sense, it might be impossible for two funds to arrive at the same set of conclusions (i.e., signals), even if they started with the same objective and same sets of data. Minor differences in assumptions or initial conditions could yield different results. Still, I agree with you; it feels intuitive to me that as the number of funds grows, the likelihood of signals being arbitraged away also grows, causing returns to suffer.

I wonder weather the funds recent decline in average returns over the past few years (2013 and onward) is here to stay, or just a brief period of lower returns. Returns in the quantitative trading hedge fund sector are down precipitously over the past few years and endless competitors seem to pile into equities and foreign exchange. As barriers to accessing huge computational power decline, the edge that Renaissance has had historically may dull permanently.

Computing power does seem to be a democratizing factor; however, returns still seem to be 25-40% per annum each year – pretty solid.

Hi James. Thats a great article. Last week in my Investment Strategy class, we had a similar discussion about how passive investing has become popular in the last few decades and the returns from it are better than active investing. However, we also discussed some of the negative implications of that, specifically, that it does not lead to price discovery in the market and that not looking at a company’s fundamentals might lead to good stock performance of “bad” companies while the share price of fundamentally “good” companies might struggle. Quant trading strategies also do not help in this price discovery mechanism, right? What are your views on this?

Interesting post! I have been wondering if the quant strategy fits certain market conditions and that’s what drives all these platforms with zillions of database out to the spotlight. These conditions include low vol (before Nov 2016), high momentum, and crowding on the bluechip stocks which makes some large stake quant strategy easier to execute. This is just one conjecture. So the question is if these premise gradually fade out, how do they stay competitive compared to traditional active houses. What’s more as more funds come into this area, it requires a stronger and faster turn and delivery of new strategy before it gets crowded out. What’s your take on this

Wow – it’s pretty incredible that the fund has had such outsized returns over such a long time horizon, particularly considering that computing power and analytical approaches / capacity have evolved dramatically. I would be curious to learn more about when in the investment selection process humans engage vs. leveraging technology. Is a seasoned investor the first filter for companies in consideration, or does the company lean on its computing power so much that investors only get involved at the end of the process? Do these tech enabled processes risk eroding alpha over time (presumably advanced technologies across firms should converge on a company valuation)?