Redbubble : Targeting a Worldwide Artist Crowd

A 10 year effort to foster a worldwide on-demand artist marketplace and community

Redbubble (RB) was born in 2006 in Melbourne, Australia with the mission of giving independent artists a new way to sell their creations and be part of a worldwide reaching community. It functions as an online marketplace for print on-demand products based on user submitted artwork. The artists submit their art digitally and through a network of third party fulfillers utilizing leading edge capabilities to produce the products (including 3D printing capabilities). After they have been ordered by the customer in a print‑on‑demand model, the fulfillers arrange for their delivery to the customer. As of February 2017, the company had 15 fulfillers producing and distributing 62 different types products (including mugs, phone cases prints, T-shirts, hoodies, cushions, duvet covers, leggings, skirts and scarfs etc…) in 23 countries, the United States (65% of TGV), UK (14.5 of TGV) and Europe (12%) being the leading regions.

Redbubble became public in May 2016 (ASX:RBL) and is one of the few truly global e-commerce companies to be listed in Australia with more than 94% of revenues from outside Australia.

Artists Incentivization

Redbubble Art (1)

“The beauty of Redbubble for artists, unlike Etsy, is the repetition of sales of one design. Redbubble also has no inventory risk … and the cashflow model means that it receives payment upfront and then allocates revenue to artists and the outsourced manufacturers.”

(Robert Bruce/ Acorn Capital)

Artists using RB, especially those using RB as their primary platform and source of income, will promote their art. Perhaps their reach is insignificant on an individual scale, but promoting work done by the thousands of artists using RB has a substantial scalable effect. Furthermore, the website gives consumers the opportunity to comment on works of arts, contact the artist directly and also follow the artists, this mean RB also acts as a social media platform.

The idea of Redbubble as a dedicated artist community greatly incentivizes its users to participate, especially for artists. The website is quickly expanding to different language markets and offers the potential to wildly grow on an international scale, reaching many more communities in the world then if the website only presented itself in English.

The crowd effect therefore works internally, artists attracting other artists, mostly online but also offline as RD has started creating artist residency programs in Australia and the U.S. as well as externally as users post feedback, link with artists and can follow them inside or outside of the RD platform.

According to company’s data, referrals from other artists are the largest sources of artist acquisition: on average 33%, ahead of Google Search referrals (between 29% and 33% depending on artist earnings segmentation), social media 17% and blogs 12%. RD’s artist acquisition is entirely from free sources.

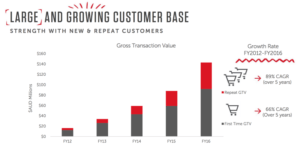

Based on the chart below, RD is able to augment through its different network incentives the share of repeat customers:

Source: Redbubble Investor Presentation, March 14, 2017

Value Creation

The company offers free membership to artists who maintain the copyrights to their work, regulate their own prices, and decide which products may display their images. The company operates on a positive cash cycle as it first receives payment from the customer and then only pays the payment platform, the artist (about 15% on average commission) the fulfillers (50% on average) and the sales tax.

Today, the company connect over 400,000 artists and designers across the planet, offering 11 million works, with millions of passionate fans allowing for “a brave new world of self-expression”.

Growth and Challenges

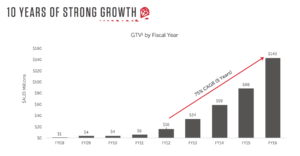

Source: Redbubble Investor Presentation, March 14, 2017

The growth of the company has been subdued at its beginning but has definitively been more robust in the past two years. Challenges will come from competition (ETSY, for example, has a market capitalization of $1.7 billion compared to $178 million for RD) and from the company’s curation strategy. Platform Revolution authors evoke that “as a rule it is desirable to have users participate in shaping the systems that govern them”. Although RD has constructed its platform to foster user feedback at many levels, repeated instances of controversial material and trademark infringement will have to be addressed in a more systematic (i.e. algorithmic based) as the company continues to expand its worldwide reach.

https://www.youtube.com/watch?v=uEA5QQrHYVo

Notes:

(1) Can be found at: https://www.redbubble.com/people/stanciuc/works/21343623-written-text-incentive-your-users?grid_pos=8&p=sticker

Sources:

http://shareholders.redbubble.com/irm/content/default.aspx

http://www.afr.com/technology/redbubble-set-to-be-2017s-comeback-stock-20161106-gsjg75

Platform Revolution by Geoffrey G. Parker Marshall W. Van Alstyne and Sangeet Paul Choudary

Great post! I had never heard of Redbubble, but they have a great set of products on their site. Aside from the competition risk that platforms with large existing user and artist bases, it seems to me that RB risks also having a not fully coherent aesthetic. This could prove to be a strength because they appeal to a broad base, but it also makes them more vulnerable to platforms that have honed in on their user’s aesthetic preferences, such as Threadless or Etsy.